Latest Dilipkumar Lakhi Portfolio, Investment Strategy & Net Worth Trend

Dilipkumar Vishindas Lakhi is a distinguished figure in the Indian investment landscape, known for his strategic acumen in stock market investments. As the chairman of the Lakhi Group and a successful diamond merchant, he has adeptly transitioned into a formidable investor, amassing significant wealth through calculated risks. His investment portfolio is diverse, reflecting his expertise in identifying high-potential stocks across various sectors.

Dilipkumar Lakhi Portfolio 2024

| Company | Sector | Market Price | 52W High | 52W Low | Market Cap (Cr.) | PE Ratio | Industry PE | PB Ratio | Div. Yield (%) | ROE (%) | 1YReturns | 3YReturns | 5YReturns | Market Cap Label | Industry Group | Industry | Sub Industry | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ALSL | Almondz Global Securities Ltd | ALMONDZ | /stocks/almondz-global-securities-ALSL | Investment Banking & Brokerage | 24.08 | 39.13 | 16.43 | 444.84 | 13.06 | 17.60 | 2.02 | 0.00 | 15.84 | 29.00 | 32.79 | 1,007.13 | Smallcap | Financial Services | Capital Markets | Investment Banking & Brokerage | 2.70 |

| AROG | Aro Granite Industries Ltd | AROGRANITE | /stocks/aro-granite-industries-AROG | Building Products - Granite | 35.74 | 64.99 | 32.10 | 54.93 | 41.61 | 41.78 | 0.29 | 0.00 | 0.69 | -28.30 | -40.48 | 52.41 | Smallcap | Capital Goods | Building Products | Building Products | 1.01 |

| AVON | Avonmore Capital & Management Services Ltd | AVONMORE | /stocks/avonmore-capital-and-management-services-AVON | Investment Banking & Brokerage | 22.08 | 29.95 | 8.63 | 612.06 | 49.36 | 17.60 | 1.55 | 0.00 | 3.28 | 143.17 | 151.32 | 2,486.13 | Smallcap | Financial Services | Capital Markets | Investment Banking & Brokerage | 0.14 |

| DILG | Diligent Media Corporation Ltd | DNAMEDIA | /stocks/diligent-media-corporation-DILG | Publishing | 4.96 | 8.84 | 4.00 | 57.09 | 0.42 | -117.81 | 0.32 | 0.00 | 123.87 | 18.10 | 74.04 | 1,317.14 | Smallcap | Media & Entertainment | Media | Publishing | 1.81 |

| GOCL | Gocl Corporation Ltd | GOCLCORP | /stocks/gocl-corp-GOCL | Commodity Chemicals | 269.40 | 516.80 | 245.00 | 1,340.94 | 27.79 | 29.12 | 0.94 | 1.48 | 3.41 | -38.49 | -13.01 | 89.92 | Smallcap | Materials | Chemicals | Commodity Chemicals | 4.31 |

| NXTD | NDL Ventures Ltd | NDLVENTURE | /stocks/nxtdigital-NXTD | Real Estate | 61.99 | 134.65 | 48.94 | 206.98 | 128.56 | 53.73 | 3.30 | 1.63 | 2.46 | -39.52 | -84.42 | -74.01 | Smallcap | Media & Entertainment | Real Estate | Cable & Satellite | -0.48 |

| RELG | Religare Enterprises Ltd | RELIGARE | /stocks/religare-enterprises-RELG | Investment Banking & Brokerage | 222.46 | 320.00 | 201.60 | 7,284.30 | 31.27 | 17.60 | 2.29 | 0.00 | 7.85 | -0.33 | 79.33 | 704.56 | Smallcap | Insurance | Capital Markets | Life & Health Insurance | 0.01 |

| REMI | Welspun Specialty Solutions Ltd | WELSPLSOL | /stocks/welspun-specialty-solutions-REMI | Iron & Steel | 27.14 | 55.52 | 25.60 | 1,787.73 | 28.62 | 29.12 | 16.00 | 0.00 | 79.19 | -24.76 | 60.41 | 293.90 | Smallcap | Materials | Metals & Mining | Steel | 2.73 |

