Trump’s 100% Tariff Threat: How Will it Impact India?

If Donald Trump’s presidency was a reality show, the trade war was one of its most dramatic episodes.

When Trump first slapped import tariffs in 2018, the US and China rivalry led to a trade war while also hitting countries like Canada, Mexico, and others across the globe.

Cut to 2024, with Trump elected as the US President for a second tenure; trade matters have heated up further with another threat of imposing 100% tariffs on the BRICS nations—Brazil, Russia, India, China, and South Africa, a bloc of mostly emerging economies.

What triggered Trump to the level that he announced tariffs even before assuming office in January next year? The answer is straightforward. The remarks come in response to discussions among BRICS nations over the possibility of reducing their reliance on the US Dollar for trade. A recent summit in Russia focused on increasing local currency transactions, which Trump is dead against. “The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER,” he has warned.

Why do BRICS Countries Want an Alternative Currency?

To make the nations less dependent on the US Dollar, the most commonly used currency in international trade. The Dollar’s dominance gives the US significant influence over global financial systems. BRICS nations want to destabilise that. Their main agendas include:

–Reducing vulnerabilities to US monetary policy decisions, such as interest rate hikes, directly impacting emerging markets, including the Indian stock market.

–Avoiding sanctions risks stemming from internal policies. Russia, for instance, has been heavily sanctioned by the West. An alternative currency would help bypass Dollar-based financial systems like SWIFT (Society for Worldwide Interbank Financial Telecommunications).

Impact on India

Trump’s tariff threat could lead to higher costs for Indian exporters, making their products less competitive in the US market. The approach also reflects an “America First” philosophy, aiming to bring jobs back, promote domestic manufacturing, and reduce reliance on foreign goods.

Now, India maintains strong trade ties with the US, particularly by being its biggest trading partner, with bilateral trade exceeding $120 billion in FY24. But consequently, Trump argues that BRICS nations, mainly China and India, benefit disproportionately from US trade agreements.

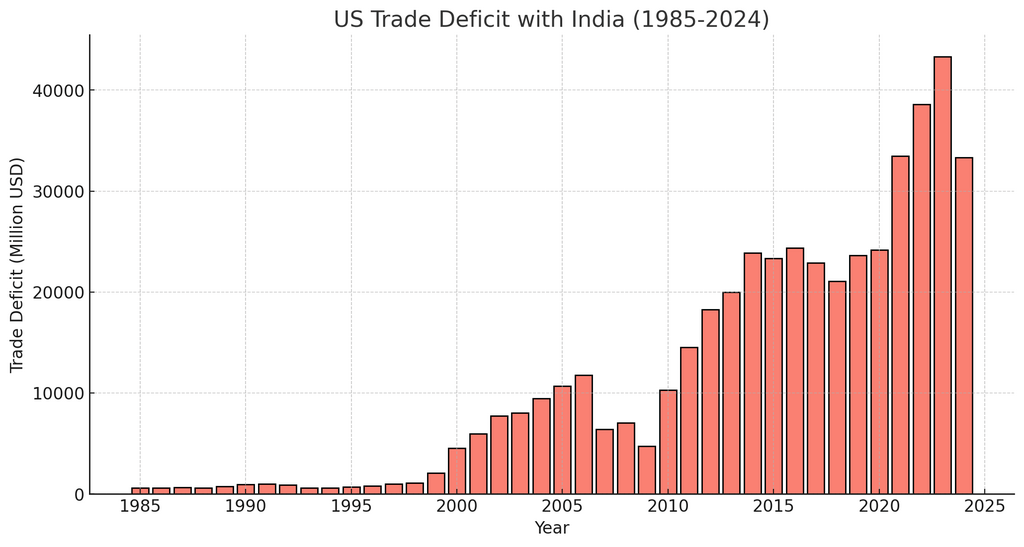

Moreover, foreign trade data highlights a persistent trade deficit the US has experienced with India over the years, with imports consistently surpassing exports. The trade deficit has widened, reaching over $43 billion in 2023.

Thus, Trump’s major announcement, posted in 6-7 lines on social media, could have severe consequences for India’s exports to the US, particularly in critical sectors such as pharmaceuticals, textiles, and IT.

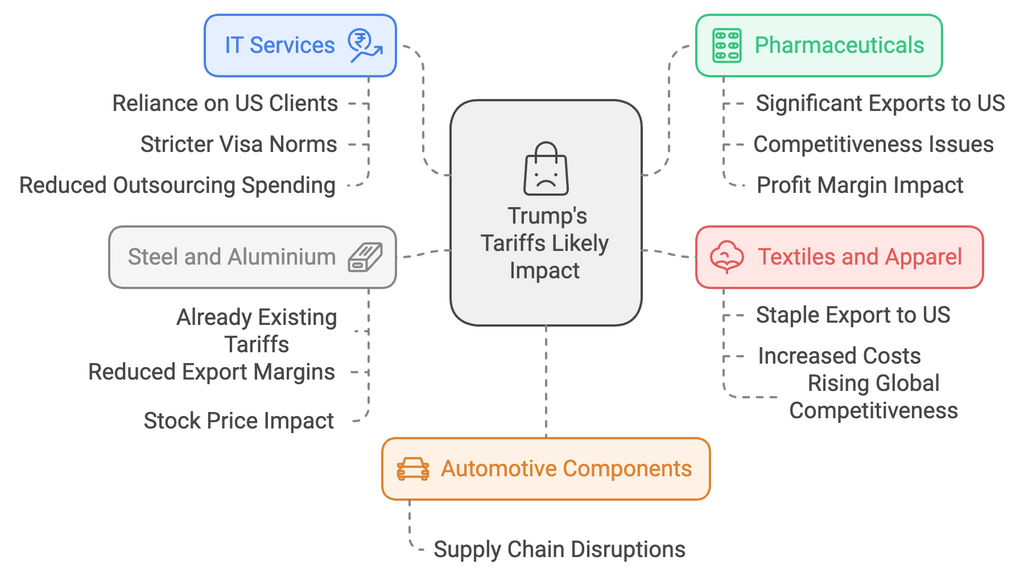

Key Sectors Likely to be Hit

- IT Services

India’s IT giants like Infosys, TCS, and Wipro rely heavily on US clients. While services aren’t directly subject to tariffs, indirect effects like rising tensions could lead to stricter visa norms or reduced spending by US companies on outsourcing.

- Pharmaceuticals

Indian pharmaceutical exports to the US are significant, especially generics. Tariffs could make Indian drugs less competitive in the American market, potentially hitting profit margins for major pharma companies.

- Textiles and Apparel

Indian textiles, a staple export to the US, could face increased costs due to tariffs. This would hurt exporters, affecting their global competitiveness.

- Automotive Components

India is a major supplier of automotive components to US automakers. Tariffs could disrupt supply chains.

- Steel and Aluminium

The US has already imposed tariffs on steel and aluminium imports, and any expansion could affect Indian manufacturers. Reduced export margins could trickle down to the stock prices of listed players.

Opportunities amid Challenges

While tariffs pose challenges, they also present opportunities for India to diversify its trade relationships and focus on domestic growth.

Domestic Consumption Plays: As exports face challenges, companies focusing on India’s domestic market may gain traction. FMCG, retail, and infrastructure are some sectors for growth opportunities.

Emerging Trade Partners: Indian exporters might pivot to non-US markets like the EU, Africa, or Southeast Asia. Companies with diverse export destinations could weather the storm better.

What Should Investors Watch Out For?

Earnings Reports: Keep an eye on how companies, especially in affected sectors, discuss tariffs in their earnings calls. Declining margins or reduced revenue guidance could signal trouble.

Policy Responses: The Indian government might provide subsidies or incentives to help exporters stay competitive. These measures could create new opportunities for investors.

Global Economic Trends: Trade policies can change fast, especially with retaliatory tariffs from other countries, mainly China and India. Stay updated on geopolitical developments and their potential impact.

Diversification Helps: Diversify your portfolio with investments that balance risks across asset classes.

Final Thoughts

Trump’s new tariffs on BRICS nations are a throwback to his protectionist policies, reigniting trade tensions with far-reaching implications. For India, the challenges are real—higher export costs, disrupted supply chains, and currency volatility. However, this also has opportunities, like Trump’s earlier “China+1” strategy, which encouraged businesses to move production out of China, benefitting India.

It’s a matter of time before these threats impact the economy and trade for both the US and India amid global trade relations.