The Good Bad and Ugly weekly review: 1 Nov 2023

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

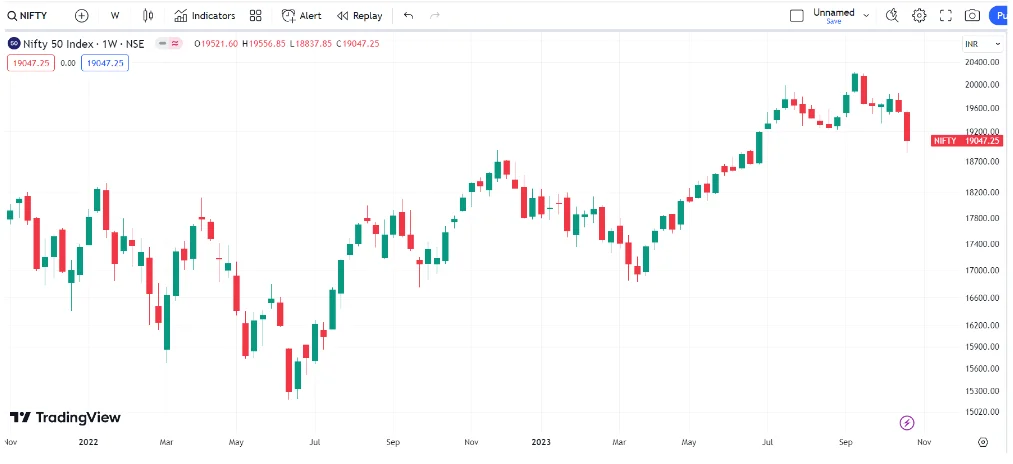

Markets this week

The market experienced significant volatility during the week, with sharp down days followed by a bounce. Nifty lost about 2.5% on the weekly chart. This decline broke the previous lows made three weeks ago and at the end of August, indicating a sign of weakness in the market.

There is uncertainty about how much the market will bounce back, but it is expected that the resistance will come around the 19000 level, which was broken down in the recent decline. The hope is that the market will consolidate for a few weeks before starting an upward trend. However, whether the bounce leads to higher highs and higher lows or another collapse remains to be seen.

