Ashish Kacholia Portfolio

There are individuals who possess a unique talent for spotting promising opportunities and turning them into remarkable success stories. One such name that resonates strongly within the Indian investment landscape is Ashish Kacholia. With a proven track record and a penchant for discovering hidden gems in the stock market, Kacholia has earned a reputation as a visionary investor and a driving force behind the rise of numerous Indian companies. In this blog, we will delve into the investment strategies and what stocks are included in Ashish Kacholia portfolio.

Let’s discover the secrets behind Ashish Kacholia portfolio 2022 phenomenal success in the share market and delve into her captivating story.

Who is Ashish Kacholia?

Born and raised in Mumbai, India, Ashish Kacholia is a prominent Indian investor and fund manager. With a focus on small-cap and mid-cap companies, Kacholia has made a name for himself by identifying undervalued shares with substantial growth potential.

Known as the ‘Big Whale’ by the media, Kacholia began his career at Prime Securities and later joined Edelweiss before establishing Lucky Securities in 1995. In 2003, he started building his own portfolio after confounding Hungama Digital with Rakesh Jhunjhunwala in 1999.

Kacholia gained widespread recognition in the investment community for his early investments in companies like Atul Auto, Eicher Motors, and Mayur Uniquoters, which delivered significant returns over time. His investment philosophy centres around identifying businesses with strong fundamentals, competitive advantages, and a robust growth trajectory.

Thus, Ashish Kacholia portfolio includes a diverse range of companies spanning various sectors such as pharmaceuticals, textiles, consumer goods(FMCG), and information technology(IT). His stock picks have not only generated substantial wealth for himself but have also inspired and influenced other investors in the Indian market.

List of Stocks in Ashish Kacholia Latest Portfolio

Known as the WizKid of financial markets, he has a keen eye for undervalued stocks. Thus, you can check out Ashish Kacholia share price by tapping into his latest investments.

As per the latest corporate shareholdings filed, Ashish Kacholia portfolio publicly holds 42 stocks with a net worth of over ₹2,025.5 Cr.

Top Holdings of Ashish Kacholia Portfolio 2022

With a strong track record of spotting undervalued companies, Ashish Kacholia latest portfolio is a curated selection of holdings. Some of his latest picks included a diverse range of companies from various sectors.

Therefore, below is a list of the top 12 Ashish Kacholia latest picks present in the stocks list.

| Company Name | Shares Held | Value (in Cr) |

|---|---|---|

| Safari Industries (India) Ltd | 5,48,000 | ₹161.6 |

| NIIT Ltd | 30,00,000 | ₹117,66 |

| PCBL Ltd | 70,84,990 | ₹99.97 |

| Ami Organics Ltd | 7,76,474 | ₹98.5 |

| Shaily Engineering Plastics Ltd | 5,99,696 | ₹98.5 |

| Gravita India Ltd | 14,84,399 | ₹93.3 |

| Fineotex Chemical Ltd | 3,124,072 | ₹92.8 |

| Garware Hi-Tech Films Ltd | 9,68,322 | ₹79.9 |

| Yasho Industries Ltd | 4,55,394 | ₹77.4 |

| SJS Enterprises Ltd | 13,48,374 | ₹76.8 |

| Ador Welding Ltd | 5,95,400 | ₹69.5 |

| La Opala R G Ltd | 17,67,433 | ₹20.7 |

Overview of Stocks in Ashish Kacholia Portfolio

Apart from the 43 stocks present in his portfolio, here is an overview of the top Ashish Kacholia stocks.

1. Safari Industries (India) Ltd

Safari Industries is a leading manufacturer of home textiles, including bed linen, towels, and rugs. The company has a strong brand presence in India and exports its products to over 50 countries. Safari Industries is well-positioned to benefit from the growing demand for home textiles in India and abroad.

2. NIIT Ltd

NIIT is a leading provider of IT education and training services. The company offers a wide range of courses, from basic computer literacy to advanced programming and networking. NIIT has a strong presence in India and has recently expanded its operations to other countries in Asia, Africa, and the Middle East.

