What are Private Equity (PE) Investments?

Chances are, you’ve already experienced the influence of private equity companies in your everyday life without even realizing it.

So, whether you’ve purchased the latest gadget, trendy fashion apparel, or household essentials online, there’s a good chance you might have engaged with Flipkart’s platform. It’s private equity-backed. Similarly, when hunger strikes and you decide to order food from the comfort of your home, Zomato comes to the rescue. And let’s not forget Ola, the popular ride-hailing service that has transformed the way we commute. Yeah..these two are PE-backed, too.

Want to know more? Let’s dive in and discover the world of private equity together!

What is Private Equity Meaning?

Private equity financing or private equity investments serve as a lifeline for companies facing challenges and cannot opt for public trading or bank loans. In such cases, these companies turn to private equity firms for assistance. These firms provide direct investment in the business, without the requirement of a public listing. Additionally, they typically do not hold stakes in companies that remain listed on a stock exchange.

The different types of private equity investments obtain capital from various sources. These include affluent investors, pension funds, labour unions, insurance companies, universities endowments, and foundations. Thus, by leveraging these diverse funding channels, capital investors fuel the growth of businesses. PE is commonly categorized alongside venture capital and hedge funds as alternative investment funds(AIFs). This asset class typically demands long-term capital commitments from investors, resulting in limited access primarily available to institutions and high-net-worth individuals.

Characteristics of Private Equity(PE)

Let’s have a look at the characteristics of private equity venture capital.

- Private Equity deals involve investing in private companies that are not publicly traded.

- Investors may participate in PE through private investment funds managed by professionals.

- PE funds may take an active role in the management of portfolio companies.

- Investments in PE may have a longer time horizon, as exits can take several years.

- PE investments may involve a higher level of risk due to the nature of private equity markets.

- PE Investors may benefit from potential higher returns, but the illiquidity of investments can be a consideration.

- PE investment partners may provide capital funds for expansion, acquisitions, or restructuring of portfolio companies.

- Valuation of PE investments may be challenging, and returns can be influenced by market conditions.

- Limited partners in PE funds may have less control over investment decisions.

- Regulatory considerations and potential changes in tax policies may impact PE investments.

Therefore, investors may conduct thorough due diligence to understand the specific characteristics and risks associated with PE before participating.

Now that we have covered the private equity definition and what is a private equity firm, let’s understand its workings in the next section.

Private Equity Fund Structures

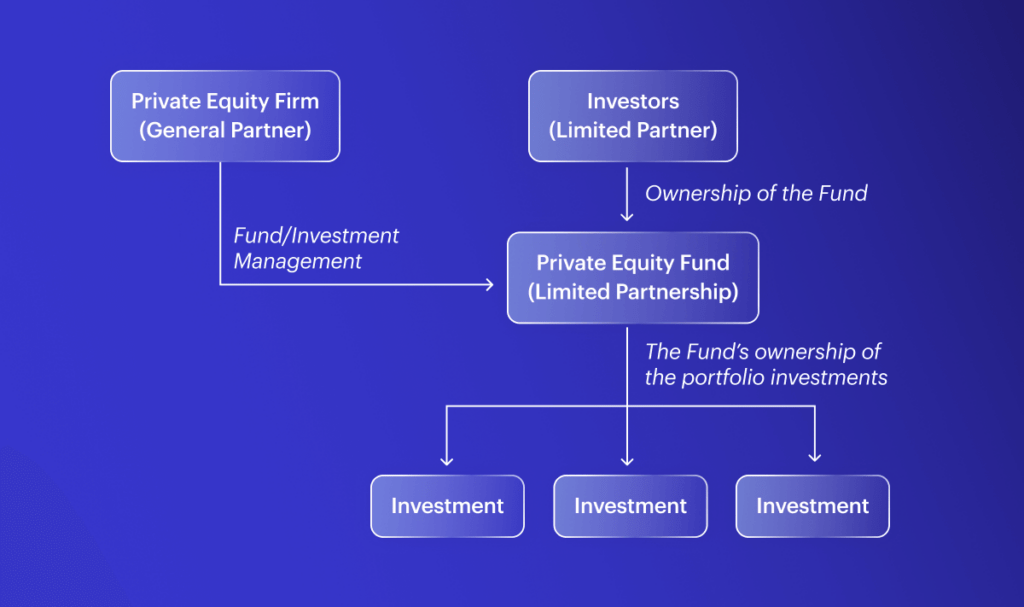

The typical structure of a Private Equity fund is shown below.

