What is Return on Equity (ROE)? Learn How to Generate Accurate ROE

Return on Equity (ROE) is a fundamental financial metric that shines brightly in the realm of investing. It is the celestial navigator of profitability and guides investors on their quest for stellar returns and financial success.

In this blog, we will embark on an illuminating journey through the essence of the ROE ratio, exploring return on equity meaning and significance as a powerful tool for evaluating a company’s performance. We will also unlock the secrets of its formula, understand its components, and delve into the factors affecting its magnitude.

What is ROE in Share Market?

Return on Equity is a financial metric that assesses a company’s profitability and efficiency from the perspective of its shareholders. It is a crucial ratio used by investors and analysts to evaluate how effectively a company generates profits using shareholders’ capital.

How to Calculate ROE?

ROE Formula

The Return on Equity (ROE) ratio is calculated using the following formula:

| Return on Equity Ratio Formula = (Net Income / Shareholders’ Equity) * 100 |

It’s important to note that shareholder’s equity, in the calculation, refers to an average shareholders equity held by the stockholders of a business as individual shareholders may have varying amounts of equity.

Components of ROE Formula

Here are the components of return on average equity:

Net Income

Net income refers to the total profit earned by the company after deducting all expenses, taxes, and interest payments. It represents the company’s bottom-line performance.

Shareholders’ Equity

Shareholders’ equity is the net worth of a company and is calculated as the difference between total assets, return on assets and total liabilities. It indicates the residual interest that shareholders have in the company’s assets.

Now, let’s understand how ROE calculation can be done by using the above-mentioned formula.

Return on Equity Example

Suppose, if a company has a net income of Rs. 500,000 and shareholders’ equity of Rs. 2,000,000, the ROE would be:

| Return on Equity Formula = (500,000 / 2,000,000) * 100 = 25% |

In this example, the company’s Return on Equity is 25%, indicating that for every rupee of shareholders’ equity, the company generated 25 paise in net income.

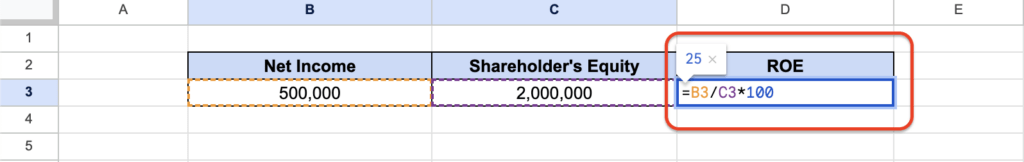

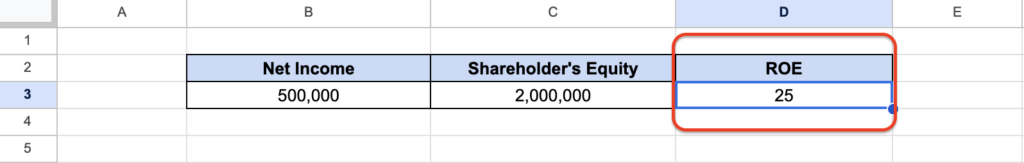

How to Calculate Return on Equity Using Excel?

For calculating return on equity, here’s how to use Microsoft Excel to set up the calculation for ROE:

- In the excel, enter the relevant data in separate columns. For this example, enter the net income in one cell (let’s say B3) and the shareholders’ equity in another cell (let’s say C3).

- Apply the given formula in column D3 i.e. = B3/C3 * 100 as illustrated in the example below.

- After entering the formula, press Enter. The cell D3 will now display the calculated ROE percentage i.e. 25%

Now, you have successfully calculated the Return on Equity for the given net income and shareholders’ equity values in Excel.

Significance of Return on Equity

The Return on Equity can be a crucial financial metric that holds significant importance for investors, analysts, and businesses. Let’s delve into the significance of Return on Equity in various aspects:

- Evaluating Profitability: Return on Equity measures a company’s ability to generate profits relative to shareholders’ equity. It provides insight into how effectively a company utilizes shareholders’ capital to earn profits. A good ROE can indicate that the company is more profitable and efficient in generating returns on the invested equity, making it a good investment option.

