Theme of the Rebalance: Sustainable Efficiency

In the midst of global turbulence and uncertainty, the Indian markets stand strong, offering a beacon of hope for investors. Yet, finding valuable opportunities can be like searching for hidden gems. This is where Craving Alpha’s quality-centric approach shines, providing you with insights and investment strategies that align with resilience.

As our dedicated community of readers continues to grow, we wish to emphasize the uniqueness of our investment philosophy. Our focus is clear: to invest in the best and most efficient businesses within industry sub-sectors that exhibit strong potential

In our most recent rebalance of the Sector Advantage portfolio, we’ve handpicked four remarkable companies, each with a distinct profile that sets them apart

Let’s delve into the theme of this rebalance and the highlights of these exceptional additions

Our mission has remained clear – to ensure our investments are rooted in companies that have substantially improved their operations while maintaining their valuations, as reflected in their median price-to-earnings (PE) ratios.

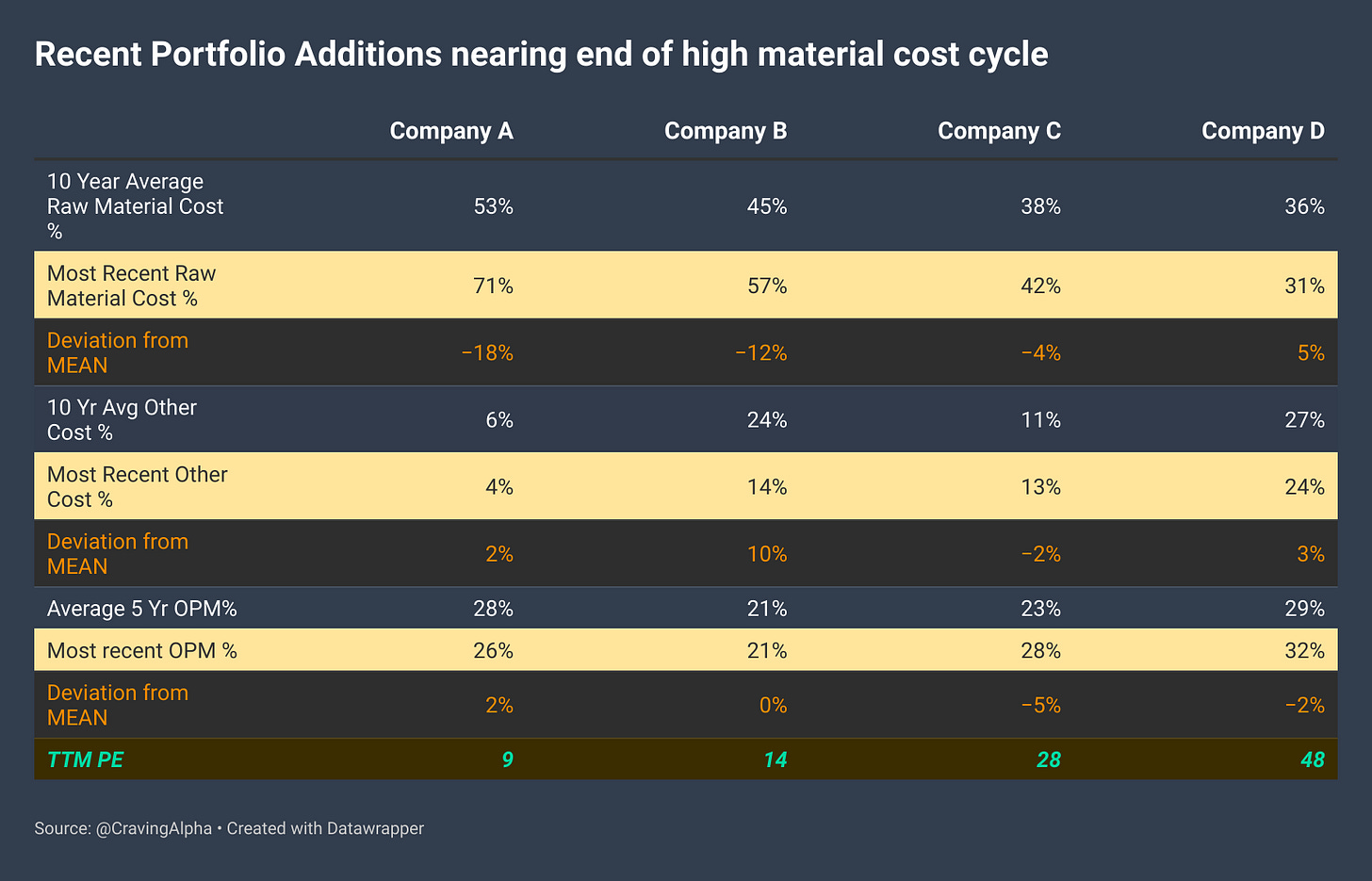

Review the table below for a quick glimpse of these companies and their key statistics

Cost Synergy and Competitive Edge

One common thread that binds these companies is their ability to navigate the challenges of soaring raw material prices without compromising their operational margins. They’ve achieved this feat through sustainable cost synergy measures, enabling them to reduce “other costs” (comprising all costs except raw materials and employee costs) as a percentage.

Companies with a proven ability to optimize operations can lower their expenses without sacrificing quality or customer service. Such operational prowess is paramount, especially in the present economic climate characterized by high inflation and supply chain disruptions. Companies equipped with sustainable cost synergies enjoy a significant advantage.

We believe that as raw material prices eventually cool down, these companies will deliver even more robust results. Their inclusion in our portfolio reflects our confidence in their resilience and growth potential.

The US Bond Impact: A Second Trigger

The US bond market, historically a significant influencer, is showing signs of stabilising. This could act as a catalyst for Foreign Institutional Investors (FIIs) to reinvest in the Indian market. Notably, larger investors have historically favoured companies like the ones we choose – those with strong fundamentals and moderate sizes, boasting decent liquidity. This preference is in contrast to smaller companies, many of which are currently trading at elevated valuations.

In these changing market dynamics, the intrinsic strength of the companies within our portfolio aligns perfectly with the demands of discerning investors. As the US bond market gradually stabilizes, our carefully selected investments are poised to benefit from increased FII interest.

As we navigate the evolving financial landscape, your subscription to Craving Alpha becomes even more invaluable.

You can avail a 30% discount by using the code DIWALI23

Explore the Sector Advantage smallcase by Craving Alpha

Disclaimer:- Mails are meant for the sole recipient only and are confidential in nature, any unauthorised copy, duplication, or modification of the contents will subject you to legal actions. Equity investing is risky, you stand to lose most or all of your capital.

Name of Investment Adviser: Craving Alpha LLP; CIN: AAX- 8064;

BASL membership number: BASL1847;

Registered office address: Room No 19, 4th Floor, Martin Burn Building, 1 RN Mukherjee Road, Kolkata 700 001; Telephone – +91(0) 33 4068 8077;

SEBI Registration number – INA300017038;

Compliance officer/Grievance officer: Mr. Shashi Mehra, Contact No: +91(0) 33 4068 8077, Email Id: compliance@ia.cravingalpha.com