Sunil Singhania Portfolio

You must have heard about Sunil Singhania portfolio, right? It’s been the talk of the town all thanks to the amazing performance of Abakkus Asset Managers. They started just a few years ago in September 2018, and already they’re making waves in the stock market. Can you believe it? Sunil Singhania’s portfolio is now worth a staggering ₹1,829.78 crore as of May 2022. That’s a jaw-dropping growth of nearly 8,105%! No wonder everyone’s buzzing about it.

People are dying to know the secret behind Sunil Singhania’s success. In this blog, we will discover which stocks he’s invested in, what Sunil Singhania portfolio looks like, and even the ones he bought and sold in March 2023.

Who is Sunil Singhania?

Sunil Singhania is a prominent figure in the Indian financial industry, known for his expertise in portfolio management and investment strategies. He was born and raised in a middle-class family. Additionally, Sunil Singhania was instrumental in propelling Reliance Mutual Fund to become one of India’s largest asset management companies (AMCs). As the fund manager of Reliance Growth Fund since its inception in 1995, he oversaw its exceptional growth of 100 times. Notably, he holds the distinction of being the first Indian to serve on the CFA Global Board of Governors, showcasing his credentials as a Chartered Financial Analyst (CFA).

What are Abakkus Asset Managers?

Abakkus Asset Managers is a renowned investment management firm that has been making waves in the stock market. Led by the expert stock-picker Sunil Singhania, this company has been creating quite a buzz in the financial world.

The firm was launched back in September 2018, and in just a few short years, it has managed to establish a strong reputation for itself. One of the most striking things about Abakkus is the outstanding performance of Sunil Singhania’s portfolio, which has caught the attention of many investors. However, the company offers investment advisory, portfolio management services (PMS), mutual fund strategies, research and insights, and investor education.

As of June 2023, Sunil Singhania abakkus portfolio has reached an incredible net worth of ₹2,451.3 crores. That’s right, a whopping 33.96% absolute growth since last year! Thus, this mind-boggling success has made people curious and eager to know more about the stocks he’s investing in and how he’s achieved such impressive results.

Sneak Peak into Sunil Singhania Portfolio 2023

As per the latest corporate shareholdings filed, Sunil Singhania portfolio publicly holds 26 stocks with a net worth of over ₹2,451.3 crores.

