The Varun Beverages Story: Quenching India’s Thirst 🧃

Introduction:

The story of Varun Beverages Ltd. (VBL) is extremely fascinating and portrays the confluence of an Indian brand scaling up an American brand. Varun Beverages has been the official bottling partner of PepsiCo in India for the last 3 decades, since 1991. The company operates in three major segments – Carbonated Soft Drinks (Pepsi, Sting), Non-Carbonated Drinks (Tropicana, Sting), and Packaged Drinking Water (Aquafina). We will cover each of the business segments in detail going forward. The majority ownership of Varun Beverages is held by the RJ Corp Group operates as a diversified conglomerate, with businesses spanning fast-food franchises (like Yum! Brands), dairy (Cream Bell), healthcare, and education, apart from beverages.

Industry:

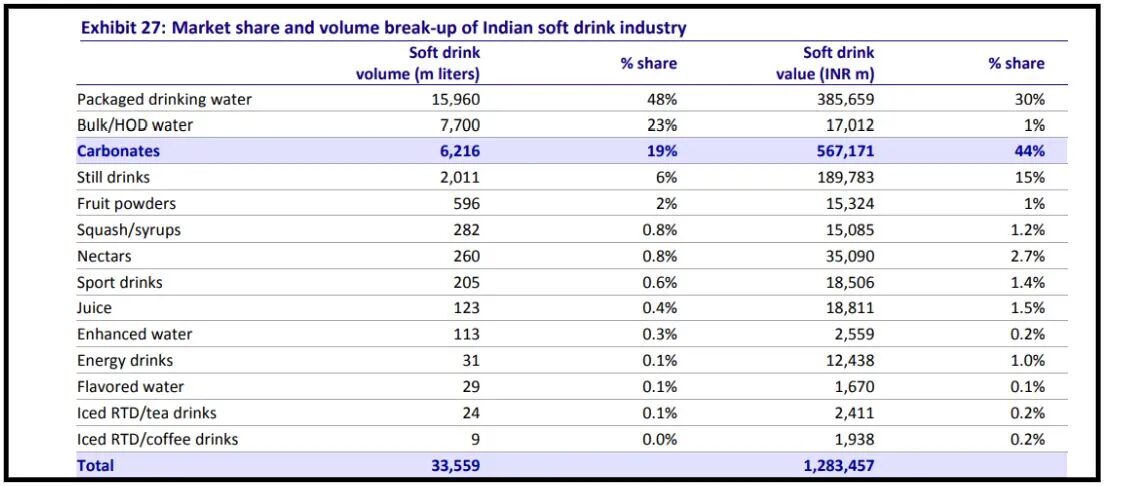

The global market for non-alcoholic beverages was valued at $1,180 billion in 2020 and is expected to grow to $2,100+ billion by 2026, with an annual growth rate of over 7%. More than 60% of this market consists of carbonated soft drinks, ready-to-drink tea and coffee, energy drinks, and sports drinks. In India, people drink far fewer soft drinks compared to developed countries—44 bottles per person in India versus 1,496 bottles per person in the United States. This lower consumption is mainly due to lower incomes and limited electricity access in Indian households which is required for cooling carbonated drinks. However, with gradual improvement in the standard of living and increased rural electrification, supported by various government programs, soft drink consumption in India is expected to grow significantly in the coming years.

Take a careful look at the table above. The interesting aspect is around the market share split. Currently, you would see that carbonated drinks command the highest % share. However, that might change, as people (especially the youth) are getting health conscious and moving away from carbonated (read: sugary) drinks to non-carbonated or sports drinks.

While we are on the topic of industry, let’s discuss the way the beverage industry stands in India. It’s a duopoly market dominated by two big players – Coca-Cola & PepsiCo. Broadly speaking, the beverage industry usually operates in a non-collusive oligopoly framework. Meaning, a market wherein a small number of large firms dominate an industry, but they compete independently rather than collaborating or forming agreements on pricing, production, or market sharing. Hence, you will never find PepsiCo & Coca-Cola fighting over pricing. Instead, they focus on better distribution, better sales, better marketing and the like.

