Wright Balanced Multi Factor REBALANCED!

(30 Jan 2023)

A lot happening in the market! We are reducing exposure to Adani group, cutting some banking exposure and adding Metals and IT.

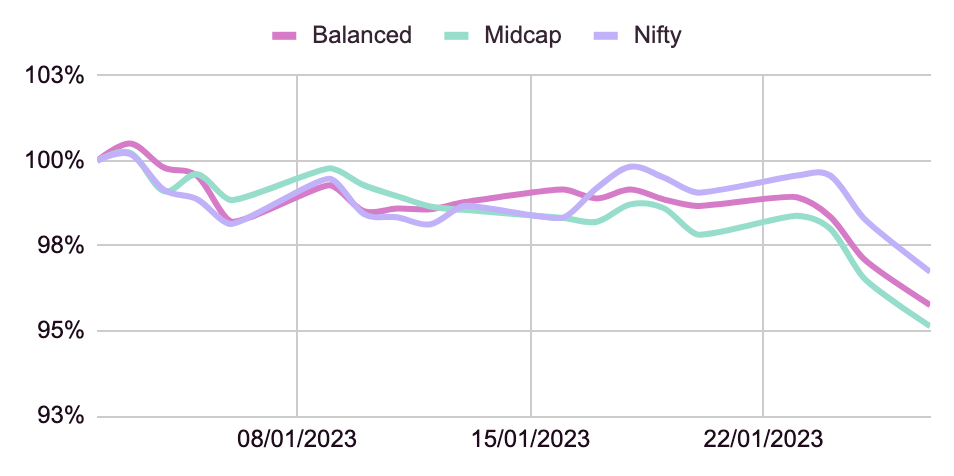

Performance

Last month our portfolio with high banking allocations unerperformed.

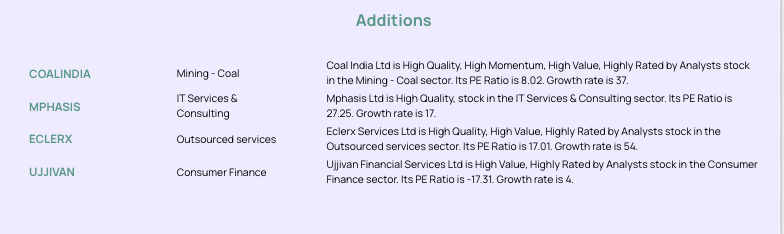

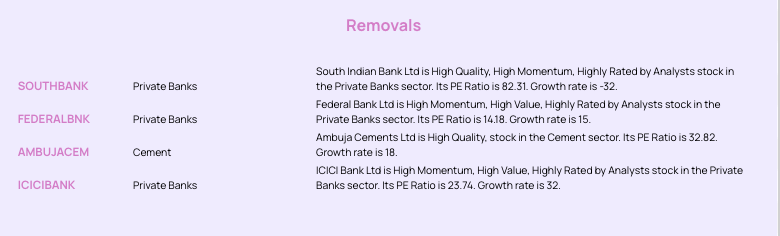

We are adding metals, IT and reducing banks and Adani stocks

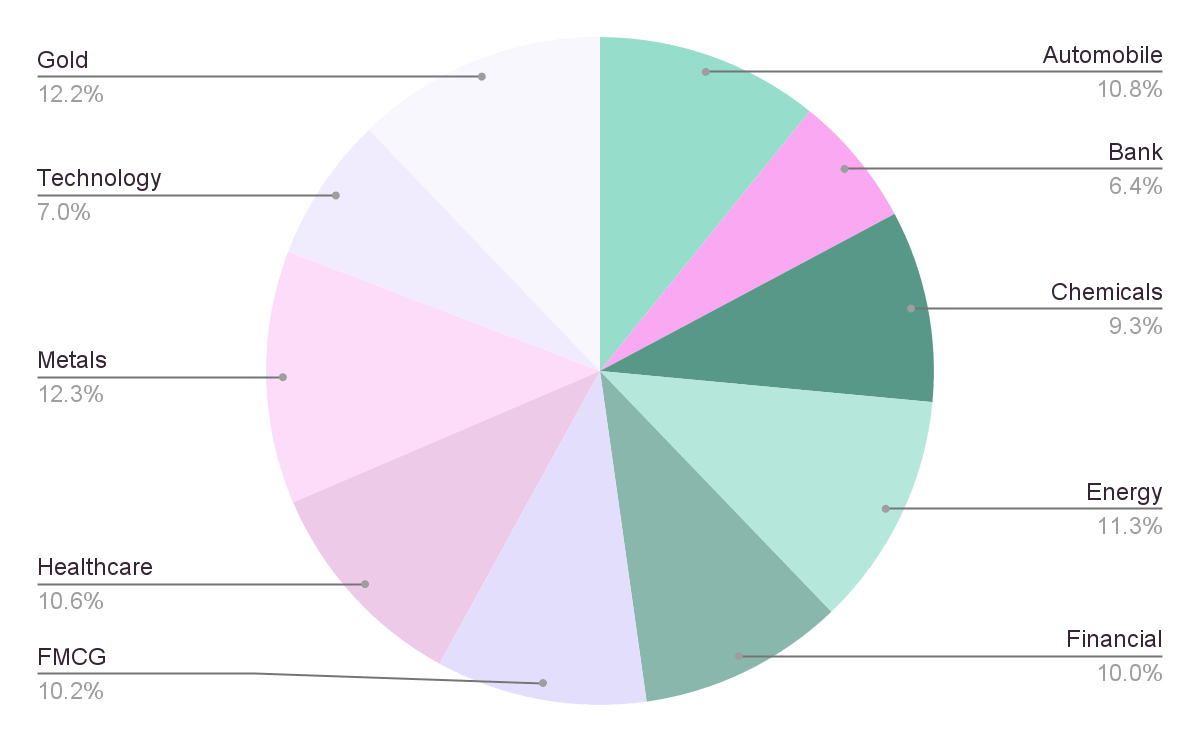

Our current sector allocation

With so much happening in the market, it can be difficult to make sense of it all. However, by analyzing data and understanding the underlying factors, we can gain a better understanding of what’s driving the market and make more informed decisions. In this post, we will take a closer look at the trends in the equity markets leading up to the budget announcement, the expectations surrounding the US Federal Reserve’s upcoming decision, the Q3 earnings results, and the recent crash in Adani stocks.

By the end of this post, you’ll have a clearer picture of the market and a better understanding of how to navigate it. So, let’s dive in!

Budget Trends

Time for the customary look at price trends before the budget. The market has fallen five times while gaining six times in the month ahead of the Union Budget in the last 11 years and has oscillated between -3 and +3%.

However, the budget day has been joyous most of the time with 7 out of 11 budget days turning positiv. Post-budget we have seen the market oscillate between -4 to 6% and give 6 out of 11 positive weeks.

Which sectors do well around the budget historically. Looking at average stats (which is not the best way to gauge this trend) we can see that Banks, Realty have has the best pre budget run, while Autos and Banks do best on budget day. After the budget, Banks and Pharma tend to take a lead. I see a pattern of Banks doing well, do you?

Obviously each year is different and will have a different reaction. In 2023, the sectors that the government is looking to focus on – manufacturing, capital goods, defence, sustainability, railways, and public sector banks are already seeing fresh investments. So we expect these sectors to continue to be in the spotlight.

Don’t forget about the US Fed

Another big event coming on Feb 2nd is the FED rate hike. The Federal Reserve is predicted to slow down its next interest rate increase to a small quarter-point increase, which is the smallest increase since it started raising rates in March 2022. This has led to discussions on whether the central bank will stop increasing rates after the upcoming February 1st FOMC meeting. If inflation remains low and economic activity decreases, it becomes more likely that the rate increases will end. Additionally, the 2-year Treasury yield, which is often used as a measure of future interest rate expectations, is currently lower than the Fed funds target rate, indicating that interest rate increases may have reached or are nearing their peak.

Earnings

A limited number of large-cap companies have released their results, which were better than expected and the guidance for future performance is not as negative. It is worth considering the trend of strong growth, even during this difficult year. The IT sector has not performed well, but there is optimism in the market for industries such as cement, capital goods, railways, IT, and pharmaceuticals. The financial sector has become more cautious. This year, value stocks are performing better than growth stocks as investors are favoring cyclical industries, due to the global recovery of capital expenditures.

The best performing sector bases on QOQ earnings till now is hospitality, followed by consumer durable and plastics. The losers among th 550/4000 companies releasing their earnings till now are textile, alcohol and agriculture.

The Adani in the room

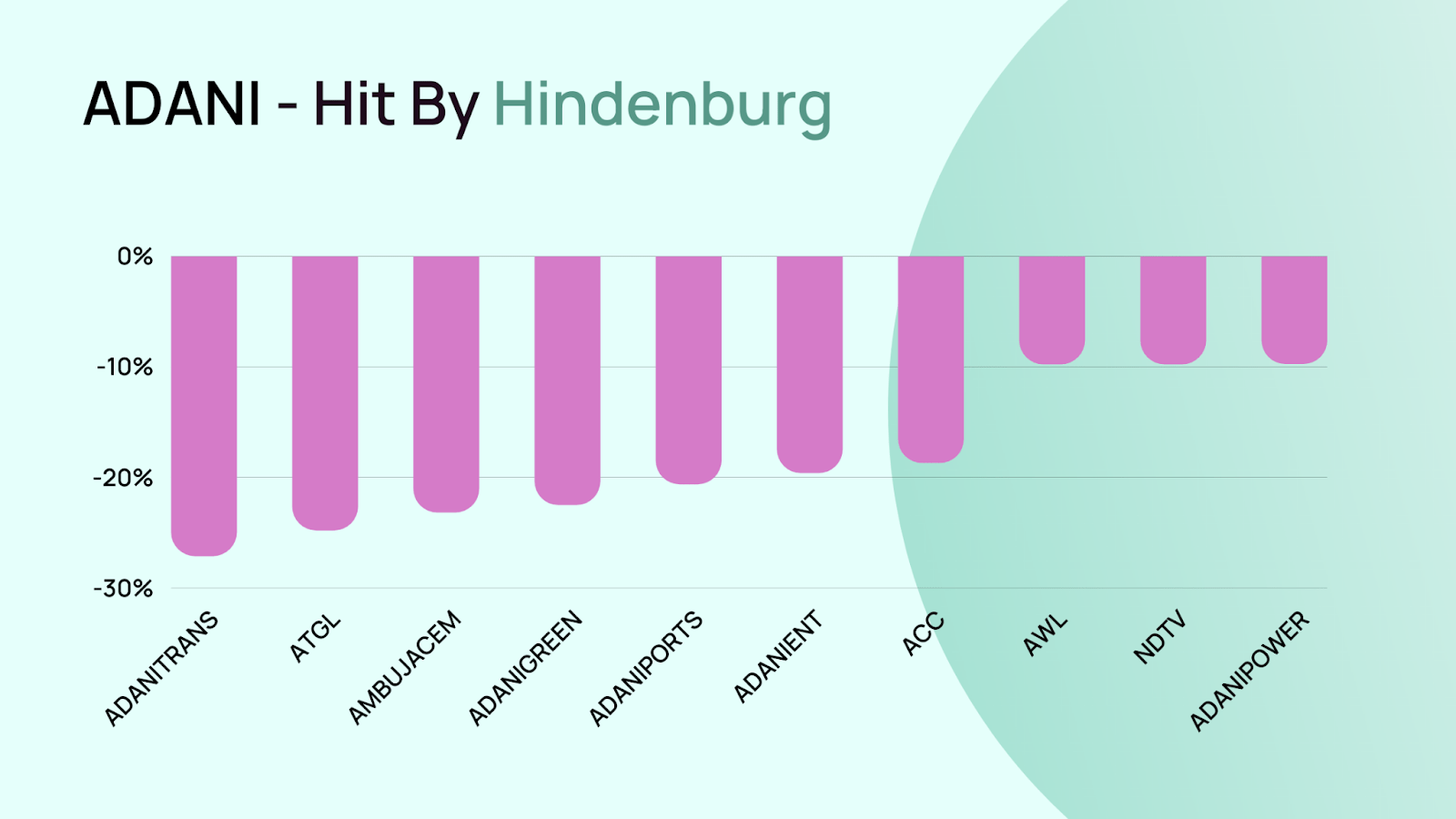

The hindenburg short against Adani group is the biggest news of the hour. It is no secret that Adani stocks are extremely overvalued! But the allegations in the Hindenburg report go far and beyond that. They call it the biggest con in corporate history highlighting stock manipulation and accounting fraud scheme over the course of decades.

The company has called the report malicious but the impact is here on the stock performance. With the group having become too big to fail it’s high time that the company and the regulator come clean.

We did not have much of an exposure to Adani and are exiting the minor positions we had at big profits.

Where to invest in this crazy market?

We are updating our momentum portfolio this week – reducing Adani, reducing Banking exposure and adding metals, autos, shipping and autos.