| Company Name | Holding Value (in ₹) | Quantity Held | June 2023 Change in % |

|---|---|---|---|

| ADF Foods Ltd | 37.0 Cr | 337,287 | 0.0% |

| AGI Greenpac Ltd | 77.5 Cr | 1,125,884 | -0.1% |

| Carysil Ltd. | 100.6 Cr | 1,570,492 | -0.2% |

| CMS Info Systems Ltd. | 58.5 Cr | 16,11,678 | 0% |

| DCM Shriram Industries Ltd. | 35.1 Cr | 25,90,000 | 0% |

| Dreamfolks Services Ltd | 50.1 Cr | 9,50,000 | 0% |

| Dynamatic Technologies Ltd | 76.8 Cr | 1,97,728 | 0.1% |

| Ethos Ltd | 48.8 Cr | 3,02,663 | 0% |

| HG Infra Engineering Ltd (Part IX) | 92.2 Cr | 9,58,187 | -0.1% |

| HIL Ltd | 73.6 Cr | 2,42,000 | 0.1% |

| Hindware Home Innovation Ltd | 179.0 Cr | 35,38,341 | 0% |

| IIFL Securities Ltd | 69.2 Cr | 99,10,323 | 0% |

| Ion Exchange (India) Ltd | 246.5 Cr | 48,00,000 | 0% |

| J Kumar Infraprojects Ltd | 79.9 Cr | 20,05,000 | 0% |

| Jubilant Pharmova Ltd | 87.6 Cr | 19,12,681 | 0% |

| Mastek Ltd | 213.0 Cr | 9,86,689 | 0% |

| PSP Projects Ltd | 43.6 Cr | 5,45,000 | 0% |

| Rajshree Polypack Ltd | 10.9 Cr | 7,12,864 | -1.3% |

| Route Mobile Ltd | 247.2 Cr | 16,12,457 | 0% |

| Rupa & Company Ltd | 85.5 Cr | 32,85,000 | 0% |

| Sarda Energy & Minerals Ltd | 14.7 Cr | 7,72,026 | 0% |

| Siyaram Silk Mills Ltd | 47.4 Cr | 9,03,044 | -0.2% |

| Stylam Industries Ltd | 68.2 Cr | 4,23,790 | 0% |

| Technocraft Industries (India) Ltd | 123.9 Cr | 6,47,796 | -0.4% |

| The Anup Engineering Ltd | 81.4 Cr | 3,79,012 | -0.2% |

| Uniparts India Ltd | 58.5 Cr | 10,13,770 | 0% |

Top Holdings of Sunil Singhania Portfolio 2023

The veteran of the stock market, Sunil Singhania stock picks are carefully analyzed among the investors in the stock market. Sunil Singhania’s investment strategy is characterized by a focus on long-term value investing. Some of the Sunil Singhania stock picks belong to a diverse range of companies from various sectors.

Therefore, below is a list of the top 7 Sunil Singhania latest picks present in the stocks list.

| Company Name | Shares Held | Value (in Cr) |

|---|---|---|

| Ion Exchange (India) Ltd | 48,00,000 | ₹246.5 |

| Route Mobile Ltd | 16,12,457 | ₹247.2 |

| Hindware Home & Innovation Ltd | 35,38,341 | ₹179.0 |

| Mastek Ltd | 9,86,689 | ₹213.0 |

| Carysil Ltd | 15,70,492 | ₹100.6 |

| Technocraft Industries (India) Ltd | 6,47,796 | ₹123.9 |

| Sarda Energy & Minerals Ltd | 7,72,026 | ₹14.7 |

Overview of Sunil Singhania Stock Picks

Apart from the 26 stocks present in his portfolio, here is an overview of the top 7 Sunil Singhania stocks.

- Ion Exchange (India) Ltd: A leading manufacturer of ion exchange resins in India. The company’s products are used in a variety of industries, including water treatment, pharmaceuticals, and food processing. This is relatively an undervalued stock, making it an attractive investment for value investors like Sunil Singhania.

- Route Mobile Ltd: Leading provider of mobile-based business solutions. Therefore, the company’s products and services are used by a variety of businesses, including banks, retailers, and government agencies.

- Hindware Home & Innovation Ltd: It is a leading manufacturer of home improvement products. The company’s products include faucets, sanitaryware, and tiles. The company is also relatively undervalued, making it an attractive investment for value investors like Sunil Singhania.

- Mastek Ltd: Provider of IT services and solutions. The company’s services are used by a variety of businesses, including banks, insurance companies, and manufacturing companies. The company is also well-positioned to benefit from the growth of the Indian IT sector.

- Carysil Ltd: Leading manufacturer of sanitaryware and tiles. The company’s products are sold under the brand name “Carysil”. Carysil is a well-established company with a strong brand name. The company is also relatively undervalued.

- Technocraft Industries (India) Ltd: Another prominent player in the engineering and infrastructure sector. It manufactures a diverse range of products, including steel drums, scaffolding systems, and industrial packaging solutions.

- Sarda Energy & Minerals Ltd: A key player in the mining and metallurgy domain present in the portfolio of Sunil Singhania. Renowned for spanning iron ore mining, sponge iron production, and power generation. Thus, the company’s strategic focus is on resource optimization and sustainable practices.

