We crossed 1 lac+ investors on Timeless Asset Allocation (formerly All Weather Investing) smallcase!

Last month, we secured an important milestone in our mission to provide quality investment options to retail investors. One of the most innovative products we built at Windmill Capital – the All-Weather Investing smallcase, crossed over 1 lakh investors in August!

Everyone at Windmill Capital would like to thank our existing as well as future investors for the love, support and belief in our mission to make efficient wealth creation a norm in the vast Indian retail investor clan. We hope to continue offering more investment products that are intuitive, cost-friendly and transparent such that it is best suited for your financial goals. 🙂

With the formalities are out of the way, let’s get to talking about our flagship portfolio – the All-Weather Investing smallcase! 🙂

The Need for Timeless Asset Allocation smallcase

When we started out in 2016, our goal was not to suggest or recommend an idea/strategy which was best for the average retail investor. Instead, we wanted to offer an interesting bouquet of well-designed stock portfolios based on various ideas that our investors could feel free to chose and invest in based on their own beliefs.

However, sometime in 2018, after observing investor behaviour for well over 1.5 years, we understood that there was a need of an anchor product that helped all retail investors remain invested in the markets for the long-term. Look, markets are volatile. There was a need of a product that acted as a core or foundation of an investor’s portfolio. This product, as we began thinking, would ideally check 2 broad boxes –

- Stability: The investment would be stable even during times of market volatility. By this, we meant an investment that could be sold anytime without worrying about market tops and bottoms. Neither would the investment ship sink during bad times, nor would the flight sore to scary heights during good times. It would be designed to be stable and slowly but steadily build wealth over the long term.

- Higher returns than Fixed Deposits/Bank Savings: With inflation hovering at around 5% levels and FD returns also being around those levels, FD investors were essentially either losing money or not making any money at all. We understood that while these options might be stable, they were not efficient wealth creators.

We needed something innovative – something that gave us the best of both worlds. An investment which would give us 3 things:

- The stability of an FD-like investment

- The upside and wealth creation characteristic of equity-like investments

- The hedge/protective layer of gold-like investments when equity markets would not do well

The birth of Timeless Asset Allocation smallcase

The answer to all the above problems, we figured, would be the Timeless Asset Allocation smallcase. And after over 3 years of its existence, the All Weather Family is 1 lac+ investors strong and is only set to grow! 🙂

The All-Weather Investing smallcase is a one-of-its-kind dynamic asset allocation portfolio that uses ETFs to invest in 3 broad asset classes – Equity, Debt, and Gold.

The Equity portion helps build wealth over the long-term. The debt portion acts as an investment which gives us regular returns like a Fixed Deposit, and the Gold portion protects the portfolio from sudden equity-market downturns, since equity and gold are said to be inversely correlated, especially during volatile markets.

While we knew that all 3 of these asset classes were needed for a portfolio like this, the hard part was figuring out the right combination of equity, gold and debt and their respective weights in the portfolio. And that’s where our analysts come in 🙂

The combination of Equity-Gold-Debt

So say that the equity market outlook over the foreseeable future looks bright. By that we mean that the economy is growing, business is booming, and consumption is rising. In such a time, our analysts would increase the portfolio allocation to equity while reducing the allocation to gold. This is to take advantage of the upcoming bull run.

On the contrary, if markets demand some caution and the future outlook looks bleak, then our analysts would increase the allocation of gold in the portfolio as gold helps in protecting the portfolio from sudden market downturns.

Our analysts bring in the much-needed dynamism to the portfolio that helps it to be stable while also giving high returns compared to conventional and safe investment options.

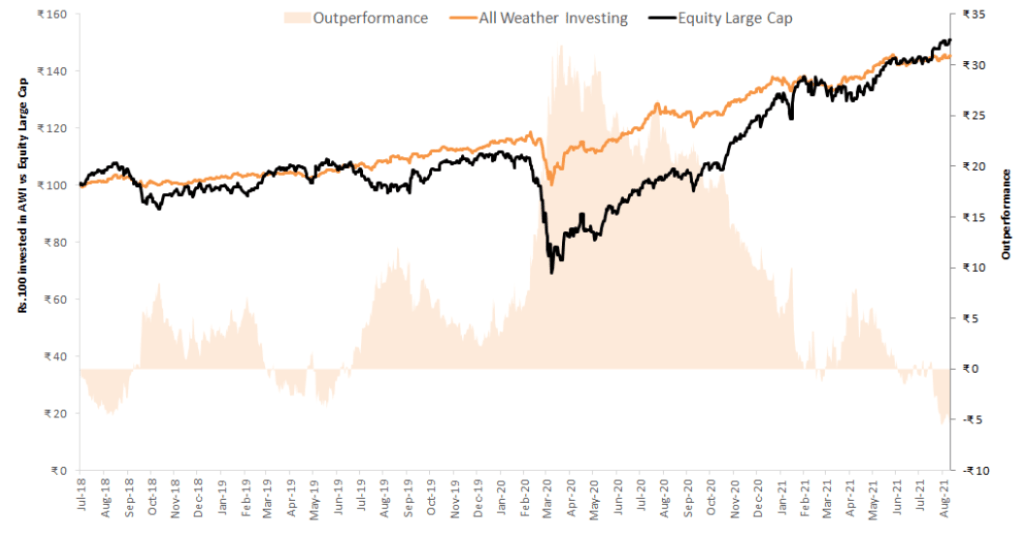

As you can see from the chart above, the Timeless Asset Allocation smallcase has been stable and steady since its launch. It successfully weathered black-swan events like the market crash of March 2020 while also rising steadily in-line with the broader equity markets since then.

Another thing to note here is the Maximum Drawdown that the portfolio assumes. Before that, let’s understand what drawdown means. Maximum Drawdown helps gauge a portfolio/stock’s downside risk. It measures the loss that would occur when someone invested in the peak and sold at the bottom before a new peak is attained. The Timeless Asset Allocation smallcases’ max drawdown is much lesser than the Equity large-cap index.

| Portfolio | Maximum Drawdown |

| Timeless Asset Allocation | -15.70% |

| Equity Large-Cap | -38.10% |

These numbers, the thesis behind constructing this portfolio and the portfolio crossing 1 lakh investors are precedent to the power and value-add that this product brings to an investor’s portfolio. It was built keeping in mind the best interest of investors and their journey towards financial indepedance. Like all other offerings of Windmill Capital, this offering –

- is liquid — so you can invest & redeem your money instantaneously

- is cost-efficient compared to alternatives

- has greater value than can be found anywhere else

Thank you if you are already an investor in the All-Weather Investing smallcase. If not, you should definitely check it out as this is one investment that fits the portfolio of all kinds of investors. Check out the offering, here.

Take care, and happy investing! 🙂