[UPDATED] Paytm: Regulatory Challenges and Portfolio Considerations

![[UPDATED] Paytm: Regulatory Challenges and Portfolio Considerations](https://www.smallcase.com/wp-content/uploads/2023/02/Blog-Header.png?x77181)

Update as of February 21, 2024

Amidst recent events, Paytm is navigating a challenging period marked by regulatory constraints and intensified market competition. The sequence of events, beginning with the RBI’s directives, has stirred the market, casting a shadow on Paytm’s credibility.

The proactive measures taken by Paytm, such as the establishment of a Group Advisory Committee and the realignment of their nodal account to Axis Bank, suggest efforts to mitigate risks and sustain operations. The full extent of these developments on Paytm’s market position remains to be seen. We continue to monitor the situation closely, maintaining an objective stance as the events unfold.

Windmill’s take as of Feb 6, 2024:

One might assess the recent RBI directives against Payments Bank as a constriction point in Paytm’s operational funnel. The imposed limitations on the acceptance of new deposits and customer onboarding are a direct hit to the company’s payment services sector. Given that these services are typically the entry point for customers into Paytm’s broader financial ecosystem, the restrictions pose a risk to future growth and revenue diversification strategies. The impact on Paytm’s lending services and cross-selling of higher-margin products could be significant, potentially affecting the company’s market positioning and merchant trust. This development calls for a close watch on Paytm’s adaptability and its moves to maintain merchant relationships and customer trust.

Paytm stock is present only in the Digital inclusion smallcase. Since it has been hitting lower circuit for the last 3 days, we haven’t put a rebalance sell order in our smallcase as it will lead to order failures. We are keeping a close watch and will rebalance the portfolio once the stock comes out of the circuit.

Impact on Digital Inclusion smallcase – In a hypothetical situation, if an investor allocated Rs 10,000 to the Digital Inclusion smallcase, and given that Paytm constitutes only 5.36% of the smallcase, the overall impact on the portfolio due to the recent decline in Paytm stock over the last three trading sessions would be approximately Rs 230, equivalent to around 2.3% of the portfolio.

About PAYTM:

Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants. The Company runs Paytm, which is a digital goods and mobile commerce platform.

Business Model:

Paytm has diversified its revenue streams across various services, including payments, financial services, and cloud solutions. Here’s a brief overview of each segment and their contribution to Paytm’s revenue:

Payments Business:

Paytm’s payments services are a significant part of its revenue model. They offer a variety of payment use cases for consumers, including mobile recharges, utility bills, rent, education fees, wallet top-ups, and money transfers. On the merchant side, Paytm provides solutions to accept payments through multiple instruments and devices that help with reconciliations. This includes QR codes, Soundbox devices for voice payment confirmations, and POS devices. Most of these use cases are powered by Paytm Payments Bank (as once can see from the app snapshot below). Paytm’s payment business revenue grew by 44% to ₹4,928 Cr in FY23.

Financial Services and Others:

This includes lending services such as Paytm Postpaid (BNPL), personal loans, and merchant loans. They partner with financial institutions for loan distribution, earning revenue through sourcing and collection fees. Their revenue from this segment grew by 252% in FY 2023 to ₹1,540 Cr.

Commerce and Cloud:

Paytm monetizes its app traffic by providing marketing services to merchants, including travel and event ticketing, deals, and gift vouchers. Their cloud services cater to enterprises, telecom companies, and digital and fintech platforms to enhance customer engagement and build payment systems. The Commerce & Cloud revenue grew by 38% to ₹1,520 Cr in FY 2023.

The RBI Saga:

Paytm Payments Bank Ltd (PPBL) has faced multiple regulatory actions by the Reserve Bank of India (RBI) over 2 years since 2022. Paytm owns 49% equity in PPBL. PPBL is the beneficiary bank for multiple PAYTM payment instruments like FASTag, NCMC, and UPI. Here’s a chronology of the events:

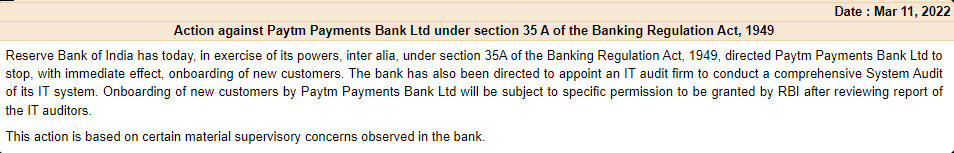

March 11, 2022:

The RBI, citing section 35A of the Banking Regulation Act, 1949, directed PPBL to halt the onboarding of new customers with immediate effect due to certain supervisory concerns observed in the bank. The bank was also instructed to conduct an IT audit to perform a comprehensive system audit of its IT system.

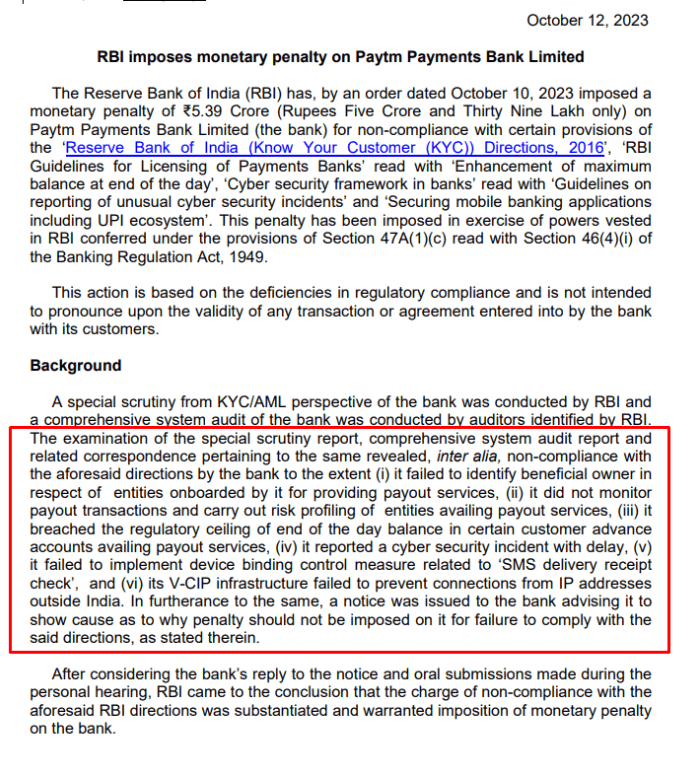

October 12, 2023:

The RBI imposed a monetary penalty of ₹5.39 Crore on PPBL for non-compliance with various regulatory requirements including KYC norms and cyber security incident reporting. This penalty was based on deficiencies in regulatory compliance but did not impact the validity of any transactions or agreements with its customers.

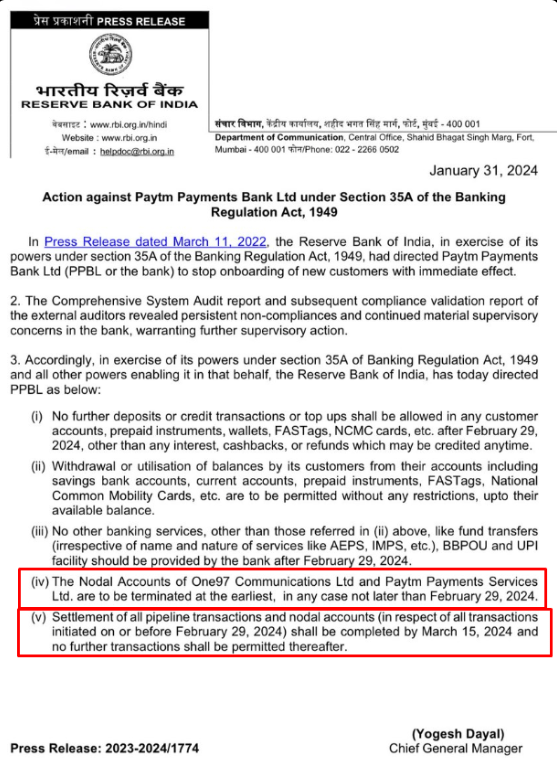

January 31, 2024:

The RBI took further action against PPBL under section 35A of the Banking Regulation Act, 1949, due to continued non-compliance issues that were not resolved following the comprehensive system audit report and compliance validation report. The RBI’s action included restrictions on accepting new customer deposits, credit transactions, or top-ups after February 29, 2024, and on providing other banking services by PPBL except for allowing the withdrawal and utilization of balances by its customers. The RBI also stated that all pipeline transactions and nodal accounts in respect of all transactions initiated on or before February 29, 2024, must be settled by March 15, 2024.

February 4, 2024:

One97 Communications Ltd (OCL), the parent company of Paytm, responded to speculative media reports. They categorically denied any investigation by the Enforcement Directorate on OCL, its associates, or its CEO for anti-money laundering activities and reaffirmed their commitment to abiding by Indian laws and regulatory orders.

February 9, 2024:

The Board of Directors of One97 Communications Limited approved the formation of a Group Advisory Committee on compliance & regulatory matters. This was done per Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

February 16, 2024:

OCL announced that services like Paytm QR, Soundbox, and Card Machine would continue to operate as usual beyond March 15, as confirmed by RBI. OCL had shifted its nodal account to Axis Bank to ensure seamless merchant settlements.

February 17, 2024:

OCL released a press statement confirming its partnership with Axis Bank for an Escrow Account to continue seamless merchant settlements.

Impact on PAYTM’s business:

The latest RBI directive against Paytm Payments Bank, which bars the fintech firm from accepting new deposits or top-ups in any customer accounts and other related services post-February 2024, is expected to impact Paytm’s annual EBITDA adversely. Paytm anticipates a worst-case scenario impact of ₹300-500 crore on its annual EBITDA. The company has stated its intent to comply with RBI’s directions and plans to expand its existing relationships with third-party banks to distribute payments and financial services products. This regulatory action does not affect the user deposits in their savings accounts, wallets, FASTags, and NCMC accounts, and customers can continue to use their existing balances.

Annexure:

1. RBI issues first notice to PPBL:

2. RBI imposes monetary penalty on PPBL:

3. RBI takes action against PPBL under Section 35-A on Jan 31, 2024:

4. PAYTM’s response to RBI’s circular:

5. RBI on Paytm’s operation continuation:

6. OCL partners with Axis Bank for Escrow Account – 17th Feb

7. Paytm QR, Soundbox, Card machine to work even after March 15 – 16th Feb

8. Formation of a Group Advisory Committee by OCL – 9th Feb

9. OCL denies any investigation of their associates and/or its Founder & CEO for anti-money laundering activities – 4th Feb

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital TeamWindmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.