What is a Micro Cap Stock? Which are the Best Micro Cap Stocks in India in 2023

Understanding Microcap Stocks

There are currently over 5,000 companies listed on the BSE and in excess of 2,000 on the NSE. Large-cap stocks, as defined by SEBI, are the top 100 companies based on market capitalization, while mid-caps rank from 101st to 250th, and small-caps from 251st and beyond. While SEBI hasn’t officially provided a definition for microcap stocks, stocks that are falling outside the top 500 in terms of market capitalization are usually referred to as microcap stocks. Typically, these enterprises have a market cap of under Rs 5,000 crore.

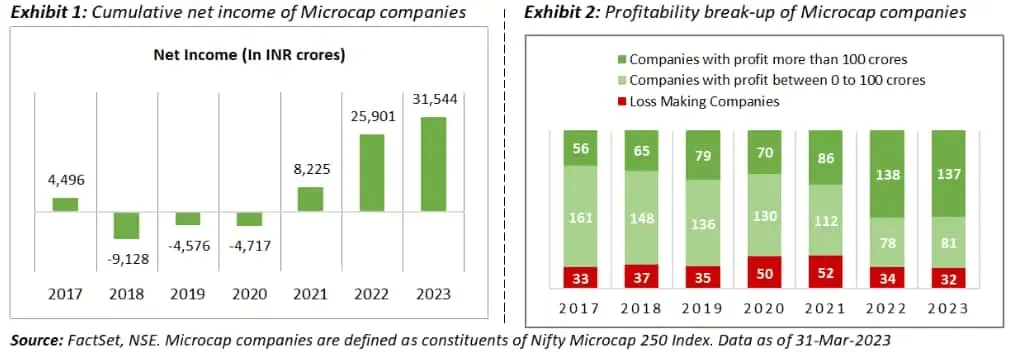

As of March 2023, cumulative net income of microcap companies had increased from ₹4,496 Cr in 2017 to a ₹31,544 cr. Furthermore, out of 250 microcap companies, 218 were profitable with 137 having a profit of more than Rs. 100 Cr in 2023 compared to only 56 in 2017. Microcap stocks are also not penny stocks which are typically priced less than Rs.10. Low share prices doesn’t mean low market capitalization.

As of June 2023, here is the transition of microcap towards smallcaps , midcaps and largecaps.

Performance of Microcap Stocks in 2023

The Nifty Microcap 250 index features the leading 250 firms outside the Nifty 500 index, representing micro-cap companies ranked from 501st to 750th based on their average total market capitalization. Its stock weight depends on its free-float market capitalisation. Let’s look at how microcaps are performing in 2023.

Data for the current year shows Nifty Microcap 250 index’s impressive 43% growth. For perspective, the Nifty Smallcap 250 grew by 29%, the Nifty Midcap 150 by 26%, and the Nifty 50 by 7.8% over the same timeframe. When we look at August, the Nifty Microcap 250 Index’s price index recorded an impressive 48.67% annual return, with its Total Return Index variant not far behind at 49.52%.

8 Factors to Consider When Investing in Microcap Stocks

- Competitive Advantage: Catalysts can include new leadership, strong government backing for the sector, monopolisation of specific segments within a market, market or product expansion, acquisitions, or profitability achievements. Sustainable competitive advantage act as catalysts to help grow the company and the stock

- Quality of Management: Good governance, known and competent management are essential, especially for microcap companies. Assess if the team can execute the strategy and if the CEO can manage the company’s growth. Make sure the board is independent and reputed

- Rising Sales and Profits: We have seen out of 250 microcap companies, 218 were profitable with 137 having a profit of more than Rs. 100 cr in 2023. Microcap companies with a strong track record of regular sales, growing sales or regular strong net income can be solid investment choices

- Cash Flow: A company’s cash flow should be positive or trending positive over time. If not, it might not be a wise investment. Monitor company reports to analyse the cashflow and determine business growth

- Price-Earnings Ratio (P/E): This crucial metric can indicate whether a company’s shares are over- or undervalued. Be cautious if the P/E exceeds 35

- Debt/Equity: Cash is always king. Find microcap stocks that have ideally no debt since it gives the company more flexibility without any recurring liabilities and avoids equity dilution risk. Avoid firms that have over 30 to 50%+ net debt to equity ratio. This ratio reveals the debt per rupee of ownership. High debt can be a warning sign, so examine debt levels carefully

- High Operating Margin: A consistently increasing operating profit margin is a good sign and can suggest a promising investment opportunity

- Institutional Activity & Analyst Coverage: Microcaps typically will have limited, if any analyst coverage, and most large FIIs may be restricted from investing. However, researching in sector reports, talking to industry analysts and watching mutual fund investing activity could give some insights

The Best Microcaps in India

Best Microcaps in India #1: Kotle Patil Developers Ltd

Kolte-Patil Developers Ltd (KPDL) is a leading real estate developer in India with a strong financial position and track record of growth. However, the real estate sector is cyclical, and KPDL faces competition from other established developers. Investors should consider these risks before investing in KPDL.

Best Microcaps in India #2: Nucleus Software

Nucleus Software is a financially sound IT company with a strong track record of growth in the banking and financial services sector. It is a good investment option for investors who are looking for exposure to this growing sector, but they should be aware of the premium valuation.

Best Microcaps in India #3: Mangalam Seeds Ltd

Mangalam Seeds is a leading seed company in India with a strong financial position and track record of growth. The company’s stock is currently trading at a reasonable valuation, making it a good investment option for investors who are looking for exposure to the Indian seed sector. However, investors should consider the cyclical nature of the seed sector and the competition from other established companies before investing in Mangalam Seeds.

Best Microcaps in India #4: Lloyd Equipments

Loyal Equipments is a small-cap engineering company in India with a strong financial position and track record of growth. The company’s stock is currently trading at a reasonable valuation, making it a good investment option for investors who are looking for exposure to the Indian engineering sector. However, investors should consider the cyclical nature of the engineering sector and the competition from other established companies before investing in Loyal Equipments.

Best Microcaps in India #5: Kingfa Science & Technology (India) Ltd

Kingfa India is a leading PP manufacturer in India with a strong financial position and track record of growth. The company’s stock is currently trading at a reasonable valuation, making it a good investment option for investors who are looking for exposure to the Indian plastics sector. However, investors should consider the cyclical nature of the plastics sector and the competition from other established manufacturers before investing in Kingfa India.

Conclusion

Microcap stocks may promise long-term returns but are also highly susceptible to short-term volatility. While midcaps and smallcaps can be bundled under a broad strategy umbrella, the same doesn’t apply to micro-caps. In the microcap domain, investment decisions must be highly specific, focusing on individual stocks rather than the entire segment. We need to be careful and selective in identifying the correct microcaps to invest in.

Explore Wright ⚡️ Momentum smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.