What does Varun Beverages do:

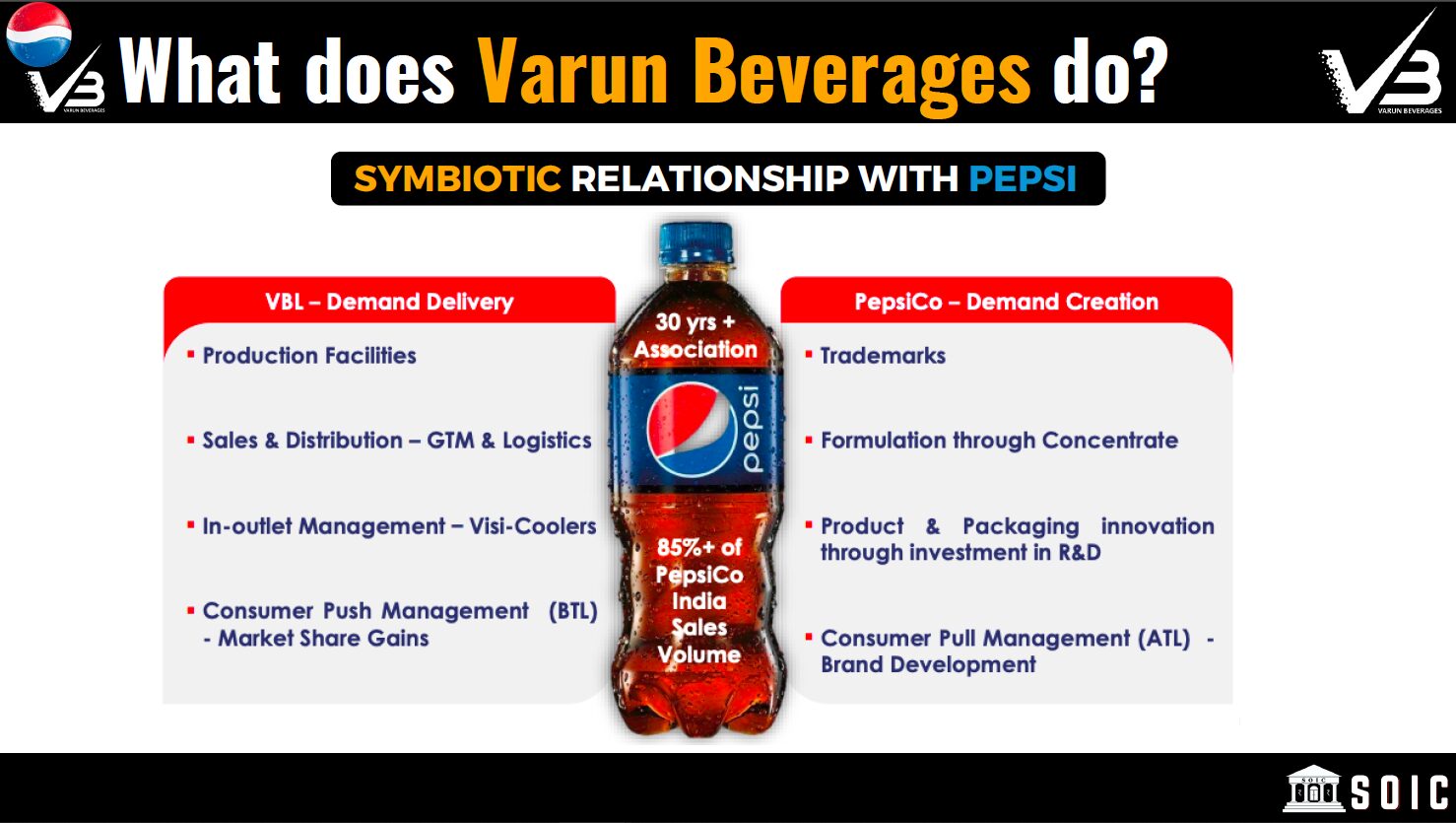

As mentioned above, it is the official bottler of PepsiCo in India. But what does a bottler do? They get the concentrate (ingredients) from the brand owner, that is Pepsi in this case, and manufacture the carbonated soft drinks (CSDs) and distribute them themselves. The price of this concentrate is decided by PepsiCo. This concentrate forms 10-20% of the raw material cost for the company.

But why did a brand as big as PepsiCo choose Varun Beverages (VBL) as its partner in India? And how has VBL cracked this difficult code of selling Pepsi bottles profitably while its parent ran into losses while trying to do the same? Let’s have a look.

Did you see the infographic above? That’s how the hand fits the glove. VBL has managed to plug in the exact gaps that PepsiCo was looking to fill.

What products do they have & where do they sell?:

First, let’s understand the product breakup of the company.

Under these product lines, what brands do they have?

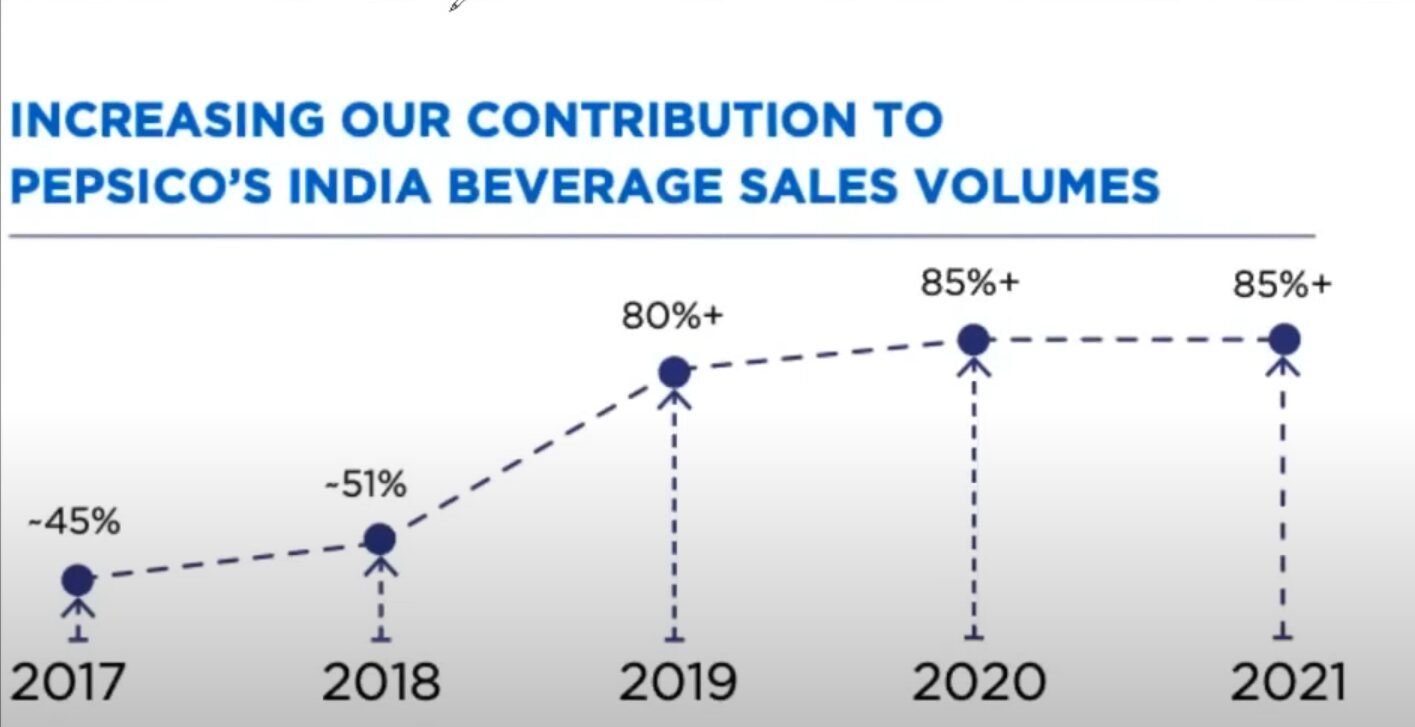

VBL accounts for roughly 85% of PepsiCo India’s business. And the brand spread speaks for itself. Add to that the brand affinity for almost all of them. These brands have become synonymous with Indian households and hence the demand. They have handsomely increased their contribution weight to PepsiCo’s Indian beverage business.

