The Good Bad and Ugly weekly review : 28 Nov 2023

Markets this week

Nifty remained relatively flat throughout the week, with no significant movement observed over the past four sessions. However, it is worth noting that the index has not experienced any major declines either. Despite a few days of FII selling, the index is holding strong and is approaching its all-time high close. This indicates a positive and strong chart, suggesting that we may challenge the previous all-time high in the coming weeks.

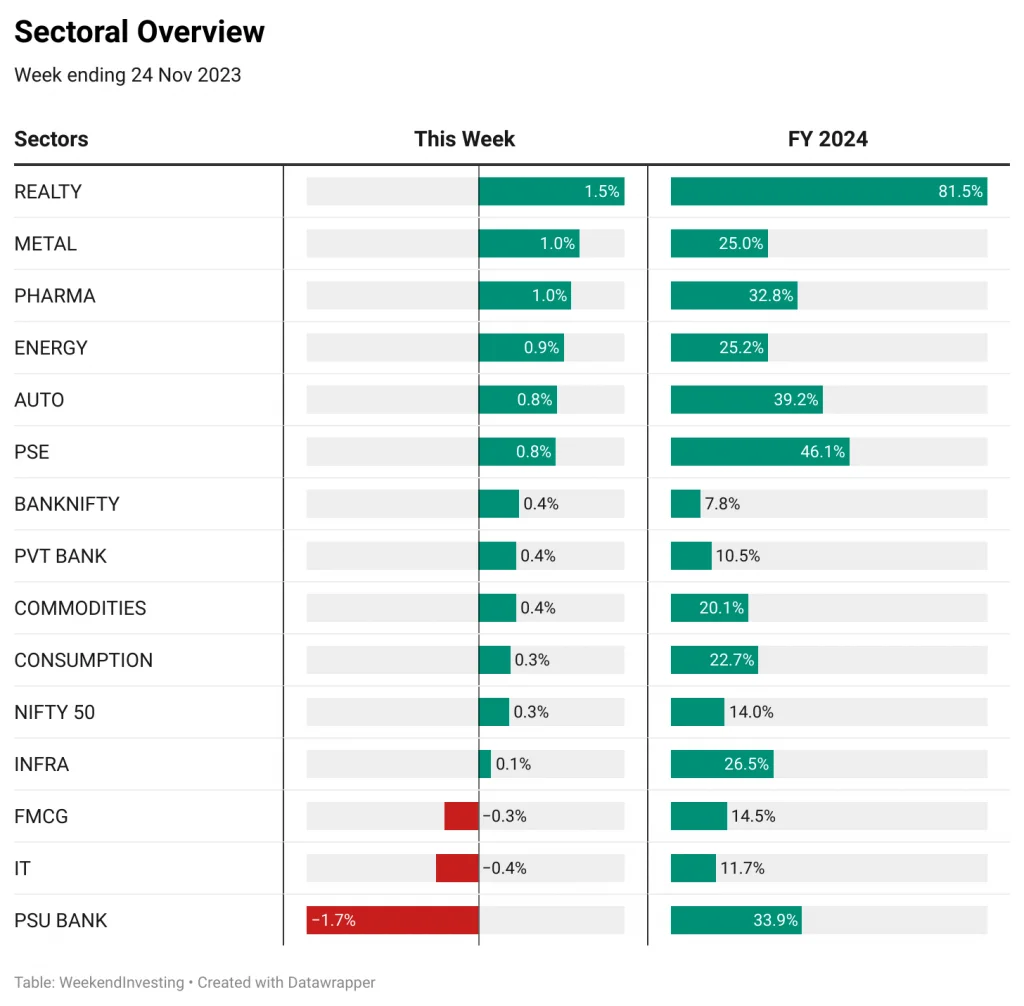

Sectoral Overview

Real estate continues to perform exceptionally well. As we know, real estate cycles run for a long time and with great intensity. In the current financial year, the Real Estate index has surged by a staggering 81.5% in just eight months. Additionally, metals and pharma sectors have also shown positive performance, with gains of 1% and 1.5% in the current week respectively. Energy, autos, and public sector enterprises have experienced marginal increases as well. On the other hand, FMCG and PSU banks have seen a decline of 0.3% and 1.7%, respectively on a previous week basis.

