Crude Reality: Why are Oil Prices Crashing Again, and What’s OPEC+ Doing?

In 2020, when COVID-19 hit, the oil market was so distressed that the price of US crude briefly plunged below $0 per barrel – a shocking collapse from about $18 to –$38 in a single day. That crash showed how volatile oil markets can be.

Now, in 2025, we’re seeing another big fall in oil prices—mainly due to the ongoing trade war. Global oil prices have dropped to their lowest point in almost four years. You must be wondering what’s causing this, how the Organisation of the Petroleum Exporting Countries (OPEC+) is reacting, and what it means for the global economy and India.

Let’s break it down.

Oil Prices Plummet Amid Trade War Jitters

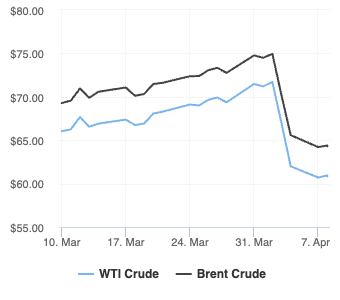

In the first week of this month, oil prices have been in freefall. On April 4, Brent crude (the global oil benchmark) ended at around $65.6 per barrel. US West Texas Intermediate (WTI) was about $62.

In intraday trading, prices hit lows not seen in four years, with Brent briefly touching $64 and WTI about $60. Just a week earlier, Brent was around $73. That’s a huge drop. In fact, Brent fell nearly 11% in one week—its biggest weekly loss in 18 months.

The chart shows how several major forces are pushing prices down. The trade war, worries about a recession, and a surprise increase in oil supply are all playing a role. The latest tariffs from the Trump administration have added to the chaos in financial and commodity markets.

On top of that, OPEC+ recently decided to pump more oil than expected. Eight countries in the group agreed to increase production by 411,000 barrels per day in May – three times the initially planned monthly increment of 137,000 bpd. This move added more pressure on oil prices.

With all this uncertainty, oil is now reflecting fears of weak demand in the future.

Why are Oil Prices Important to Track?

Oil plays a big part in the global economy. According to the World Economic Forum, it makes up around 3% of the world’s GDP. Oil isn’t just used for fuel—it’s in things like plastic, chemicals, fertilisers, aspirin, clothes, solar panels, and even protective gear.

To sum it in one sentence: When economies grow, oil demand grows too.

However, trade wars and new tariffs are making goods more expensive and slowing down global trade. This means factories produce less, fewer goods are shipped, and people travel less—all of which reduces oil use.

Even US Federal Reserve Chair Jerome Powell said the new tariffs were “larger than expected” and could lead to more inflation and slower economic growth, all of which will lead to oil prices falling and global economies lagging.

This brings us to the next section on how oil-producing nations strategise this surplus supply to stabilise prices.

What Does OPEC+ Do?

OPEC was formed in 1960 by prominent oil-producing countries like Iran, Iraq, Saudi Arabia, and Venezuela. In 2016, OPEC joined forces with non-OPEC countries like Russia to create OPEC+. Together, they control about 40% of global oil production and hold 80% of the world’s proven oil reserves.

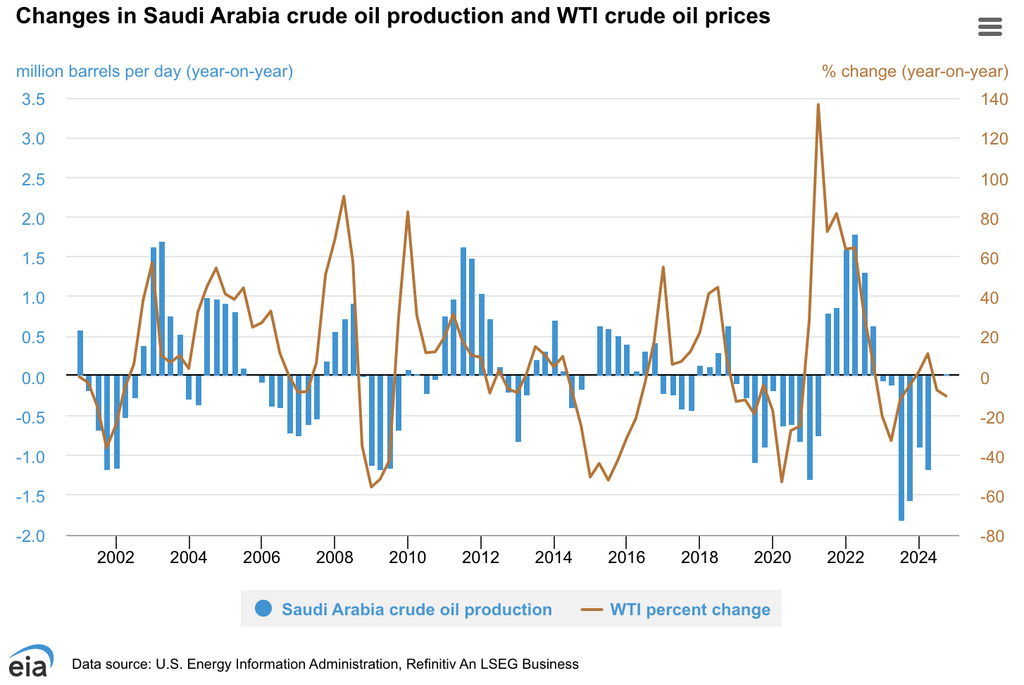

Because of this market share, OPEC’s actions influence international oil prices. In particular, changes in crude oil production from Saudi Arabia, the group’s largest oil producer, frequently affect oil prices. Take a look at the pattern:

Here’s how OPEC+ influences the market:

Setting Production Quotas: They decide how much oil each country should produce. This helps balance supply and demand. For example, in 2020, they cut output by nearly 10 million barrels a day to support prices during COVID-19.

Using Spare Capacity: Countries like Saudi Arabia and the UAE can quickly increase or decrease output to manage supply shocks. Even their public statements can move markets.

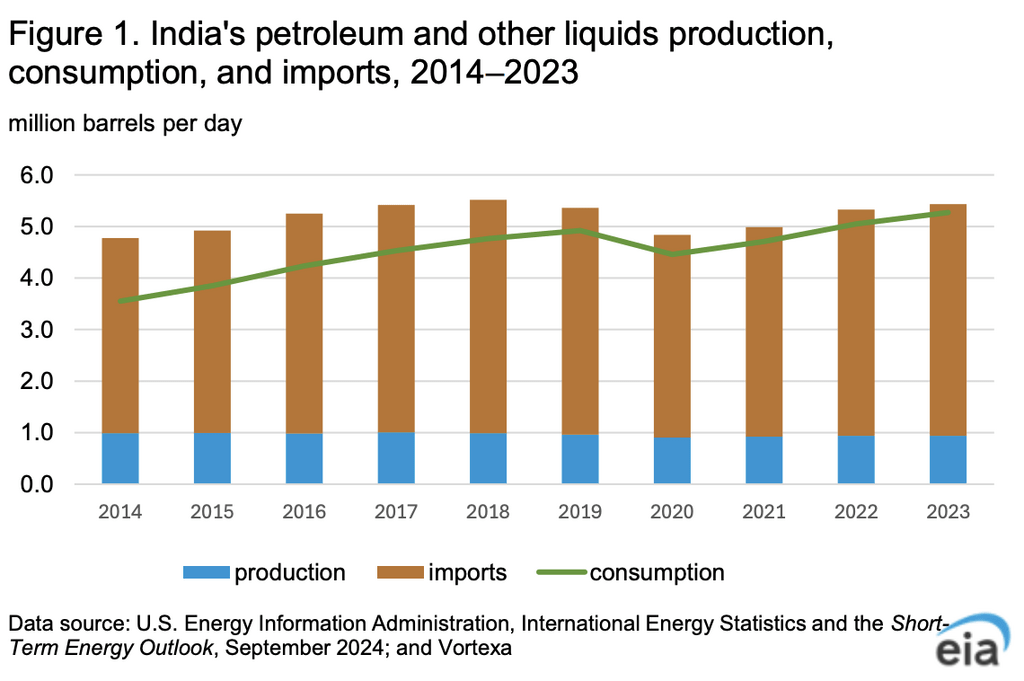

Impact on Importers Like India: India imports over 85% of its oil. So, OPEC+ decisions really matter—higher prices hurt India’s budget and push up inflation, while more oil helps bring prices down.

Why is OPEC+ Increasing Supply Now?

OPEC+ has three main reasons for boosting oil production, even though demand is weak:

US Sanctions on Venezuela and Iran: These countries can’t export much oil due to sanctions. Saudi Arabia and the UAE are stepping in to fill that gap—and grab more market share.

Pressure from the US: Trump wants lower oil prices, and Saudi Arabia often tries to keep ties strong with the US. This helps keep fuel prices in check during tough economic times.

Punishing Overproducers: Some OPEC+ members, like Iraq and Kazakhstan, have been producing more than allowed. By raising production limits for everyone, Saudi Arabia is removing their advantage and sending a warning.

What’s Next for Oil Prices?

Most experts think oil prices will stay low for a while—unless something big happens, like a major geopolitical event or if Trump rolls back the tariffs.

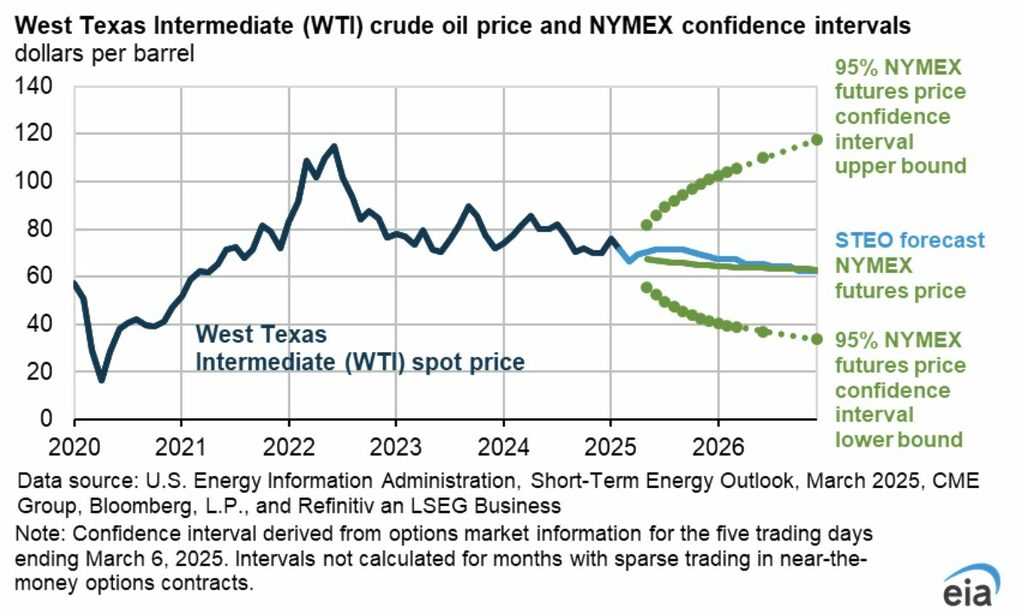

- The US Energy Information Administration (EIA) recently lowered its price forecast. It expects oil stockpiles to grow in late 2025 and into 2026, which could push prices down. However, they also see inventories falling in Q2 2025 due to lower production from Iran and Venezuela.

Here’s EIA’s WTI crude oil price history and forecast (2020–2026). As seen in the chart, the 2025 crash brought WTI down to levels not seen since 2021, though EIA projections (blue line) see a modest recovery later in the year.

- Some big US banks are more negative, saying prices might stay low through 2026, with Brent at $73 in 2025 and $61 in 2026.

- Goldman Sachs even warned that prices could fall below $40 per barrel if the market becomes more volatile.

- OPEC, though, was more hopeful. In late 2024, they expected demand to grow thanks to more air travel and strong petrochemical demand. But when prices dropped, they had to delay their plans to increase output—until now.

By boosting supply in April 2025, OPEC+ seems to believe demand will eventually recover.

But, here’s the bigger catch!

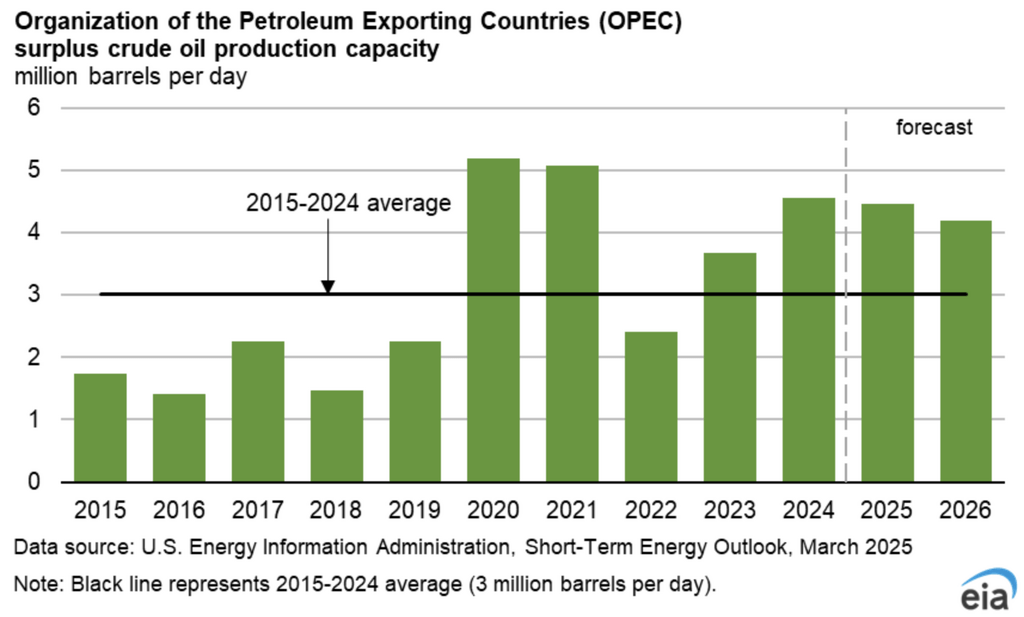

Despite this boost, OPEC+ still has not fully opened supply gates. Even after this increase, approximately 3 million barrels per day still remain in reserve till 2026. To say the least, more taps can open later, and oil prices can get lower. Take a look:

Whether OPEC+ will decide to release more oil in the market later this year depends on the geopolitical scenarios and demands and, of course, the tariff escalations!

Till then, let’s take a look at how India is positioned in the oil market.

India’s Gains from Low Oil Prices

India was the third highest energy consumer in the world in 2023 behind China and the US. It imports most of its oil, so lower prices are a big win. Cheaper oil helps reduce the country’s trade deficit and keeps inflation under control.

Essentially, India is treating the price dip as a buying opportunity to strengthen its energy buffer.

At the same time, the Indian government is managing domestic fuel prices in a way that balances consumer relief with fiscal needs. For this, as a practice in the past following fall in international oil prices, they’ve increased excise duties on fuel to collect more taxes —without raising retail prices.

Additionally, according to India’s oil secretary, the tax hike will fetch the government Rs 32,000 crore in additional revenue in a year, which authorities plan to use to compensate state-run oil companies for losses incurred last year from selling LPG (cooking gas) below cost.

Lower fuel inflation is good news for the Reserve Bank of India, too. It gives the central bank more room to manage interest rates.

Plus, stocks of state-owned oil companies like Indian Oil, BPCL, and HPCL saw an uptrend as the decline in crude prices would lower their input costs.

Thus, since India doesn’t produce much oil locally, the overall impact on the economy is still positive.

To Wrap Up

This oil price crash is a perfect example of how global politics, economics, and energy policy all mix together. What we are gathering from the outlook and analyses is that oil prices may remain volatile for the second and third quarters of FY25.

For now, consumers and oil-importing countries are enjoying cheaper oil. However, oil-producing nations and energy companies are entering a tougher phase that may force them to rethink their strategies.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary. Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.