The MAGIC of Lower Portfolio Drawdowns !

A Quick Intro

If you have no idea about drawdowns. here is a quick explainer before we get to the crux of this blog that is expected to help you interpret a few performance related metrics better.

Maximum Drawdown is defined as the maximum drop from a peak. This gives a view of the largest fall the portfolio has witnessed from a peak

Current Drawdown is the distance to peak. This reflects on the recent performance of the strategy and showcases how far below is the portfolio from the highest peak achieved. If current drawdown is 0% continuously, it means that the portfolio is currently on an uptrend & is hitting new peaks regularly. On the flip side, if current drawdown is equal to max drawdown or if it is in a tight range closer to the max drawdown, it suggest a downward trend in the portfolio.

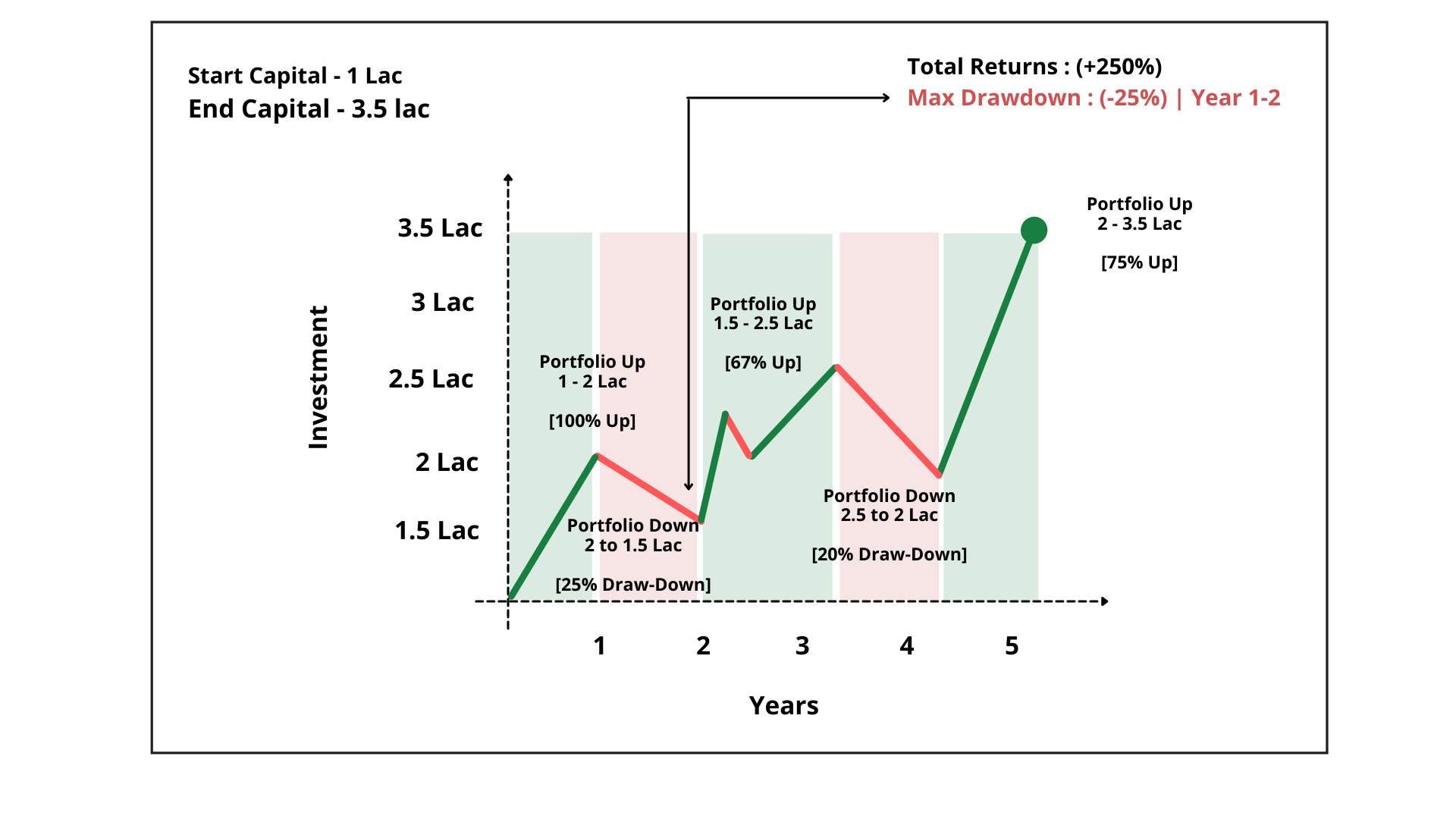

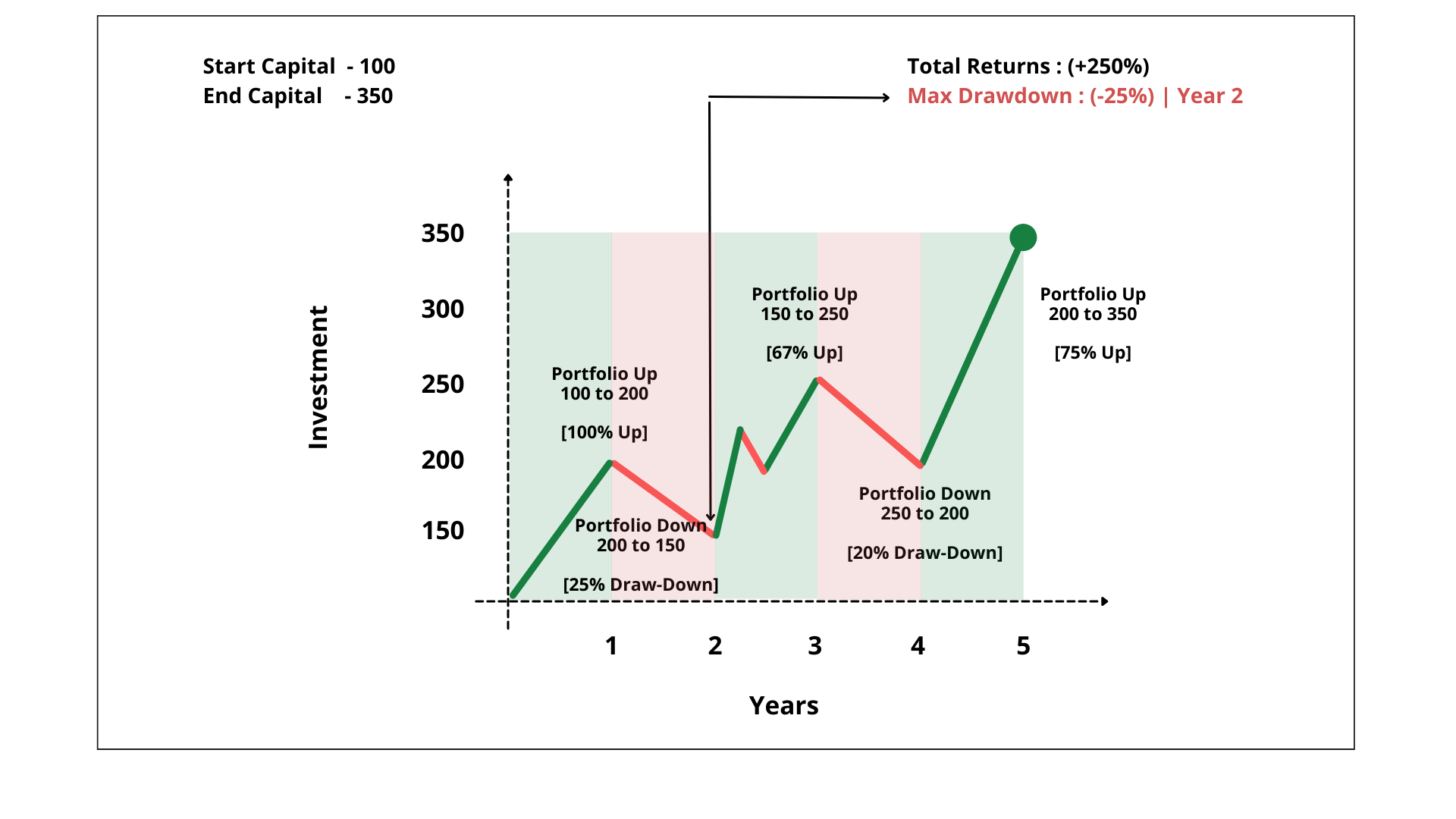

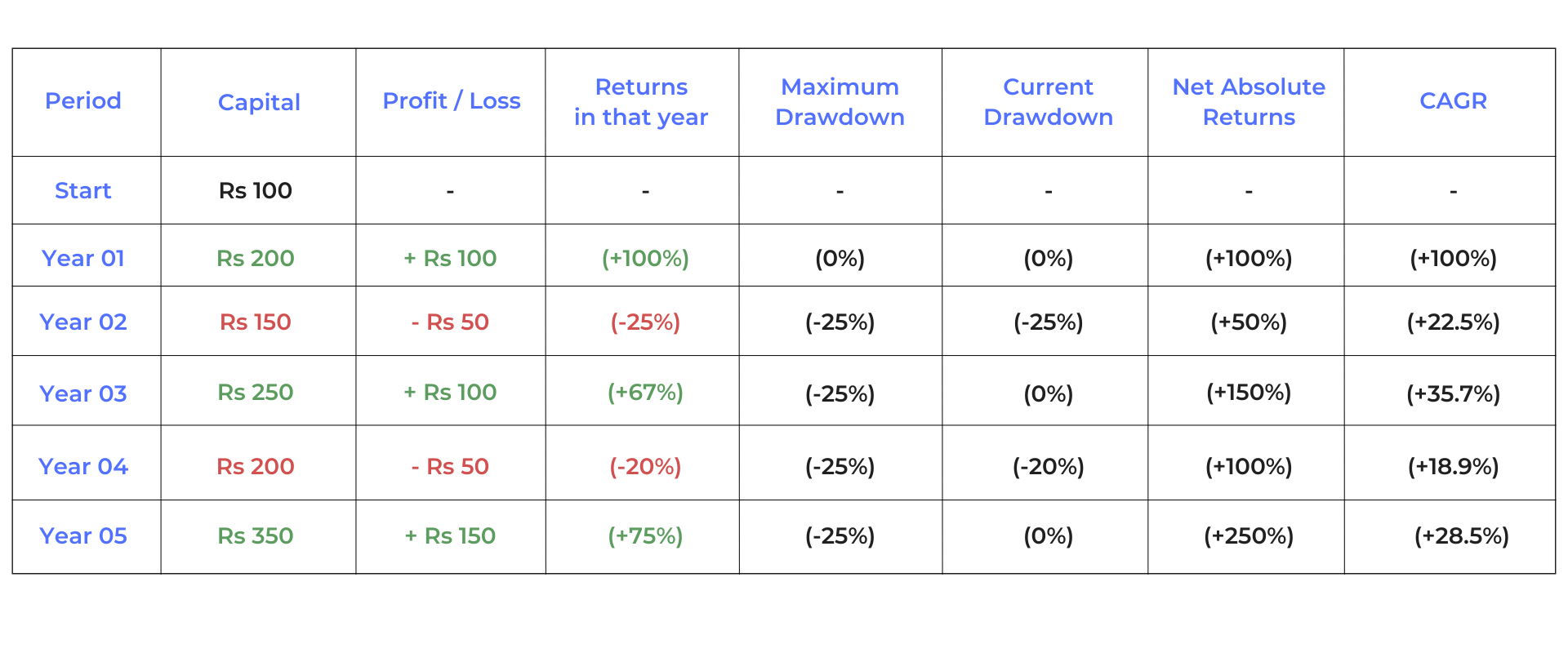

Below is a tabular description of what is happening at the end of each year.