Looking at the sectoral momentum table, we can observe that certain sectors are gaining traction while others are losing favor. Autos and consumption stocks have seen a sudden rise in momentum. Simultaneously, public sector enterprise stocks have started to lose popularity. Gold is making a comeback, while pharma remains in the top five or six sectors in terms of momentum. However, real estate continues to dominate as the top-performing sector.

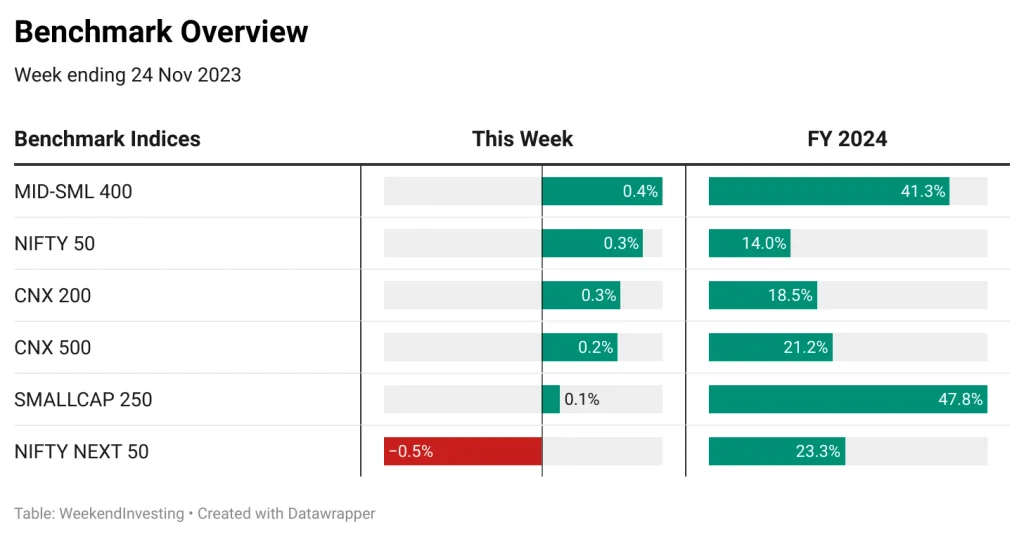

Benchmark Indices Overview

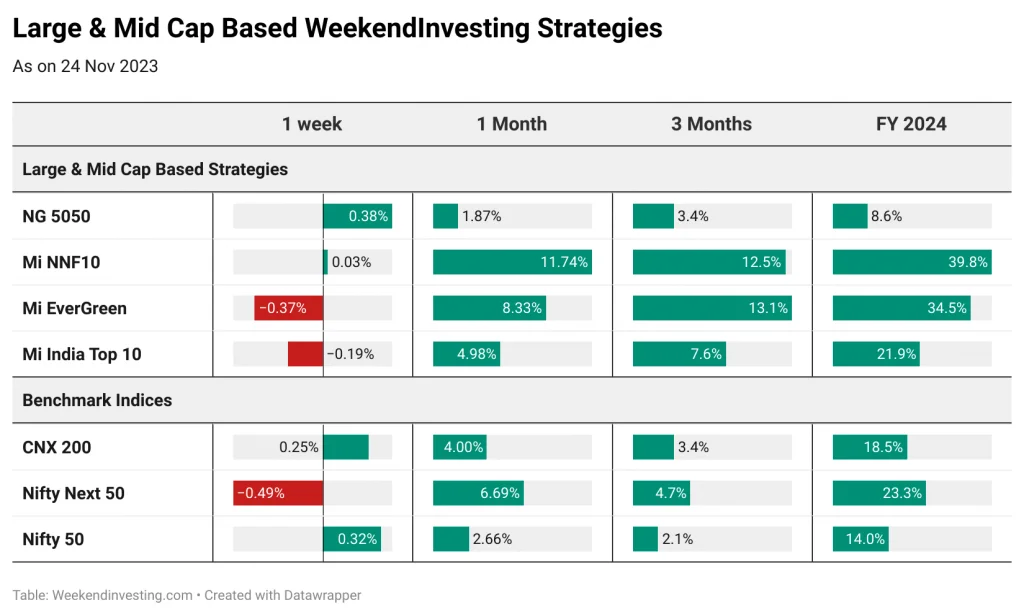

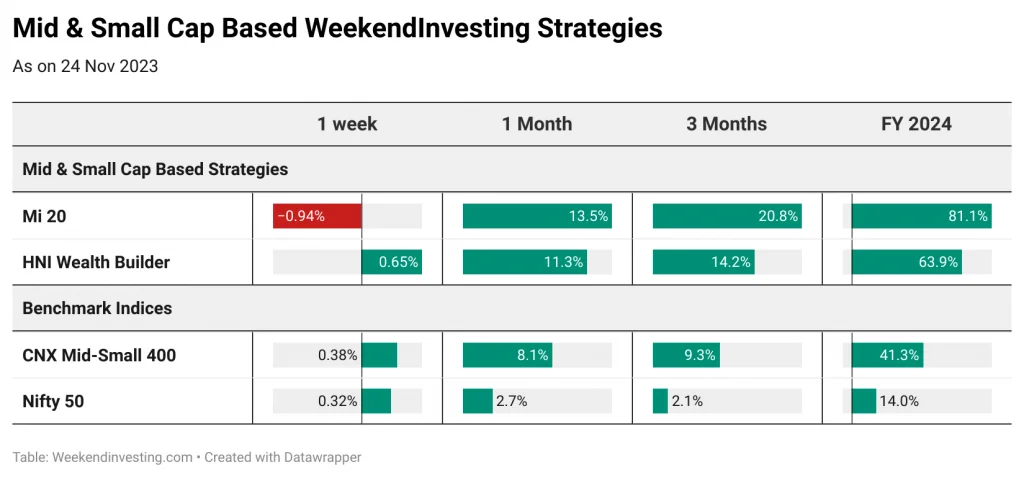

