Open Kotak Demat Account Online for Trading

Are you ready to embark on your journey into the world of investing? Opening a Demat account is a crucial first step. A Kotak Demat account, short for a dematerialized account, allows you to hold securities in electronic form, providing convenience, safety, and easy access to your investment portfolio.

If you’re considering opening a Demat account, look no further than Kotak Securities. With a trusted name in the industry and a seamless online platform, Kotak Securities makes it simple and hassle-free to open a Kotak account for Trading.

In this blog, we will guide you through the process of opening a Kotak Securities Demat account, ensuring that you have all the information you need to get started on your investment journey with confidence.

What is a Kotak Demat Account?

Kotak Bank’s Demat Account is dual-registered with both NSDL and CDSL, offering a wide range of Demat services for traders and investors. While they do not provide physical share dematerialization, their Demat account serves as a secure storage for all your invested shares and financial instruments. It’s an essential tool for investments across various financial instruments in the share market, including equities, mutual funds, and derivatives.

How Does the Kotak Demat Account Work?

The Kotak Demat Account is a type of account that allows investors to hold shares and other securities in electronic form. It is a convenient and secure way to access the stock market, and it offers a wide range of investment options.

To open a Kotak Demat Account, investors can either visit a Kotak Securities branch or open it online. The online process is quick and easy, and investors can have their accounts up and running in a matter of days. Once the account is activated, investors can fund their accounts and start their trading journey. They can also use the account to hold shares and other securities that they have already purchased.

Kotak Account for trading offers a wide range of investment options, including stocks, mutual funds, bonds, and ETFs. Investors can also use the account to trade derivatives, such as options and futures. The user-friendly interface of Kotak Securities’ trading platform ensures a seamless trading experience. Investors can monitor market data, place orders, and track their investments with ease.

In short, Kotak Account for Trading is a comprehensive suite of services that enables investors to navigate the financial markets with ease and achieve their investment goals.

Types of Kotak Demat Accounts

Kotak Securities stands out as a preferred choice, offering a range of Demat Account options tailored to diverse clients and traders.You have the flexibility to choose from eight types of Demat accounts to meet your specific needs:

- Auto Invest: Ideal for Gold ETF investments, guided by our advisors to match your risk profile.

- Kotak Gateway: Designed for beginners, this account offers a wealth of trading options, including call and trade, SMS alerts, market reports, and more.

- Kotak Privilege Circle: Tailored for elite traders maintaining margin money exceeding Rs. 10,00,000 (in cash or stocks).

- Kotak Freedom: An all-encompassing account for various Mutual Fund investments.

- Kotak Super Saver: This account features fixed, flat brokerage charges and a super low margin requirement.

- PMS Account: Managed by financial experts, this account oversees and optimizes your investments.

- NRI Account: An online trading platform enabling NRIs to invest in the nation’s financial vehicles.

- Trinity Account: This three-in-one account, exclusive to Kotak Securities, streamlines fund transfers and ensures security across all linked accounts.

Kotak Demat Account Opening – Documents Required

Here are the documents required to open a Kotak Mahindra Demat Account:

1. Proof of Identity: You can use any of the following documents as proof of identity:

- PAN card

- Aadhaar card

- Passport

- Voter ID card

- Driving licence

- Ration card (only if it has your photograph)

2. Proof of Address: You can use any of the following documents as proof of address:

- Aadhaar card

- Passport

- Voter ID card

- Driving licence

- Utility bill (not older than 3 months)

- Bank statement (not older than 3 months)

3. Passport-sized photographs: You need to submit two passport-sized photographs.

4. Application form: You can download the demat account opening form from the Kotak Securities website.

5. E-KYC: You need to complete the e-KYC process to open a Kotak Demat Account. You can do this by uploading your PAN card and Aadhaar card details.

6. Application fee: The application fee for a Kotak Demat Account is ₹100.

These are the documents required for opening Demat Account at Kotak. Once you have submitted all the required documents, your Kotak Account for Trading will be opened within a few days.

Step-by-Step Guide to Open a Kotak Demat Account

You may be wondering, at this point, ‘How can I open a Demat Account at Kotak Mahindra?’. Well, fear no more, because we bring to you this step-by-step guide for 3 different ways on how to open a Kotak Demat Account!

A. Open Kotak Demat Account via smallcase

If you’re excited to start your stock market investing journey, opting for a Kotak Mahindra Bank Demat account through smallcase is a smart decision.

With smallcase, you can discover thoughtfully curated portfolios centred around specific ideas, themes, or strategies. Follow these easy steps to effortlessly open your Kotak Demat account via smallcase and embark on your investment adventure:

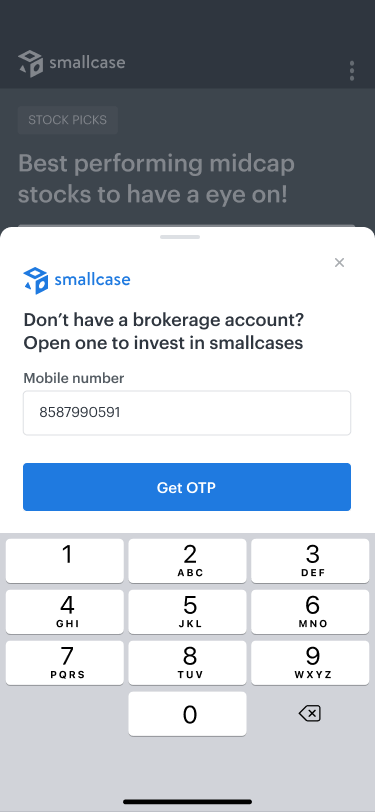

1. Visit the smallcase website. Click on ‘more’ on the right-hand side of your screen and then click on ‘Open Broker Account’

