IIFL Demat Account India in 2023: Opening Process, Security, Charges, AMC & Infoline

In today’s digital age, with everything going online, having a Demat account is a big deal! It’s like having a digital vault where you can store all your shares and assets electronically. So, imagine this: You’re sitting at home, sipping your coffee, and you decide to sell some shares to take advantage of a great opportunity. With a Demat account and a reliable online brokerage firm, you can make that trade happen in no time. So, when it comes to online brokerage firms in India, IIFL securities demat account isn’t left behind.

IIFL, also known as India Infoline Limited, has emerged as a highly reputed and popular brokerage firm in the Indian financial market. Founded in 1995 by Mr. Nirmal Jain, IIFL has established a strong presence and garnered a significant customer base over the years. The company offers a comprehensive range of financial services, including brokerage, investment banking, wealth management, and more.

So, let’s jump into how to create an IIFL demat account, shall we?

What is an IIFL Demat Account?

A IIFL Demat Account securely stores your invested shares and securities electronically. Think of it as your digital stock savings account. It keeps electronic share certificates for all your market investments, replacing the old physical certificates. Whether you invest directly or indirectly, having a Demat account is essential for stock market investments in today’s digital era.

How Does the IIFL Account Opening Work?

Ranked among the top seven financial service providers in the country, IIFL Securities is among the few organizations that offer 2-in-1 accounts where a Demat account is linked with the Trading account.

After simply filling up the form from the Depository Participant websites, investors can access the user-friendly trading platform. Thus, by opening an IIFL demat account, you get the chance to trade in multiple options like futures and options, stocks, IPOs, currency, mutual funds, and commodity markets. The Demat account serves as a safe repository for holding securities electronically, allowing investors to track their holdings, view transaction history, and manage their portfolios efficiently. With additional features like research tools and investment products, IIFL Securities simplifies the process of investing and trading in the Indian stock market.

Types of IIFL Demat Trading Accounts

IIFL offers three types of Demat accounts:

- Regular Demat Account: For Indian residents.

- Repatriable Demat Account: Tailored for NRIs with a link to an NRE bank account.

- Non-Repatriable Demat Account: Also for NRIs, linked to an NRO bank account, with funds not transferable abroad.

Why Open an IIFL Demat Account Work?

IIFL Securities offers a secure Demat account for your shares. It’s a must for stock market investors, ensuring safe storage of your purchased shares and hassle-free trading.

- Paperless & Quick: Open an account online, saving time and effort. Just provide identity and address proof documents, complete KYC, and you’re set.

- User-Friendly Interface: IIFL’s platforms are easy to use with low latency for swift trade execution.

- Informative: Get the latest news, company research, financial reports, and accurate stock suggestions for informed trading.

- Personalized Services: Tailored services to meet your needs, backed by experienced financial advisors.

- Adept Research: Award-winning research team offering insights into company performance and financials.

- Reasonable Charges: Competitive brokerage fees, starting at 0.25% to 0.10% for equity delivery. No account opening charges, and the first year of Annual Maintenance Charges is free and you can open a free demat account.

What are the Documents Required for the IIFL Demat Account Opening?

The documents required for the IIFL Demat account opening are as follows:

- PAN Card: A self-attested copy of your PAN card is required.

- Aadhaar Card: A self-attested copy of your Aadhaar card is required.

- Bank Proof: A canceled cheque or bank statement with your name and account number clearly visible is required.

- Signature: A scanned copy of your signature is required.

- Income Proof: If you want to trade in derivatives, you will need to provide income proof. This can be a salary slip, Form 16, or a bank statement.

Once you have submitted all the required documents, India Infoline demat account will verify them and approve your account opening request. The entire process usually takes a few days.

What is the Step-by-Step Guide for IIFL Demat Account Opening?

One can open an IIFL demat account via online and offline methods. Therefore, here we have listed out a step-by-step guide as to how you can open demat account by following these easy steps.