3. PCBL Ltd

PCBL is a leading manufacturer of printed circuit boards (PCBs). A wide range of electronic products, including computers, mobile phones, and medical devices are used as products.

4. Fineotex Chemical Ltd

Fineotex Chemical is a leading manufacturer of speciality chemicals. It is used in a wide range of industries, including textiles, plastics, and pharmaceuticals.

5. Ami Organics Ltd

Ami Organics is a leading manufacturer of fine chemicals. Thus, industries, including pharmaceuticals, cosmetics, and agrochemicals use this company’s products. It serves customers in the domestic and international markets.

6. Gravita India Ltd

Gravita India is a leading manufacturer of packaging films. The company’s products are used in a wide range of industries, including food, beverage, and pharmaceutical.

7. Garware Hi-Tech Films Ltd

Garware Hi-Tech Films is a leading manufacturer of speciality films. The company’s products are used in a wide range of industries, including solar, electronics, and automotive.

8. Yasho Industries Ltd

Yasho Industries is a leading manufacturer of precision engineering components. The company’s products are used in a wide range of industries, including aerospace, defense, and medical devices.

9. Shaily Engineering Plastics Ltd

Shaily Engineering Plastics is a leading manufacturer of engineering plastics. The company’s products are used in a wide range of industries, including automotive, electrical, and construction.

10. SJS Enterprises Ltd

SJS Enterprises is a leading manufacturer of stainless steel tubes and pipes. Thus, industries, including food, beverage, and chemical use this company’s products.

11. La Opala RG Ltd

La Opala RG is a leading manufacturer of art glass. The company’s products are used in a wide range of applications, including decorative items, lighting, and tableware.

12. Ador Welding Ltd

Ador Welding is a leading manufacturer of welding consumables. A wide range of industries, including construction, manufacturing, and oil & gas uses this company’s products.

Ashish Kacholia Multibagger Stocks

Known for his ability to identify multibagger stocks. He has earned a reputation for his successful investment strategies. Thus, some of the multibagger stocks in Ashish Kacholia portfolio include:

- Balu Forge Industries: A forging company that has benefited from the increasing demand for forged products in the automotive and construction industries generating 127% return.

- DU Digital Global: A leading digital marketing agency that has seen strong growth in recent years delivering 120% return since last year.

- Hindware Home Innovation: A home improvement company that has benefited from the increasing demand for home renovations generating 80% return since last year.

- Goldiam International: A jewelry retailer that has seen strong sales growth in recent quarters giving a 60% return since last year.

- Raghav Productivity Enhancers: A productivity software company that has seen increased demand for its products as businesses look to improve efficiency. The company’s stock has given a return of over a 40% since last year.

- Knowledge Marine & Engineering Works: A marine engineering company that has benefited from the rising demand for shipbuilding and ship repair services delivering a return of over 20%.

- D-link India: A networking equipment company that has seen strong growth in the Indian market. The company’s stock has given a return of over 60%.

- Venus Pipes and Tubes: A pipes and tubes manufacturer that has seen strong demand for its products in the infrastructure sector. It has contributed to 140% return nearly 1.5 times to investors.

- Gravita India: A sustainable packaging company contributing over 25% of Ashish Kacholia portfolio.

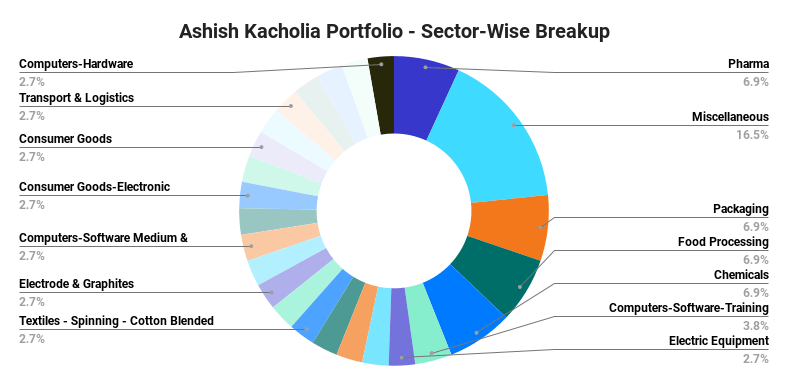

Ashish Kacholia Portfolio – Sector-Wise Investment

Here’s a sector-wise breakup of Ashish Kacholia holdings:

In Ashish Kacholia portfolio, investments in stocks with a varied portfolio include hospitality, education, infra, and manufacturing stocks, as per exchange filings.