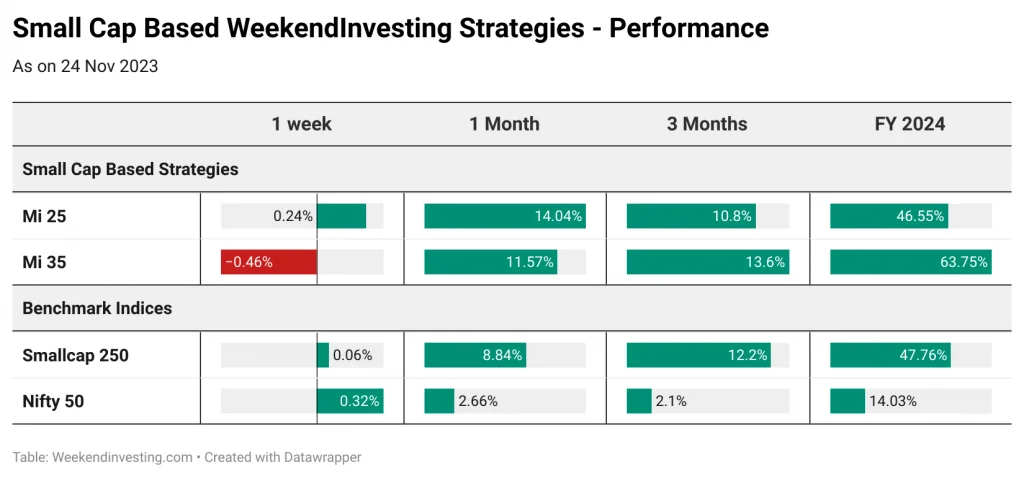

In terms of benchmark indices, the mid and small-cap 400 index saw a marginal gain of 0.4% this week. Nifty 50, CNX 200 and CNX 500 indices all witnessed a 0.3% and 0.2% increase, respectively. Meanwhile, the Nifty Next 50 index experienced the biggest loss of -0.5%. Among these indices, the small-cap 250 index performed the best, showing a significant gain of 47.8% in the financial year. Mid and small-cap indices demonstrated robust performances, with gains of 41.3% and 47.8%, respectively, for the financial year.

