Star Investor – Mukesh Ambani Portfolio

Mukesh Ambani, the chairman and managing director of Reliance Industries Limited, is one of the most influential business figures in India. His strategic investments and diverse portfolio have significantly impacted various sectors, including telecommunications, retail, and energy. This article explores Mukesh Ambani’s portfolio, his investment strategies, and key learnings from his approach to wealth accumulation.

| symbol | Company | ticker | slug | Sector | Market Price | 52W High | 52W Low | Market Cap (Cr.) | PE Ratio | Industry PE | PB Ratio | Div. Yield (%) | ROE (%) | 1YReturns | 3YReturns | 5YReturns | Market Cap Label | Industry Group | Industry | Sub Industry | percentageChange |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| JIO | Jio Financial Services Ltd | JIOFIN | /stocks/jio-financial-services-JIO | Consumer Finance | 230.02 | 394.70 | 198.65 | 146,534.68 | 91.32 | 17.16 | 1.05 | 0.00 | 1.27 | -35.08 | -7.59 | -7.59 | Largecap | Financial Services | Consumer Finance | Diversified Financial Services | 4.12 |

| RELI | Reliance Industries Ltd | RELIANCE | /stocks/reliance-industries-RELI | Oil & Gas - Refining & Marketing | 1,218.95 | 1,608.80 | 1,114.85 | 1,649,528.59 | 23.69 | 11.23 | 1.78 | 0.41 | 7.94 | -16.79 | 5.56 | 133.54 | Largecap | Energy | Oil, Gas & Consumable Fuels | Oil & Gas Refining & Marketing | 2.83 |

Disclaimer: Please note that the above table is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing. The data is derived from Tickertape Stock Screener and is subject to real-time updates.

Note: The data in the list of Mukesh Ambani stocks is dynamic and subject to real-time changes. This data is derived from Tickertape Stock Screener.

🚀 Pro Tip: You can use Tickertape’s Stock Screener to research and evaluate stocks with over 200+ filters and parameters.

Who is Mukesh Ambani?

Mukesh Ambani is an Indian billionaire industrialist known for his leadership of Reliance Industries, a conglomerate with interests spanning petrochemicals, telecommunications, and retail. Born on 19th April 1957, he took over the reins of Reliance after the death of his father, Dhirubhai Ambani. Under his guidance, Reliance has transformed into one of the largest companies in India, with a market capitalisation exceeding ₹20 lakh cr. Mukesh Ambani’s investments have not only bolstered his net worth but also positioned him as a key player in shaping India’s economic landscape.

List of Stocks in Mukesh Ambani Portfolio

| Name | Holding Value | Sep 2024 Holding % | Jun 2024 % | Mar 2024 % |

|---|---|---|---|---|

| Reliance Industries Ltd | 161,235.8 Cr | 19.00% | 19.00% | 19.00% |

| Jio Financial Services Ltd | 42,616.9 Cr | 19.80% | 19.80% | 19.80% |

Overview of Mukesh Ambani Shares

Reliance Industries Ltd

Reliance Industries Ltd, founded in 1973 by Dhirubhai Ambani, is one of India’s largest conglomerates, headquartered in Mumbai. The company operates across diverse sectors, including petrochemicals, refining, oil and gas exploration, retail, telecommunications, and digital services. People widely recognise Reliance for leading technological innovation and driving sustainability initiatives in India.

As of September 2024, the holding value of Reliance Industries Ltd is Rs. 1,61,235.8 cr., with a holding capitalisation of 19.00%. The holding percentages have remained consistent across September 2024, June 2024, and March 2024 at 19.00%.

Jio Financial Services Ltd

Jio Financial Services Ltd, a subsidiary of Reliance Industries Ltd, was established to consolidate and expand the financial services arm of the Reliance Group. Launched in 2023, the company focuses on digital financial solutions, lending, insurance, and asset management services, leveraging the expansive digital network of Reliance Jio.

As of September 2024, Jio Financial Services Ltd holds a value of Rs. 42,616.9 cr., with a holding capitalisation of 19.80%. The holding percentages have remained stable at 19.80% for September 2024, June 2024, and March 2024.

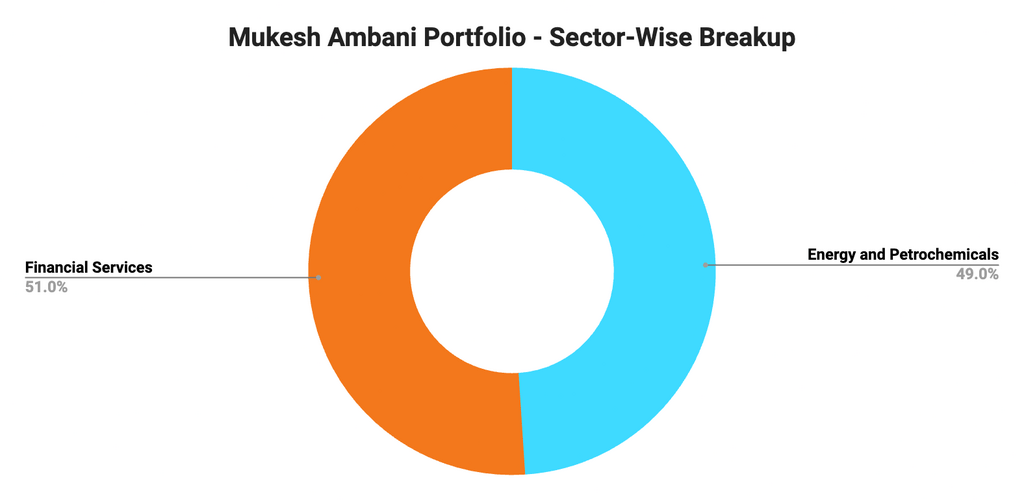

Mukesh Ambani Portfolio: Sector-Wise Investments

The portfolio of Mukesh Ambani comprises a range of investments across various sectors:

- Energy and Petrochemicals: Reliance Industries continues to be a leader in these sectors, focusing on sustainable practices and renewable energy initiatives.

- Financial Services: With the launch of Jio Financial Services, Ambani is expanding into financial products, leveraging Jio’s vast user base to offer innovative solutions.