| UNTE | Unitech Ltd | UNITECH | /stocks/unitech-UNTE | Real Estate | 6.28 | 13.20 | 5.57 | 1,661.35 | -0.50 | 53.73 | -0.33 | 0.00 | 0.00 | -44.67 | 167.23 | 402.40 | Smallcap | Real Estate Management & Development | Real Estate | Real Estate Development | 0.96 |

| WELS | Welspun Enterprises Ltd | WELENT | /stocks/welspun-enterprises-WELS | Construction & Engineering | 511.55 | 655.00 | 315.10 | 6,912.25 | 23.42 | 41.78 | 2.78 | 0.59 | 12.16 | 51.91 | 471.56 | 892.34 | Smallcap | Capital Goods | Construction & Engineering | Construction & Engineering | 0.20 |

Disclaimer: Please note that the above table is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing. The data is derived from Tickertape Stock Screener and is subject to real-time updates.

Note: The data in the list of Dilipkumar Lakhi stocks is dynamic and subject to real-time changes. This data is derived from Tickertape Stock Screener.

Who is Dilipkumar Lakhi?

At 73 years old and based in Mumbai, Dilipkumar Lakhi is celebrated not only for his achievements in the diamond industry—where he established Asia’s largest diamond manufacturing facility—but also for his prowess as an investor. Over the years, he has expanded his focus to the stock market, where his investments have yielded impressive returns.

As of November 2024, Lakhi’s net worth stands at approximately ₹1,340.04 cr., having experienced notable fluctuations over the years due to market conditions and his investment strategies. His investment strategy often emphasises small-cap stocks and sectors that are less competitive than traditional industries like pharmaceuticals and banking, showcasing his willingness to explore unique opportunities.

List of Stocks in Dilip Kumar Lakhi Portfolio

As of September 2024, Dilipkumar Lakhi share holdings are mentioned below:

| Stock Name | Sep 2024 Holding (%) | Holding Value (Rs.) | Qty Held |

|---|---|---|---|

| Welspun Specialty Solutions Ltd | 23.00% | 513.0 Cr | 1,22,132,717 |

| Welspun Enterprises Ltd | 5.80% | 376.7 Cr | 7,972,512.00 |

| Unitech Ltd | 4.40% | 105.7 Cr | 1,16,057,004 |

| Aro Granite Industries Ltd | 4.00% | 2.9 Cr | 611,694.00 |

| Religare Enterprises Ltd | 3.60% | 291.5 Cr | 11,736,872.00 |

| Almondz Global Securities Ltd | 3.50% | 16.3 Cr | 5,920,702.00 |

| NDL Ventures Ltd | 1.90% | 7.4 Cr | 654,153.00 |

| Avonmore Capital & Management Services Ltd | 1.80% | 6.5 Cr | 4,103,920.00 |

| Diligent Media Corporation Ltd | 1.10% | 65.9 L | 1,272,540.00 |

| GOCL Corp Ltd | 1.10% | 19.4 Cr | 527,074.00 |

Overview of Stocks in Dilipkumar Lakhi Portfolio

Welspun Specialty Solutions Ltd

Welspun Specialty Solutions Ltd, part of the Welspun Group, manufactures stainless and alloy steel products. It serves oil, gas, power, and automotive industries. Dilipkumar Lakhi holds a 23.00% stake worth ₹513.0 cr., totaling 12,21,32,717 shares.

Welspun Enterprises Ltd

Welspun Enterprises Ltd is part of the Welspun Group and focuses on infrastructure projects, including roads, water, and energy. Lakhi’s stake in the company is 5.80%, valued at ₹376.7 cr., comprising 79,72,512 shares.

Unitech Ltd

Unitech Ltd, a real estate company, focuses on residential and commercial developments but has faced challenges recently. Lakhi’s 4.40% stake is valued at ₹105.7 cr., equating to 11,60,57,004 shares.

Aro Granite Industries Ltd

Aro Granite Industries Ltd is a major exporter of polished granite slabs and tiles globally. Lakhi holds a 4.00% stake valued at ₹2.9 cr., corresponding to 6,11,694 shares in total.

Religare Enterprises Ltd

Religare Enterprises Ltd offers financial services across lending, insurance, and capital markets. Lakhi holds a 3.60% stake worth ₹291.5 cr., comprising a total of 1,17,36,872 shares.

