ICICI Demat Account Login – A Step-By-Step Guide

Welcome to the world of seamless investing and financial freedom! In this fast-paced era of digital transactions, where paper is becoming a relic of the past, the concept of an ICICI Demat account emerges as a game-changer in the realm of stock trading and investments.

Therefore, in the world of modern finance, the ICICI Demat account stands as a reliable and efficient tool for individuals looking to venture into the realm of securities trading and investments. As one of the leading financial institutions in India, ICICI Bank has long been recognized for its comprehensive range of financial services, and its Demat account offering is no exception.

So, let’s jump into how to create an ICICI Bank demat account, shall we?

What is a Demat Account at ICICI Bank?

ICICI Direct, a part of ICICI Securities Ltd., offers the ICICI Demat Account, a popular choice among investors and traders in India. This article explores the benefits of these accounts, procedure to open demat account at ICICI Bank, associated charges, and key considerations when selecting a Demat account.

ICICI Bank Demat Account provides access to various investment options, from shares to bonds, mutual funds, ETFs, and more, all in electronic format. This Demat account plays a crucial role in storing and trading these investment instruments, making it an essential component of your financial portfolio.

How Does the ICICI Demat Account Work?

As a leading name in the financial services industry, ICICI Direct offers a comprehensive suite of investment solutions, with its Demat account standing out as a key offering. The ICICI Direct Demat Account serves as a secure and convenient platform for individuals to hold and manage their securities electronically. Process to open demat account at ICICI Bank is pretty straightforward and once the account is set up, investors can seamlessly access their holdings, including shares, bonds, mutual funds, and other financial instruments, through an online interface.

You can buy and sell securities in a hassle-free manner through the trading platform provided by ICICI Direct, which is integrated with the Demat Account. Moreover, the account also facilitates the settlement of transactions, enabling the transfer of securities between buyers and sellers. With ICICI Direct’s Demat Account, investors can enjoy the convenience of paperless transactions, real-time updates on their holdings, and seamless connectivity to the stock market, making it a reliable and efficient way to manage their investments.

Features of an ICICI Demat Account

Investing in the stock market has become more accessible than ever, thanks to dematerialized (Demat) accounts. ICICI Direct offers a feature-rich Demat account to streamline your investment journey. Here are the key features that make an ICICI Demat account stand out:

Zero Account Opening Charges

If you have ever asked yourself, ‘How to Open a free Demat Account?’, then look no further! Opening an ICICI Demat account is cost-free, ensuring a hassle-free start to your investment portfolio.

Paperless Transactions

Say goodbye to the paperwork. ICICI Demat accounts facilitate seamless, paperless trading and investments, reducing administrative burdens.

Integrated Trading and Demat Account

ICICI Direct provides a unified platform, combining your trading and Demat accounts for convenient access to your investments and trades.

3.5% Interest on Idle Funds

Your unutilized funds in the Demat account can earn up to 3.5% interest, maximizing the value of your money.

Digital Access

Manage your Demat ICICI account with ease through the ICICI Direct website or mobile app, ensuring 24/7 access to your investments.

Wide Range of Investment Options

Invest in a variety of assets, including equities, derivatives, mutual funds, bonds, and more, all from a single Demat account.

Hassle-free Stock Transfers

ICICI Demat accounts simplify stock transfers and transactions, making it easy to buy, sell, and hold securities.

Personalized Customer Support

Benefit from dedicated customer support to address your queries and concerns promptly.

Regular Portfolio Updates

Stay informed about your investment portfolio with regular updates and account statements.

Value-added Research and Tools

Access research reports and analytical tools to make informed investment decisions.

Security Measures

ICICI Direct employs stringent security measures to safeguard your investments and personal information.

Let us now explore the documents required to open a demat account with ICICI Bank.

What are the Documents Required for the ICICI Bank Demat Account Opening?

To get started on your investment journey, we kindly request a few essential documents required to open Demat Account at ICICI Bank Demat account opening.

- Identity Proof: You can carry PAN Card, Driving License, Voter ID Card or a Passport with you.

- Address Proof: For address proof, you can submit a copy of your Electricity Bill, Water Bill, Telephone Bill, Bank Statement or Aadhaar Card.

- Passport Size Photograph: A recent passport-size photograph

- Signature: You need to upload a scanned copy of your signature.

- ITR Statement: Submit the soft copy of the Income Tax Return (ITR) statement, net-worth certificate, Demat holding statement, or holding report. This is optional.

- Form 15G/H: If you are a resident Indian, you will need to submit Form 15G/H to claim tax benefits.