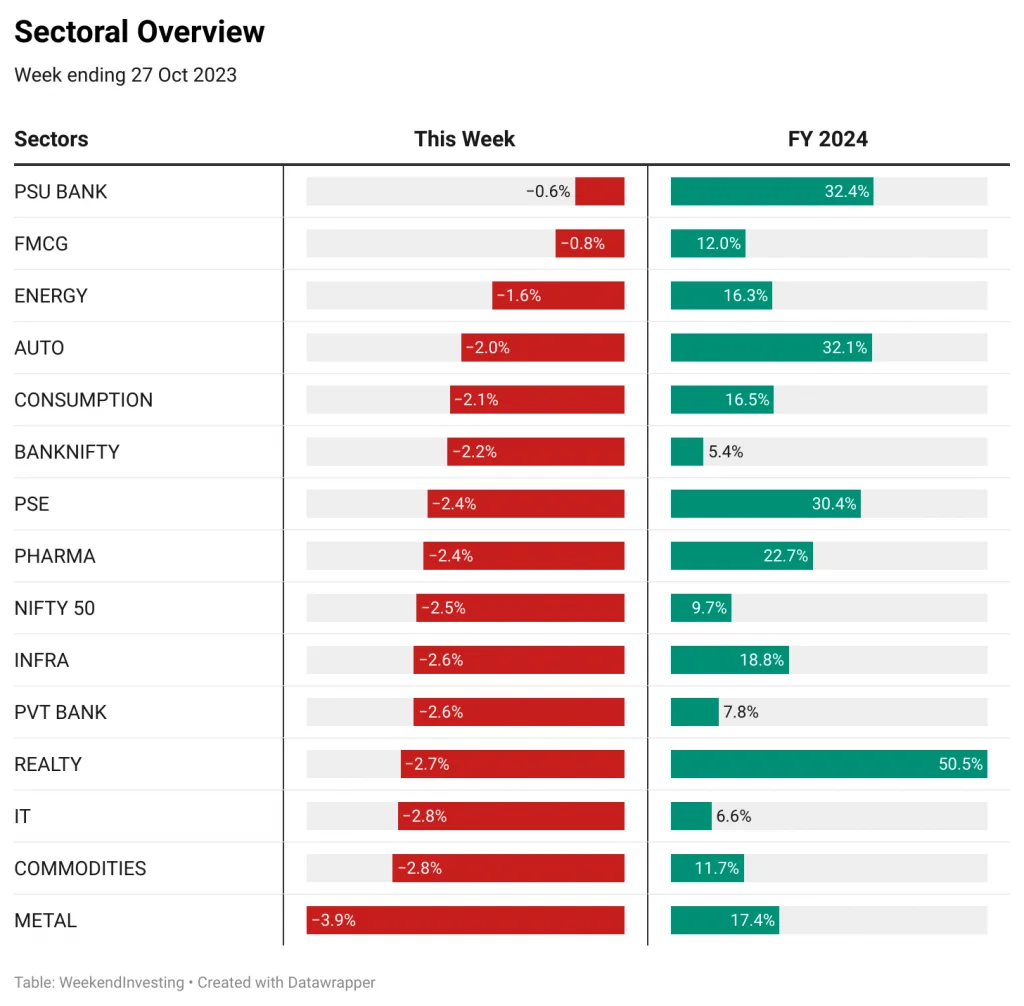

Sectoral Overview

In terms of sectoral performance, metals experienced the most significant loss at 3.9%, followed by commodities, IT stocks, real estate, private banks, infrastructure, pharma, public sector enterprises, consumption, auto, and energy, all of which lost around 2% to 3%. FMCG, the defensive sector, experienced a minimal loss of 0.8%, while PSU Banks made a sharp recovery on the last day to end the week with an overall loss of 0.6%.