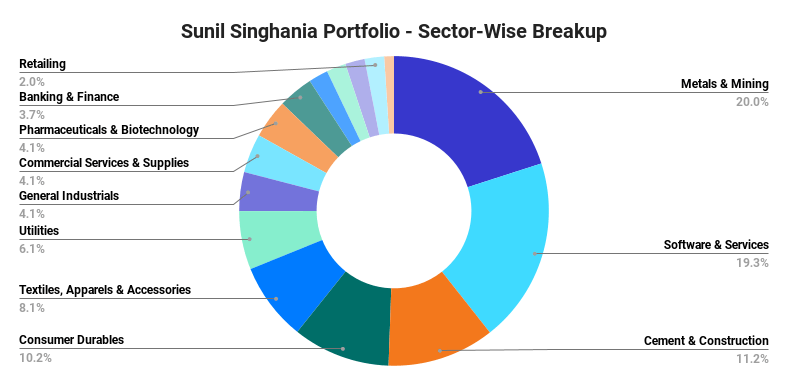

Sunil Singhania Portfolio – Sector-Wise Investment

Sunil Singhania’s investment strategy is characterized by a focus on long-term value investing. He believes in identifying quality companies with strong fundamentals and holding them for an extended period, allowing their intrinsic value to be realized over time.

Here’s a sector-wise breakup of Sunil Singhania holdings:

In Sunil Singhania portfolio, investments in stocks with a varied portfolio include Metals & Mining, Software & Services, Cement and Construction, and consumer durables.

Here’s a brief analysis of the mentioned sectors:

- Metals & Mining: This sector is closely tied to the global economic cycle, as metals are essential for infrastructure development and industrial activities. Investments in this sector can be influenced by factors such as commodity prices, demand-supply dynamics, and global economic conditions.

- Software & Services: The software sector has been witnessing rapid growth with the increasing adoption of technology in various industries. Companies involved in software development, IT services, cloud computing, and other related fields could be potential investment opportunities.

- Cement and Construction: This sector’s performance is directly linked to the health of the real estate and construction industries. Infrastructure development and urbanization play key roles in the growth of cement and construction companies.

- Consumer Durables: This sector includes companies producing non-perishable goods like appliances, electronics, home furnishings, etc. The performance of consumer durables companies is influenced by consumer spending patterns, economic conditions, and innovation in the industry.

Stocks Traded by Sunil Singhania in 2023

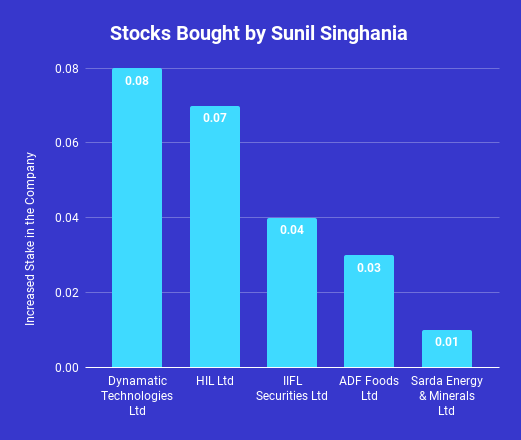

During the June quarter, Sunil Singhania, a renowned investor, embarked on an extensive buying spree.

As a result, it becomes imperative to examine a well-varied assortment of Sunil Singhania’s stock holdings, strategically positioned to leverage burgeoning prospects and optimize yields. Subsequently, our focus will shift to the stocks that witnessed a reduction in allocation within Sunil Singhania portfolio.

Which Stocks were Added to Sunil Sighania Portfolio List in FY23?

- Dynamatic Technologies Ltd (DYTL): Singhania bought 2.02 million shares of DYTL in the March quarter of FY23, increasing his stake to 0.08%. The stock has risen by 43.3% since then.

- HIL Ltd (HIL): Singhania bought 1.2 million shares of HIL in the March quarter of FY23, increasing his stake to 0.07%. The stock has risen by 14.2% since then.

- IIFL Securities Ltd (IIFL): Singhania bought 1.05 million shares of IIFL in the March quarter of FY23, increasing his stake to 0.04%. The stock has risen by 16.7% since then.

- ADF Foods Ltd: Singhania bought 2.02 million shares of ADF in the June quarter of FY23, increasing his stake to 0.03%. The stock has been rising since then.

- Sarda Energy & Minerals Ltd (SEML): Singhania bought 1.05 million shares of SEML in the June quarter of FY23, increasing his stake to 1.01%. The stock has been rising since then.