You can also open an ICICI Demat account online and avail the benefits of ICICI trading account login. To do this, you will need to provide the same documents as mentioned above, along with a scanned copy of your signature. Now that we know what you will require, let us now learn how to create demat account in ICICI Bank.

What is the Step-by-Step Guide for ICICI Bank Demat Account Opening?

Let me guide you through the step-by-step process, ensuring a seamless and hassle-free experience from start to finish.

ICICI Bank Demat Account Opening via smallcase

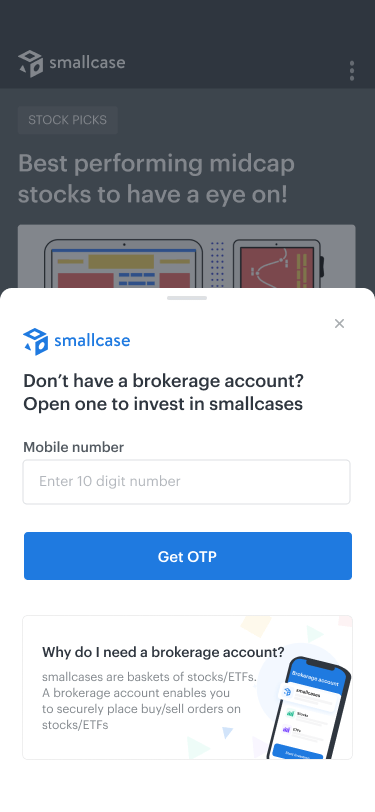

Are you ready to embark on a journey towards financial freedom and prosperity? Look no further, for ICICI Bank brings you an unparalleled opportunity to open your Demat account through smallcase, revolutionizing the way you invest and manage your securities. Follow these steps to enjoy a hassle-free process of ICICI Direct account opening.

- Go to the smallcase website. Under the ‘More’ section, click on the “Open Account” button.

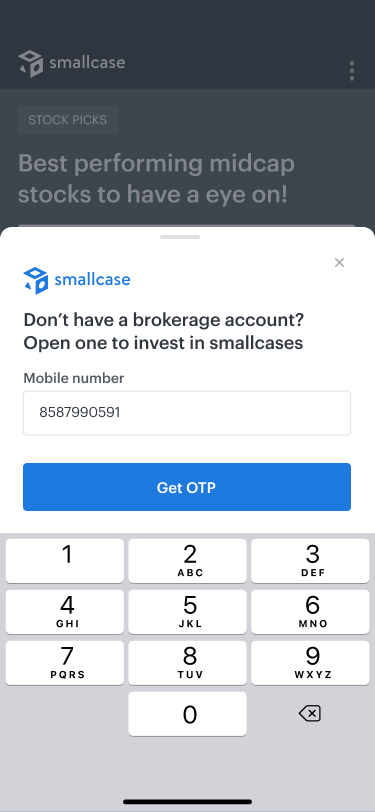

- Enter your phone number to receive an OTP.

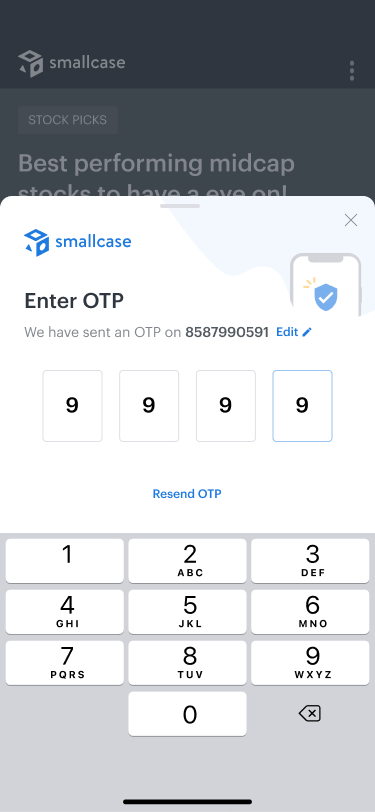

- Enter the OTP

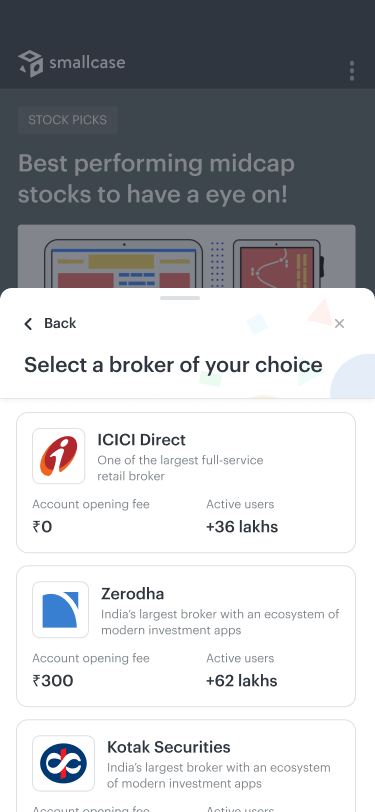

- Next, select ICICI Direct from the list of brokers of your choice.

