Rakesh Jhunjhunwala Portfolio

Welcome to the exciting world of the stock market, where fortunes are made and lost, and legends are born. One name that resonates loudly in this dynamic realm is Rakesh Jhunjhunwala, a true maverick and an undisputed titan of the Indian stock market. To some, Rakesh is the Pied Piper of stock markets, while to some he is the proverbial Big Bull and to many others, he is India’s answer to Warren Buffett. Recently, Rakesh Jhunjhunwala portfolio investment has not only captured the attention of seasoned investors but has also inspired countless aspiring traders.

The big bull of Dalal Street may be gone, but his legacy, learnings, and success on the stock market will live on. If you’re curious about Rakesh Jhunjhunwala’s latest portfolio and the list of stocks he holds, look no further. In 2023, his portfolio showcases a diverse range of stocks across various sectors. Therefore, let’s discover the secrets behind Rakesh Jhunjhunwala’s stock portfolio and its remarkable success in the stock market.

Who was Rakesh Jhunjhunwala?

Rakesh Jhunjhunwala, often hailed as the “Big Bull” of Indian stock markets, was a legendary figure in the world of finance. Born in Mumbai, India, Jhunjhunwala began his career as a Chartered Accountant and eventually ventured into the world of investing. His unique investment philosophy, characterized by a blend of astute research, patience, and a long-term perspective, has propelled him to great heights in the financial industry.

Rakesh Jhunjhunwala portfolio is a fascinating mix of stocks, ranging from blue-chip companies to various sectors of the Indian economy. The portfolio of Rakesh Jhunjhunwala also contains smallcap stocks. As an example, let’s look at Prozone Intu Properties Ltd. In August 2022, the stock had a market capitalization of just ₹319 crore.

As one delves into the intricacies of Rakesh Jhunjhunwala’s stock portfolio, it becomes evident that Jhunjhunwala’s investment philosophy extends beyond mere stock selection. He strategically positions himself in promising sectors, keeping a watchful eye on market trends and valuations. He strongly believed in ‘Anticipating trends and benefiting from it. Traders should go against human nature.’

However, because of his undying love for the stock market and ability to take risks, his portfolio networth as of August 2022 was ₹31,833 crore. He also invested in his wife’s name, Rekha Jhunjhunwala whose portfolio values over ₹29,534.6 crore as of March 2023. Additionally, he set up a stock trading firm called RARE Enterprises. The name is a combination of the initials of Rakesh Jhunjhunwala’s wife and his’.

Now, we will discuss Rakesh Jhunjhunwala’s stock list in detail shortly. We will also understand the thought process behind Rakesh Jhunjhunwala portfolio construction.

Rakesh Jhunjhunwala and Associates’ Portfolio 2022

With a focus on sectors such as banking, financial services, consumer goods, and technology, Rakesh Jhunjhunwala portfolio 2022 with his team has demonstrated their acumen in identifying promising companies poised for growth and profitability.

Here is a list of 32 stocks on exchanges that are valued at around ₹32,000 crore so far in August.

| Stock Name | Holding Value (in Cr) | June 2022 holdings in % | March 2022 holdings in % |