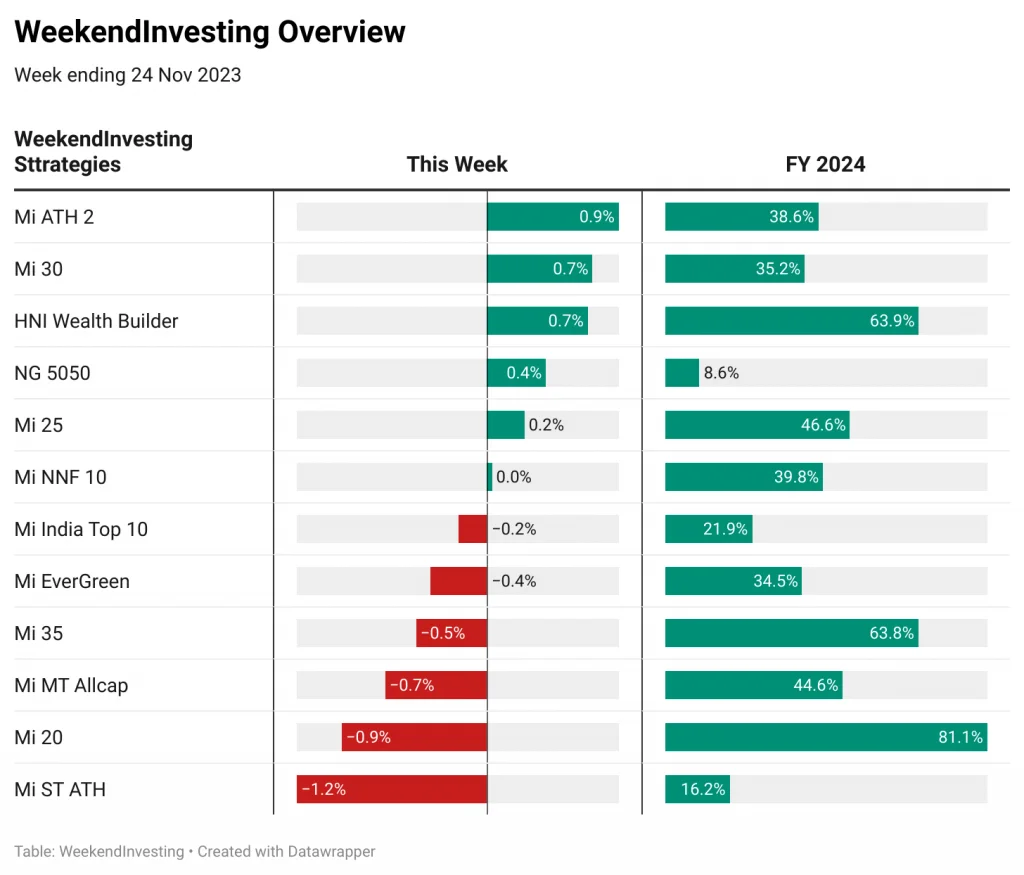

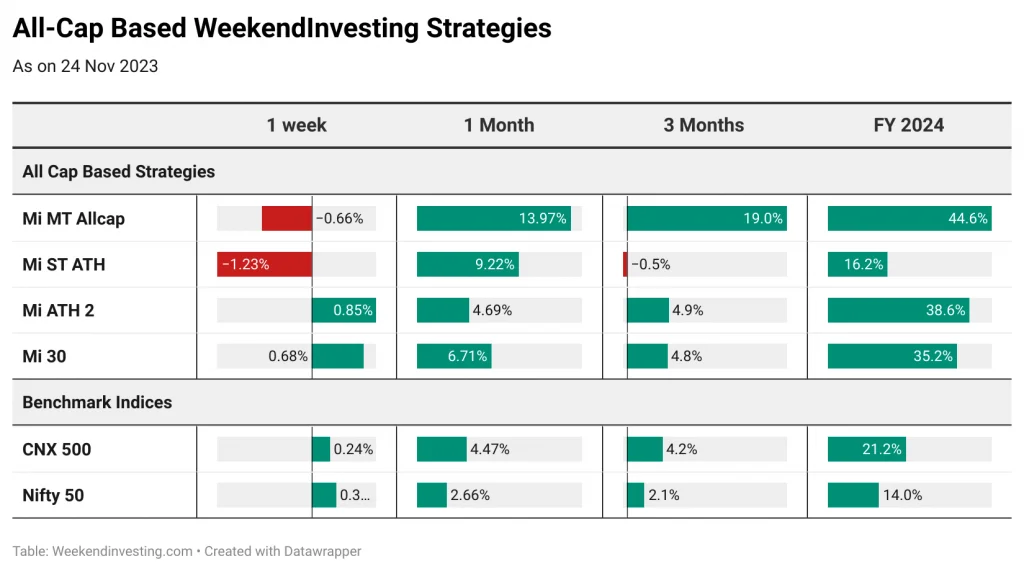

WeekendInvesting Overview

Some of the WeekendInvesting strategies did decently to stay in line with their respective benchmarks while the rest marginally underperformed. Mi 20 continues to remain robust with an exceptional 81% gains in the current FY 2024 followed by HNI Wealth Builder & Mi 35 at 63% gains each. It has been a remarkable year so far for almost all strategies barring Mi ST ATH which has lagged a bit.

SPOTLIGHT – Mi MT Allcap completes 5 glorious years of great performance

Mi MT Allcap has successfully completed 5 glorious years of exceptional performance in the markets !

Let’s take a journey through the last five years and see how the strategy has performed in different phases.