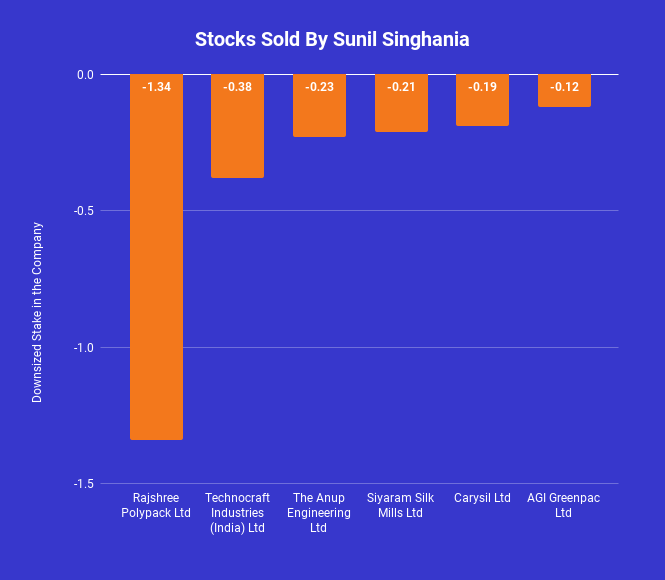

Which Stocks Were Downsized to Sunil Singhania Portfolio List in FY23?

Below is the list of 6 stocks that were downsized from Sunil Singhania Portfolio 2023

- Rajshree Polypack Ltd: Rajshree Polypack has been growing rapidly in recent years, and its stock price has more than doubled in the past five years. However, with a relatively high valuation, Sunil Singhania has decided to reduce his exposure to the stock by -1.34%

- Technocraft Industries (India) Ltd: Technocraft Industries has been growing steadily in recent years, and its stock price has more than doubled in the past five years. However, with a relatively high valuation, Singhania may have decided to reduce his exposure to the stock by -0.38%.

- The Anup Engineering Ltd: It is a manufacturer of pumps and compressors. The company’s products are used in a variety of industries, including water, oil, and gas. This purposeful decision led to a percentage decrease of -0.23%

- Siyaram Silk Mills Ltd: t is a leading manufacturer of silk textiles in India. The company’s products are sold under the brand name “Siyaram”. The company’s stock price has fallen by more than 50% in the past five years. Therefore, Sunil Sighania decided to downsize the stock holding by -0.21%

- Carysil Ltd: It is a manufacturer of sanitaryware and tiles. Thus, Sunil Singhania judiciously scaled down his involvement in Carysil Ltd and reduced the holding by -0.19% in June 2023.

- AGI Greenpac Ltd: It is a manufacturer of packaging solutions for the food and beverage industry. Sunil Singhania’s discerning investment strategy extended to AGI Greenpac Ltd., where he selectively trimmed his position by downsizing -0.12% stake in the company.