Almondz Global Securities Ltd

Almondz Global Securities Ltd provides investment banking, wealth management, and advisory services. Lakhi holds a 3.50% stake valued at ₹16.3 cr., with 59,20,702 shares in his portfolio.

NDL Ventures Ltd

NDL Ventures Ltd, previously Nitesh Estates, operates in real estate development and management. Lakhi has a 1.90% stake worth ₹7.4 cr., with a total of 6,54,153 shares.

Avonmore Capital & Management Services Ltd

Avonmore Capital & Management Services Ltd focuses on financial advisory and investment services. Lakhi holds a 1.80% stake valued at ₹6.5 cr., consisting of 41,03,920 shares overall.

Diligent Media Corporation Ltd

Diligent Media Corporation Ltd operates in the media sector and is known for publishing “DNA.” Lakhi’s stake of 1.10% is valued at ₹65.9 lakh, amounting to 12,72,540 shares.

GOCL Corporation Ltd

GOCL Corporation Ltd, part of the Hinduja Group, produces explosives and chemicals and is active in real estate. Lakhi’s 1.10% stake is valued at ₹19.4 cr., covering 5,27,074 shares.

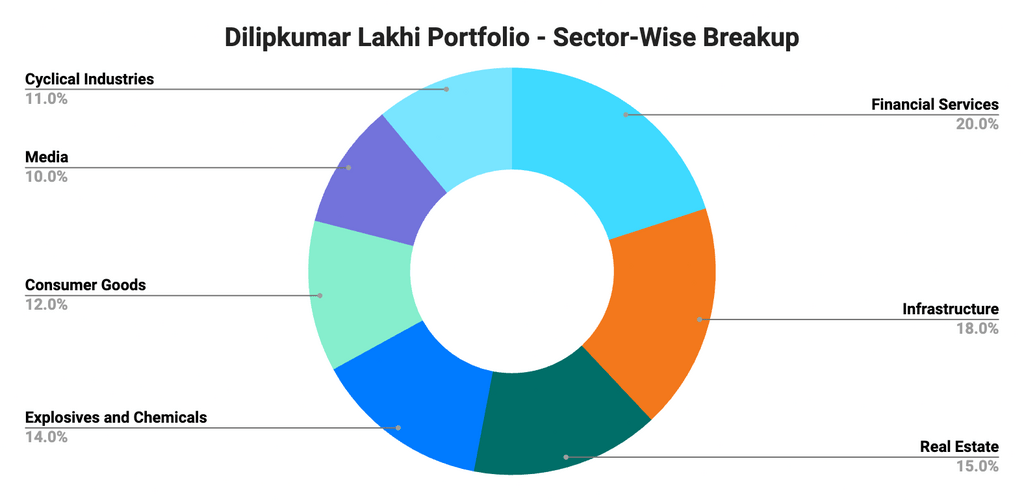

Dilipkumar Lakhi’s Portfolio: Sector-Wise Investment

Here’s a breakdown of the sectors Dilipkumar Lakhi invests in, along with the percentage allocated to each sector:

- Financial Services: Dilipkumar Lakhi holds stocks in companies like Religare Enterprises Ltd., which focuses on securities and commodities broking, contributing significantly to this sector.

- Infrastructure: This sector includes investments in infrastructure development firms such as Welspun Enterprises Ltd., which focuses on essential projects through public-private partnerships.

- Real Estate: Unitech Ltd. represents Lakhi’s interest in the real estate sector, which specialises in the development of both residential and commercial properties.

- Explosives and Chemicals: This sector includes key investments in Premier Explosives Ltd., which produces industrial explosives, and GOCL Corporation Ltd., which manufactures explosives and related accessories.

- Consumer Goods: Lakhi invests in companies that manufacture products for daily use, with Welspun Specialty Solutions Ltd. being a notable player in this area.

- Media: His portfolio includes strategic investments in media companies, focusing on less competitive niches that highlight long-term growth potential.

- Cyclical Industries: This category encompasses investments in sectors like steel and automotive, where Lakhi aims to capitalise on market recoveries during favourable economic conditions.

These percentages reflect the diversification of Dilipkumar Lakhi’s investments across multiple sectors, showcasing his strategic approach to building a balanced portfolio.

Sector-Wise Investment Chart

The following pie chart shows the distribution of Dilipkumar Lakhi’s portfolio across various sectors based on his publicly held stocks as of November 2024:

- Financial Services (20%)

- Infrastructure (18%)

- Real Estate (15%)

- Explosives and Chemicals (14%)

- Consumer Goods (12%)

- Media (10%)

- Cyclical Industries (11%)

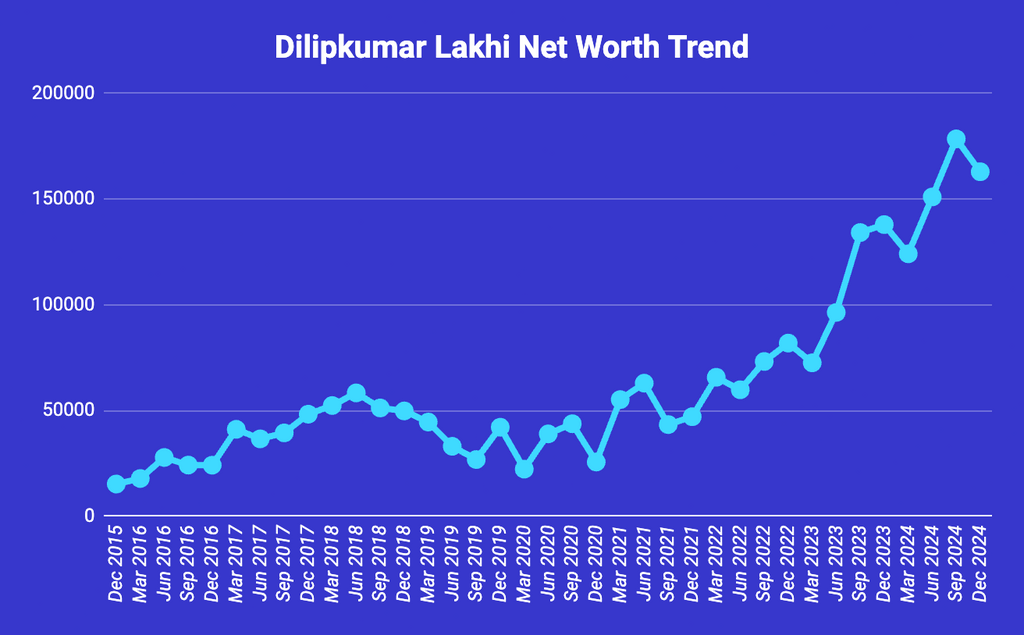

Dilipkumar Lakhi Net Worth Trend

Dilipkumar Lakhi’s net worth has seen significant highs and lows over the years, shaped by market conditions and portfolio strategies.

- 2015–2016: Net worth rose steadily, with a 17.34% increase in June 2016 and a sharp 56.11% growth by December 2016.

- 2017–2019: After growth of 70.59% in mid-2017, net worth declined sharply by -25.81% in December 2018 and -47.22% by June 2019, reflecting market corrections.

- 2020–2021: A strong recovery phase saw net worth soar by 115.73% in December 2020 and 39.26% by December 2021, driven by favourable conditions.

- 2022–2023: Growth remained consistent, with 39.72% and 32.89% increases in 2022, followed by 21.70% growth by December 2023.

- 2024: A steep decline of -24.9% in November reduced net worth to ₹1,340.04 cr., likely due to recent market challenges.

This trend emphasises the importance of resilience and adaptability in navigating fluctuating market conditions. It highlights how strategic investments can lead to recovery and growth despite short-term setbacks.

Dilipkumar Lakhi’s Bulk and Block Deals in 2024

In May 2024, Dilipkumar Lakhi sold off a significant number of NDL Ventures Ltd shares. The details are mentioned below.

| Stocks | Date | Category | Transaction Type | Quantity | Value Traded (Rs.) | Holdings change(%) | Average Trade Price (Rs.) |

| NDL Ventures Ltd | 30th May 2024 | Bulk | sell | 514000 | 48238900 | 1.5265080347631600 | 93.85 |

To keep track of bulk and block deals, you can use Tickertape’s Stock Deals tool to analyse Dilipkumar Lakhi’s bulk and block deals for different time periods.