2. Enter your phone number and then click on ‘get OTP’

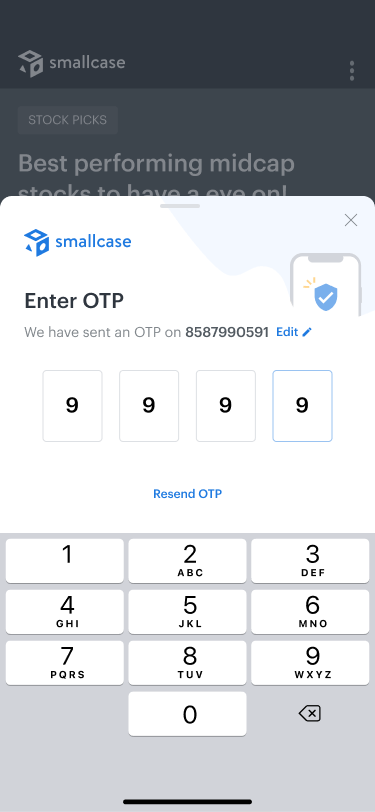

3. Enter the ‘OTP’

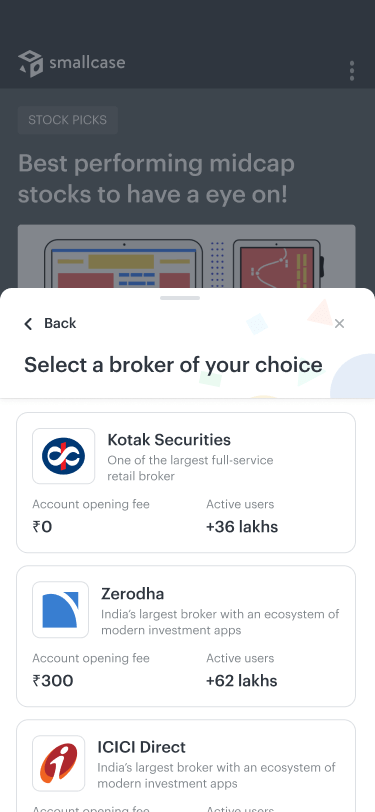

4. Select a broker of your choice

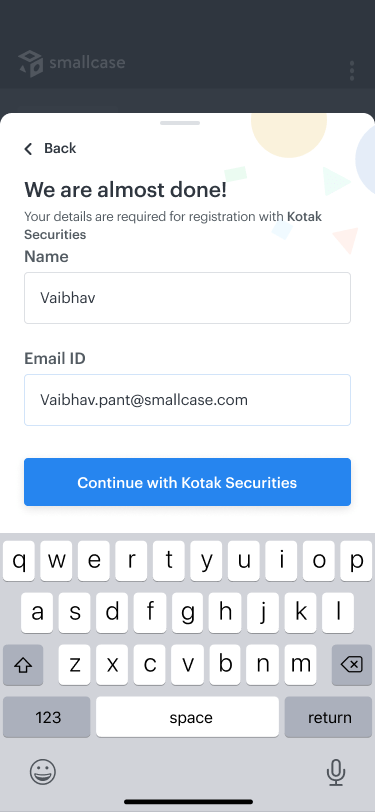

5. After choosing the broker, enter your name and email address

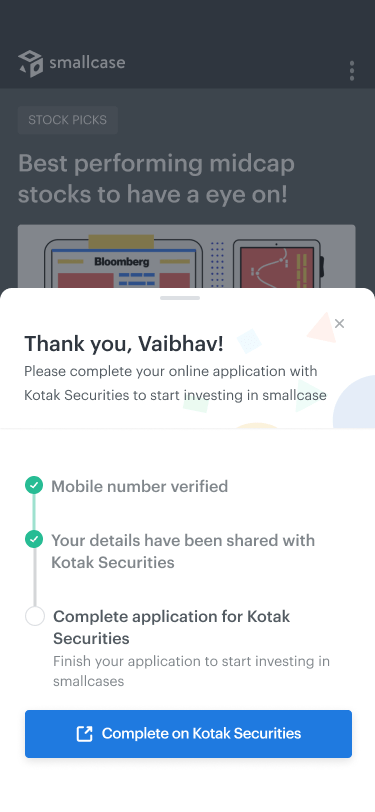

6. Once you have entered all the details, complete your application process

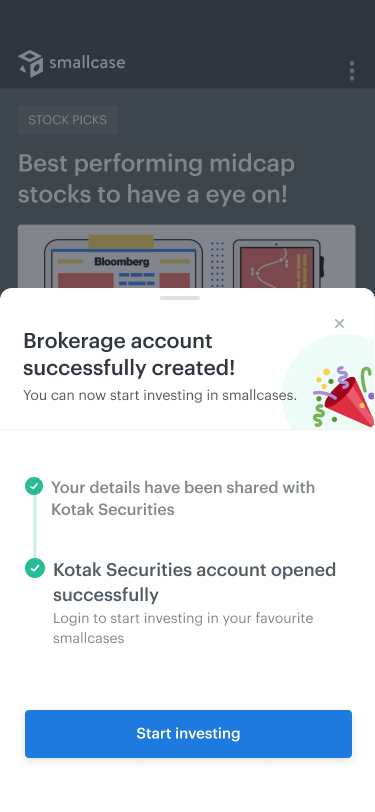

7. Voila! Your Demat Account is opened. You can now start using your it via smallcase to invest in various securities and manage your portfolio.

B. Steps for Kotak Demat Account Opening Online

If you have ever thought, ‘Can I open a Demat Account online?’, then look no further! You can also open the Kotak Demat Account by visiting the Kotak Securities website. Here are the steps you need to follow to open a Kotak Account for Trading online:

1. Visit this website https://www.kotaksecurities.com/open-demat-account/.

2. Locate and click on the “Open Demat Account” link.

3. Fill out the online application form with your personal information, including name, address, PAN number, and contact details. Choose a trading plan as well.

4. Upload the required documents, such as scanned copies of your PAN card, Aadhaar card, and passport-sized photographs.

5. Complete the e-KYC process by providing your PAN card and Aadhaar card details.

6. Make the payment of the ₹100 application fee.

Once you have submitted all the required documents, your Demat Account will be opened within a few days.

C. Steps for Demat Account Opening Offline

Here are the steps to open your Demat Account offline:

1. Visit the nearest Kotak Securities branch or authorized centre.

2. Request the account opening form from the representative.

3. Fill out the form with your personal details, including name, address, PAN number, and contact information.

4. Attach the necessary documents, such as photocopies of your PAN card, Aadhaar card, and passport-sized photographs.

5. Submit the completed form and documents to the representative.

6. Pay the applicable account opening fees, if any, as per the instructions provided.

7. The representative will verify your documents and process your application.

8. Once your application is approved, you will receive your Demat Account details, including your account number and login credentials.

What are the Kotak Securities Demat Account Charges and Fees?

To begin online trading, investors need to establish an account with a Depository Participant (DP). When opting for a Kotak account for trading, certain fees and charges are applicable.

You can check out the charges associated with your Demat account in the table below:

| Transaction | Charges |

| Trading Account Opening Charges | ₹0 |

| Kotak Trading Account Charges | ₹65 per month (up to 10 debit transactions) |

| Kotak Securities Demat Account Charges (Account Opening) | ₹100 |

| Demat AMC (Yearly) | Up to ₹50,000: Nil ₹50,001 to ₹2,00,000: ₹100 Above ₹2,00,000: 0.0015% of the average quarterly balance |

What is the Kotak Securities AMC or Annual Maintenance Charge?

Kotak Securities charges Rs. 300 for the Demat account, but you can potentially open free demat account through their AMC offers. The trading account incurs an annual maintenance charge of Rs. 500, which is relatively higher compared to most brokerage houses that don’t charge for trading account maintenance. Additionally, a minimum margin of Rs. 25,000 must be maintained in the trading account at all times to facilitate trades and transactions.

Can We Buy and Sell Stocks on Kotak Securities?

Yes, you can buy and sell stocks on Kotak Securities. As a leading stockbroker, Kotak Securities provides a platform for investors to trade stocks, derivatives, and other financial instruments. You can place buy and sell orders for stocks listed on various exchanges, such as BSE and NSE, through your Kotak Securities trading account.

In order to engage in buying or selling stocks through Kotak Securities, you must establish a trading account and deposit a minimum amount of ₹2000 into it. Once your account is funded, you gain the ability to commence trading by executing orders for the specific stocks you desire to purchase or sell.

Upon selling shares from the demat a/c , a Depository Participant (DP) charge is levied by the depository, known as Central Depository Services (India) Limited (CDSL). In Kotak Securities, the DP account charge amounts to ₹15 (₹5 by CDSL and ₹10 by Kotak Securities) plus 18% GST, and is applicable on a daily basis per stock, irrespective of the quantity sold.

Steps for Buying and Selling Stocks on Kotak Securities

Here are the steps on how to buy and sell stocks on Kotak Securities:

- Open a trading account with Kotak Securities.

- Fund your trading account.

- Select the stocks you want to buy or sell.

- Enter the number of shares you want to buy or sell.

- Enter the price you want to buy or sell at.

- Place the order.

- Once you have placed an order, it will be executed as soon as possible. You will be notified of the status of your order and the price at which your order was executed.

What are the Benefits of Opening a Kotak Demat Account?

Opening a Kotak Bank Account for Demat offers a number of advantages, including:

- Security: Your shares are held in a secure depository account that is protected by multiple layers of security.

- Convenience: You can trade stocks online 24/7, or use the Kotak Securities mobile app to trade on the go.

- Flexibility: You can hold shares from different companies in your demat account, and you can easily transfer shares between demat format accounts.

- Affordability: The brokerage fees and other fees charged by Kotak Securities are competitive.

- Customer service: Kotak General Securities has a dedicated customer service team available 24/7 to assist you with your demat account.

Important Tips and Precautions for Kotak Demat Account Holders

Here are some important tips and precautions for Kotak Bank Demat account holders:

- Keep your Kotak securities login trade credentials safe and secure. Do not share your login credentials with anyone.

- Be careful of phishing emails and websites. Do not click on links in emails or websites that you are not familiar with.

- Keep your software up to date. This includes your web browser, antivirus software, and any other software that you use to access your demat account.

- Use a strong password for your demat account. Your password should be at least 8 characters long and include a mix of uppercase and lowercase letters, numbers, and symbols.

- Enable two-factor authentication for your demat account. This will add an extra layer of security to your account.

- Monitor your account activity regularly. This will help you to identify any unauthorized activity.

- Report any suspicious activity to Kotak Securities immediately. If you see anything that looks suspicious, such as unauthorized login attempts or unusual transactions, you should report it to Kotak Securities immediately.

To Wrap It Up…

Opening a Kotak Securities Demat Account is a straightforward process that can be completed online or offline. By following the necessary steps and providing the required documents, you can gain access to a reliable platform for buying and selling stocks.

With the convenience of online demat trading, real-time market data, and user-friendly interfaces, Kotak Securities offers a seamless experience for you to manage your investment portfolios.

FAQs

No, Kotak Securities charges for opening and maintaining a Demat account. There’s a one-time fee of ₹100, and additional annual maintenance fees and charges may apply.

To open a Kotak Demat account, provide essential documents like PAN card, Aadhaar card, address proof, and passport-sized photos. Additional documents may be needed to comply with regulations.

Kotak Securities is a well-known brokerage firm that offers Demat and trading account services for electronic securities trading.

Kotak Securities does not require a minimum account balance for demats. However, there may be charges or fees associated with the account, which will be communicated by the bank.

The DP charges for Kotak Securities ltd amount to ₹15 (₹5 by CDSL and ₹10 by Kotak Securities) plus 18% GST.

To close your Kotak Securities account, submit the closure form, clear dues, and follow Kotak Securities’ guidelines.

A Demat Account is mainly for holding securities; direct money withdrawal isn’t linked. Funds available in your Kotak Web trading account, connected to the Demat account, can be withdrawn per Kotak Securities Limited’s terms.

There are no charges for closing Kotak Securities Demat Account, unlike Kotak Securities Account Opening.

You can check your Kotak Demat account status through the online trading platform or mobile app for access to your account details, holdings, and transaction history

All About Demat Accounts on Smallcase –

Learn what are demat accounts, how to use them, process to open a new demat account with the multiple broker supported on smallcase platform. Below is the list of such articles to help you with the Demat process –