Using Price-to-Book Ratio (PB ratio) to Compare Companies

When it comes to investing in the stock market, understanding financial metrics is crucial for making informed decisions. One such metric that investors often use is the P/B ratio, also known as the price-to-book value ratio. This blog will explore its meaning, calculation, and its significance to investors. Let us now understand what exactly is the P/B Ratio.

P/B Ratio Meaning

The price-to-book value ratio is a financial metric that compares a company’s market capitalisation to its book value in the stock market. You can calculate it by dividing the market price per share by the book value per share. The book value is the total assets minus the total liabilities of a company, divided by the number of outstanding shares.

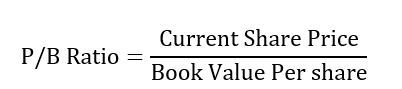

P/B ratio formula

Current Share Price = Market Price per Share.

We can find the current market price of stocks easily from exchanges or any other financial websites.

Book Value Per Share= (Total Assets – Liabilities – Intangible Assets) / Number of outstanding shares.

For example, Company XYZ has a book value per share of ₹100 and its current stock price is ₹200 per share. To calculate the price-to-book value for Company XYZ, we would divide the current stock price by the book value per share:

so, ₹200 / ₹100

Thus, the P/B ratio = 2.0

Why Use the P/B Ratio?

The price-to-book ratio in the share market is a useful metric for investors because it provides insight into a company’s valuation. It can be used to compare companies in the same industry or sector, and it can also be used to compare a company’s current P/B ratio to its historical trends.

In addition, the price-to-book ratio can be used in conjunction with other financial metrics to gain a more complete understanding of a company’s financial health. For example, a company with a low Price-to-Book ratio and high earnings per share may indicate that the company is undervalued.

Compared to other financial ratios like the P/E ratio or the dividend yield, the price-to-book ratio is more suitable for companies with tangible assets, such as real estate, machinery, or inventory. It’s particularly useful for investors who want to focus on companies that have a strong balance sheet.

Interpreting P/B Ratio

A high P/B ratio might indicate that a company is overvalued, while a low P/B ratio might indicate that a company is undervalued. However, investors should not rely solely on the price-to-book ratio to make investment decisions. Instead, they should consider other factors, such as the company’s growth prospects, industry trends, and competitive landscape.

What is a Good Price-to-Book Ratio?

The definition of a good Price-to-Book ratio varies depending on the industry and the company’s growth prospects. Generally, analysts consider a P/B ratio below 1 as low, and a ratio exceeding 4 as high.However, investors should interpret the ratio in relation to industry averages and historical trends.

For example, if companies in a particular industry have an average Price-to-Book ratio of 3 and a company’s price-to-book ratio is 2, it may suggest the company is undervalued. Conversely, if the industry’s average price-to-book ratio is 2 and a company’s ratio is 4, it may indicate the company is overvalued.

Limitations of the Price-to-Book Ratio

- Intangible Assets: One of the limitations is that it does not take into account intangible assets, such as intellectual property or brand value.

- Negative Book Value: It may not be suitable for companies with negative book value, such as startups or companies with significant debt.

- Changing Factors: Investors should also be aware that other factors, such as changes in interest rates, economic conditions, or geopolitical events, can influence a company’s valuation, even if its price-to-book ratio remains the same.

To Wrap It…

In conclusion, the price-to-book or P/B ratio in the share market is a useful financial metric for investors who want to evaluate a company’s valuation. However, one should not use it in isolation and should interpret it in relation to other financial metrics and industry trends. As with any investment decision, investors should conduct thorough research and consider multiple factors before making a decision.

FAQs

Traditionally, investors consider a P/B ratio below 1.0 as a sign of undervaluation. Some analysts see any value under 3.0 as favorable, but the definition of ‘good PB value’ varies by industry.

A high P/B ratio indicates potential stock overvaluation.

A lower P/B ratio, especially below one, signals that investors may find the stock undervalued, meaning it trades at a lower price relative to the company’s asset value.

A negative book value signifies a company’s total liabilities exceeding assets. It doesn’t necessarily spell bad news for investors.

Consider various parameters when analyzing a bank. While P/B Ratio is more relevant than P/E Ratio, evaluate the bank comprehensively. Avoid isolating a single metric.

A company generally offers better value with a lower price-to-book ratio, especially if its book value is less than one, indicating it trades for less than its asset value. Purchasing a company’s stock below book value creates a “margin of safety” for value investors.

Important Ratios to Know About in Finance & Investment Sector –

All about how to calculate different types of financial/investment ratios, their impact and how to manage them, just one click away on smallcase –