- Measuring Management Efficiency: ROE serves as an indicator of management efficiency and effectiveness. A consistently high Return on Equity suggests that the management team potentially makes sound decisions and generates strong returns on investments. It also usually indicates competent allocation of resources and strategic planning to maximize shareholders’ wealth.

- Assessing Financial Health: ROE indicates the company’s ability to withstand economic challenges and generate sustainable profits. A healthy and stable Return on Equity may reflect a strong financial foundation, indicating a lower-risk investment opportunity.

Factors Affecting Return on Equity

The factors affecting the Return on Equity ratio are vital components that can impact a company’s profitability and financial performance. Let’s explore these factors:

- Profit Margin: Profit margin refers to the percentage of each sales that represents profit after accounting for all expenses. A higher profit margin may indicate effective cost control and better conversion of revenue into profit. This may also lead to increased earnings for shareholders, contributing to a higher ROE.

- Asset Turnover: Asset turnover gauges how efficiently a company utilizes its assets to generate revenue. It is calculated by dividing total revenue by the average total assets. A higher asset turnover usually suggests that the company effectively converts its assets into sales. Such efficient asset utilization can lead to improved profitability and, subsequently, a higher Return on Equity.

- Financial Leverage: Financial leverage involves using borrowed funds to finance a company’s operations and investments. Debt can amplify returns, as the cost of borrowed funds is usually lower than the return on equity investment.

However, higher financial leverage also entails increased interest payments and debt obligations, potentially elevating risk. Prudent use of financial leverage can enhance Return on Equity, but excessive debt may negatively impact Return on Equity, particularly during economic downturns.

Why Should You Pay Attention to Return on Equity (ROE) Before Making Investment Decisions?

Investors should pay attention to return on equity in share market for several important reasons:

- Profitability Indicator: Return on Equity measures a company’s ability to generate profits relative to its shareholders’ equity. The return on equity should be high or low. A high ROE stocks or the return on equity usually indicates that the company is efficiently using its equity capital to generate earnings.

- Management Efficiency: It may reflect how effectively a company’s management is utilizing shareholder funds to generate profits. A consistently increasing or high Return on Equity usually suggests efficient management practices and strong leadership.

- Growth Potential: A company with a good ROE may have the potential for faster growth. This may also hint about expansion, as it can reinvest earnings back into the business.

- Comparative ROE Analysis: It allows investors to compare the financial performance of different companies within the same industry. It potentially helps to identify businesses that are more efficient at generating returns on equity investments.

- Investment Decision Making: By considering return on equity alongside other financial metrics, investors can make informed investment decisions. A company with a high and stable ROE may be a good investment option, while a declining ROE could be a warning sign of underlying issues.

- Financial Health: It provides insights into a company’s financial health and sustainability. A low or negative ROE may indicate financial difficulties or a need for improved operational efficiency.

- Long-Term Performance: Tracking the return on equity ideal ratio over time helps assess a company’s long-term performance and growth trajectory. Consistently improving Return on Equity may suggest a positive outlook for the company.

Interpreting Return on Equity (ROE)

Return on equity ratio interpretation is essential for understanding a company’s financial performance and profitability in relation to its shareholders’ equity. Here are two crucial aspects of interpreting ROE in stock market:

- Comparing ROE with Industry Averages: To gain valuable insights, it’s important to compare a company’s return on equity with the industry averages. If a company’s Return on Equity is higher than the industry average, it may suggest that the company is using its shareholders’ equity efficiently to generate profits and outperform its competitors. Conversely, a lower Return on Equity compared to the industry average may indicate that the company’s profitability is not competitive.

- Analyzing ROE Trends Over Time: Analyzing the historical trends of a company’s ROE in share market is crucial for identifying patterns. Consistent increase in ROE over time indicates that the company is consistently generating higher profits for shareholders, which is a positive sign. However, declining or fluctuating ROE might indicate underlying issues that require further investigation.

- ROE Ideal Ratio Value: The ideal ROE ratio can vary depending on the industry and specific company circumstances. Generally, a higher ROE is considered favourable, indicating better profit generation per shareholder equity. An ROE of 15% or higher is often seen as a good benchmark for financial health.

However, comparing ROE with industry peers is crucial for a comprehensive assessment of a company’s performance. Evaluating other financial metrics and factors is essential for a holistic understanding of a company’s financial strength and prospects.

Can Return on Equity be Considered a Consistent Indicator?

ROE can serve as a consistent indicator of a company’s financial performance and profitability over time. However, the interpretation of ROE should consider the appropriate context. A stable and consistently high ROE may imply effective utilization of equity to generate profits consistently. However, external factors, industry dynamics, and economic conditions can influence fluctuations in Return on Equity. Therefore, it is crucial to assess ROE alongside other financial ratios and indicators to obtain a comprehensive view of a company’s financial health and stability.

High ROE Stocks in India

After understanding the advantages and drawbacks of the return on equity, let’s have a look at the companies with high ROE stocks in India.

| Company Name | Sub-Sector | Market Cap (in Cr) | Share Price | Close Price | PE Ratio | 1Y Return |

|---|---|---|---|---|---|---|

| Fertilisers And Chemicals Travancore Ltd | Fertilizers & Agro Chemicals | ₹51,316.04 | ₹803 | ₹779.10 | 83.71 | 325.00 |

| Jindal SAW Ltd | Building Products - Pipes | ₹13,679.09 | ₹435.3 | ₹434.70 | 21.63 | 322.07 |

| BSE Ltd | Stock Exchanges & Ratings | ₹32,012.45 | ₹2,312 | ₹2,350.75 | 145.07 | 303.88 |

| REC Ltd | Specialized Finance | ₹1,17,125.80 | ₹432.1 | ₹442.10 | 10.49 | 292.59 |

| Power Finance Corporation Ltd | Specialized Finance | ₹1,39,198.29 | ₹412.3 | ₹423.10 | 8.76 | 260.51 |

| Suzlon Energy Ltd | Renewable Energy | ₹51,859.34 | ₹38.55 | ₹37.35 | 18.20 | 250.46 |

| JBM Auto Ltd | Auto Parts | ₹16,551.05 | ₹1,409.35 | ₹1,395.50 | 133.07 | 242.81 |

| Kaynes Technology India Ltd | Electrical Components & Equipments | ₹14,273.69 | ₹2,580.45 | ₹2,474.25 | 149.93 | 234.07 |

| Apar Industries Ltd | Electrical Components & Equipments | ₹21,261.29 | ₹5,403.85 | ₹5,375.95 | 33.34 | 212.69 |

| Kalyan Jewellers India Ltd | Precious Metals & Jewellery | ₹32,930.80 | ₹316.2 | ₹324.20 | 76.04 | 169.33 |

Disclaimer: Please note that the above table is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing. The data is derived from Tickertape Stock Screener and is subject to real-time updates.

Note: The data on the top companies with ROE in India in the list is from 14th December 2023. However, for real-time updates on stock prices and market trends, visit the smallcase stocks collection today!

What Do Companies with High ROE Tell You?

Let’s have a look at the ROE interpretation of companies and what it might be suggesting.

- If a company with high ROE is generating a lot of profit relative to its shareholders’ equity. This suggests they are using their investors’ money effectively, maximizing returns and creating value.

- Companies with a high ROE excel in retaining earnings. By reinvesting earnings as working capital, these companies reduce dependence on debt, eliminating interest expenses. As an investor, monitoring a company’s retained earnings annually and observing subsequent increases in return on equity indicates efficient utilization of profits for sustained growth.

- Companies with high ROE have an advantage over its competitors. Therefore, this may allow them to generate more earnings than their peers. This could be due to factors like superior technology, efficient operations, or strong brand recognition.

How Can Companies Improve Return on Equity?

Companies can improve their ideal return on equity ratio in the following ways:

- Strategies to Increase Profitability: Companies can focus on boosting their profit margins through cost-cutting measures, efficient pricing strategies, and enhanced revenue generation. Increasing net income will directly improve Return on Equity.

- Enhancing Asset Management: Optimizing asset utilization and turnover rates can contribute to higher Return on Equity. Efficient inventory management, asset allocation, and productive use of resources can improve operational efficiency.

- Optimal Capital Structure: Balancing the mix of debt and equity is crucial for achieving an optimal capital structure. Reducing excessive debt and increasing equity can positively impact ROE while minimizing financial risks.

By implementing strategies to improve ROE, businesses can enhance their financial performance and create value for their shareholders.

What are the Limitations of Return Return on Equity

Some of the limitations of Return on Equity are as follows:

- Ignoring Debt Levels: Return on Equity ratio solely focuses on equity and net income, disregarding the influence of debt. A high debt burden can inflate ROE but expose the company to financial risks, making it essential to consider the debt-equity ratio alongside ROE.

- Seasonal or Cyclical Variations: ROE may fluctuate due to seasonal or cyclical changes in a company’s business. Using a single Return on Equity value without considering these variations can lead to inaccurate assessments of a company’s long-term performance.

- Influence of Accounting Policies: Different accounting policies adopted by companies can impact the calculation of ROE. Comparing the ROE ratio across companies with varying accounting methods might not provide a fair basis for evaluation.

Relation Between ROE and Stock Market and High ROE Stocks

The relationship between Return on Equity, the stock market, and high ROE stocks is crucial in the world of investing. Return on Equity is a financial ratio that measures a company’s profitability by evaluating how effectively it generates earnings from shareholders’ equity. A higher ROE is generally considered favourable as it indicates efficient use of equity to generate profits.

In the stock market, high ROE stocks are often sought after by investors. Companies with consistently high ROEs are seen as financially strong and capable of delivering superior returns. Investors tend to favour high ROE stocks as they offer the potential for better performance and increased shareholder value.

However, it is important to note that the relationship between ROE and stock market performance is not always straightforward. Market conditions, industry trends, and other financial metrics also influence stock prices. Additionally, a high Return on Equity ratio alone does not guarantee success; investors must consider other factors such as debt levels, competitive advantages, and management efficiency.

Return on Equity vs Return on Capital Employed

Return on Equity (ROE) and Return on Capital Employed (ROCE) are key financial metrics that assess a company’s profitability and efficiency. While ROE focuses on the return relative to shareholders’ equity, ROCE provides a broader view by considering the return in relation to the total capital employed, encompassing both equity and debt.

Let’s have a look at the differences between ROE vs ROCE.

| Feature | Return on Equity (ROE) | Return on Capital Employed (ROCE) |

|---|---|---|

| Focuses on | Profitability relative to shareholders’ equity | Profitability relative to all capital employed |

| Formula | Net income / Shareholders’ equity | EBIT / Average capital employed |

| Higher value generally indicates | More efficient use of shareholders’ equity | More efficient use of all capital employed |

| Affected by | Net income, shareholders’ equity | Net income, total assets, total liabilities |

To Wrap It Up…

Return on Equity is a powerful financial metric that provides valuable insights into a company’s profitability and efficiency.

It serves as a key indicator for investors, enabling them to identify companies that are capable of generating higher returns on shareholders’ equity. It also helps businesses gauge their financial performance and make informed decisions to enhance profitability and optimize capital allocation.

However, keep in mind that no single metric can provide a complete picture, and it’s essential to assess other financial ratios and factors as well.

FAQs

A good return on equity ratio varies by industry, but generally, a higher Return on Equity indicates better profitability and efficiency. An ROE above 15% is often considered favourable.

ROE stands for Return on Equity, which is a financial metric used to measure a company’s profitability relative to shareholders’ equity.

Return on Equity is calculated by dividing net income by shareholders’ equity and is expressed as a percentage.

ROI (Return on Investment) is a broader financial metric that measures the return on investment. ROE, on the other hand, specifically focuses on the return generated for shareholders based on their equity investment in a company.

If ROE (Return on Equity) is negative, it indicates that the company’s net income is insufficient to cover shareholder equity. Investors may view it as a red flag and consider other investment opportunities with positive ROE and healthier financial performance.

ROE will rise with a rise in net income and reduction in shareholder’s equity. It’s important to note that while increasing debt or engaging in share buybacks can artificially inflate ROE, it doesn’t necessarily indicate improved profitability.

All About Investment Concepts on smallcase –

smallcase offers you a quick view to the different finance related concepts to help you on your investment journey to achieve the financial freedom you have always dreamt of –