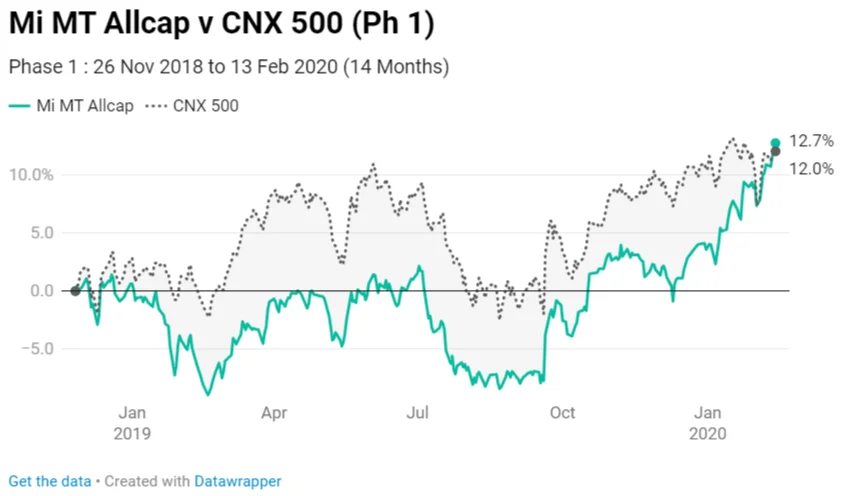

Phase 1: November 2018 – February 2020

In the initial phase, Mi MT Allcap underperformed for a brief period but made a strong comeback towards the end. Overall, it managed to largely meet the benchmark, achieving a return of 12% in this 14-month period.

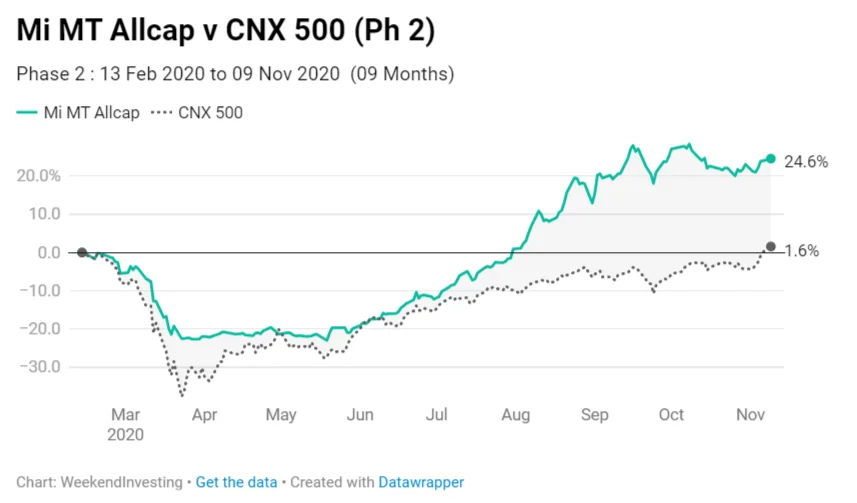

Phase 2: February 2020 – November 2020

This phase was marked by the COVID-19 pandemic, which caused a significant market correction. Mi MT Allcap, however, corrected much less than the underlying benchmark due to its dynamic cash allocation strategy. As the market recovered post-May 2020, the strategy outperformed the benchmark with an impressive return of 24.6% compared to just 1% by the benchmark.