|---|---|---|---|

| Aptech Ltd | ₹461.0 | 43.80% | 43.80% |

| Star Health and Allied Insurance Company Ltd | ₹7,463.9 | 17.50% | 17.50% |

| Metro Brands Ltd | ₹3,202.0 | 14.40% | 14.40% |

| NCC Ltd | ₹578.9 | 12.60% | 12.60% |

| Nazara Technologies Ltd | ₹149.1 | 10.00% | 10.00% |

| Rallis India Ltd | ₹456.1 | 9.80% | 9.80% |

| Bilcare Ltd | ₹12.50 | 8.50% | 8.50% |

| Agro Tech Foods Ltd | ₹153.8 | 8.20% | 8.20% |

| Va Tech Wabag Ltd | ₹138.3 | 8.00% | 8.00% |

| Geojit Financial Services Ltd | ₹86.8 | 7.50% | 7.60% |

| Jubilant Pharmova Ltd | ₹356.4 | 6.80% | 6.80% |

| CRISIL Ltd | ₹1,281.0 | 5.50% | 5.50% |

| Titan Company Ltd | ₹12,134.7 | 5.10% | 5.10% |

| Jubilant Ingrevia Ltd | ₹377.1 | 4.70% | 4.70% |

| Karur Vysya Bank Ltd | ₹280.3 | 4.50% | 4.50% |

| Autoline Industries Ltd | ₹14.9 | 4.50% | 4.60% |

| Fortis Healthcare Ltd | ₹933.3 | 4.20% | 4.20% |

| Federal Bank Ltd | ₹902.2 | 3.60% | 3.70% |

| Anant Raj Ltd | ₹91.3 | 3.40% | 3.40% |

| Dishman Carbogen Amcis Ltd | ₹55.4 | 3.20% | 3.20% |

| Indian Hotels Company Ltd | ₹952.9 | 2.10% | 2.10% |

| Wockhardt Ltd | ₹81.8 | 2.10% | 2.10% |

| Prozone Intu Properties Ltd | ₹7.5 | 2.10% | 2.10% |

| Canara Bank Ltd | ₹878.9 | 2.00% | 2.00% |

| D B Realty Ltd | ₹47.0 | 1.90% | 2.10% |

| Edelweiss Financial Services Ltd | ₹108.1 | 1.60% | 1.60% |

| Escorts Ltd | ₹363.9 | 1.40% | - |

| Indiabulls Housing Finance Ltd | ₹74.7 | 1.20% | 1.30% |

| Man Infraconstruction Ltd | ₹42.6 | 1.20% | 1.20% |

| Orient Cement Ltd | ₹33.0 | 1.20% | 1.20% |

| Tata Motors Ltd | ₹1,655.9 | 1.10% | 1.20% |

| Tata Communications Ltd | ₹380.2 | 1.10% | 1.10% |

Top Holdings of Rakesh Jhunjhunwala Portfolio 2022

From financial powerhouses to promising tech firms, Rakesh Jhunjhunwala stock holdings demonstrated his astute investment decisions and provided a glimpse into the stocks that captured his attention and trust during the year.

Therefore, below is a list of the top 5 stocks present in Rakesh Jhunjhunwala portfolio stocks list.

| Name of the Stock | Total Value (in Cr) | Number of Shares Held | % of the Company Held (Sep’22) |

|---|---|---|---|

| Titan Company Ltd | ₹13,047.1 | 4,92,00,970 | 5.50% |

| Star Health and Allied Insurance Company Ltd | ₹6,982.8 | 10,07,53,935 | 17.40% |

| Metro Brands Ltd | ₹3,130.5 | 3,91,53,600 | 14.40% |

| Tata Motors Ltd | ₹1,556.4 | 3,67,50,000 | 1.10% |

| Crisil Ltd | 1,193.4 | 40,00,000 | 5.50% |

However, apart from these top 5 Rakesh Jhunjhunwala portfolio holdings, there is a list of penny stocks referred to as low-price stocks that we will cover in the next section.

Rakesh Jhunjhunwala Penny Stocks List

Here we have listed Rakesh Jhunjhunwala penny stocks that have the potential to generate high returns. However, investors should do their own research before investing in any of these stocks.

