Book Value: Meaning, Formula, Calculation and Examples

In the dynamic world of finance, understanding key metrics is essential for investors and businesses alike. One such fundamental metric that holds great significance is “Book Value.”

It is also known as “net asset value” or “carrying value,” is a fundamental financial metric that plays a crucial role in the world of investing. It is a crucial indicator used in financial analysis to gauge the financial health of a business and assess its potential for growth and stability.

Despite its importance, it can be intimidating for those not familiar with financial jargon. Many individuals may not recognize its significance or know how to interpret it within the context of their investment decisions. Therefore, let’s understand what is book value of share and how it is helpful.

What is Book Value in Stock Market?

The book value meaning in share market, more commonly known as net book value or carrying value, is a financial metric that represents the value of an asset on a company’s balance sheet. In other words, it is calculated by taking the original cost of the asset and subtracting the accumulated depreciation or amortization up to the current date. Consequently, it can be conceptualized as the net asset value(NAV) of a company, obtained by subtracting its intangible assets and liabilities from the total assets. For instance, if a vehicle costs ₹1,00,000 and its accumulated depreciation amount is Rs. 50,000, then, the book value in the market price, and book value of the stock market of this vehicle will be Rs. 50,000.

How is Book Value Calculated?

As previously stated, it represents the contrast between a company’s total assets and liabilities, as recorded on its balance sheet. Assets encompass both current and fixed assets, while liabilities comprise both current liabilities and non-current liabilities.

Therefore, the book value formula is as follows: Total Assets – Total Liabilities

Components

Thus, the components of BVPS are tangible assets, intangible assets, and liabilities.

- Tangible Assets: Such as land, buildings, equipment, and inventory.

- Intangible Assets: Such as patents, trademarks, goodwill, and intellectual property.

- Liabilities: Debts and obligations a company owes to external parties, including loans, accounts payable, and accrued expenses.

Book Value Vs Market Value

It is important to understand that BVPS in the share market is different from the market value of a share. The market value is determined by the stock’s current market price, which can fluctuate based on supply and demand in the stock market. BVPS, on the other hand, is based on the company’s historical accounting data. The BVPS full form is the Book Value of Equity Per Share.