- Hospitality: Ashish Kacholia portfolio includes companies operating in the hospitality sector, such as hotel chains, resorts, or restaurants. His confidence in the growth potential of the tourism industry and the increasing demand for quality hospitality services in India could drive these investments.

- Education: Kacholia’s latest portfolio might include investments in the education sector, focusing on companies involved in skill development, vocational training, or educational technology. With a strong belief in the power of education, he may have identified promising opportunities within this sector.

- Infrastructure: Ashish Kacholia portfolio could include investments in infrastructure-related companies. These may encompass areas like construction, real estate, transportation, or utilities. The anticipated growth in infrastructure development and the government’s focus on improving physical infrastructure across the country may drive his investments in this sector.

- Manufacturing: Ashish Kacholia portfolio of stocks may have investments in the manufacturing sector, which covers a broad range of industries. This could include companies engaged in areas such as automobiles, consumer goods, chemicals, or engineering.

Stocks Traded by Ashish Kacholia in 2023

The ace investor Ashish Kacholia was on a shopping spree during the March quarter.

Therefore, let’s have a look at a diversified portfolio of Ashish Kacholia stocks, aiming to capitalize on emerging opportunities and maximize returns. Thereafter, we will move on to which stocks were downsized in Ashish Kacholia portfolio.

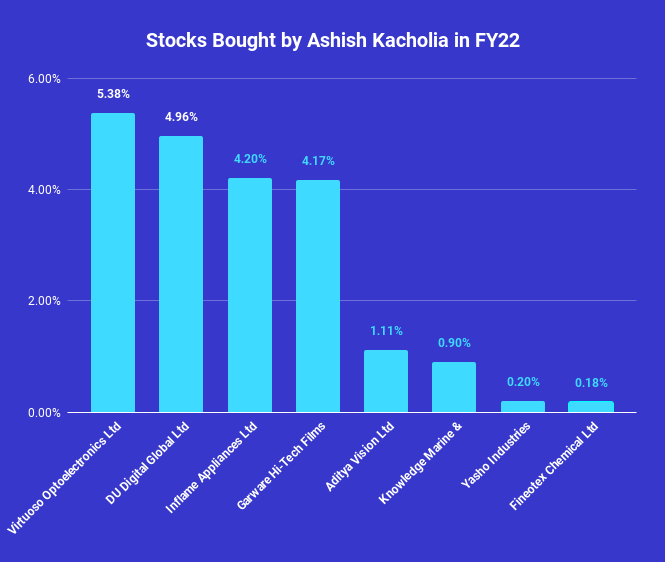

Which Stocks were Added to Ashish Kacholia Portfolio List in FY22?

- Virtuoso Optoelectronics Ltd: A manufacturer of optical components. A wide range of applications utilizes the company’s products, including telecommunications, medical devices, and defence. Ashish Kacholia increased his stake in Virtuoso Optoelectronics to 5.38% in the past year.

- DU Digital Global Ltd: A digital marketing agency. The company provides a wide range of services, including search engine optimization (SEO), pay-per-click (PPC) advertising, and social media marketing. In Ashish Kacholia portfolio, the company’s stake increased from 0% to 4.96% in the past year.

- Inflame Appliances Ltd: Inflame Appliances is a leading manufacturer of kitchen appliances. The company’s products are sold under the brand name Inflame. In Ashish Kacholia portfolio, the company’s stock increased from 0% to 4.20% in the past year.

- Garware Hi-Tech Films Ltd: Known as a leading manufacturer of speciality films. The company’s products are used in a wide range of industries, including solar, electronics, and automotive. In the portfolio of Ashish Kacholia, the company’s stock has increased to 4.17% in the past year.