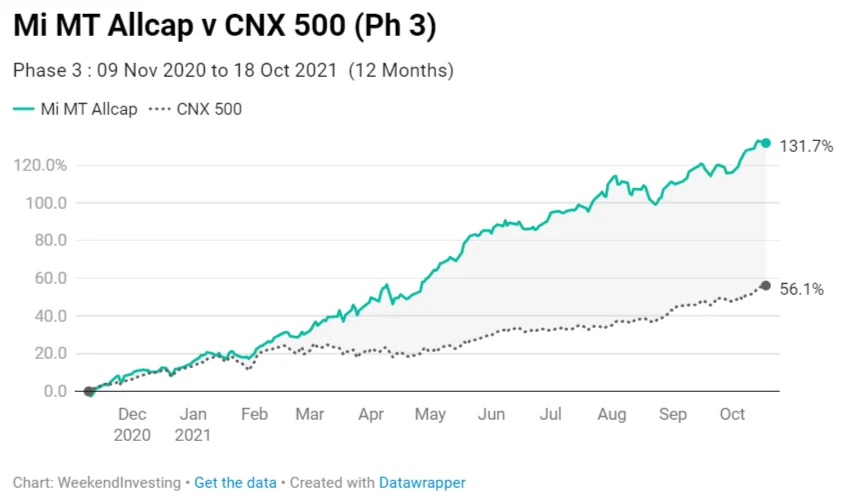

Phase 3: November 2020 – October 2021

This phase witnessed rapid market growth, and the strategy truly shined. The strategy achieved a remarkable return of 131% compared to the benchmark’s 56%. The pace at which it performed during this period was exceptional.

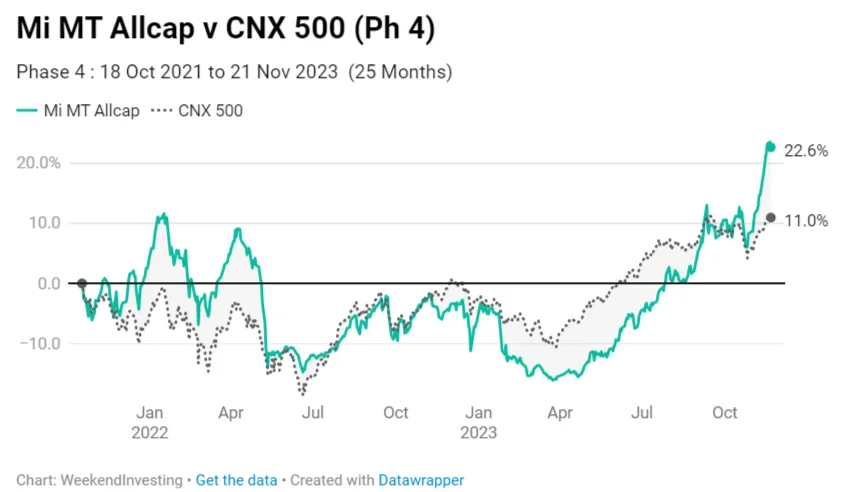

Phase 4: October 2021 – Nov 2023

Currently, we are in a consolidation phase, and while the strategy has performed well, it has not done exceptionally well so far primarily due to the lack of sustained uptrends. The phase is closing at a return of 22% compared to the benchmark’s 11%.

