Unlocking India’s Economic Potential: Consumption, Manufacturing, and the Road Ahead (2024 Outlook)

In the realm of global economics, few stories are as compelling and promising as India’s growth narrative. Recent insights from KKR in the report titled, “Thoughts From the Road”, borne by the company’s analysts’ exploratory voyage across India, shed light on the intricate dynamics propelling India’s economic expansion. KKR & Co. Inc. is a global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. This comprehensive analysis reveals a tapestry of opportunities, challenges, and strategic imperatives that define India’s economic landscape.

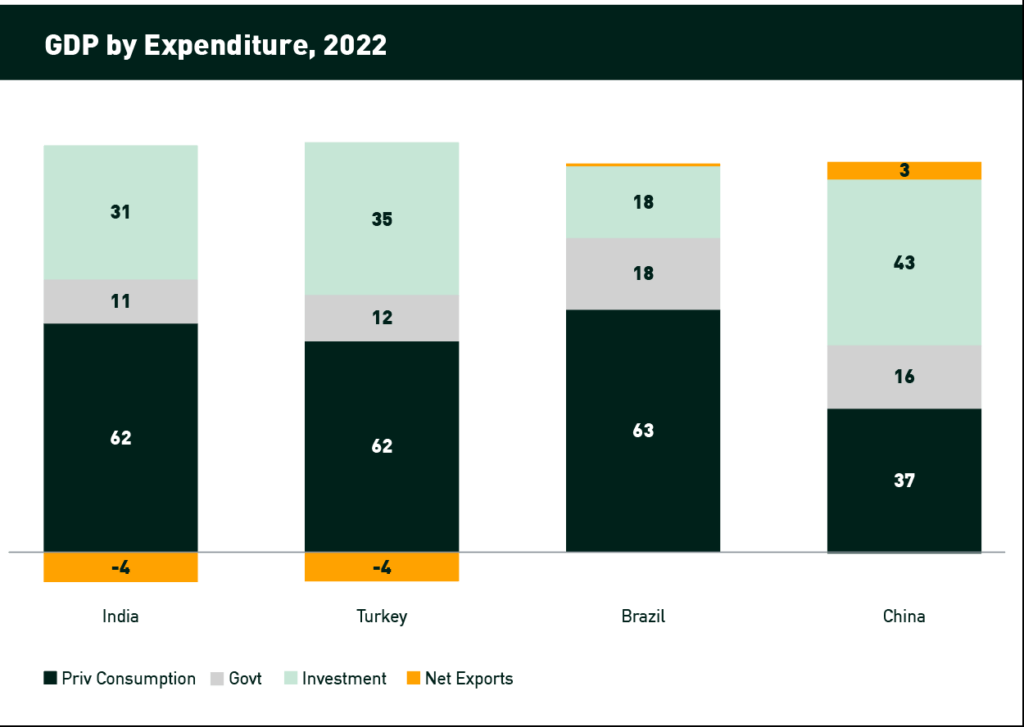

Consumption: The Engine of Growth

At the heart of India’s economic potential lies a powerful driver – consumption. Buoyed by rising GDP per capita, domestic demand reigns supreme.

While Manufacturing Is Growing, Private Consumption, Especially at the Middle to High End, Still Drives GDP in India

This trend is particularly pronounced among the middle-to-high-income segment, as evidenced by the burgeoning growth of affluent consumers. KKR identifies this burgeoning demographic as a goldmine of investment opportunities, particularly in wealth management, healthcare, luxury goods, and experiences tailored to this discerning consumer base.