1. IIFL Demat Account Opening via smallcase

If you seek a convenient and expeditious method to initiate your stock market investments, consider opting for opening an IIFL Demat account through smallcase. Thus, a smallcase comprises portfolios that reflect a specific concept, theme, or strategy. Follow these steps to experience a seamless procedure for opening an IIFL demat account.

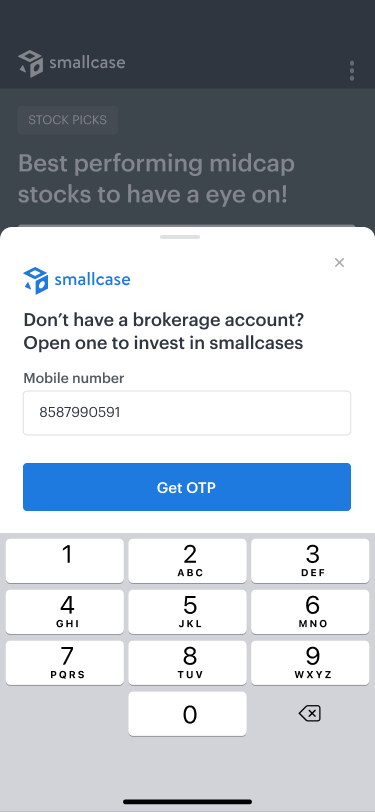

1. Go to the smallcase website. Under the ‘More’ section, click on the “Open Account” button.

2. Enter your phone number to receive an OTP.

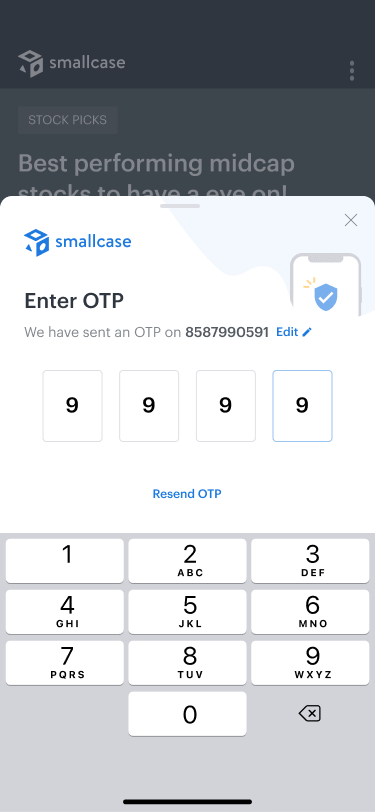

3. Enter the OTP

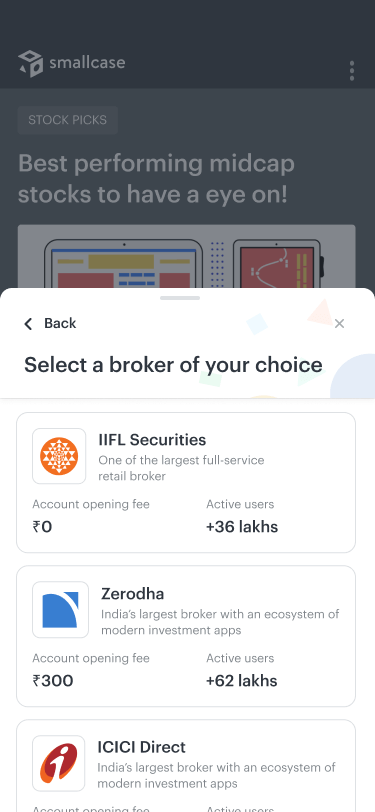

4. Next, select IIFL Securities from the list of brokers.

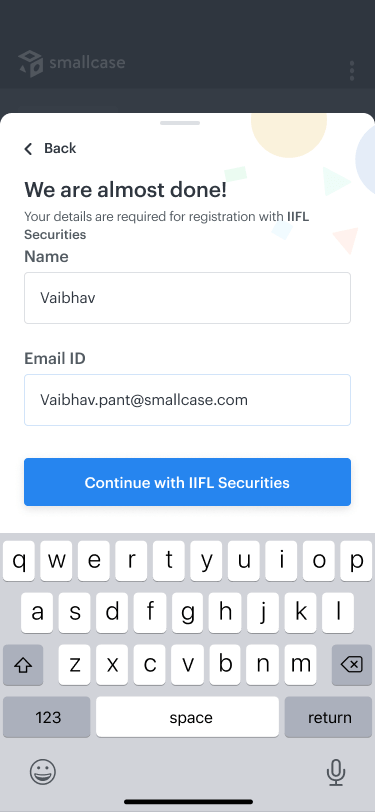

5. After entering the preferred broker, add your name and email ID.

6. Once the details have been entered, complete your application process.

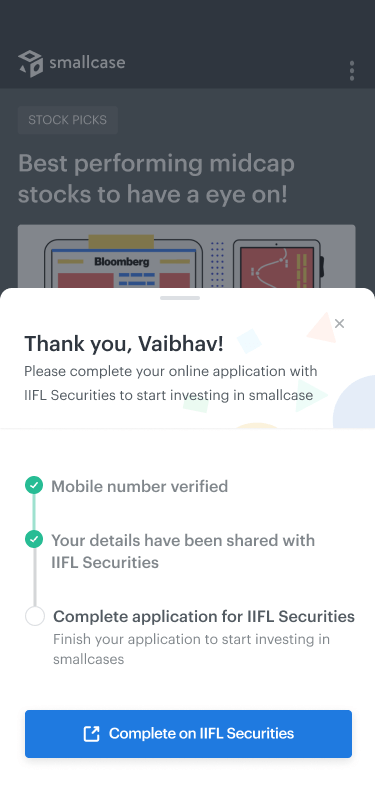

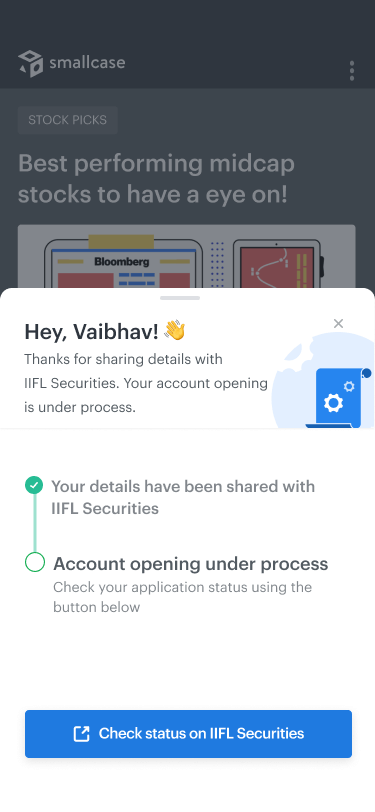

7. Wait for a few seconds.

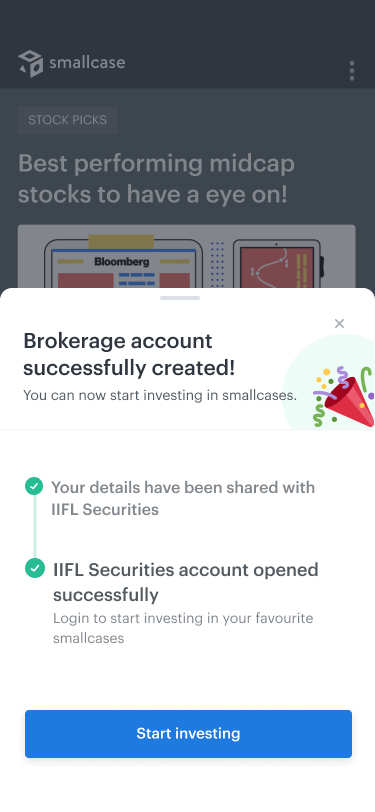

8. Tada! Your IIFL demat account is opened.

2. How to Open a Demat Account Online

Apart from signing in via smallcase, you can simply visit the website for the IIFL demat account login. Thus, to trade or invest with IIFL Securities, a customer needs to open a demat account and trading account.