| Penny Stocks List | Industry | Sector Dividend Yield (%) |

|---|---|---|

| Prozone Intu Properties | Real Estate | 0.84 |

| Karur Vysya Bank | Banks | 1.13 |

| Edelweiss Financial Services | Diversified Financial Services | 5.08 |

| Autoline Industries | Auto Components | 0.64 |

| TV18 Broadcast Ltd | Media | 0.46 |

| NCC Ltd | Construction & Engineering | 0.57 |

| Anant Raj Ltd | Real Estate | 0.84 |

| Geojit Financial Services | Capital Markets | 1.13 |

| Bilcare Ltd | Life Sciences Tools & Services | 0.82 |

| Steel Authority of India Ltd | Metals & Mining | 3.48 |

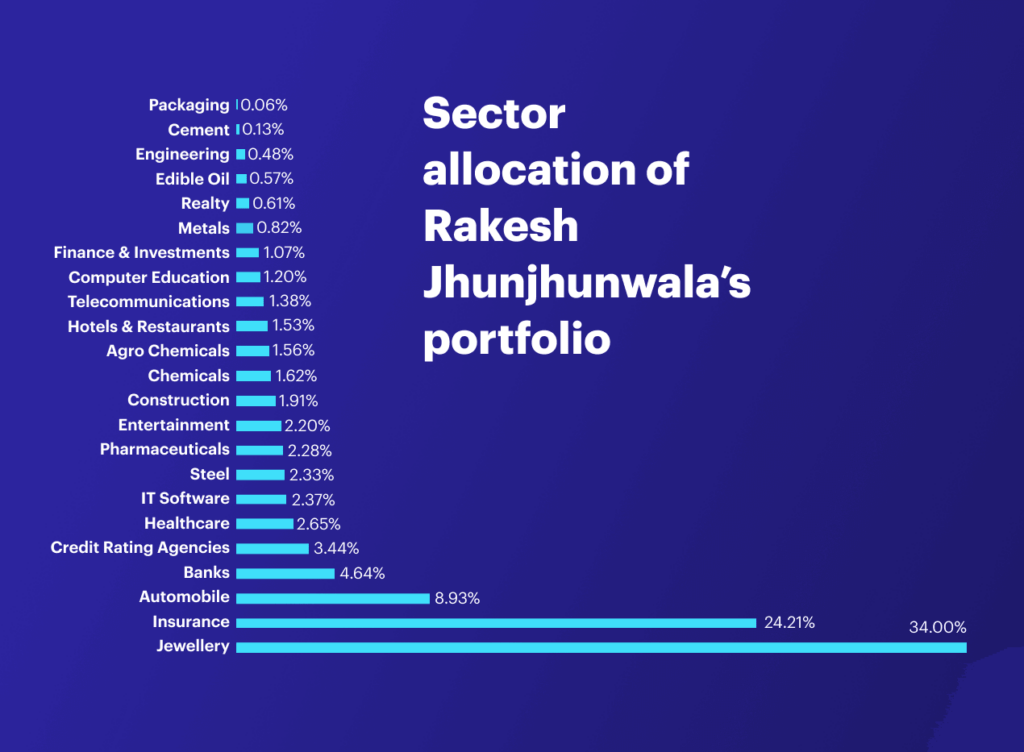

Rakesh Jhunjhunwala Portfolio List-Sector Split Overview

Rakesh Jhunjhunwala is one of the most successful investors in India. He has a knack for picking stocks that outperform the market. As of June 2023, his portfolio is worth over Rs 31,833 crore.

Jhunjhunwala’s portfolio is diversified across 23 sectors. However, he is bullish on a few sectors in particular.

Therefore, as per Rakesh Jhunjhunwala portfolio list, these are the following sectors that were on a lookout.

| Sector | Weightage | Top Stocks |

| Jewellery | 34% | Titan Company Ltd., PC Jeweller Ltd., Tribhovandas Bhimji Zaveri Ltd. |

| Financials | 4.64% | IndusInd Bank, HDFC Bank, Kotak Mahindra Bank |

| Pharmaceuticals | 10% | Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Lupin Ltd. |

| Consumer Durables | 8% | Titan Company Ltd., Whirlpool of India Ltd., Bajaj Electricals Ltd. |

| Media | 6% | Zee Entertainment Enterprises Ltd., Star India Ltd., TV18 Broadcast Ltd. |

| Others | 37.36% | Agro Tech Foods Ltd., Crisil Ltd., Jubilant Pharmova Ltd. |

A briew overview of the top sectors:

- Jewellery: Jhunjhunwala is bullish on the jewellery sector. He has a 34% weightage in Titan Company Ltd., which is the largest jewellery retailer in India. Titan is a well-managed company with a strong brand. It is also the market leader in the jewellery segment.

- Financials: Jhunjhunwala is also bullish on the financial sector. He has a 4.64% weightage in banks, 3.44% in credit rating agencies, and 1.07% in financial services stocks. The financial sector is expected to grow at a healthy pace in the coming years. This is due to the growth in the economy and the increasing demand for financial services.

- Other Sectors: Rakesh Jhunjhunwala portfolio also has significant exposure to other sectors such as pharmaceuticals, consumer durables, and media. He has a 10% weightage in pharmaceuticals, 8% in consumer durables, and 6% in media.

Jhunjhunwala is a value investor. He looks for stocks that are trading at a discount to their intrinsic value. He also invests in stocks that have strong management teams and good track records.

Rakesh Jhunjhunwala Stocks Traded in 2022

‘Trading always keeps you on your feet, it keeps you alert. That’s one of the reasons why I like to trade’.

Rakesh Jhunjhunwala portfolio has outperformed the market in the long term. He has delivered a compounded annual return of over 30% over the last 20 years. This is a remarkable achievement and it is a testament to his investment skills.

Let us first look at Rakesh Jhunjhunwala stock portfolio where he increased his holdings in the Mar-22 quarter and then we’ll move to which stocks were downsized in Rakesh Jhunjhunwala portfolio.