Investment Strategy of Dilipkumar Lakhi

Dilipkumar Lakhi has crafted a unique investment strategy reflecting his insights and stock market experience. Key elements of his approach include:

- Focus on Long-Term Growth: Lakhi prioritises investments in companies with strong fundamentals and significant potential for appreciation. His strategy emphasises the importance of holding stocks for the long term to allow their true value to emerge.

- Strategic Diversification: He maintains a diversified portfolio, strategically investing across various sectors. Lakhi particularly targets less popular industries like media, lubricants, and printing ink, which mainstream investors often overlook.

- Preference for Small-Cap Stocks: Lakhi shows a strong preference for high-potential small-cap stocks, recognising their volatility and potential for substantial returns. For example, his investment in Unitech Ltd has achieved an impressive 667.86% return over the past year.

- Contra Calls and Contrarian Approach: Lakhi is known for making contra calls by investing in beaten-down stocks that others may overlook. This contrarian approach demonstrates his confidence in identifying undervalued opportunities that can lead to significant gains.

- Avoidance of Conventional Sectors: He deliberately avoids investing in conventional sectors such as pharmaceuticals and private banks. Instead, Lakhi opts for less competitive markets that present unique growth prospects, allowing him to capitalise on opportunities that others might miss.

Learnings from Dilipkumar Lakhi’s Portfolio

Dilipkumar Lakhi’s portfolio is characterised by several key features that can serve as valuable lessons for investors:

- Diverse Holdings: Dilipkumar Lakhi portfolio includes shares from various sectors, notably materials and consumer staples. This diversification helps mitigate risk while maximising growth potential.

- High-Potential Stocks: Lakhi focuses on Dilipkumar Lakhi stocks that exhibit strong growth prospects. Notable Dilipkumar Lakhi investments include Religare Enterprises Ltd and Welspun Enterprises Ltd, both of which have shown substantial returns.

- Risk Management: His strategy often involves investing in small-cap stocks, which can be volatile but offer high reward potential. This approach requires careful monitoring and risk assessment to balance potential losses with gains.

- Strategic Investment Choices: Lakhi’s choices reflect a preference for less popular segments of the market, allowing him to capitalise on opportunities overlooked by other investors. This includes holdings in companies like Unitech Ltd and Premier Explosives Ltd.

- Performance Metrics: Dilipkumar Lakhi stocks portfolio has demonstrated impressive performance metrics, with many stocks yielding significant returns over one year. For instance, Unitech Ltd recorded a remarkable 667.86% return over the past year.

To Wrap It Up…

Dilipkumar Lakhi’s journey from a diamond merchant to a successful investor illustrates the power of strategic investment and diversification. His portfolio serves as an example of how careful selection of high-potential stocks and an understanding of market dynamics can lead to substantial wealth accumulation. Aspiring investors can draw valuable insights from his approach to investing in less competitive sectors and managing risks effectively.

Frequently Asked Questions About Dilip Kumar Lakhi

Dilipkumar Lakhi is a renowned diamond merchant and investor in India, known for his strategic investments in the stock market. His portfolio has grown significantly over the years, reflecting his expertise in identifying high-potential stocks.

As of June 2023, Dilipkumar Lakhi’s net worth is estimated at approximately ₹1,075.8 cr., showcasing substantial growth from ₹157.54 cr. in December 2015 due to his successful investment strategies.

Dilipkumar Lakhi portfolio consists of various stocks, including notable holdings like Religare Enterprises Ltd, Welspun Enterprises Ltd, and Unitech Ltd, among others.

Lakhi’s investment strategy involves focusing on small-cap stocks and less competitive sectors, allowing him to capitalise on opportunities that other investors may overlook. He often engages in bold investments that reflect a high-risk, high-reward approach.

The performance of Dilipkumar Lakhi stocks portfolio has been impressive, with many holdings yielding significant returns. For instance, Unitech Ltd recorded a remarkable 667.86% return over the past year, highlighting the effectiveness of his investment choices