1. Visit the IIFL website. Enter your mobile number and email ID.

2. A one-time password (OTP) will be sent to your mobile number, along with a link to your registered email address.

3. Enter the OTP received on your registered email.

4. After verifying the OTP, proceed to fill out the PAN Card details and online Account Opening Form. Select your preferred trading segment.

5. Upon submitting the form online, a Relationship Manager (RM) will get in touch with you to assist with the documentation process.

6. Upload scanned copies of your PAN card, Aadhar card, Passport, and photographs.

7. If you choose to trade in the derivatives segment, a bank statement may be necessary.

8. Once the documents are uploaded, the broker will initiate the verification process.

9. Upon successful completion of the verification, the trading and Demat account is typically opened within 24 hours.

3. Open IIFL Demat Account Offline

If you’re wondering about “How to Create an IIFL Securities Demat Account Offline?”, then the next section is just for you.

1. Visit the IIFL website (https://www.iiflsecurities.com/demat) and download the demat opening forms.

2. Attach the supporting documents like passport-size photograph, PAN card details, bank account details, and nominee details.

3. Send the forms and documents to the nearest IIFL branch.

4. Once your documents are verified, your account will be opened.

What are the IIFL Demat Account Opening Charges and Fees?

An investor who wants to trade online must create an account with a Depository Participant (DP).

IIFL offers broking and depository (2-in-1 account) services to its customers to open a trading and Demat account. Now, for the India Infoline demat account opening online/ offline, a customer needs to pay the following charges.

IIFL Account Charges

| Transaction | Charges |

|---|---|

| Trading Account Opening Charges | Rs 0 (Free) |

| IIFL AMC Charges | Rs 0 |

| Demat Account Opening Charges | Rs 0 |

| Demat AMC (Yealy) | Rs 250 (Free for 1st year) |

Can We Buy and Sell Stocks on IIFL Securities?

With IIFL Securities, you can trade online and offline at BSE, NSE, MCX, and NCDEX through trading and demat accounts. Thus, apart from the demat account that gives access to the trading platforms like IIFL TT Web, IIFL Markets, and IIFL Trader Terminal. These can help you to learn and implement trades without any hassle.

Buying Stocks on IIFL Securities

1. Open the IIFL Securities website and sign in to your account.

2. Locate the “Buy” section and enter the required details, such as the stock symbol, and quantity.

3. Select your order type. You can choose from a market order, limit order, or stop loss order.

4. At last, review your order and click on the ‘Buy’ button.

Selling Stocks on IIFL Securities

1. Open the IIFL Securities website and sign in to your account.

2. Locate the “Sell” section and specify the price at which you wish to sell the stocks if you choose a limit order.

3. At last, review your order and click on the ‘Sell’ button.

4. Monitor and track the progress of your sell order through the trading platform.

What is the Annual Maintenance Charge for IIFL AMC?

IIFL AMC is typically Rs. 300 for the Demat account, but they frequently offer full waivers. So, you may not pay any annual maintenance charges.

The trading account is entirely fee-free, free demat account online, with no annual maintenance charges. However, a minimum of Rs. 25,000 as margin money is required to trade actively.

What is an IIFL Trading Account?

The IIFL Trading Account facilitates share and financial instrument trading in the secondary market. It empowers you to execute orders using trading platforms. This account links your IIFL Demat and bank accounts, allowing seamless crediting or debiting of shares and funds when trading online or offline.

How to Close IIFL Demat Account?