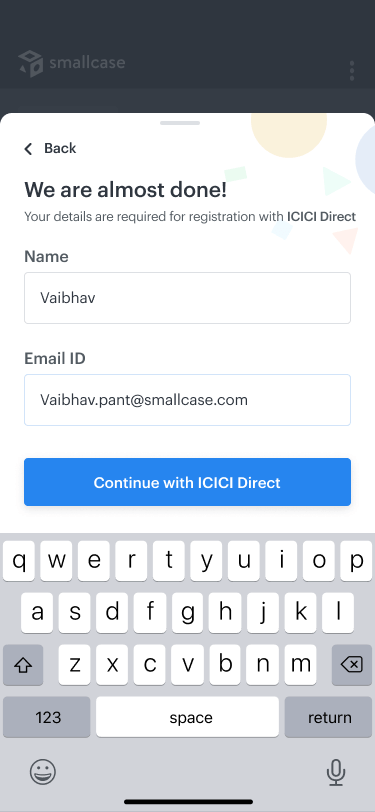

- After entering the preferred broker, add your name and email ID.

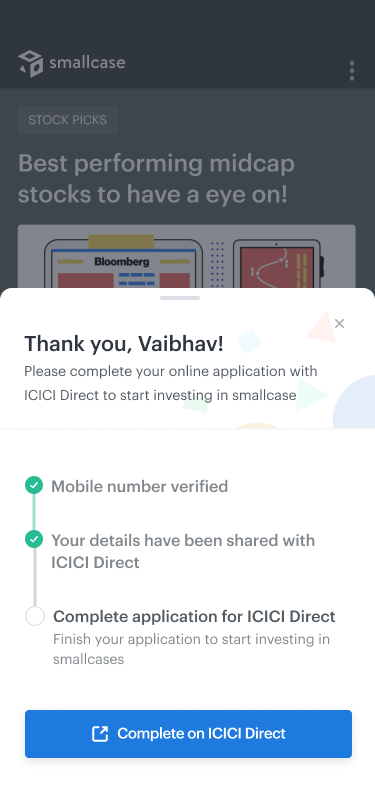

- Once the details have been entered, complete your application process.

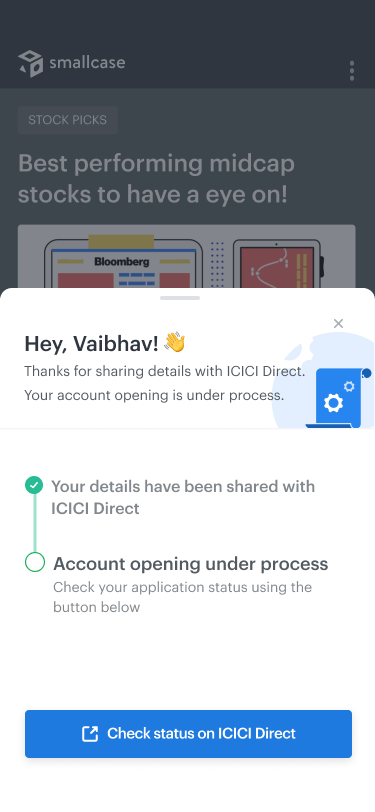

- Wait for a few seconds for ICICI Direct to confirm your account.

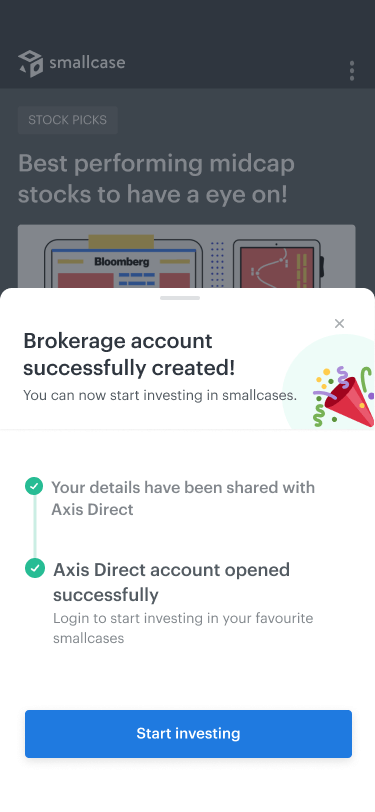

8. Tada! Your ICICI demat account is opened.

Open ICICI Demat Account Online

You can log into your demat account directly via the website. Therefore, to invest or trade with the Bank, a customer must consider ICICI trading account and ICICI Bank demat account opening options first.

- Visit the ICICI Direct website

- Click on ‘Open New Account’ and sign up for ICICI Direct.

- Enter Your Mobile number preferably the one linked with an Aadhar card.

- Enter the OTP and click on Submit.

- Provide Email address and validate with new OTP sent.

- Fill in your personal details, including your name, email address, phone number, and PAN card information.

- Verify KYC details.

- Upload your documents online and capture your live photo.

- E-sign your online demat account opening form.

- You’re done! Start trading and avail great benefits like low brokerage and enjoy unlimited trading at just ₹50 per order.

Open ICICI Direct Demat Account Offline

The process of opening an ICICI Direct demat account offline is easy if you follow these steps:

- Visit the nearest ICICI Bank branch.

- Ask for a Demat account opening form.

- Fill out the form and provide the required information.

- Submit the original documents.

- Pay the application fee.

- Once your application is processed, you will receive a Demat account opening kit.

What are the ICICI Demat Account Charges and Fees?

Like any financial service, ICICI Bank levies certain charges and demat account fees. These ICICI direct demat account charges are levied to cover the costs involved in the smooth functioning of the account and the services provided by the bank.

Let’s get down to the nitty-gritty—what are the ICICI Bank demat account charges and fees associated with this powerful tool.

ICICI Direct Demat Account Charges

| Transaction | Charges |

| Account Opening Charges | ₹0 |

| Account Annual Maintenance Charges | ₹300 |

| Demat Debit Transaction Charges (Sell Orders) | ₹20 per transaction |

| Call &Trade Charges | ₹50 per order |

| Inactivity Charges | If the Demat Account remains inactive for 12 months, ₹100 per month will be charged. |

Can We Buy and Sell Stocks on ICICI Securities Demat Account?

An ICICI Demat account offers individuals the convenience and flexibility to engage in buying and selling stocks in the Indian stock market. You need to open an ICICI trading account in addition to a Demat account to buy and sell shares in the secondary market.

Thus, with an ICICI Demat account, you can seamlessly trade a wide range of stocks listed on various exchanges such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Through the ICICI Demat account, you track investments and enjoy features like real-time market updates and portfolio management tools. With ICICI trading account’s user-friendly interface and comprehensive trading services, individuals can efficiently navigate the stock market and make informed investment decisions.

Additionally, ICICI Direct charges a fee for placing buy and sell orders. The fee is typically a percentage of the value of the trade. For example, if you place a trade worth ₹1000, and the fee is 0.5%, you will be charged ₹5.

Steps to Buy Stocks:

- Open an ICICI trading account. You can do this online or by visiting an ICICI branch.

- Fund your trading account by linking your bank account or by using a credit or debit card.

- Research and consider factors before choosing stocks to buy, such as the company’s financial performance, its competitive landscape, and its future prospects.

- Once you have chosen a stock to buy, you can place an order through your ICICI trading account. You can choose to buy the stock at the current market price or at a specified price.

- Once you have bought a stock, you can monitor its performance by tracking its price and other metrics. You can also sell your stock at any time.

Steps to Sell a Stock:

- Log in to your ICICI trading account.

- Click on the “Equity” tab.

- Click on the “Place Order” button.

- In the “Sell” section, enter the following details:

- Symbol: The ticker symbol of the stock you want to sell.

- Quantity: The number of shares you want to sell.

- Price: The price at which you want to sell the shares.

- Type: Select “Market” if you want to sell the shares at the current market price, or “Limit” if you want to sell them at a specific price.

- Click on the “Place Order” button to submit your order.

What is a 3 in 1 Demat account in ICICI Bank?

An ICICI 3 in 1 account, offered by the RBI-recognized bank, combines a savings bank account, trading account, and demat account. In a standard 2 in 1 ICICI demat account, the trading and bank accounts are linked but not merged, necessitating manual fund transfers. However, a 3 in 1 demat account streamlines this process, automatically crediting cash to your savings account when selling shares and simplifying purchases without the need for manual transfers. Get trading account demat account, at the same time with ICICI 3 in 1 Demat Account!

How to Close ICICI Demat Account?

An ICICI Direct Demat account cannot be closed online. To terminate it your offline demat account, follow these steps:

- Download the Account Closure form from the depository participant’s website or visit your local ICICI Bank branch to get a form.

- Complete the form with essential details like client ID, DP ID, name, address, reason for closure, and your signature.

- Attach any supporting documents, such as a copy of the ledger or unused DP slips.

- Submit the form at the nearest ICICI depository participant’s office.

- You’ll receive an account closure request number via SMS.

- The account closure process may take 7-10 working days, and you’ll receive an SMS confirmation upon completion.

Explore Various Investment Options with Demat Account

When you open an ICICI Demat Account, you gain access to a wide array of investment options. These include:

- Equities: Buy and sell shares of companies, giving you ownership in the stock market.

- Mutual Funds: Invest in professionally managed portfolios of stocks and bonds.

- Exchange-Traded Funds (ETFs): Trade like stocks but represent a diversified set of assets, such as commodities or indices.

- Bonds and Debentures: Invest in fixed-income securities that provide regular interest payments.

- Initial Public Offerings (IPOs): Participate in new stock issuances and potentially benefit from early-stage investments.

- Government Securities: Invest in risk-free government bonds and securities.

- Commodities: Trade in various commodities, including gold, silver, and more.

- Derivatives: Engage in futures and options trading for potential hedging or speculation.

- Currency Trading: Participate in the forex market with currency pairs.

- smallcase Investments: Explore thematic and model-based investment strategies.

Having a Demat Account with ICICI not only simplifies the process but also opens up a world of opportunities for your financial growth.

What are the Benefits of ICICI Direct Demat Account Opening?

If you are looking for a convenient, secure, and affordable way to invest in the stock market, then an ICICI Demat account can be a good option for you. Here are some of the benefits of ICICI Direct demat account opening:

- Convenience: You can open an ICICI Bank Demat account online or at any of their branches.

- Security: ICICI Bank is a leading financial institution with a strong track record of security.

- Low Fees: ICICI Bank offers competitive fees for Demat accounts.

- Easy Trading: You can trade in stocks, mutual funds, and other securities through ICICI Bank’s online trading platform.

- Access to Research: ICICI Bank offers access to research reports and analysis from its team of in-house experts.

What are the Important Tips and Precautions for ICICI Demat Account Holders?

As an ICICI Bank Demat Account holder, here are some important tips and precautions to keep in mind to ensure a secure and successful investing experience via ICICI Bank demat account login.

- Use a Strong Password: Your password should be at least 8 characters long and include a mix of uppercase and lowercase letters, numbers, and symbols.

- Enable Two-Factor Authentication(2FA): 2FA adds an extra layer of security to your account by requiring you to enter a code from your phone in addition to your password.

- Be Aware of Phishing Scams: These emails or text messages will often ask you to click on a link or provide personal information. Do not click on any links in these emails or text messages and do not provide any personal information.

- Report Any Suspicious Activity to ICICI Immediately: If you think that your Demat account has been compromised, contact ICICI immediately. They will help you secure your account and prevent any unauthorized transactions.

To Wrap It Up…

A Demat account is like a magic portal that revolutionizes the way you hold and manage your securities. So, take the first step towards a prosperous future and experience the power of seamless, secure, and rewarding investing. Open an ICICI Demat Account today and embark on an extraordinary journey to financial success!

FAQs

The ICICI Trading and Demat Account charges ₹0 for opening an account. However, there is an annual maintenance charge of ₹700 plus applicable taxes.

ICICI demat account opening online process takes approximately 5 minutes.

ICICI 3-in-1 Account is a composite of Savings, Demat & Trading Accounts. As an investor, it broadens your portfolio and helps you earn impressive returns.

ICICI Bank, one of the leading financial institutions in India, offers its customers the convenience of opening a Demat account. The user-friendly platform and 3-in-1 account option.

The ICICI Direct Demat account can be closed online with zero charges. This is only when there are no holding or outstanding dues in your account.

There is no limit.

No, ICICI Demat account does not charge monthly. However, you need to pay ₹300 Annual Maintenance Charges.

To open a Repatriable Demat Account at ICICI Bank, NRIs need to submit their passport, PAN card, Visa copy, overseas address proof, passport-sized photo, FEMA declaration, and a cancelled cheque leaf from their NRE account.

All About Demat Accounts on Smallcase –

Learn what are demat accounts, how to use them, process to open a new demat account with the multiple broker supported on smallcase platform. Below is the list of such articles to help you with the Demat process –