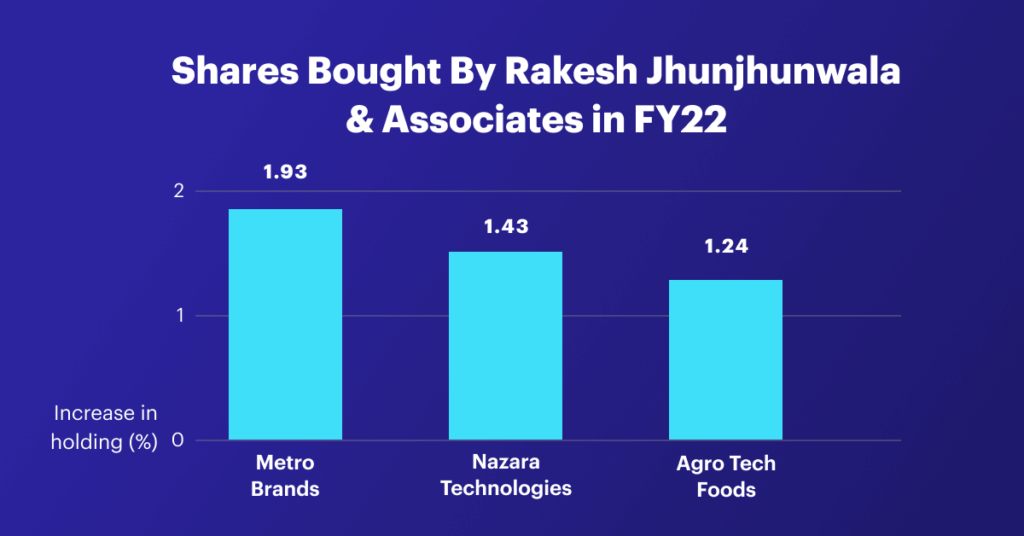

Which Stocks Were Added to Rakesh Jhunjhunwala Stocks List in FY22?

Here is the list of 3 stocks that were added to Rakesh Jhunjhunwala portfolio in 2022.

- Metro Brands: Jhunjhunwala bought 1.9 million shares of Metro Brands, a footwear retailer, in the last quarter of 2022. He now owns a 1.93% stake in the company.

- Nazara Technologies: Jhunjhunwala bought 1.3 million shares of Nazara Technologies, a gaming and sports media company, in the last quarter of 2022. He now owns a 1.43% stake in the company.

- Agro Tech Foods: Jhunjhunwala bought 1.1 million shares of Agro Tech Foods, a food processing company, in the last quarter of 2022. He now owns a 1.24% stake in the company.

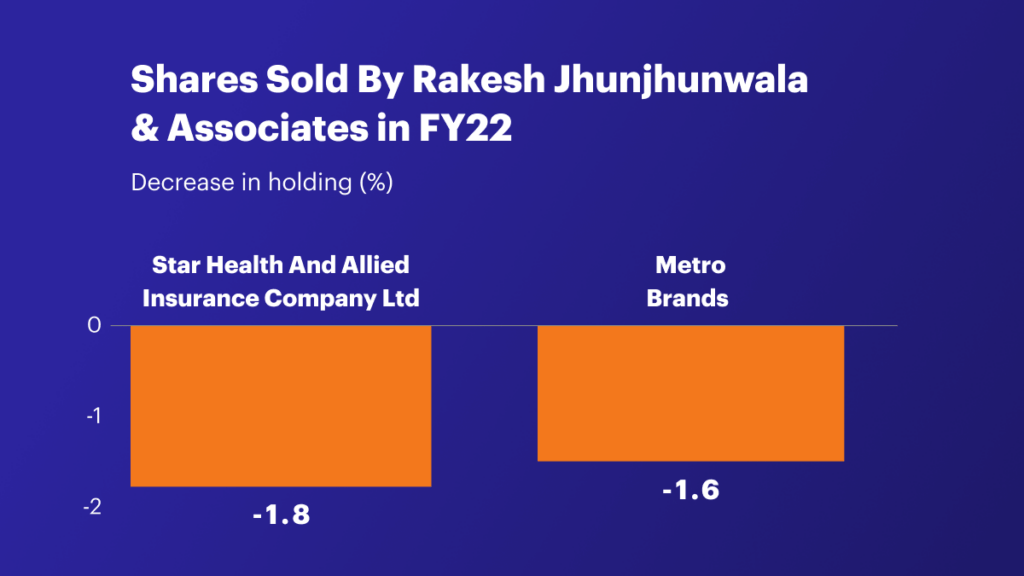

Which Stocks Were Downsized From Rakesh Jhunjhunwala Stocks List in FY22?

Below is the list of stocks that were downsized from Rakesh Jhunjhunwala portfolio 2022:

- Star Health and Allied Insurance Company Ltd: Jhunjhunwala sold 2 lakh Star Health and Allied Insurance Company Ltd. shares in March 2022. This reduced his stake in the company to 1.8%. Star Health is a private health insurance company that is one of the largest health insurers in India. The company has been facing some challenges in recent months due to the rising cost of healthcare.

- Metro Brands Ltd: Jhunjhunwala sold 1 lakh shares of Metro Brands Ltd. in March 2022. This reduced his stake in the company to 1.6%. Metro Brands is a footwear retailer that is one of the largest footwear retailers in India. The company has been facing some challenges in recent months due to the slowdown in the retail sector.

Investment Strategy of Rakesh Jhunjhunwala’s-Stock Picking Philosophy

Till now, we have mostly covered the basics and if you’re here to understand how he took cautious risk decisions and became a billionaire, then this section is for you. While observing Rakesh Jhunjhunwala holdings, we did observe some new learnings. Let’s checkout the prominent ones first:

- Jhunjhunwala believes that the most important factor in investing is the quality of the management team. Take the example of Rakesh Jhunjhunwala’s favourite stock Titan Company Ltd. (the largest jewellery retailer in India). He has invested in the company because he believes that it has a strong management team, a good business model, and is trading at a discount to its intrinsic value.

- Rakesh Jhunjhunwala holds the belief that there isn’t a precise buying point for stocks, but a correct moment to sell exists. According to him, the optimal time to sell a stock is when its price-to-earnings ratio (P/E ratio) reaches an unsustainable level. This strategy proved profitable for him during the Harshad Mehta Scam in the 1990s when he correctly assessed that market valuations were not viable and took a short position.

- Take a look at Rakesh Jhunjhunwala portfolio. By investing in multiple sectors, Rakesh Jhunjhunwala has added diversification to the portfolio. His investments range from jewelry, pharma, automobiles, financial services, and much more.

- Similar to Warren Buffet, even Rakesh Jhunjhunwala believes that cash is a good asset to have on a balance sheet. A huge cash reserve is something he looks for in companies he invests in. This is one of the reasons behind his love for CRISIL Ltd.

Learnings from Rakesh Jhunjhunwala

Here are some of the key learnings from Rakesh Jhunjhunwala Portfolio 2022:

- Do Your Research: Don’t follow quick hot tips. Do your extensive research on companies before investing in them. You must look at the company financials, management team, and industry trends to form a sound decision.

- Invest for the Long Term: Jhunjhunwala is a long-term investor. He believes that it takes time for companies to grow and for their stock prices to appreciate. He is willing to hold on to stocks for years, even if the market is volatile.

- Don’t Be Afraid to Take Risks: Jhunjhunwala is not afraid to take risks. He invests in companies that are in emerging industries or that are facing challenges. He believes that these companies have the potential to grow rapidly and generate high returns.

- Be Patient: Jhunjhunwala is patient. He knows that it takes time for companies to grow and for their stock prices to appreciate. He is willing to wait for the right opportunity to invest.

- Don’t Follow the Herd: Jhunjhunwala is not a follower. He invests in companies that he believes in, even if they are not popular. He believes that it is important to do your own research and make your own investment decisions.

To Wrap It Up…

Rakesh Jhunjhunwala invests in companies that he believes in, even if they are not popular. Additionally, he tries to invest in multiple sectors to reduce the overall risk while enjoying great returns overtime.

However, we understand that stock picking can be a challenging task, requiring extensive research and analysis. That’s where smallcase comes in. With over 500 portfolios curated by SEBI-registered experts, smallcase provides you with a hassle-free investing experience. You can access our website or download the app to discover the portfolio of your dreams, backed by years of research and expertise.

So, whether you’re interested in exploring Rakesh Jhunjhunwala portfolio & holdings or seeking a diverse range of investment options, smallcase offers a comprehensive platform to help you make informed investment decisions.

Know More About Star Investors on smallcase –

Learn More about few of the other star investors, their investment strategies, stocks investments, net worth and much more –