Closing an IIFL Demat account is an offline process. To do so:

- Download the IIFL closure form and fill it.

- Have all account holders sign the IIFL account closure form.

- Attach the unused DIS and submit the form to your branch or courier it.

Note: Allow 7-10 days for processing, clear dues, and transfer securities to another Demat account.

What are the Benefits of Opening an IIFL Demat Account?

Therefore, here are some of the benefits of opening an IIFL demat account:

- No Account Opening Fee: IIFL Securities Limited demat account does not charge any demat account opening demat account process fee for a Demat account.

- Low Brokerage: IIFL Securities demat account offers some of the lowest IIFL brokerage charges in the industry.

- Wide Range of Investment Products: IIFL Securities offers a wide range of investment products, including stocks, mutual funds, bonds, and ETFs.

- Access to Multiple Markets: IIFL Securities demat account gives you access to multiple markets, including the Bombay Stock Exchange (BSE), the National Stock Exchange (NSE), and the National Commodity and Derivatives Exchange (NCDEX).

- 24×7 Trading: You can trade in stocks and other securities 24×7 through India Infoline demat account.

- Advanced Trading Platform: IIFL Securities offers an advanced trading platform that gives you access to real-time market data and analytics.

- Reliable Customer Support: IIFL Securities offers reliable customer support through its website, mobile app, and call center.

What are the Important Tips and Precautions for IIFL Securities Demat Account Holders?

As an IIFL Securities Demat Account holder, here are some important tips and precautions to keep in mind to ensure a secure and successful investing experience.

- Enable Two-Factor Authentication: Activate the two-factor authentication (2FA) feature provided by IIFL Securities. This adds an extra layer of security to your account by requiring a verification code or OTP during login.

- Regularly Monitor Your Account: Stay vigilant and monitor your Demat account regularly. Keep track of your holdings, transaction history, and any changes made to your account. Report any suspicious activity or discrepancies to IIFL Securities immediately.

- Understand Charges and Fees: Familiarize yourself with the charges and fees associated with your Demat account. This includes account maintenance charges, transaction fees, and other applicable costs. Keep track of these expenses to manage your investment costs effectively.

- Be Cautious of Scams: Be wary of phishing attempts and fraudulent activities. Additionally, IIFL Securities will never ask for your account login details or personal information through unsolicited calls, emails, or messages. Thus, always verify the authenticity of any communication before providing sensitive information.

To Wrap It Up…

Earlier, investors had to grapple with the risks of theft, forgery, and loss associated with physical share certificates. However, the introduction of Demat accounts has eliminated these concerns by converting shares into electronic form. Thus, opening an account with IIFL Securities can be a smart move for investors.

So, take the first step towards a secure and seamless trading journey by opening an IIFL Demat account today and exploring the vast range of investment opportunities available through smallcase.

FAQs

IIFL does not charge any opening fee for a Demat account.

You can open an IIFL demat account in just 15 minutes if your Aadhar is linked to your current phone number through IIFL’s instant online account opening service.

The minimum balance requirement for an IIFL Securities demat account is ₹10,000

IIFL securities is a safe, secure, and easy-to-use platform to invest in the stock market.

Yes, you can transfer funds to IIFL from any bank account. You can transfer the money through IMPS, NEFT or RTGS, cheque, and DD/ Pay order.

If you wish to close or delete your IIFL account, you can do so by submitting a physical account closure request form to the appropriate IIFL branch or office as instructed. Please note that it is an offline process and cannot be done online or by contacting customer support.

IIFL Securities offers free trading and demat account opening process. For the demat account, there’s a nominal Rs 250 AMC per year (free for the 1st year) and a Rs 25 charge for each debit transaction.

All About Demat Accounts on Smallcase –

Learn what are demat accounts, how to use them, process to open a new demat account with the multiple broker supported on smallcase platform. Below is the list of such articles to help you with the Demat process –