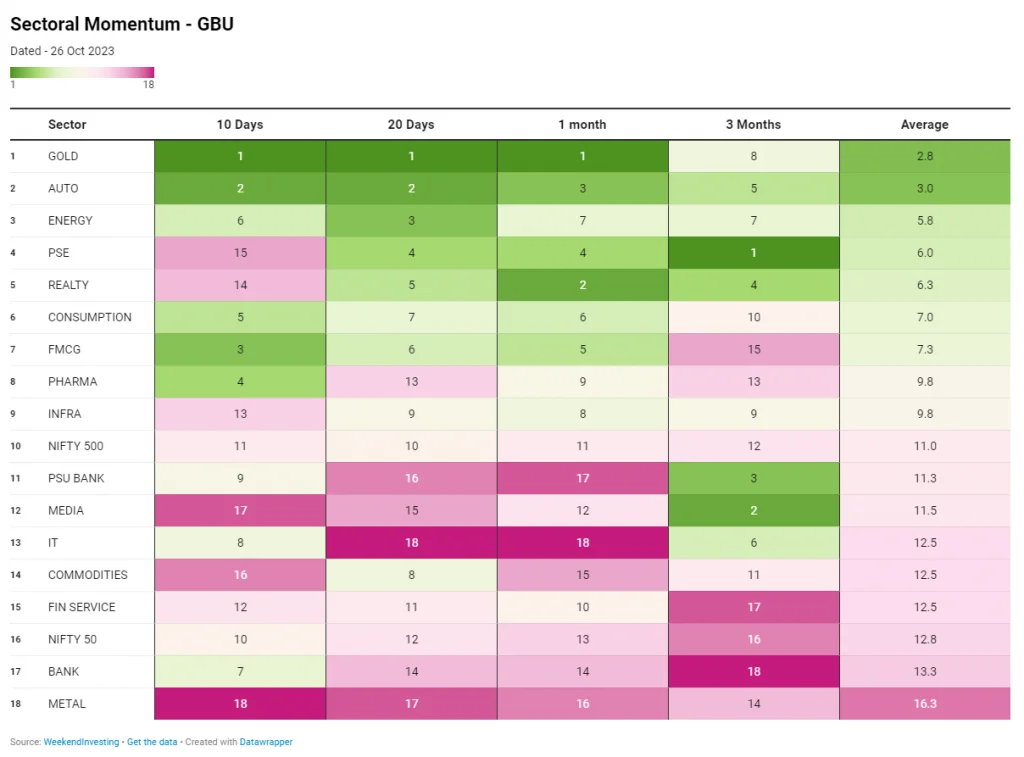

The sectoral momentum has shifted dramatically, with pharma, FMCG, and consumption stocks moving up in the ranks in the short term. Real estate and public sector enterprise stocks, which were previously performing well, have moved down in terms of momentum. Gold has also shown remarkable strength, closing above $2,000 for the first time since May 23. Autos are performing strongly, and Maruti’s recent results have confirmed the positive trend in the sector.