How Does Private Equity Work?

PE operates by investing in privately-held companies with the goal of generating substantial returns. Private equity firms raise funds from Limited Partners (LP) forming a pool of capital. These firms then identify promising investment opportunities, conduct due diligence, and select companies with growth potential.

Once invested, they actively manage and work closely with the portfolio companies to drive growth and enhance value. The ultimate objective is to improve the company’s performance. Also increase its valuation, aiming for an exit strategy such as selling the company or taking it public to generate profits for the investors. Private equity firms often have a long-term investment horizon. This allows them to implement strategic initiatives and optimize the company’s operations for maximum profitability.

What are Private Equity Specialties?

Some private equity firms and funds specialize in a particular category. While venture capital is a subset of PE, it definitely has a unique set of skills. In addition to venture capital, PE encompasses various other specialized areas:

- Distressed Investing focuses on investing in struggling companies that are in urgent need of financial support and restructuring.

- Growth equity provides funding to companies that have surpassed their startup phase and are in the expansion stage.

- Sector specialists concentrate exclusively on specific industries such as technology or energy.

- Secondary buyouts involve the sale of a company owned by one private equity firm to another firm within the same industry.

What are the Types of Private Equity Firms?

There are many different types of private equity firms, but they can generally be categorized into two main groups: venture capital firms and buyout firms.

- Venture Capital Firms: Invests in early-stage companies with high growth potential. They typically provide funding for these companies in exchange for a minority ownership stake.

- Buyout Firms: Invest in mature companies that they believe can be improved through restructuring or operational changes. They typically acquire these companies with a combination of debt and equity, and they often take a controlling interest in the company.

However, the type of private equity speciality that is right for you will depend on your investment goals and risk tolerance. So, let’s say that if you are looking for a high-risk, high-reward investment, then a venture capital fund may be a good option for you. If you are looking for a more conservative investment, then buyout funds may be a better fit.

Other Types of Firms

- Growth Equity Firms: These firms invest in later-stage companies that have already achieved some success.

- Mezzanine Capital Firms: These firms provide debt financing to companies that are too risky for traditional banks. Mezzanine debt is typically secured by the company’s assets, and it often has a higher interest rate than traditional debt.

- Distressed Debt Firms: These firms invest in companies that are in financial trouble. They typically buy the company’s debt at a discount, and they then work with the company to try to turn it around.

- Real Estate Private Equity Firms: These firms invest in real estate assets, such as commercial properties, hotels, and apartments. They typically buy these assets with a combination of debt and equity.

What are the Factors Affecting the Performance of Private Equity Investments?

There are many factors that can affect the performance of a private equity fund, including:

- Stage of the Investment: Private equity investments typically invest in companies at different stages of their lifecycle, such as early-stage, growth-stage, or mature-stage companies.

- Industry Sector: The industry sector in which the fund invests can also have a significant impact on performance. Some industries, such as IT, are more cyclical than others, and this can affect the fund’s performance.

- Geographic Location: The geographic location of the investments can also affect performance. Some countries or regions are more attractive to private equity investors than others, and this can also affect the fund’s performance.

- Investment Strategy: The investment strategy of the fund can also have a significant impact on performance. Some funds focus on a particular industry sector, while others focus on a particular stage of investment.

- Management Team: The management team of the fund is also an important factor that can affect performance. A strong management team with a proven track record can help to improve the fund’s performance.

- Market Conditions: Market conditions can also have a significant impact on the performance of a PE fund. If the stock market is bullish, then the fund is more likely to perform well. However, if the stock market is bearish, then the fund is more likely to perform poorly.

Private Equity Secondary Market

Historically, investors might have faced reduced control over their portfolios due to the delayed cash flows and illiquid nature of private equity. However, an increasing trend suggests that investors who need to rebalance or urgently access liquidity now can explore secondary market opportunities. In this market, investors can potentially liquidate their fund interests before the fund’s term concludes. Trading on the secondary market can alter the cash flow profile, offering urgent liquidity and potentially mitigating the private equity blind pool risk for buyers. These features may contribute to the rapid growth of the secondary market, emerging as an alternative option for both investors and equity managers.

How Do PE Firms Create Value?

Private equity firms create value in a number of ways, including:

- Leverage: Private equity firms often use leverage to acquire companies. This means that they borrow money to finance the acquisition, which can magnify the returns if the company is successful.

- Operational Improvements: Private equity firms often have expertise in managing companies, and they can help to improve the operational performance of the companies they acquire. This can lead to increased profits and higher valuations.

- Strategic Changes: Private equity firms can also help to make strategic changes to the companies they acquire. This can include things like entering new private markets, expanding product lines, or acquiring other companies. These changes can lead to increased growth and profitability.

- Exit Strategies: Private equity firms typically have a finite investment horizon, and they need to exit their investments at some point. This can be done through an initial public offering (IPO), a sale to another company, or a sale to a strategic buyer.

How Are Private Equity Funds Managed?

Private equity funds are managed by a general partner (GP), typically the private equity firm that established the fund.

The GP makes all of the fund’s management decisions. It also contributes 1% to 3% of the fund’s capital to ensure it has skin in the game. In return, the GP earns a management fee often set at 2% of fund assets and may be entitled to 20% of fund profits above a preset minimum as incentive compensation, known in private equity jargon as carried interest.

Limited partners (LPs) are clients of the private equity firm that invest in its fund; they have limited liability. LPs do not participate in the management of the fund, but they have the right to vote on certain important decisions, such as the sale of a portfolio company.

How to Invest in Private Equity?

Here are some ways in which an investor can invest in private equity:

- Invest Directly in a Private Equity Fund: This is the most traditional way to invest in private equity. Investors can invest directly in private equity funds by purchasing shares in the fund.

- Fund of Funds: A fund of funds is a mutual fund that invests in other mutual funds, including private equity funds. This can be a good way for investors to gain exposure to private equity without having to meet the high investment minimums of private equity funding.

- Exchange-Traded Fund (ETF): There are a number of ETFs that track private equity indices. These ETFs can provide investors with exposure to a diversified portfolio of private equity investments.

- Secondary Buyout: A secondary buyout is the purchase of a private equity fund’s interest in a company from another investor. This can be a good way for investors to gain exposure to private equity without having to invest in a new fund.

- Special Purpose Acquisition Company (SPAC): A SPAC is a shell company that is formed with the sole purpose of acquiring another company. SPACs can be a good way for investors to gain exposure to private equity without having to go through the traditional private equity investment process.

However, investors should carefully consider their investment objectives and risk tolerance before investing in private equity.

Who Can Invest in Private Equity?

Private equity investment is typically restricted to institutional investors and high-net-worth individuals due to the high investment minimums, illiquidity, and complexity involved. Here’s a breakdown of who can invest in private equity:

- Institutional Investors: These include pension funds, endowments, foundations, insurance companies, and other large financial institutions. They have the capital and resources to meet the high investment minimums of private equity funds.

- High-Net-Worth Individuals (HNWIs): This allows them to participate in more sophisticated investments like private equity.

- Family Offices: These are private wealth management firms that manage the investments of ultra-high-net-worth individuals and families. They have the expertise and resources to evaluate and invest in private equity opportunities.

- Secondary Market Investors: These investors purchase existing shares of private equity funds from other investors, typically at a discounted price.

- Retail Investors: In recent years, there has been a growing trend of making private equity investments more accessible to retail investors through various means, such as:

- Private Equity ETFs:

- Online Crowdfunding Platforms

- Direct Investment in Special Purpose Acquisition Companies (SPACs)

However, investors should comprehend both the growth potential and challenges confronted by private equity firms before private equity investing.

What are the PE Regulations That You Must Be Aware Of?

Private equity structures vary from country to country and it’s important to be aware of some general regulations that apply. Therefore, we have listed out some that typically cover the following areas:

- Fund Formation: The process of forming the best private fund is typically regulated by the securities laws of the country in which the fund is formed. These laws may require the fund to file a registration statement with the securities regulator and to provide investors with certain disclosures.

- Investment Restrictions: Private funds are typically subject to investment restrictions that limit the types of investments that they can make. These restrictions may be designed to protect investors from excessive risk or to prevent conflicts of interest.

- Disclosure Requirements: PE funds are typically required to disclose certain information to investors, such as the fund’s investment strategy, fees, and risks. This information is typically provided in a private placement memorandum (PPM).

- Auditand Reporting Requirements: An independent auditor typically audits the financial statements of PE funds. Thus, investors may also require them to provide regular reports on the fund’s performance.

What are the Advantages and Disadvantages of PE investments?

PE investments offer several advantages and disadvantages. Let’s have a look at them.

Advantages

- Potential for High Returns: PE investments have the potential to generate high returns, especially in the long term. This is because PE firms typically invest in companies that have the potential to grow rapidly.

- Access to Private Companies: This can give investors the opportunity to invest in companies that have the potential to become very successful.

- Active Management: PE firms typically take an active role in managing the companies they invest in. This can help to improve the performance of the companies and generate higher returns for investors.

- Tax Benefits: In some cases, PE investments can offer tax benefits to investors.

Disadvantages

- Illiquidity: PE investments are typically illiquid, meaning that they cannot be easily bought or sold. This can make it difficult to exit an investment if you need to do so.

- High Fees: PE investments typically have high fees, which can eat into the returns.

- Risk: PE investments are typically riskier than other types of investments, such as shares or bonds. This is because PE firms invest in companies that are often young and growing, which makes them more volatile.

- Lack of Transparency: PE investments can be opaque, meaning that it can be difficult to get information about the companies that they invest in. This can make it difficult to assess the risks of an investment.

Private Equity vs Venture Capital

Although venture capital is a subset of private equity, it is not as similar as we think it is. Here we have presented a clear differentiation between private capital and venture capital.

| Characteristic | Private Equity | Venture Capital |

|---|---|---|

| Stage of companies invested in | Mature companies | Early-stage companies |

| Size of investments | Typically larger | Typically smaller |

| Risk | Lower risk | Higher risk |

| Return potential | Lower return potential | Higher return potential |

| Exit strategy | Typically an IPO or sale to another company | Typically an IPO |

| Fees | Typically higher fees | Typically lower fees |

| Liquidity | Less liquid | More liquid |

To Wrap It Up…

Private equity is a dynamic and influential sector within the world of finance and investment. It represents a distinctive form of investment activity characterized by the allocation of capital to privately held companies that are not publicly traded on stock exchanges. Nevertheless, the majority of private equity transactions generate value for investors and often lead to significant improvements in the acquired companies. As long as reasonable regulations are in place, owners have the right to select the capital structure that best suits their need.

As always, please do your own research and/or consult a financial advisor before investing.

FAQs

Private equity fund meaning is a type of investment that involves buying shares of companies that are not publicly traded.

Private equity plays an important role in the economy by providing capital to companies that would not be able to access it from traditional sources, such as banks or public markets.

PE firms are private investment firms that manage private equity funds.

There are a number of different types of private equity funds, but they can be broadly classified into three categories: buyout funds, venture capital funds, and growth funds.

The examples of private equity investments are private credit, real estate, natural resources, private equity, infrastructure, and hedge funds.

All You Need to Know About Starting Your Share Market Journey

Share market investments can seem a bit tedious at first but smallcase is here to simplify all your queries and worries. Right from “Share market for beginner”, “Portfolio Diversification” to “short term investments” we’ve got all the tips, just a single click away –