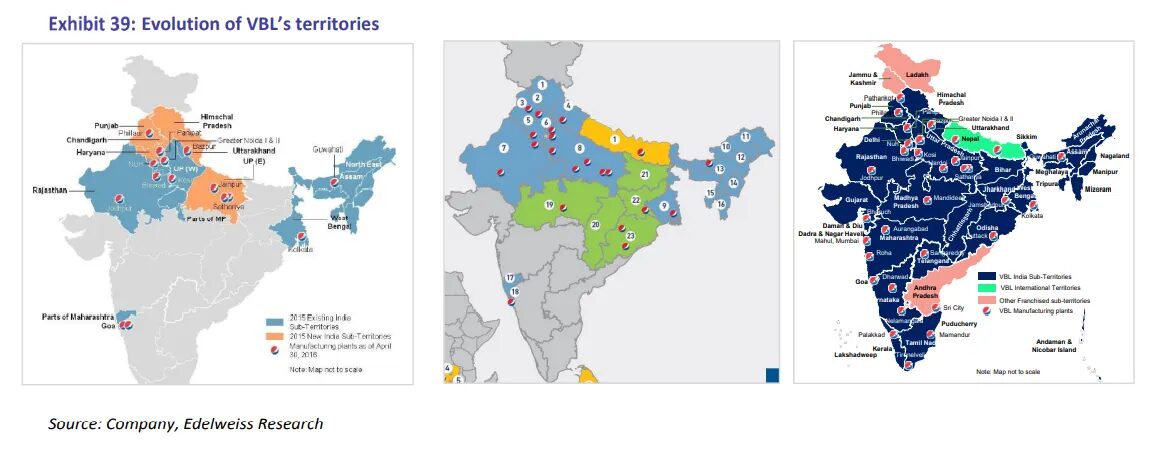

Now, take a look at the way they have captured the market in the country. For context, the areas marked in blue are the places where VBL has exclusive rights to sell PepsiCo products. Quite impressive, right?

How good is the business model?:

In this section, we shall cover a whole host of interesting business aspects that VBL has employed to run its business in an efficient way. Firstly, plug and play on the important things when it comes to scaling of their products.

Let’s discuss the important pointers here –

- The promptness with which VBL has invested in their distribution has worked out really well for them. The management realized that the key aspect in this sort of high volume business is distribution. And they went ahead and invested in just the right things to set the distribution straight.

- Backward integration for all the parts of the bottle from the plastic to wrapper. This helps VBL gain more control over the supply chain, reduce costs, maintain consistent quality, and improve production efficiency. It also enables the company to manage supply risks and minimize delays, especially important in high-demand seasons.

Now, I would like to bring your attention towards the intricacies of VBL’s business model. During the earnings call of VBL for Q4FY22, the management highlighted an extremely important facet of their business plan. Mr Raj Gandhi remarked, ‘We are increasing our penetration in the market, not only by increasing distribution and go to market, but also by enriching our product portfolio over last year.’

This shows the aggressive yet prudent mindset of the management. The company just doesn’t want to sit on the legacy product portfolio and increase distribution. They want to keep innovating on that portfolio as well. The launch of Sting has completely taken the energy drink market in India by a storm. Between FY21 to FY22, Sting saw volume growth of nearly 440%. Quarter after quarter, Sting has managed to deliver stupendous numbers. But what did the company do differently in order to capture such tall demand?

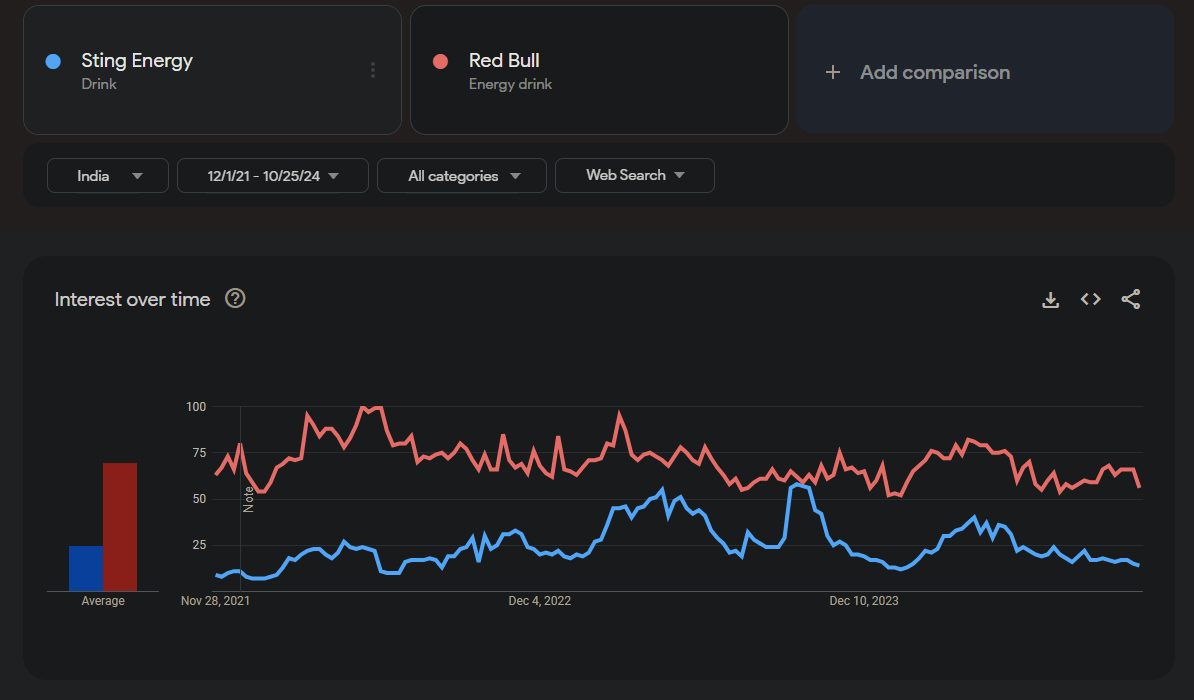

Before Sting, the only reputed energy drink player in the market was Red Bull. One can of Red Bull costs ₹125 while one bottle of Sting costs ₹20. In a price-sensitive market like India, this big price difference will be a natural appeal. From the naked eye also, you would tend to see folks drinking more of Sting than Red Bull. Now you would ask, how is Sting being produced at 1/6th of the cost of a Red Bull? Both drinks come in 250 ml cans and have the same amount of sugar. Sting even has a bit more caffeine than Red Bull. However, Sting doesn’t include taurine. Taurine is known to help improve physical performance and support the brain as we age. Instead of taurine, Sting contains sodium, which is cheaper. Take a look at the ingredients.

And Sting is fast catching the Red Bull. We looked for Google Trends and saw that the interest over Sting has been on a continuous rise as it closes the gap with the Red Bull.

Growth Drivers:

The story has not yet played out for VBL completely as they are staring into multiple growth drivers that they can leverage to stimulate growth –

- As mentioned earlier, the beverages industry in India is at a nascent stage. With a huge influx of new and young population entering the consuming class, the prospects for VBL looks strong, as they would be able to ride on a healthy demand environment.

- Beverages, as the name of the company suggests, have been the focal point of the company. However, they are starting to cover other departments as well. In 2022, they got the co-packing rights from PepsiCo India for one of its food categories – Kurkure Puffcorn. While PepsiCo has kept the entire food category for itself, if VBL delivers good results, then it could be a game changer for the company.

- Capex in underpenetrated states. In one of the most populated states, i.e. Bihar, they didn’t have a manufacturing plant. The management has sensed under-penetration in one of the most populated states, wherein the per capita consumption in Bihar is 8 to 9 bottles versus 24 bottles in the country.

- And lastly, the non-carbonated drinks category, where a lot of work has been already done on Tropicana and energy drink Sting. VBL is the first company to get the rights to Tropicana in the world. Before VBL got the rights, PepsiCo was struggling with Tropicana and losing market share. However, VBL has handsomely turned it around.

Fundamental Performance:

The business has seen impressive fundamental performance over the past few years. The revenues have nearly doubled from ~₹8,800 crores in FY21 to ₹19,000 crores in the last twelve months. While PAT has grown from ~₹700 crores to ₹2500 crores in the same time period. Earnings Per Share (EPS) has grown from ~₹1 in Y20 to ~₹7.8 in TTM. This number indicates that most of the share price appreciation has been led by earnings growth which in turn points to a healthy business position.

Risks:

- Losing the PepsiCo India license. Though it seems like an extreme case currently, that is one business risk that the company is running.

- Change in consumer preferences. With everyday passing by, consumers are getting more and more health conscious. If that persists and carbonated and non-carbonated drinks are viewed negatively, then it could be a challenge for the company.

Conclusion:

It’s really interesting to see how different business houses navigate through their industry in their own ways and styles. That is how a marketplace is generated. Varun Beverages has been doing a lot of right things and we hope you can understand the business ins and outs of the company from this piece.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.