Financial services, private banking, and infrastructure sectors have lagged in terms of performance, while media is trying to recover from a downward trend. Metals have shown little movement.

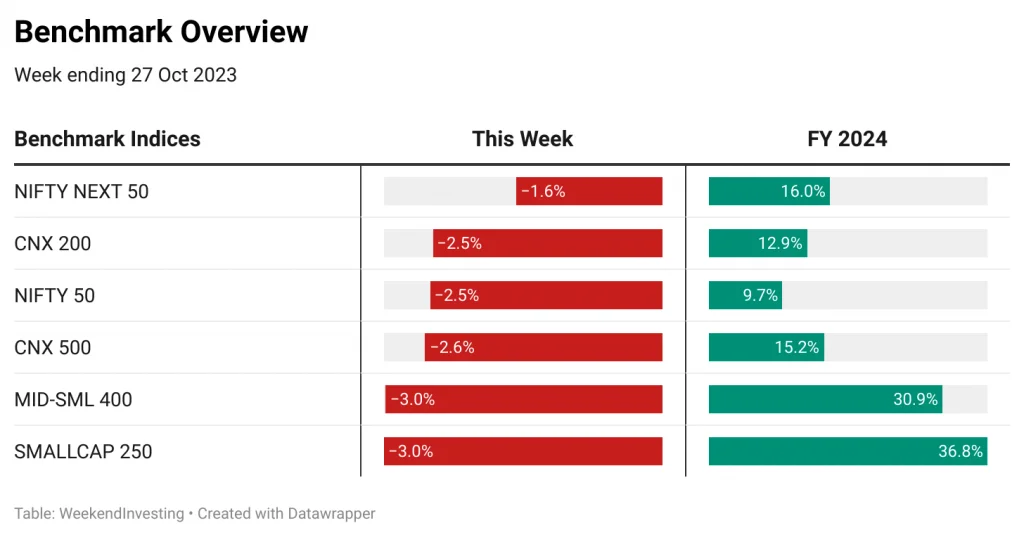

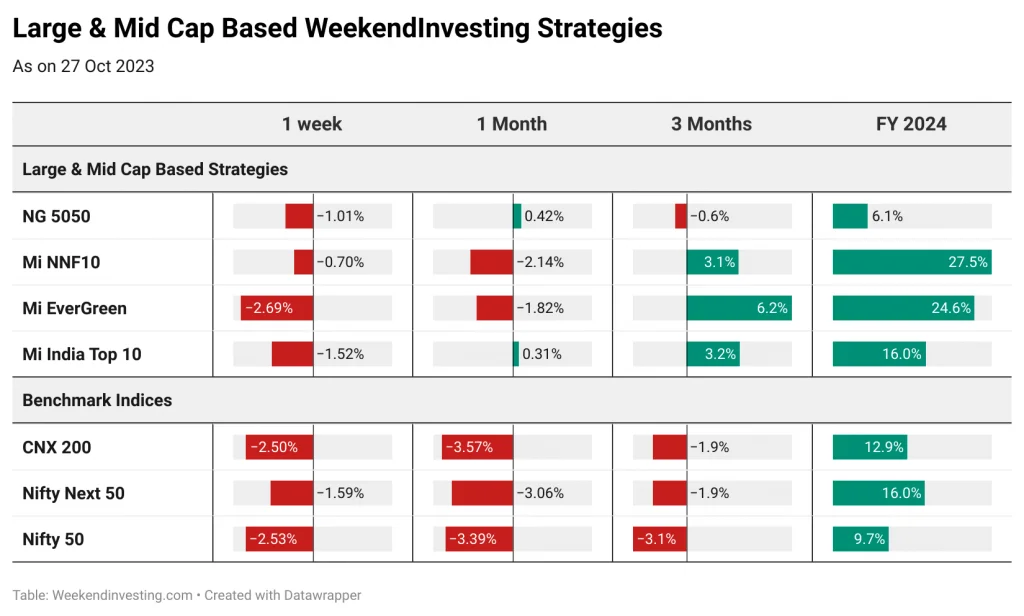

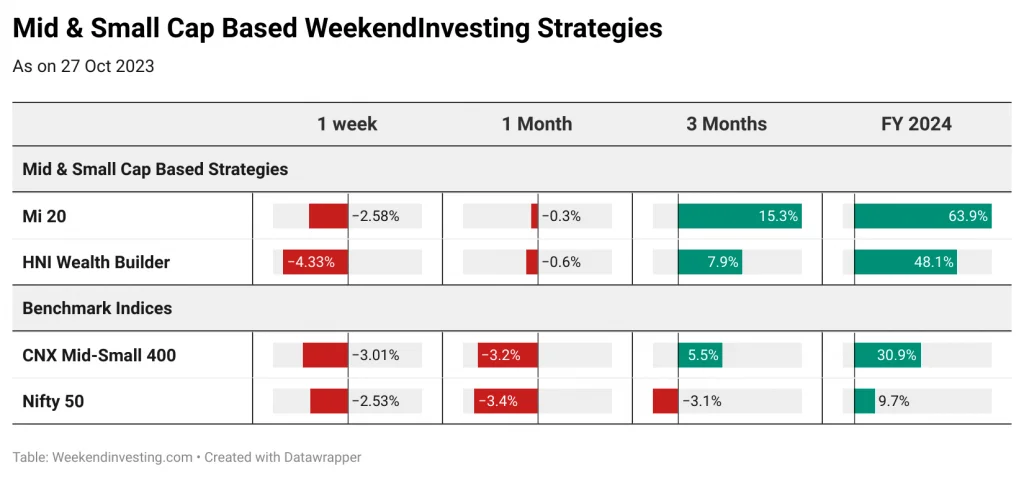

Benchmark Indices Overview

All benchmark indices were in deep red this week but the bounce on the last session would have provided some cushion to market enthusiasts. The fact that mid and smallcaps did not fall too bad in comparison to large caps also signifies that there may not be much of weakness heading forward but only time can answer this accurately.