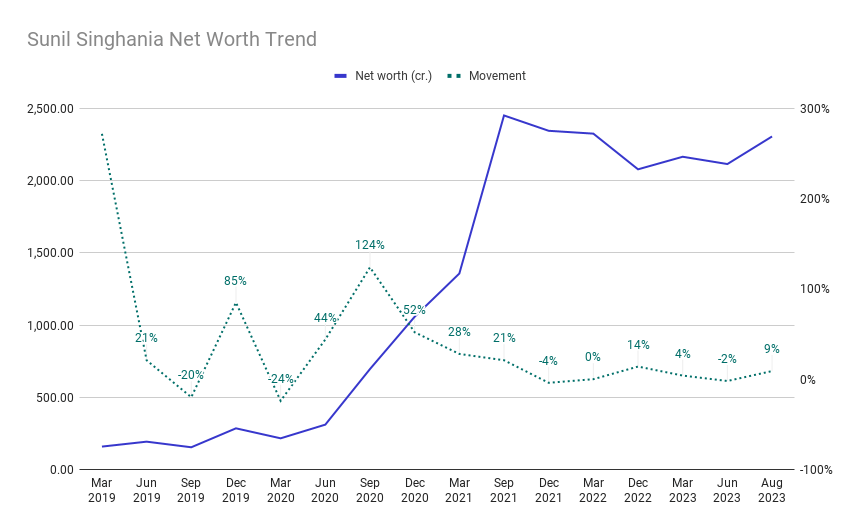

Sunil Singhania Net-Worth Trend

Sunil Singhania, the founder and managing director of Mumbai-based Abakkus Asset Management, boasts over two decades of experience in investment management. His financial standing has experienced notable fluctuations throughout the years.

Sunil Singhania’s net worth stood at ₹15.24 crore in September 2018. This figure surged to ₹158.01 crore by March 2019, before experiencing a dip to ₹153.31 crore by September 2019. Subsequently, his net worth witnessed a sharp upswing, reaching ₹284.56 crore by December 2019, and an even higher peak of ₹695.39 crore by September 2020. Remarkably, it reached its pinnacle at ₹2,452.23 crore in September 2021, subsequently receding to ₹2,211.71 crore in August 2023.

These considerable fluctuations in Sunil Singhania’s net worth are largely attributable to the inherent volatility of the Indian stock market. Being a value investor, Sunil Singhania portfolio primarily consists of large-cap stocks. Despite the inherent volatility, Sunil Singhania continues to rank among India’s wealthiest investors.

Investment Strategy of Sunil Singhania Latest Portfolio

You see, there are two types of investors in the stock market – the fundamentalists and the shortcut lovers. The fundamentalists spend hours analyzing a company’s fundamentals, but then there are the shortcut lovers who simply imitate the portfolios of market legends. Instead of doing the heavy lifting, they wait for big investors like Rakesh Jhunjhunwala and Vijay Kedia to reveal their quarterly declarations. And now, there’s a new name on that list – Sunil Singhania’s portfolio. People just can’t get enough of it!

His investment strategy typically focuses on identifying undervalued companies with strong fundamentals and growth potential. He looks for stocks that are trading below their intrinsic value, often based on factors such as earnings, cash flow, and book value. Singhania also pays attention to macroeconomic trends and industry dynamics while constructing his portfolio.

Investment Learnings From Sunil Singhania

There are several valuable learnings that one can draw from observing Sunil Singhania latest portfolio:

- Value Investing Approach: Sunil Singhania is known for his value investing approach, which involves identifying fundamentally strong companies that are undervalued by the market. This strategy emphasizes buying stocks at a discount to their intrinsic value, aiming for long-term capital appreciation.

- Long-Term Perspective: Singhania’s portfolio underscores the importance of a long-term investment horizon. He tends to hold onto his investments through market fluctuations, allowing time for his chosen stocks to realize their full potential.

- Diversification: While Singhania maintains a concentrated portfolio, his holdings span various sectors. This showcases the significance of diversification to manage risk while capitalizing on opportunities in different industries.

- Adaptability to Change: The evolution of Sunil Singhania portfolio underscores the importance of adaptability to shifting economic and industry dynamics. Learning to adjust one’s investment choices based on changing circumstances is a valuable takeaway.

- Exercising Patience: Singhania’s ability to maintain long-term positions illustrates the virtue of patience. Successful investing often demands resisting the urge to make impulsive trades in response to short-term market fluctuations.

To Wrap It Up…

In conclusion, delving into the investment portfolio of Sunil Singhania provides a wealth of insights and lessons for both novice and seasoned investors. Furthermore, accomplishments extend beyond Sunil Singhania stock picks to the realm of mutual funds. Thus, Sunil Singhania mutual funds are a testament to his expertise and dedication to managing broader investment vehicles.

If you’re considering an investment in Abakkus Investment Advisors, seize the opportunity now through Sunil Singhania smallcase. Invest in Abakkus Investment Advisors through today!

Know More About Star Investors on smallcase –

Learn More about few of the other star investors, their investment strategies, stocks investments, net worth and much more –