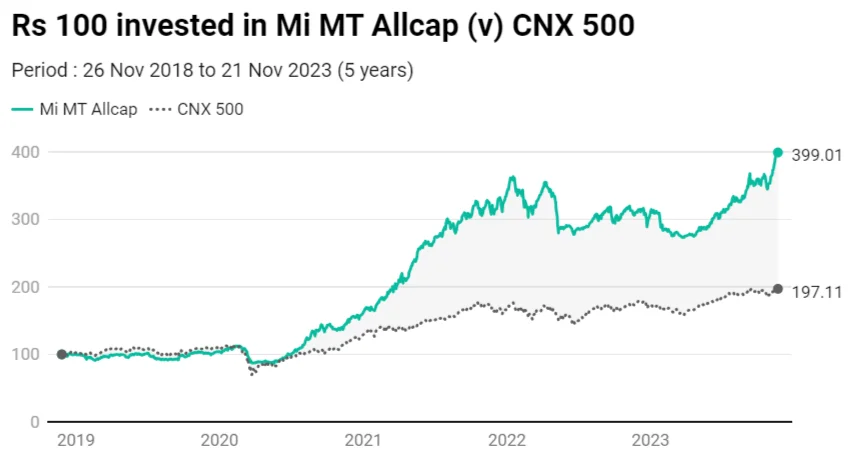

Looking at the overall five-year performance, it is evident that there were phases where Mi MT Allcap performed in line with the market, phases where it outperformed even during market downturns, phases of rapid outperformance, and phases of market-matching returns.

However, the power of compounding over time has resulted in impressive overall returns. If someone had invested ₹100, their investment would now be almost at ₹400 (4x gains), compared to the benchmark’s ₹197 (2x gains). This is a substantial beat over a five-year period.

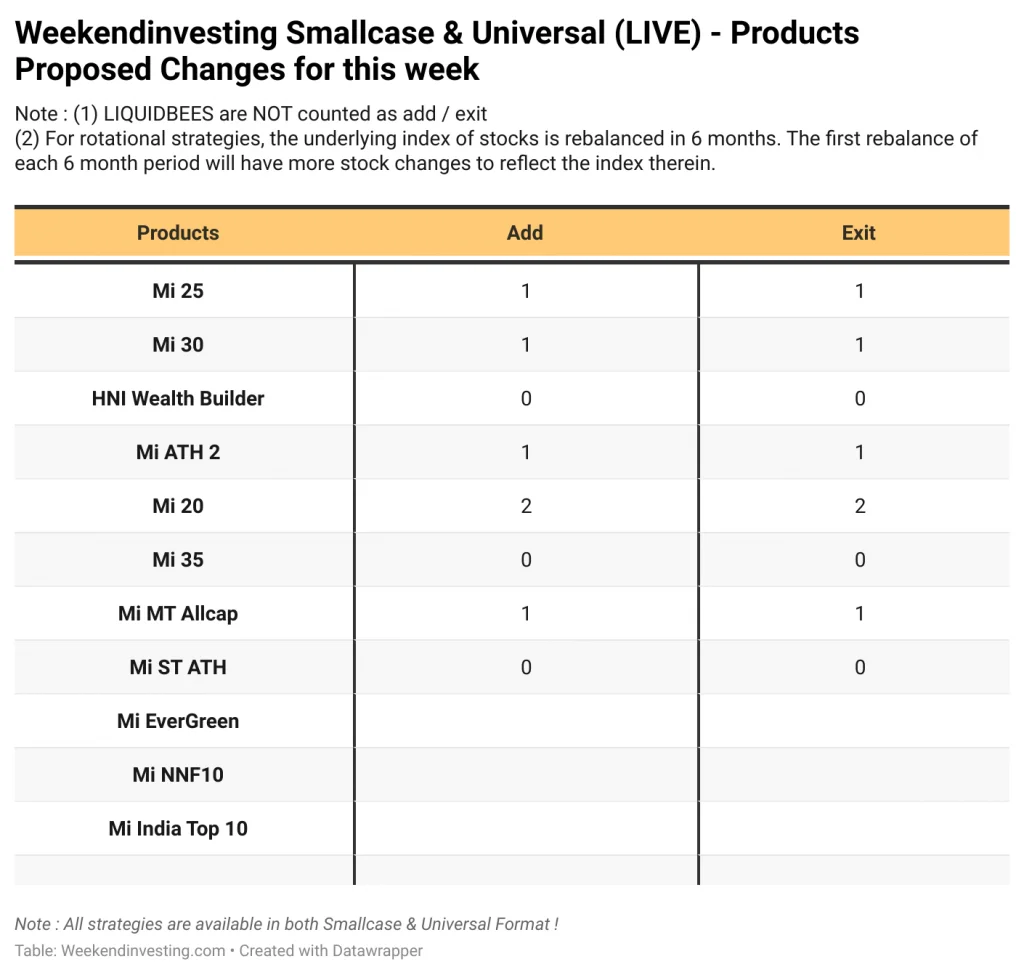

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst