Year in Review, 2024 | Windmill Capital

The Indian stock market demonstrated remarkable resilience in 2024, navigating through a complex maze of domestic and global challenges while maintaining its position as one of the world’s most attractive investment destinations. As we reflect on the year gone by, several key themes emerged that shaped market dynamics and investor sentiment.

Macroeconomic Context

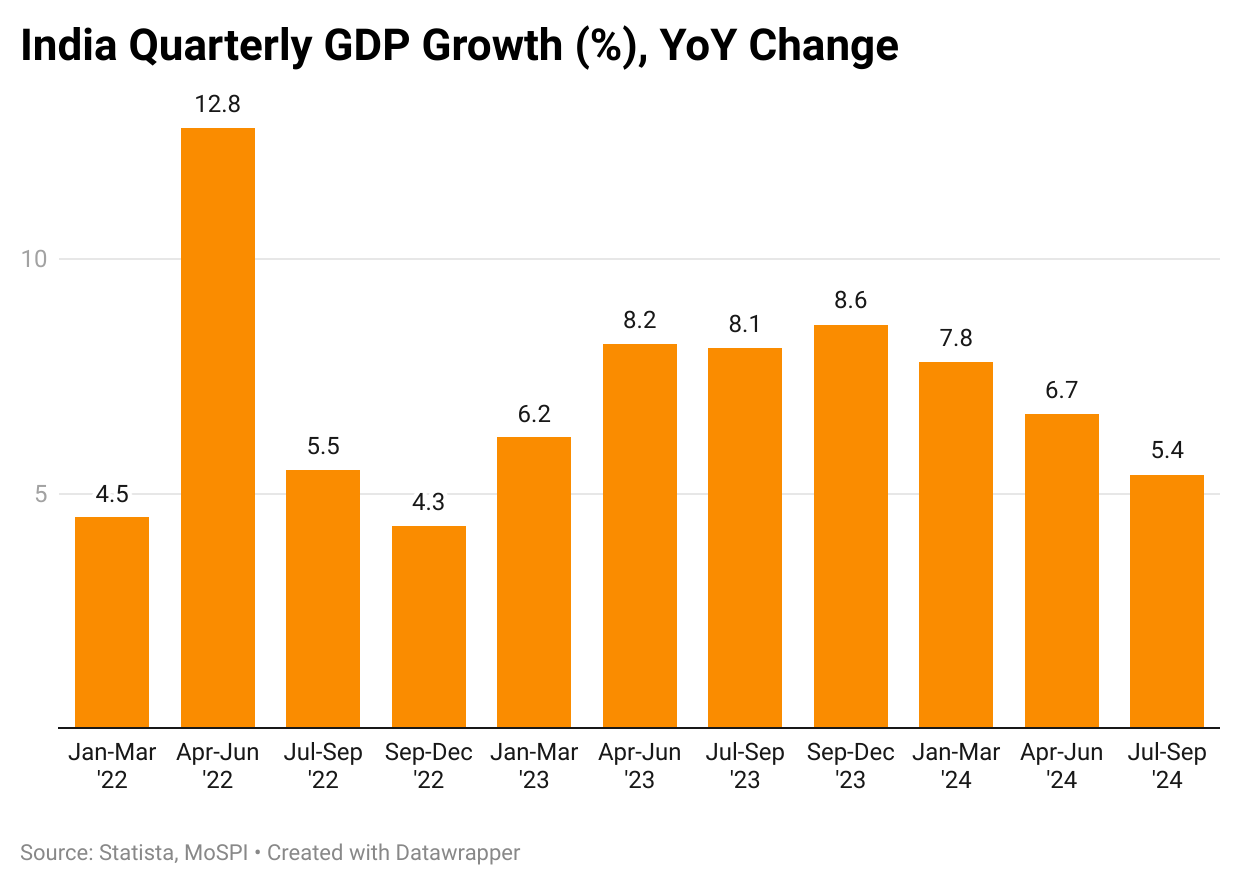

India’s economic growth remained robust throughout 2024, with GDP growth averaging around 6.6% till the September quarter, outperforming most major economies. This strong fundamental backdrop provided crucial support to equity markets, even as global markets grappled with uncertainties.

Growth vs Inflation, who trumps?

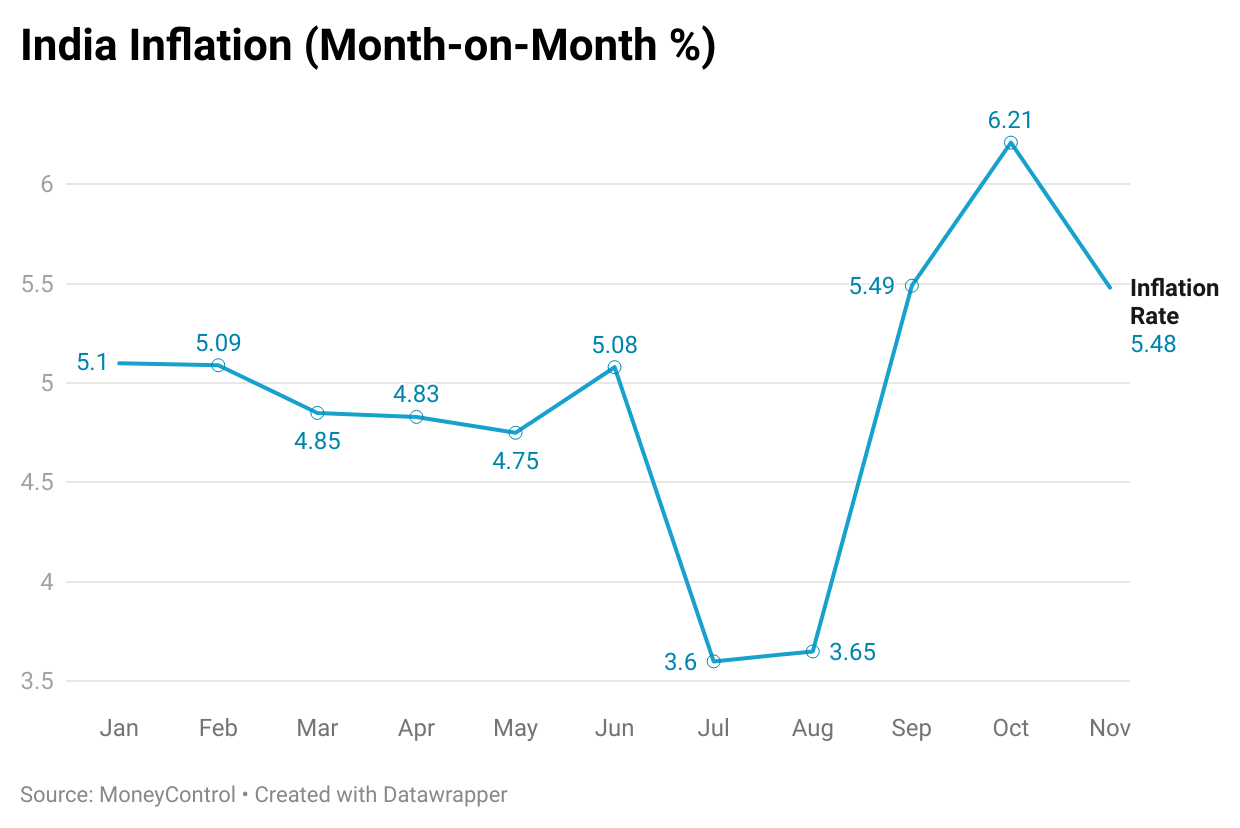

The Reserve Bank of India’s monetary policy journey through 2024 exemplified the classic central banking dilemma of balancing growth imperatives with inflation control, made particularly challenging by the unique circumstances of the Indian economy. Throughout the year, the central bank maintained its hawkish stance, keeping the repo rate steady at 6.50% while navigating through persistent inflationary pressures and managing growth expectations. The inflation narrative was largely dominated by food prices, with volatile vegetable prices, elevated cereal costs due to uneven rainfall patterns, and sustained pressure on pulses contributing significantly to headline inflation, often pushing it beyond the RBI’s comfort zone of 4-6%.

The growth side of the equation presented a mixed picture, with manufacturing PMI consistently showing expansion, robust GST collections indicating strong formal sector activity and credit growth maintaining a healthy pace of 15-16%. However, concerns about rural demand, uneven consumption patterns, and the impact of the global slowdown on exports required careful consideration in policy formulation.

The RBI’s response to these challenges demonstrated remarkable finesse in policy implementation, using a combination of conventional and unconventional tools. While the repo rate remained unchanged, liquidity management became a key policy lever, with the central bank employing various tools including Variable Rate Repo/Reverse Repo operations, strategic Open Market Operations, and careful management of government cash balances.

The external environment added another layer of complexity to policy choices, with the US Federal Reserve’s policy trajectory, global commodity price movements, and international capital flows requiring constant vigilance. The central bank’s approach to financial stability was evident in its targeted interventions for various sectors including MSMEs, housing, and agriculture, while maintaining focus on digital payment initiatives and financial inclusion efforts.

Looking ahead, the central bank’s ability to anchor inflation expectations while supporting growth will remain crucial, especially given the structural changes in the economy and evolving global financial conditions. The RBI’s policy choices in 2024 demonstrated that effective monetary policy in an emerging market context requires not just technical expertise but also careful balancing of multiple objectives and stakeholder interests. The central bank’s success in maintaining financial stability while managing inflation expectations has set a strong foundation for monetary policy effectiveness, though challenges remain in terms of global uncertainties and domestic structural factors that could influence both inflation and growth trajectories in the coming years.

Market Performance

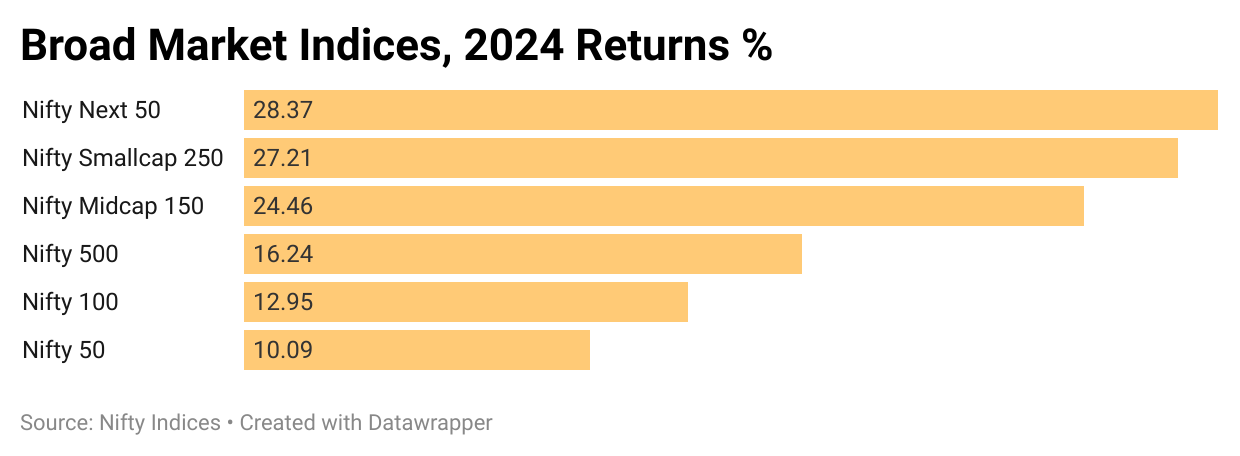

It was yet another record high year for the Indian stock markets. The representative benchmark index, Nifty 50, closed the year with ~10% returns. It was a one way rally from the start of the year till Oct, post which markets perhaps warranted a correction. The market’s performance was particularly noteworthy given the backdrop of global uncertainties and domestic transitions.

If you look at the 2024 returns with respect to the broad market indices, it’s very interesting to see that a largecap index (Nifty Next 50) has actually turned out to be the winner ahead of its risky counterparts in the form of midcap and smallcap indices.

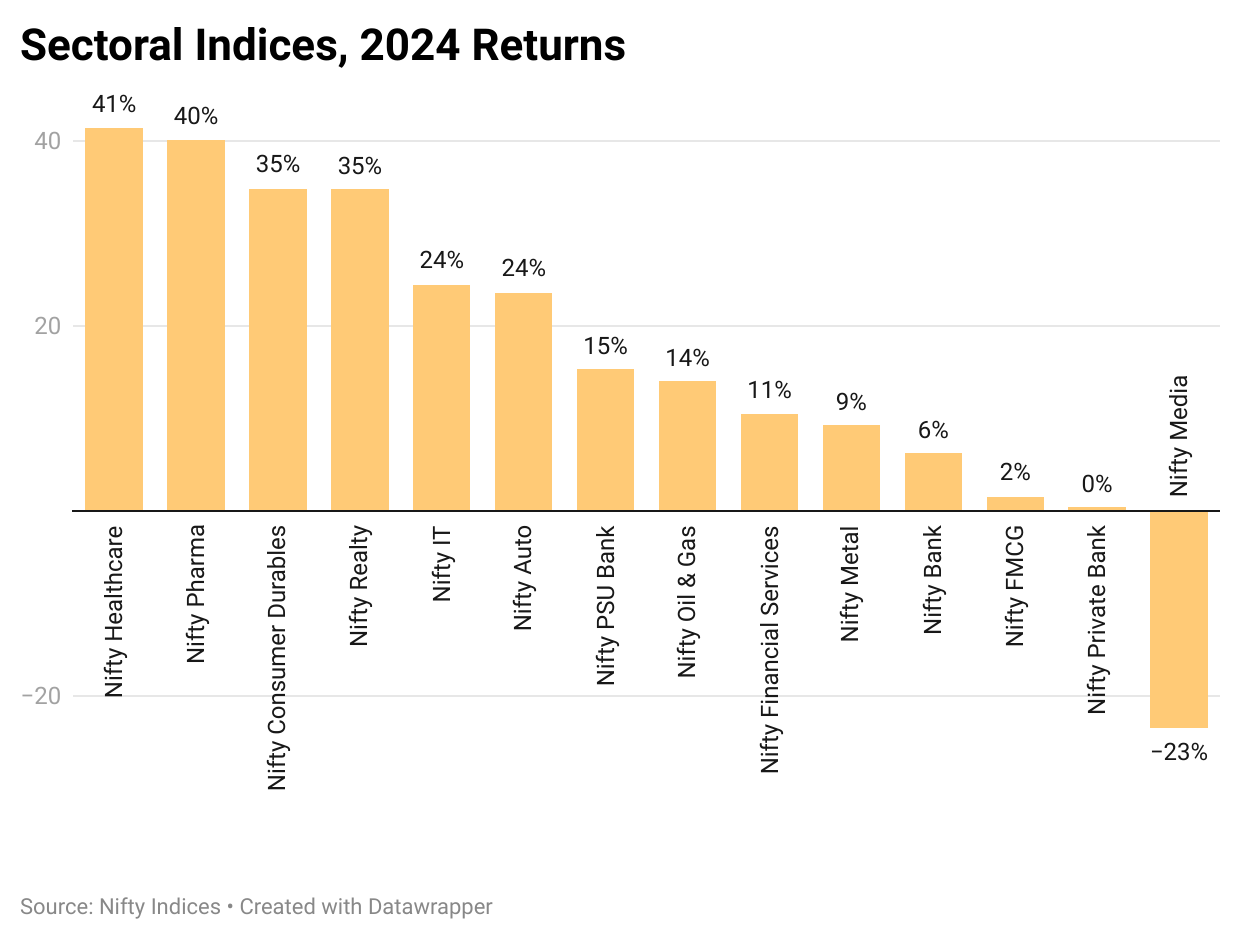

Now, let’s talk about the sectors and see which ones did well and the ones who didn’t do well.

- Nifty Pharma yet again performed, after a good run in 2023. The sector benefited from significant USFDA clearances for major manufacturing facilities, resolving long-standing regulatory overhangs. Companies like Sun Pharma, Dr. Reddy’s, and Cipla received key approvals for their facilities, enabling them to launch complex generics in the US market. Additionally, the sector saw increased investments in API manufacturing under the PLI scheme, reducing dependency on Chinese imports.

- The surprising feature out there is the Nifty Consumer Durables index which displayed a mixed commentary throughout the year with regards to underlying business fundamentals but still managed to deliver performance. That being said, the growth in this space has been quite, lopsided with the premium portfolio heavy lifting. The boom in the reality cycle also helped their cause.

On the losing side,

- Nifty Media was the biggest loser in 2024 on the back of a whole host of issues. Traditional media companies faced severe pressure on advertising revenues as advertisers, particularly FMCG companies, shifted budgets to digital platforms amid weak rural demand. The sector struggled with digital disruption as viewers, especially youth, migrated to short-form content on platforms like Instagram Reels and YouTube Shorts. To worsen the situation, content costs surged 25-30% as platforms competed for exclusive rights and talent, particularly in sports content, straining profit margins. Major companies faced company-specific issues – Zee Entertainment dealt with merger uncertainties, PVR-INOX saw slower-than-expected synergy benefits, and Sun TV struggled with market share losses in regional markets. The sector also grappled with new regulatory guidelines and failed industry consolidation attempts, leading to continued fragmentation and competitive intensity in the market.

- Nifty Bank was an obvious candidate given the multitude of problems the sector is grappling with. Net Interest Margins (NIMs) came under pressure due to rising deposit costs while lending rates remained stable. Asset quality concerns emerged in unsecured retail lending, particularly in personal loans and credit cards. Deposit growth continued to lag credit growth which led to asset-liability mismatch problems.

- Nifty FMCG, rural demand remained weak throughout the year, affecting volume growth. High food inflation led to downtrading in several categories, particularly in rural markets. Competitive intensity increased with the rise of regional players and private labels. Input costs remained elevated for key raw materials, pressuring margins. Modern trade and e-commerce channels demanded higher margins, affecting profitability. Premium segments which were contributing to the sales got lackluster. New age D2C brands captured market share in premium urban segments. Companies had to increase advertising spends to maintain market share, affecting margins.

Key Market Movers in 2024

- General Election

One of the highlights of this year was Elections. 2024 was referred to as the Election Year, as more than 64 countries headed for elections including India. And the reaction to general election results were rather pronounced here in India. The benchmark indices rose by close to 4% on the exit polls day, it dramatically crashed ~6% when the leading party failed to secure the majority all by itself. The markets clearly feared policy discontinuity if a new/coalition government were to be formed.

While this is the story of Indian Elections in June 2024, the word elections trended search yet again when Donald Trump emerged victorious for a second run at US Presidency pipping over his Democrat nemesis.

- US Federal Reserve Rate Cut

A lot of anticipation brewed around the first rate cut by the US Federal Reserve since the last four years. They finally cut rates by 50 bps in Sept ‘24 which was followed by an up move. The Fed’s shift from a hawkish to a neutral stance affected global liquidity, in turn impacting FPI flows and USD-INR.

- FII Selling

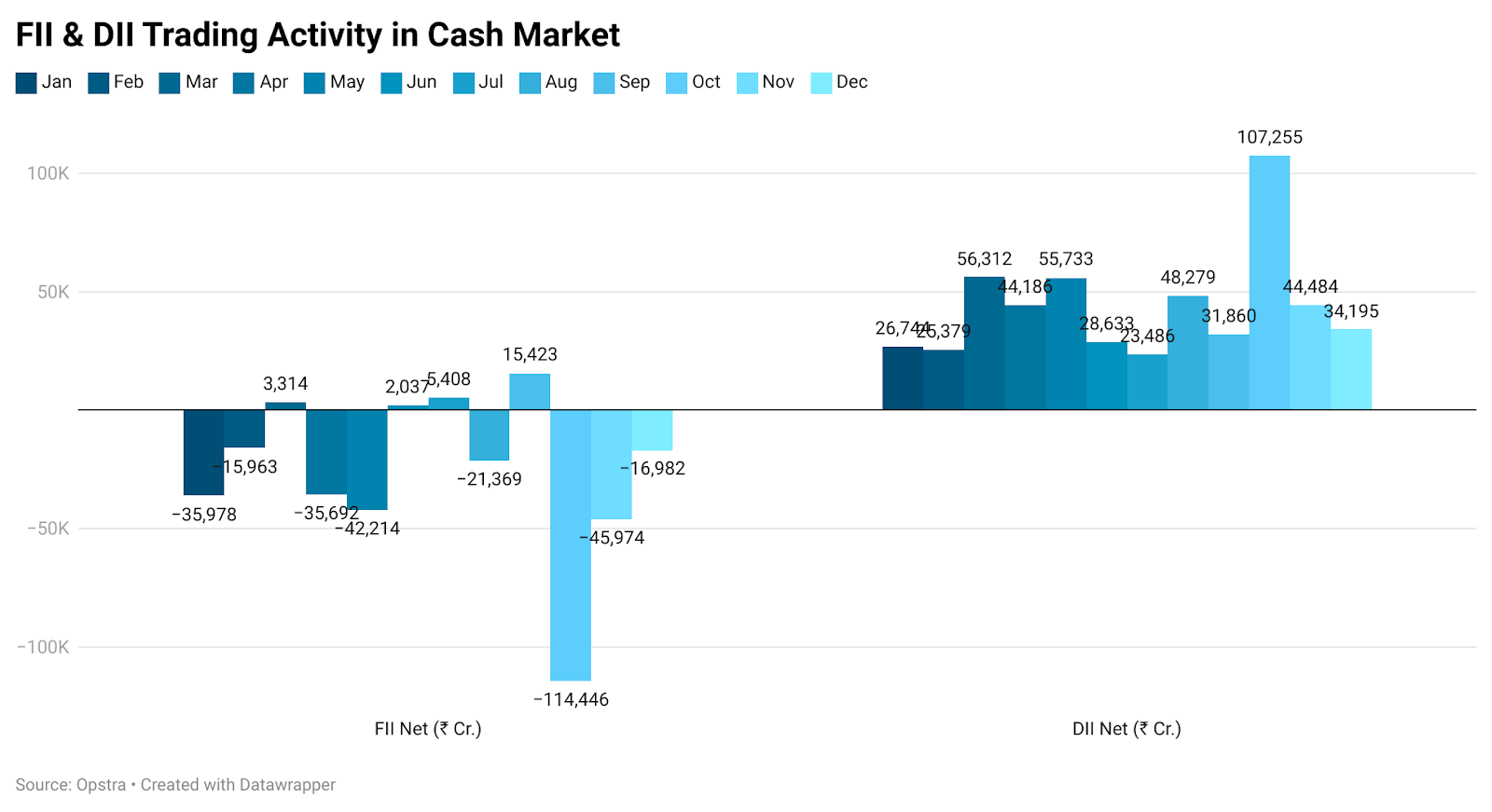

FIIs’ heavy selling ruled the news bulletin as the China stimulus measures led into record FII outflow in Oct ‘24 wherein they were net sellers to the tune of ₹1,14,000 crores. On an aggregate level, FIIs were net sellers in 8 out of the 12 months.

The chart attached below brings out the stark difference in market view between FIIs and DIIs.

Top & Bottom Performing smallcases

As far as smallcases from the Winmill Capital suit is concerned, as always few did well while others did not. Let’s discuss a few smallcases out of this –

- Canslim-esque smallcase (2024 Returns – 67.5%)

This smallcase filters in companies who have shown impressive earnings growth in the recent past and is further expected to have strong earnings. This is coupled with stocks with high ROE and underlying momentum in them. In other words, the smallcase looks for high growth companies with momentum on their side.

The flavour of growth made a comeback in 2024 which partly explains the performance of Canslim. Besides this, another factor is size. Given the selection criteria, usually it’s the mid & small cap stocks that get self selected into the basket. This has also augured well for the smallcase as the broader market indices have performed better than the largecap index.

- Quality Smallcap – Smart Beta smallcase (2024 Returns – 40.7%)

The combination of size (smallcap) and quality (ROE, D/E, etc.) has made this smallcase rule the roster in 2024. One of the best performing smallcases in 2024. The Quality Smallcap – Smart Beta smallcase seeks to mitigate this risk by selecting only those small cap stocks with high quality scores. Additionally the smallcase only selects those quality smallcap companies whose price is experiencing a positive momentum trend. This improves the chances of the smallcase giving outsized returns.

- Low Risk – Smart Beta smallcase (2024 Returns – 6.6%)

As the name suggests, the smallcase optimizes on the factor of risk, playing on the low risk anomaly. The smallcase picks up companies from the top 150 market cap companies. The strategy has a protective nature to it and hence it tends to stay flattish during bull markets (i.e. rises less as compared to the markets), however tends to stay firm during bear markets (i.e. falls less as compared to the markets).

Closing Thoughts

The year 2024 has set a strong foundation for India’s equity markets as they enter 2025. Looking ahead, while challenges remain, the structural growth story of India remains intact. The combination of favorable demographics, digital transformation, manufacturing push, and financial inclusion creates a compelling case for long-term equity investors. However, maintaining investment discipline and following a well-thought-out asset allocation strategy will remain crucial for successful investing in the Indian markets.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.