Example of BVPS

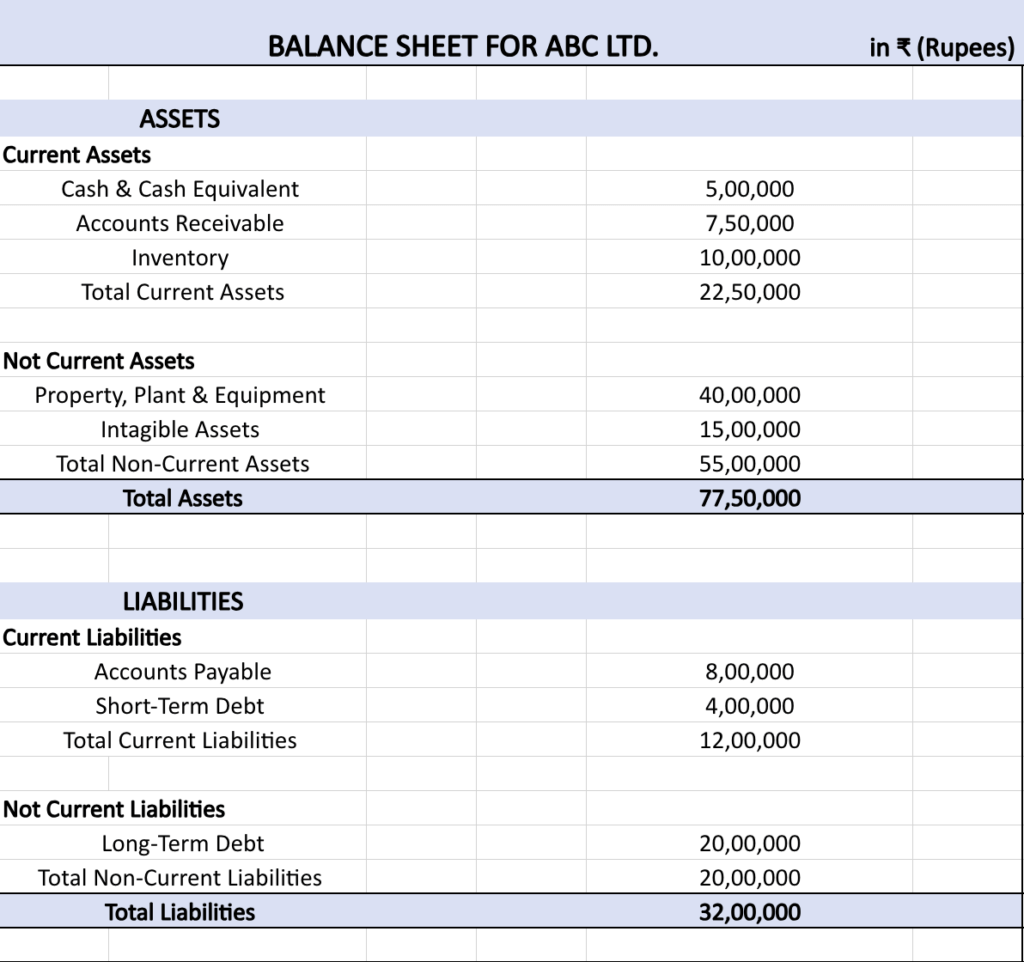

Let’s have a look at a hypothetical example of an ABC Ltd company’s balance sheet to understand the BVPS of an asset.

In this example, we have considered two main sections of the balance sheet – Assets and Liabilities. The total assets for ABC Ltd amount to Rs. 77,50,000, while the total liabilities amount to Rs. 32,00,000. To calculate the book value, we subtract the total liabilities from the total assets i.e. Rs. 45,50,000. This represents the net value of the company’s assets after deducting all its liabilities.

Why Does BVPS Matter in Investing?

By representing the net asset value per share, it allows investors to assess the portion of assets allocated to each outstanding share. When compared with the market price, the book value of a stock assists investors in identifying potential investment prospects.

In addition, stocks below book value might signal an undervalued asset, presenting an opportunity to acquire shares at a discounted rate. However, while it serves as a fundamental assessment, investors must consider other factors, such as future earnings potential, industry trends, and overall market conditions, to make well-informed investment decisions.

What are the Factors Influencing Book Value?

These are the following factors that could impact the BVPS of a company:

- Impact of Depreciation: The book value of a company can be influenced by depreciation. It lowers the carrying value of assets on the balance sheet, reducing the company’s total assets. As a result, higher depreciation expenses can have a negative impact.

- Effect of Inventory Management: Effective inventory management plays a crucial role in determining this value. Maintaining excess inventory can lead to increased carrying costs and potential write-downs, negatively impacting value.

- Consequences of Changes in Debt and Equity: Taking on more debt or issuing additional equity can increase total assets and subsequently boost the value. Whereas, paying off debt or repurchasing shares can reduce liabilities or equity, respectively, leading to a decrease in value.

Cashing in on Book Value

“Cashing in on book value” is a strategy where an investor or a company takes advantage of the difference between the book value of an asset and its market value. In some cases, you may have identified a company with genuine hidden worth that hasn’t been widely recognized. Therefore, you must wait for the market to come to the same observation.

While corporate raiders or activist investors holding significant stakes can expedite this recognition, investors shouldn’t always rely on external influences. Consequently, solely relying on the book value of a company as a buying criterion may, surprisingly, lead to losses, even if your assessment of the company’s true value is accurate.

Using Book Value in Investment Analysis

Let’s have a look at the two investment analysis tools below:

What is Book Value Per Share (BVPS)?

BVPS is also known as the Book Value of Equity Per Share. It represents the net asset value of a company’s shareholders’ equity, and it’s calculated by dividing the total shareholders’ equity by the total number of outstanding shares.

It is considered a common metric when a company decides to liquidate its assets and settle all the other claims. The book value per share formula can be expressed as:

BVPS = Shareholder’s equity or Net value of assets / Total number of outstanding shares

Example of BVPS

As of the end of the financial year 2022-2023, ABC Enterprises reported a total shareholders’ equity of Rs. 50,00,00,000 (50 crores). The company has Rs. 5,00,00,000 (5 crore) outstanding shares of common stock. To calculate the BVPS, we divide the total shareholders’ equity by the number of outstanding shares:

Book Value of Equity Per Share = Total Shareholders’ Equity / Total Outstanding Shares

BVPS = Rs. 50,00,00,000 / Rs. 5,00,00,000

BVPS = Rs. 10

Nevertheless, investors should be aware that relying solely on BVPS for analysis may not yield promising results. Instead, it should be utilized in combination with other metrics such as Discounted Cash Flow (DCF) and Price-to-Earnings Ratio (PE) to form a more comprehensive and reliable assessment of an organization’s potential.

What is Price-to-Book Value Ratio?

The P/B ratio, alternatively referred to as the price-equity ratio, is calculated based on the value of a company.

P/B ratio formula is expressed as:

P/B ratio = Market capitalisation / Net value of assets

Example of P/B Ratio

Taking the above-mentioned example of the same company, ABC Enterprises, let’s calculate its P/B ratio.

- Current market price per share: Rs. 150

- BVPS: Rs. 100

To calculate the P/B ratio, use the formula:

P/B ratio = Current market price per share / Book value per share

= 150 / 100

= 1.5

In this example, the Price-to-Book (P/B) ratio for ABC Enterprises is 1.5. This means that the market price of the company’s shares is 1.5 times higher than its book value per share. Investors can use this ratio to assess whether the stock is trading at a premium (P/B ratio above 1) or a discount (P/B ratio below 1) relative to its BVPS.

What are the Benefits of Book Value?

Here are some of the benefits of BPVS:

- Conservative Business Valuations: The book value of a share offers a conservative estimate of a company’s worth. To calculate book value, subtract a company’s liabilities from its assets. This conservative approach makes book value a more cautious measure to evaluate the valuation of a company compared to market capitalization.

- Identifying Undervalued Stocks: When a company’s stock price is lower than the price to book value, it’s considered undervalued or undervalued stocks. In this situation, investors essentially acquire the company’s assets for less than their actual worth.

- Assessing Financial Strength: A company with a higher book value per share is generally seen as financially stronger. This indicates that the company possesses more assets to cover its obligations, offering a measure of financial stability.

- Comparing Companies: BPVS serves as a standardized metric, simplifying comparisons between companies in the same industry. This is valuable for investors seeking undervalued stocks or companies with robust financial positions.

What are the Limitations of Book Value?

Some of the limitations of the book value of a company are:

- The calculation excludes intangible assets, such as patents, trademarks, and copyrights, focusing solely on tangible assets.

- It relies on historical cost for valuation, disregarding present-day factors like inflation, foreign exchange fluctuations, and market changes.

- It is derived from the company’s balance sheet, which is released either quarterly or annually, potentially making the evaluation less relevant at the time of calculation.

To Wrap It Up…

In conclusion, book value is a fundamental metric that provides valuable insights into a company’s net asset value per share. However, for a more holistic view of a company’s financial health, investors are encouraged to consider other financial ratios like the price-to-book (P/B) ratio, price-to-earnings (P/E) ratio, EBITDA, and market capitalization.

FAQs

The book value of a share, also known as the “book price,” is the value of a company’s equity divided by the number of outstanding shares. It is used to assess the valuation of a company based on its accounting records.

The book value meaning or the origination of the name comes from the accounting lingo where the balance sheet of a company was called ‘books’. Thus, it can be equated with accounting value.

Book value means in share market, a company’s assets minus its liabilities. Whereas, a face value is the nominal value of a security, such as a share of stock.

An ideal or good P/B ratio is below 1, indicating a robust undervalued company. However, value investors also find a P/B ratio value below 3 acceptable.

Book value is important because it can help investors identify undervalued stocks, assess a company’s financial strength, and compare different companies within the same industry.

To calculate the book value of a company, subtract the total liabilities from the total assets. It’s important to note that the company’s stock is valued in the books of accounts based on its historical cost, not its current market value.

All About Investment Concepts on smallcase –

smallcase offers you a quick view to the different finance related concepts to help you on your investment journey to achieve the financial freedom you have always dreamt of –