- Aditya Vision Ltd: A leading manufacturer of optical lenses. Thus, in Ashish Kacholia portfolio the company’s stocks increased to 1.11% in the past year.

- Knowledge Marine & Engineering Works Ltd: Knowledge Marine & Engineering Works is a marine engineering company. The company provides a wide range of services, including ship repair and maintenance, and offshore construction. In Ashish Kacholia portfolio, the stake in Knowledge Marine & Engineering Works has increased to 0.19% since the past year.

- Fineotex Chemical Ltd: Fineotex Chemical is a leading manufacturer of speciality chemicals. A wide range of industries, including textiles, plastics, and pharmaceuticals, uses the company’s products. In Ashish Kacholia latest buys, 0.18% was the rise in the stake in the past year.

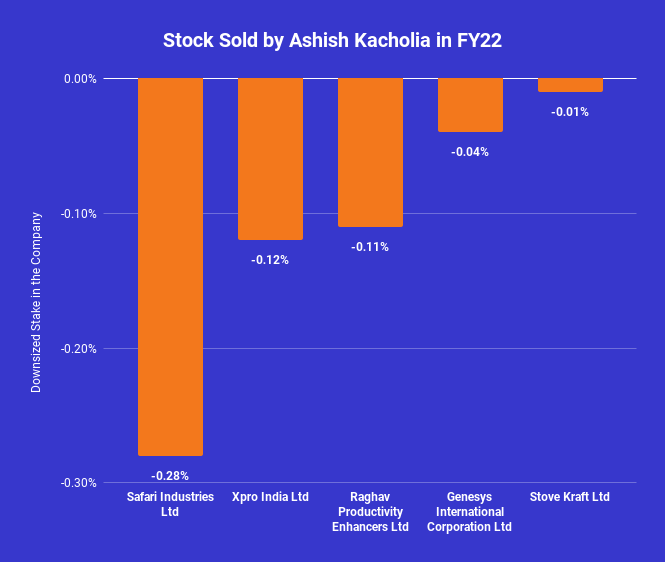

Which Stocks Were Downsized to Ashish Kacholia Portfolio List in FY22?

Below is the list of 5 stocks that were downsized from Ashish Kacholia Portfolio 2022.

- Safari Industries Ltd: Safari Industries is a leading luggage and travel accessories company in India. With a strong brand presence, Safari offers a wide range of products, including suitcases, backpacks, duffel bags, and travel accessories.

- Xpro India: Xpro India is a diversified company engaged in the manufacturing of industrial products. Its product portfolio includes precision components, automotive components, castings, and forgings.

- Raghav Productivity Enhancers Ltd: Raghav Productivity Enhancers focuses on the manufacturing and distribution of performance-enhancing chemicals as a specialty chemicals company.

- Genesys International Corporation Ltd: A geospatial technology company that specializes in providing mapping, surveying, and spatial data solutions.

- Stove Kraft Ltd: A leading kitchen solutions provider known for its flagship brand “Pigeon.” The company offers a wide range of kitchen appliances and enhances the cooking experience of consumers.