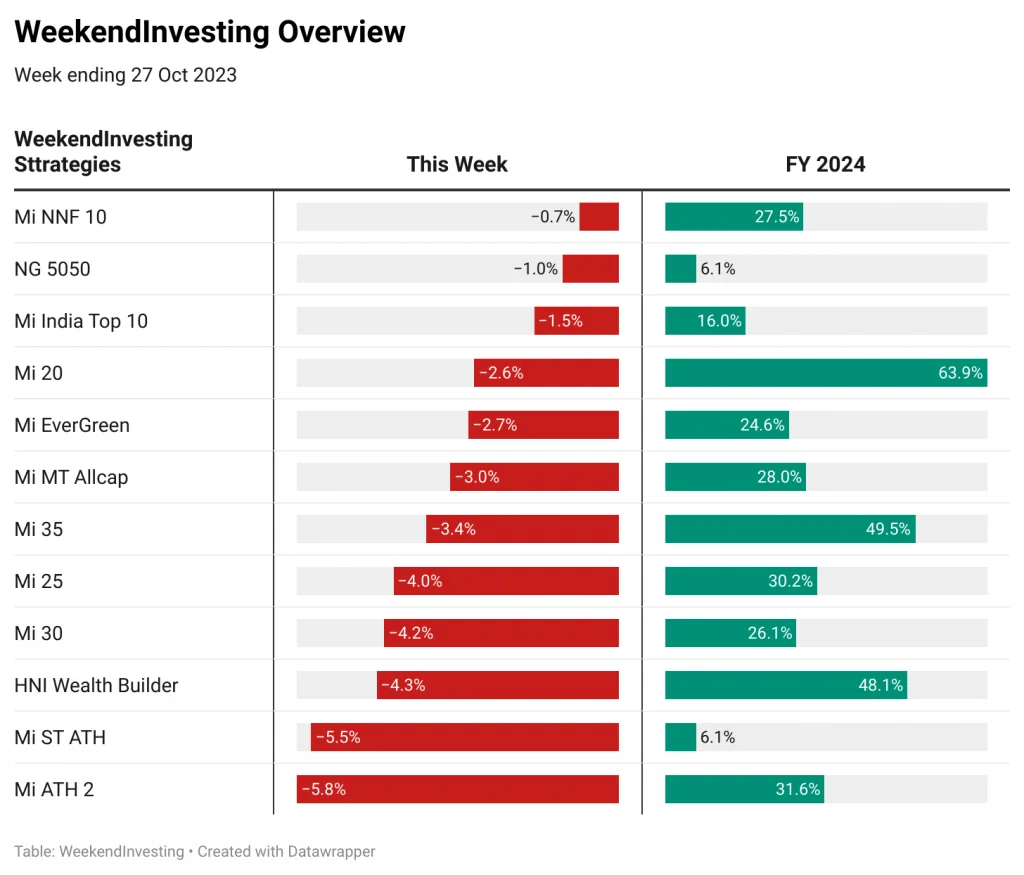

WeekendInvesting Overview

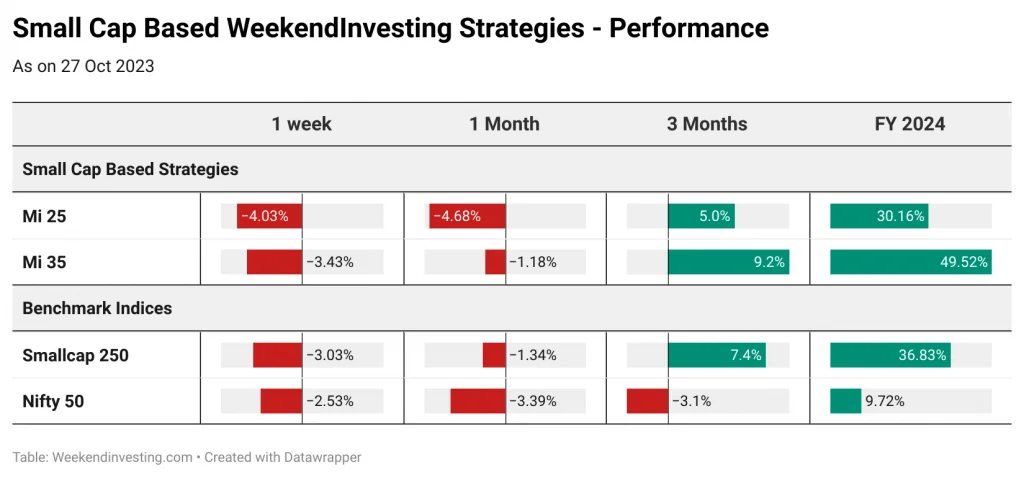

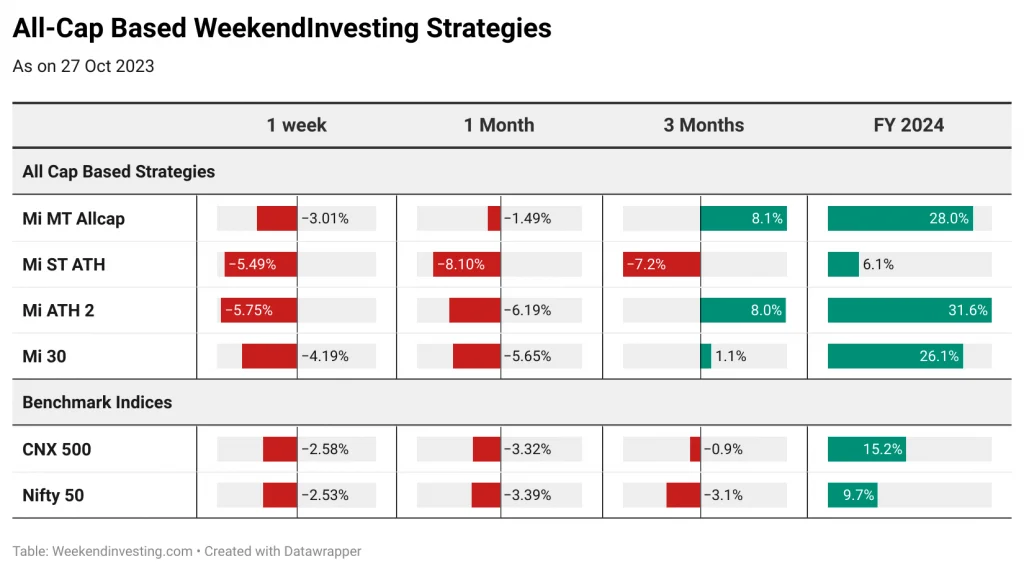

Several strategies have shown positive performance, with some outperforming the indices. Mi 20, Mi 35, Mi ATH 2, HNI