At the end of Year 01 – Max drawdown of 0% and current drawdown of 0% suggests we did not have any falls in that year

At the end of Year 02 – Both current and max drawdown are at 25% each suggesting that we are on a downtrend after hitting a peak of 200

At the end of Year 03 – We can see that the current drawdown is back at 0% indicating a hit a new peak in the portfolio

At the end of Year 04 – We did drop by 20% from the recent peak of 250 but the max drop was still the one we witnessed in year 02 : 25% drop from 200.

If you noticed , the absolute drop in numerical terms was only 50 in both these circumstances. In year 02, we fell from 200 while in Year 04 we fell from 250. Hence current drawdown is only at 20% at the end of year 04. Year 05 is fairly simple.

How to Calculate Drawdowns ?

We also made a video on how to calculate drawdowns which is linked below.

But – can keeping drawdowns lower benefit you in any way ? Absolutely yes. Lower drawdowns are essential when it comes to doing well in the longer run. Why ? Quite simple – Lower drawdowns when markets are weak means you are falling lesser & when market reverses and trends upwards, you will cruise along and hit higher peaks than benchmarks or other portfolios that may have fallen more.

Let us understand this better with a couple of examples

How Lower Drawdowns can be Helpful ?

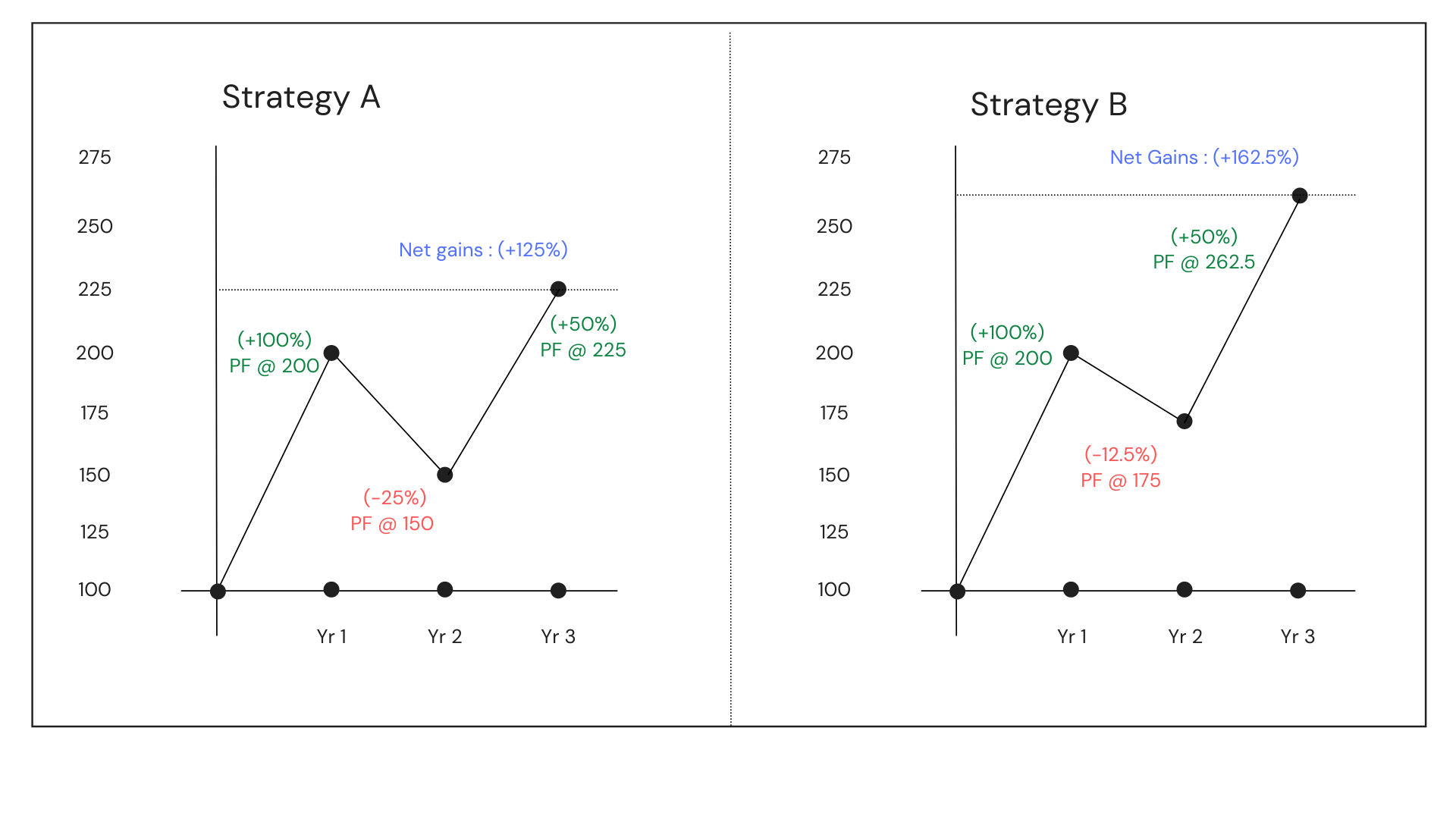

The two strategies illustrated above have everything in common but for the performance in Year 2. Both strategies clocked a similar (+100%) in year 01 & (+50%) in year 03. But if you noticed – in year 02 , strategy A dropped by 25% while strategy B fell only by 12.5%. Strategy B was able to accumulate (+162.5%) compared to (+125%) by strategy A simply as a result of outperforming only on the downside.

Let us look at a realistic examples of 2 strategies that had exactly the same returns between Feb 2019 & Dec 2021 EXCEPT for a period of 2 months – the dreaded COVID period : March and April 2020.

Strategy A went through a drawdown on 40% while strategy B only incurred half of it @ 20.3%.

You can see the massive outperformance in strategy A (+242%) compared to strategy B (+157%) by simply falling lesser in only 2 months out of the entire period.

The Recovery Conundrum

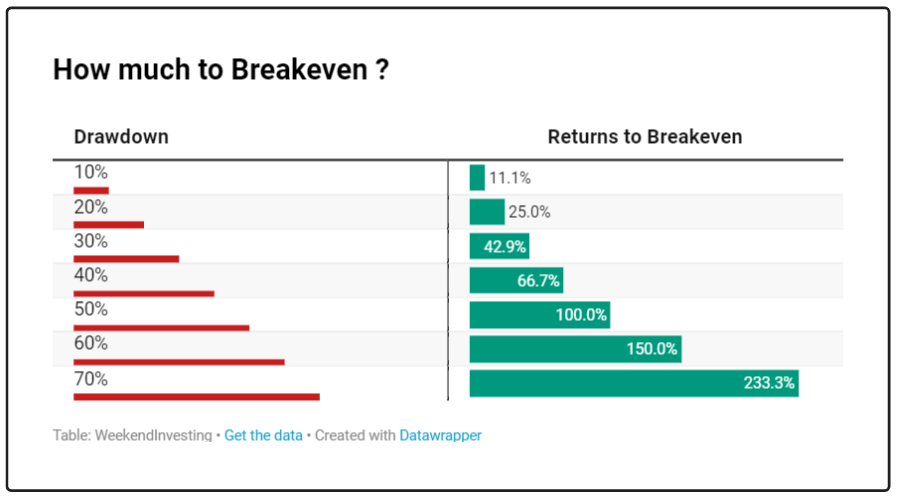

The lesser you fall , easier will be the recovery to break even.

- Let’s say you started with an investment of Rs 100 & you drop by 10%. Your investment is now at Rs 90. You will need to make +11.1% to get back to your initial investment of Rs 100.

- In the same example – if you drop by 40% to Rs 60, you will have to make 66.7% to reach 100 again.

Hence the road to recovery or breakeven will be tougher as the drawdowns go higher. This is an important phenomenon when you look at outperforming the benchmarks in the longer run.

Let’s see a case study

We will now compare two real portfolios Mi 25 (our 25 stock Smallcap based strategy) & it’s benchmark index , the Smallcap 250.

We have considered two periods to showcase one phase of a down trend & one of an up trend. We will then showcase the final picture of what happened in the entire duration. Let’s dive right into the charts

Note – The charts discussed in this blog are based on end of month data. The max drawdown in smallcap 250 index on daily data is at (-60.9%) while the same for Mi 25 is (-29.2%). The same for end of month data stands at (-55.7%) for Smallcap 250 index & (28.8%) for Mi 25.

Downtrend phase : Between 29 Dec 2017 & 31 Mar 2020 (COVID fall).

Both Mi 25 and Smallcap 250 shared a similar path till about June 2019 after which the CASH allocation helped Mi 25 stay afloat and avoided a further slip whereas Smallcap 250 cracked hard to hit (-55.7%) by 31 Mar 2020. So sheer outperformance on the Downside

Uptrend phase : Between 31 Mar 2020 (COVID fall) & 29 Apr 2022 (present), the performance has been more or less similar throughout the uptrend phase with almost identical gains at the end of Apr 2022. Now despite this similar trajectory during the uptrend, we will see what kind of outperformance was achievable only by doing extremely well during the downtrend

There it is – Between the entire duration : start of down trend (29 Dec 2017) to the end of uptrend (29 Apr 2022), Mi 25 has returned a staggering 113% while Smallcap 250 has done only about 31.2%.

That it is the biggest benefit of outperforming on the downside too with strict risk control measures embedded into the strategy.

Emphasizing downside protection to control drawdowns is at the the core of WeekendInvesting strategies.

- Firstly, all strategies are nimble enough to quickly get rid of losers as soon as they show signs of lag.

- Adding on to this – all absolute momentum strategies at WeekendInvesting allocate to CASH when markets enter a weak territory & re allocate to equities when markets trend on the up side while relative momentum strategies always stick to the strongest performing stocks in their respective universe.

- All WeekendInvesting strategies are naturally expected to do well when markets trend on the upside.

Hence, outperformance on downside as well as the upside helps the WeekendInvesting strategies create a massive alpha in the longer run. The charts that are illustrated below showcase the results of this systematic rule based approach

% Days hitting new highs denotes the percentage of the total trading days when the strategy / index hit a new all time high including few when it may have stayed flat without dropping. On the contrary, the last column (% days in drawdown) denotes the percentage of days when strategy / index has spent in drawdowns. This is nothing but 100 – % days hitting new highs.

You would already have a winning strategy even if you outperform only on the down side with effective exit rules and position sizing and generate similar returns when markets trend upside. At WeekendInvesting, we look to outperform both on the up side as well as down side as you may have read earlier in this blog.

Lesser the time you spend in drawdowns, better it is for downside outperformance. As you can see from the above charts, most strategies have been able to do well because of this phenomenon. The % of days in drawdowns are far lesser in strategies compared to the metric on their respective benchmark indices.

You may take Mi EverGreen for example : The strategy has a fixed 25% exposure to gold and this provides an additional cushion during times of weakness in markets. While it’s benchmark , the CNX 200 spent about 86.4% in drawdowns, Mi EverGreen witnessed only 59.1% in drawdowns. As a result, Mi EverGreen’s max drawdown is significantly lower at 18.7% compared to a higher 38.2% on CNX 200 index.

You may have a look at similar stats for all models below.

WeekendInvesting Strategies have been designed to extract alpha when markets go up and protect capital when markets enter weak territories. If you are interested to subscriber, you may use this link to check out our Smallcases and if you have any queries, please send them across to support@weekendinvesting.com.