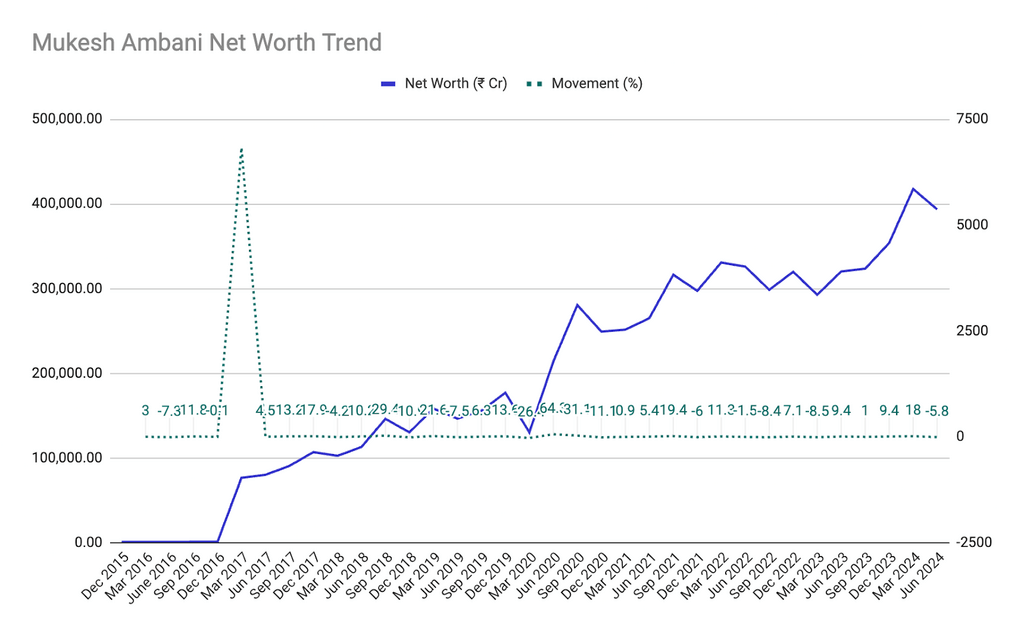

Mukesh Ambani Net Worth Trend

Mukesh Ambani’s net worth has experienced notable fluctuations over the years, driven by market dynamics and the strategic growth of Reliance Industries.

- 2015–2016: Moderate growth with a 3% increase in Q1 2016, followed by fluctuations; a -7.3% drop in Q2 2016 was offset by an 11.8% rise by Q3 2016.

- 2017: Explosive growth in March 2017 with a 6,831.9% surge, driven by Reliance Industries’ valuation spike, primarily due to Jio’s success.

- 2018–2019: Sustained growth with peaks like a 29.4% rise in Q3 2018 and dips, such as -10.9% in Q4 2018.

- 2020: Sharp declines in early 2020 (-26.4% in Q1) due to global market shocks, followed by a strong rebound (64.3% in Q2) as digital services thrived.

- 2021–2022: Continued growth, peaking in Q3 2021 with a 19.4% increase, followed by smaller gains and losses due to market adjustments.

- 2023–2024: Strong gains in Q1 2024 (18%), but occasional drops, such as -5.8% in Q2 2024, highlighting market volatility.

The overall trend underscores Reliance Industries’ impact on Mukesh Ambani’s wealth, with digital and telecom ventures playing a key role.

Mukesh Ambani Portfolio Strategy

Mukesh Ambani’s investment strategy is characterised by diversification and long-term growth. He employs a buy-and-hold approach while remaining flexible in adjusting his holdings based on market conditions. Key aspects of his strategy include:

- Sector Diversification: By investing across multiple sectors, he mitigates risks associated with market volatility.

- Focus on Growth Sectors: Ambani strategically invests in high-growth areas such as technology and renewable energy.

- Long-Term Vision: He often aims to invest for long-term gains rather than short-term profits.

- Adaptability: He is willing to shift investments from overvalued stocks to undervalued opportunities that show promise.

Learnings from Mukesh Ambani’s Portfolio

Investors can draw several key lessons from Mukesh Ambani’s investment approach:

- Diversification is Key: A well-rounded portfolio across different sectors can help mitigate risks.

- Focus on Innovation: Investing in technology-driven companies can yield significant returns.

- Patience Pays Off: Long-term investments often outperform short-term trading strategies.

- Stay Informed: Keeping abreast of market trends allows for timely adjustments to the portfolio.

To Wrap Up…

Mukesh Ambani’s portfolio reflects a strategic blend of investments that leverage growth opportunities across various sectors. His ability to adapt to changing market dynamics while maintaining a long-term vision has solidified his status as one of India’s wealthiest individuals. As he continues to explore new avenues for growth, such as Jio Financial Services and renewable energy ventures, investors can learn valuable lessons from his approach to wealth creation.

FAQs About Mukesh Ambani Portfolio

As of June 2024, Mukesh Ambani’s net worth is estimated to be around ₹3,93,594.05 cr.

Major investments include Reliance Industries Ltd., Jio Financial Services Ltd., and various stakes in retail and media companies.

He employs a diversified investment strategy focused on long-term growth while remaining adaptable to market changes.

His investments span telecommunications, retail, energy, media, and financial services.

Yes, through Jio Financial Services, he is entering the mutual fund market to capitalise on India’s growing demand for financial products.