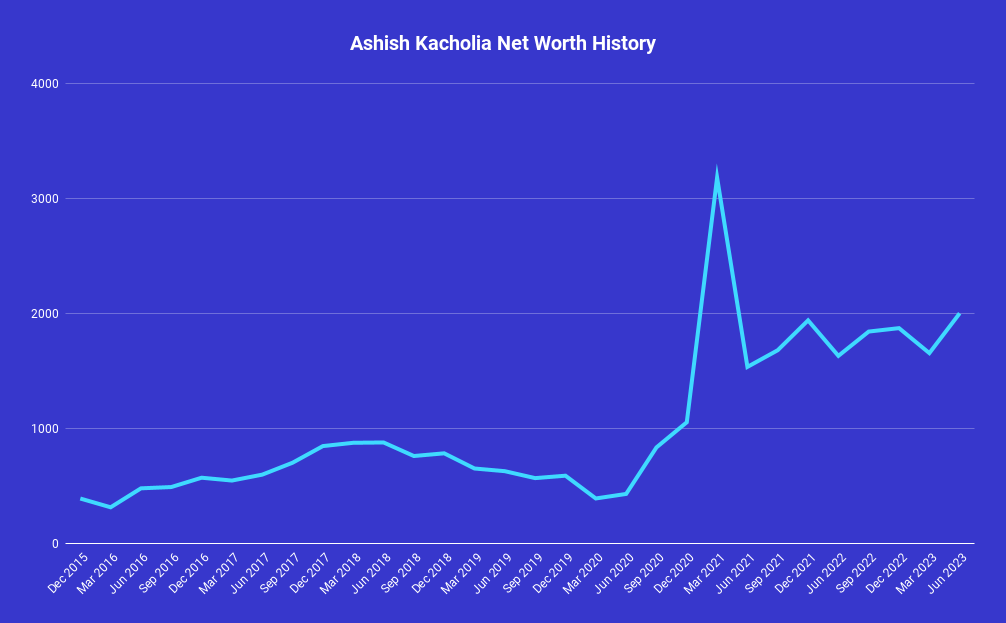

Ashish Kacholia Net-Worth Trend

Ashish Kacholia’s net worth has witnessed significant fluctuations in recent years. Starting at Rs 401.5 cr. in 2015, his portfolio has grown substantially, reaching ₹1,551.91 Cr by 2022. Anticipated to increase further, the value of his 35 stocks is expected to reach ₹1,948.7 Cr by March 2023, reflecting an impressive 50.8% increase. His net worth trend over the last eight years looks like this:

Investment Strategy of Ashish Kacholia Portfolio

Ashish Kacholia characterizes his investment strategy in his portfolio by employing a meticulous approach towards identifying undervalued companies with significant growth potential.

Ashish Kacholia’s investment philosophy has its roots in value investing, and it is influenced by the principles of renowned investor Warren Buffett. He actively seeks out companies with strong competitive advantages, effective management, and attractive valuations, emphasizing a long-term investment approach.

One can understand that a majority of Ashish’s portfolio stocks are in small and medium-sized business sectors, indicating his belief in their growth. Thus, to forecast the firm’s future performance, he studies how it operates, its financials, and its team. However, as soon as he notices that a company is drifting away from its fundamentals, he sells it!

Kacholia places great importance on the role of company management, recognizing their ability to drive success or failure. Additionally, he considers market trends and evolving consumer preferences as critical factors, favoring companies that can adapt and thrive in changing environments.

By combining these strategies, Kacholia aims to build a portfolio that delivers sustained growth and capitalizes on long-term investment opportunities.

Learnings From Ashish Kacholia Portfolio

There are several valuable learnings that one can draw from observing Ashish Kacholia latest portfolio:

- Focus on Undervalued Companies: Ashish Kacholia’s portfolio highlights the significance of identifying undervalued companies with strong growth potential. By conducting thorough research and analysis, he seeks out opportunities where the market may have overlooked a company’s true worth.

- Emphasize Competitive Advantages: Kacholia’s investment strategy places a strong emphasis on companies with competitive advantages. These advantages could include unique technologies, strong brand recognition, or dominant market positions.

- Importance of Quality Management: Recognized from Ashish Kacholia stock portfolio is the critical role of management in a company’s success. Evaluating the competence and track record of management teams is an integral part of his investment decision-making process.

- Long-Term Investment Perspective: Ashish Kacholia’s portfolio reflects a long-term investment approach. By focusing on companies’ underlying fundamentals and growth prospects, rather than short-term market fluctuations, he aims to capture value over an extended period.

To Wrap It Up…

Ashish Kacholia, known as the Big Whale of Dalal Street is a seasoned investor who has a track record of picking multibagger stocks.

Ashish Kacholia’s portfolio showcases the best picks of undervalued stocks, taking inspiration from Warren Buffet and his investment philosophy.

Thus, Ashish Kacholia’s portfolio offers valuable insights and learnings for investors, emphasizing the importance of patience, discipline, and a thorough understanding of the underlying fundamentals of companies.

Know More About Star Investors on smallcase –

Learn More about few of the other star investors, their investment strategies, stocks investments, net worth and much more –