The Power Play: What’s Making Adani, Birla Foray into Wires and Cables Sector?

There’s a high-voltage shake-up underway in India’s cables and wires (C&W) industry, thanks to the recent entry of two major conglomerates—Adani Group and Aditya Birla Group. These forays, which happened in less than a month, have the potential to rattle the sector, which specialised companies and unorganised players are currently dominating.

Adani entered this industry through a joint venture under Kutch Copper Limited called Praneetha Ecocables Limited. Meanwhile, Birla entered via UltraTech Cement with an announced investment of ₹1,800 crore.

But why are these giants suddenly eyeing a share in the cables and wires industry?

TL;DR: A strategic move.

From EVs to solar panels, bullet trains, data centers, and smart cities, the need for reliable, high-quality cables has skyrocketed. Contextually speaking, wires and cables now make up almost 40% of India’s entire electrical equipment industry.

That’s one key reason that Adani and Birla found this sector attractive. The entry into cables and wires represents a strategic extension of their existing business portfolios rather than a mere diversification play.

What exactly are their plans?

The Adani Group is leveraging synergies with its cement and copper businesses, mainly through Kutch Copper, the world’s largest single-location copper manufacturing plant at Mundra in Gujarat. This is imperative to note. Since copper is core to cable manufacturing, in-house production gives Adani a cost and supply edge.

Similarly, UltraTech Cement’s entry aligns with the Aditya Birla Group’s strategy to expand along the construction value chain. The company is building upon the success of its Birla Opus brand, which already offers a range of building products, from decorative paints to wood finishes.

What about the existing players?

There is a possibility of accelerated consolidation pressures within the industry. As per market analysts, smaller and mid-sized players may find it increasingly difficult to compete with these conglomerates’ economies of scale, integrated supply chains, and capital access. This might lead to a wave of mergers, acquisitions, or strategic alliances to maintain competitive viability.

How the C&W Market is Wired

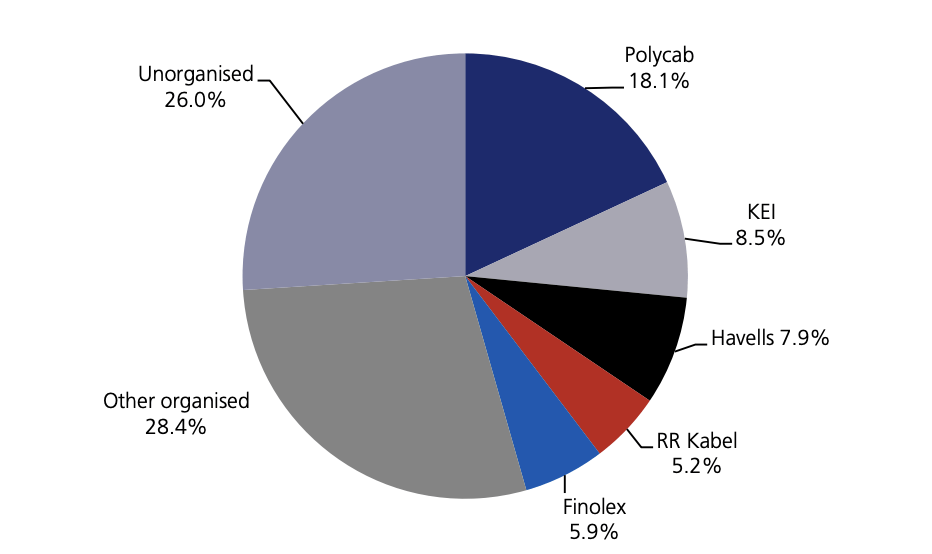

The cables and wires sector in India has historically been fragmented, with approximately 400 players ranging from small and medium enterprises to large corporations with revenues between ₹50 crore and a whopping ₹4,000 crore, according to JM Financial note. What makes this industry particularly interesting is that no single player commands a dominant market share, with the largest companies holding modest portions of the overall market.

In cables, Polycab leads with a 20% share, followed by KEI (12%), Havells (8%), and KEC (6%). On the wires front, there’s Finolex (15%), RR Kabel (12%), Polycab again (10%), V-Guard (8%), Anchor (7%), and Havells (6%), and a few unorganised sectors in the mix. Right now, it’s anyone’s game — which presents an appealing entry point for these conglomerates seeking growth opportunities.

Combined Wires & Cables Market Share

There’s more.

The industry has been steadily shifting from unorganised to organised market players, with the organised segment’s market share increasing from 68% in FY19 to approximately 73% in FY24. This transition shows improving industry standards, quality parameters, and operational efficiencies—factors that may attract more prominent players.

What’s Fuelling the Sector?

Robust growth projections.

According to an ICRA report, the C&W industry is expected to grow at an impressive 12-14% annually from FY25 to FY27, reaching approximately ₹1.2 lakh crore (₹120,000 crore) by FY27. FY24 alone saw a 13% revenue jump to ₹84,500 crore from ₹74,800 crore in FY23.

Moreover, ICRA said that the industry is poised for substantial capital investments. Around ₹17,000 crore in capex is expected between FY25–FY30, signalling structural — not cyclical — demand, making it an attractive long-term investment opportunity.

The growth drivers

Renewable Energy: According to Fortune Business Insights, there is a substantial rise in the demand for wires and cables due to the Government’s ambitious renewable energy goals, such as solar and wind power. India’s solar and wind targets demand high-performance cabling, especially in PV installations needing minimal energy loss.

Infrastructure: Data centers, railways, real estate, government-led electrification and smart city projects are boosting demand in the cables and wires industry, and it is expected to remain robust for the foreseeable future.

IT: Rising broadband penetration, 5G rollout, and Digital India initiatives have triggered a surge in wire and cable needs.

Export Market: Another significant growth avenue. Exports have doubled to ₹16,765 crore in FY24 from ₹8,322 crore in FY20, including winding wires and optical fiber cables, aided by the “China+1” shift, production-linked incentives, and global demand for telecom, auto, and renewable-focused cables.

“China+1 Strategy”

A move where multinational companies diversify their manufacturing bases beyond China, aiming to reduce reliance on a single market and mitigate risks. In this context, the shift from China positions India favourably to capture additional export market share in the cables & wires sector.

Investment Outlook: Short-term Jitters, Long-term Growth

With all said and done, if you are an investor looking to explore the cables & wires space, expect a few sparks in the short term as volatility and competitive posturing will dominate headlines. But for long-term investment, the fundamentals look solid. Here’s more:

Incumbent Advantage: Legacy players still hold strong cards — vast distribution networks, customer trust, and technical know-how — all of which act as real barriers to entry, even for deep-pocketed newcomers.

Valuation Watch: Recent corrections in the stock market may open up value buys, but due diligence is key. Focus on companies with product depth, operational efficiency, and robust balance sheets.

Niche Segments: Growth lies in specialised, high-margin segments like renewables, data centers, and smart infrastructure. Firms with R&D strength, proprietary tech, or product innovation may defend margins and scale sustainably.

To Wrap Up

The entry of Adani and Birla conglomerates into India’s cables and wires sector marks a significant inflection point in the industry’s evolution. While this development has created near-term uncertainty, it also validates the sector’s attractive growth prospects and strategic importance within the industrial landscape.

But the takeaway remains: Caution is key.

Dig deeper than just market share — look at tech prowess, supply chain agility, capex plans, etc., for an informed investment decision.