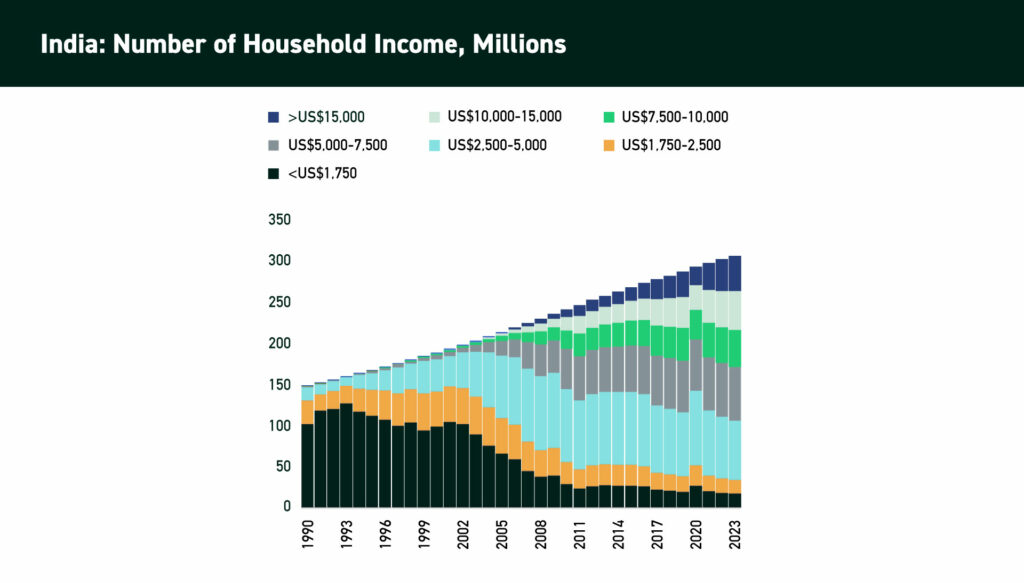

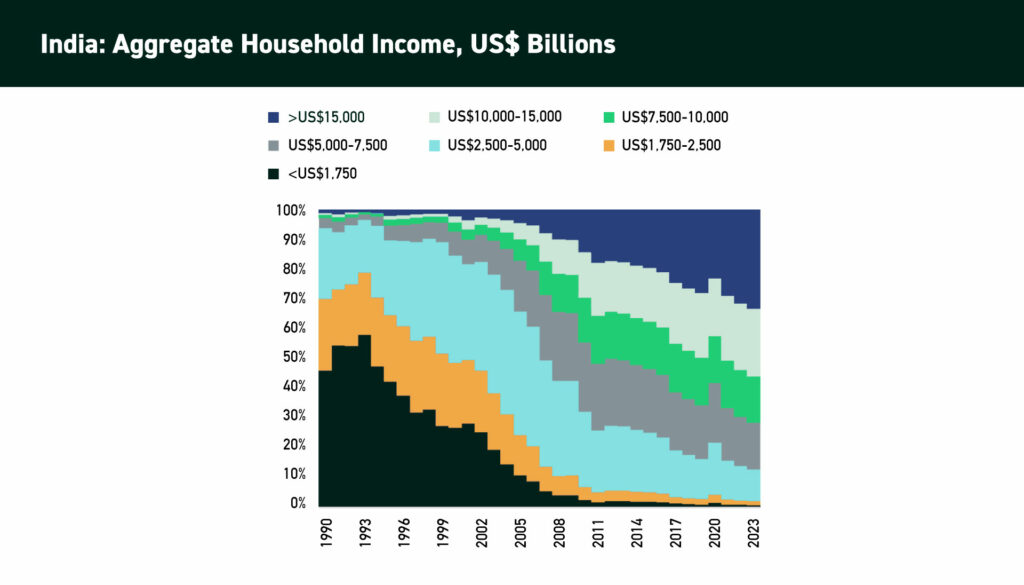

Affluent Consumers With Income Above ₹12.45 Lakhs Only Make Up 14% of Households…

…But Now Makeup 33% of Aggregate Household Income in the Country. Meaning, that the rich are getting richer, even though they’re a small group, while the rest of the houses might not be seeing their income grow as much.

Building a Strong Foundation: India’s Infrastructure Investment

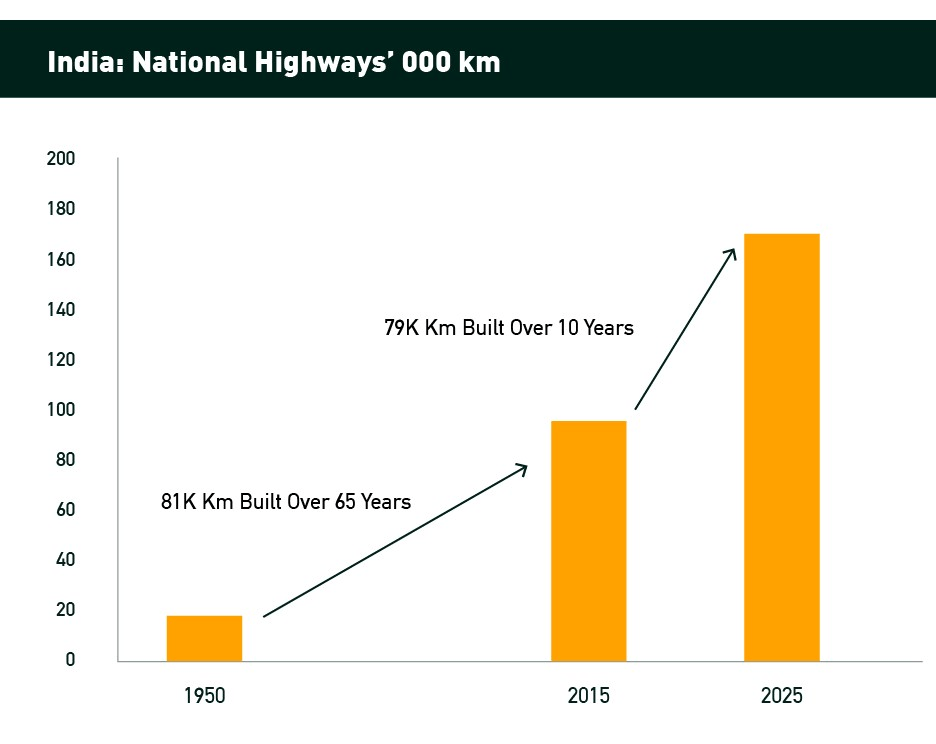

The report underscores the critical need for deeper and broader investment in infrastructure. While strides have been made in recent years, with significant expansion of national highways (e.g., quadrupling construction in the past decade), further development remains crucial. Similar trends are observed in rail networks, ports, renewable energy capacity, and power transmission. Robust infrastructure is vital to support continued economic expansion and efficient movement of goods and services.

Road Construction Over the Last Ten Years Nearly Equals What Occurred Over the Previous 65 Years

India’s Policy Reforms Pave the Way

The report acknowledges positive policy developments that have streamlined economic activity. The Goods and Services Tax (GST) has simplified taxation and boosted cross-regional trade by removing internal barriers. Additionally, initiatives like Aadhaar, a digital ID program, and UPI, a digital payments platform, have facilitated targeted government stimulus and increased financial inclusion, bringing more Indians into the formal economy.

India Emerging as a Manufacturing Powerhouse

KKR’s report identifies India’s potential as a global manufacturing hub. The landscape is witnessing a confluence of positive trends. Not only are more global manufacturers setting up shop in India, but related suppliers and logistics companies are also following suit. This creates a more robust ecosystem that benefits both multinationals and local exporters. Furthermore, India is increasingly seen as a viable location for outsourcing key business functions, including research and development, operations, and manufacturing. This shift can potentially position India as a leader in the global supply chain.

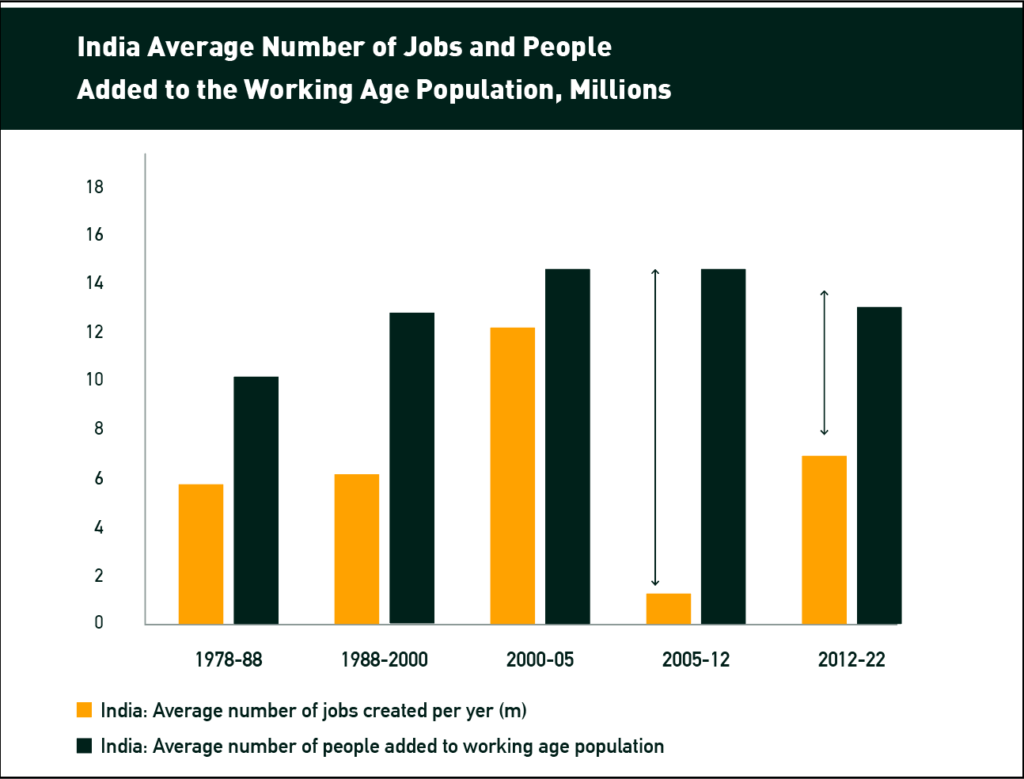

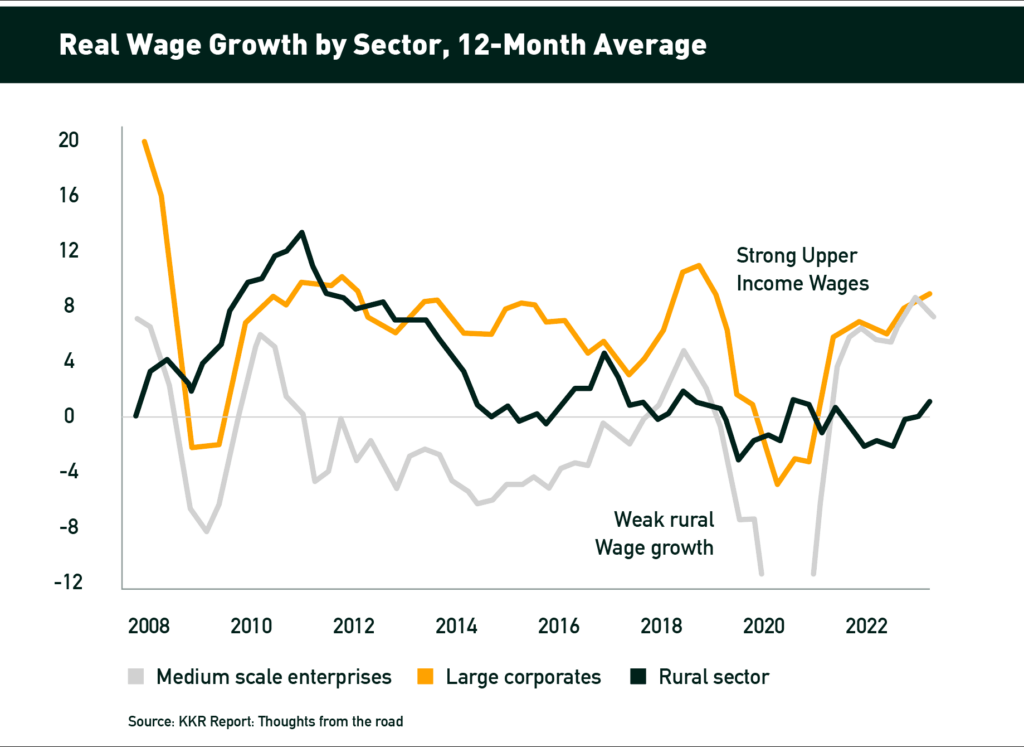

Addressing the Job Disparity: A Critical Challenge

Despite the overall growth narrative, the report acknowledges a crucial challenge. A significant portion of the economy (around 44%) remains agrarian. This translates to a large segment of the population, particularly those in the lower to middle-income brackets, not fully benefiting from the economic boom. Real income growth has stagnated for many Indians, despite government stimulus programs. Rising input costs, especially for food staples, have eroded purchasing power, hindering improvements in living standards for a substantial portion of the population. Bridging this income gap and creating more high-value jobs will be critical for ensuring inclusive and sustainable economic growth.

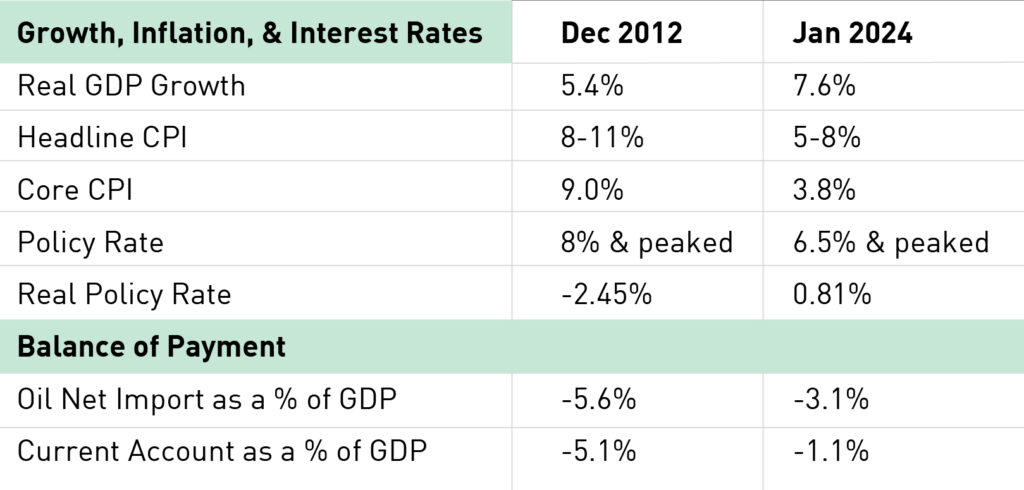

A Decade of Transformation: A Glimpse into the Numbers

The report includes a table comparing key economic indicators from December 2012 and January 2024. This comparison reveals a period of significant transformation. Real GDP growth has accelerated, while inflation and interest rates have shown a welcome decline. Notably, the real policy rate has shifted from negative to positive territory, indicating a more stable macroeconomic environment conducive to long-term investment. Additionally, the balance of payments situation has improved, with a reduced oil import burden and a narrower current account deficit. These positive trends suggest a more resilient Indian economy.

A Look Ahead: India’s Promising Future

KKR’s report presents a compelling case for India’s economic potential. The report highlights two key pillars of this potential:

- A Robust Domestic Market: Fueled by a strong, consumption-driven domestic economy backed by favorable demographics and a sound fiscal plan from the government.

- A Global Hub: India’s growing attractiveness as a global manufacturing and outsourcing destination, particularly at a time when other Asian economies face challenges in these areas.

KKR concludes that India is well-positioned to contribute significantly to global growth over the next five to seven years. However, to fully realize this potential, addressing the job creation challenge and ensuring inclusive growth will be crucial. By investing in infrastructure, fostering innovation, and creating high-value employment opportunities, India can solidify its position as a leading player in the global economic landscape.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.