Wealth Builder, and Mi 25 have all delivered impressive results, with returns ranging from 31% to 63% for the financial year. However, Mi ST ATH has lagged behind this year.

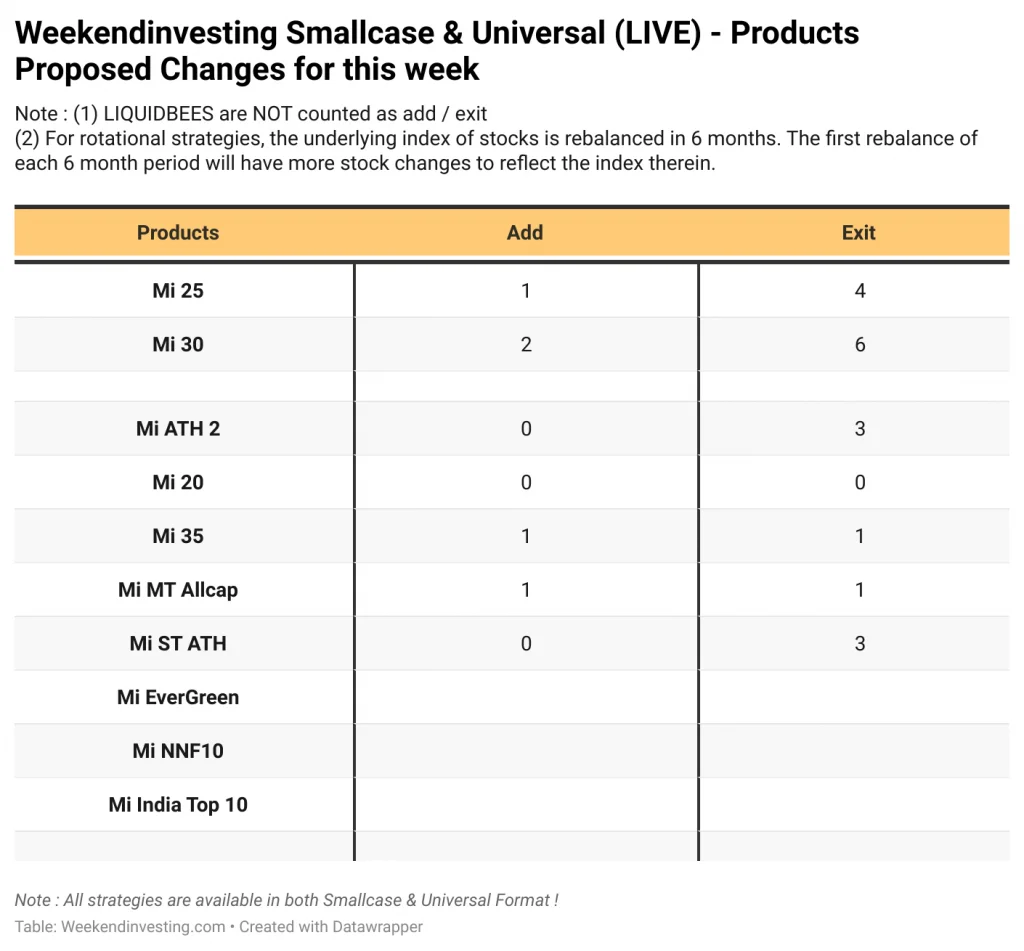

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst