The Good Bad and Ugly weekly review : 25 Apr 2023

After a brief run up, markets seem to have taken a pause around 17600 odd levels. Nifty has taken multiple supports at this level which happens to be the 200 DMA. Holding this level will be crucial for the markets if we are to witness a further up move in the days to come. 17800 is the next immediate resistance to watch out for.

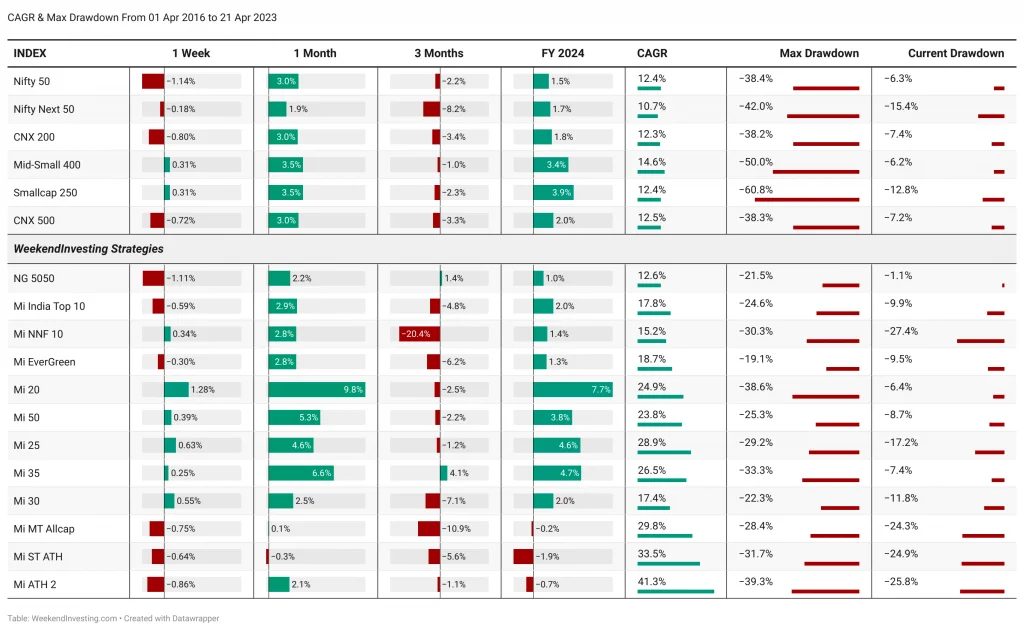

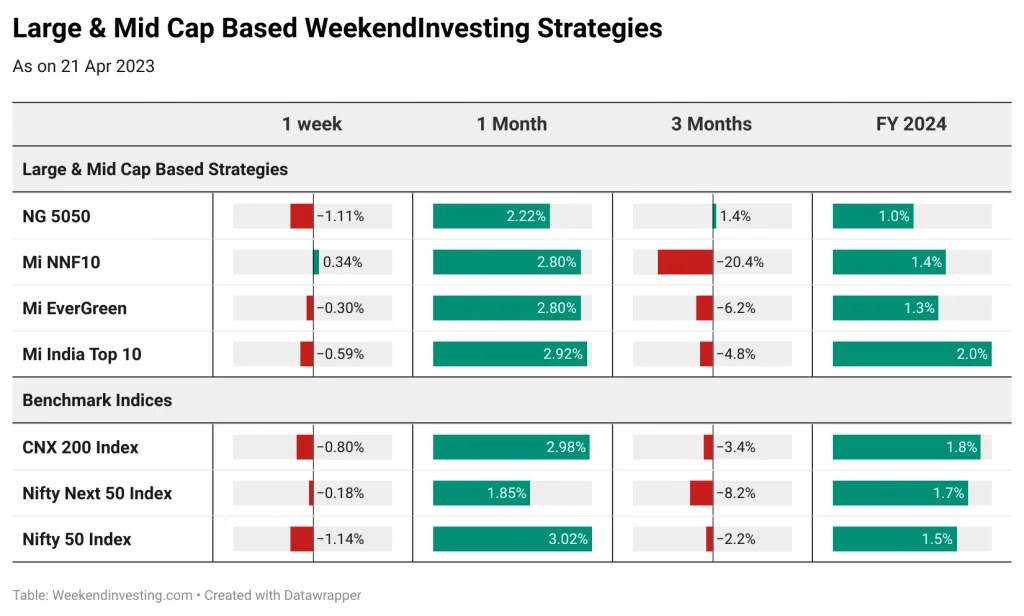

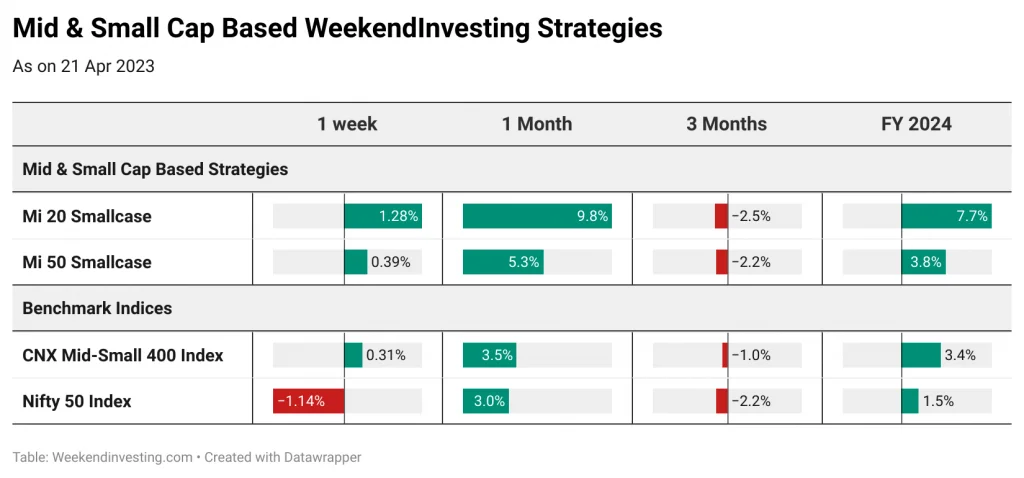

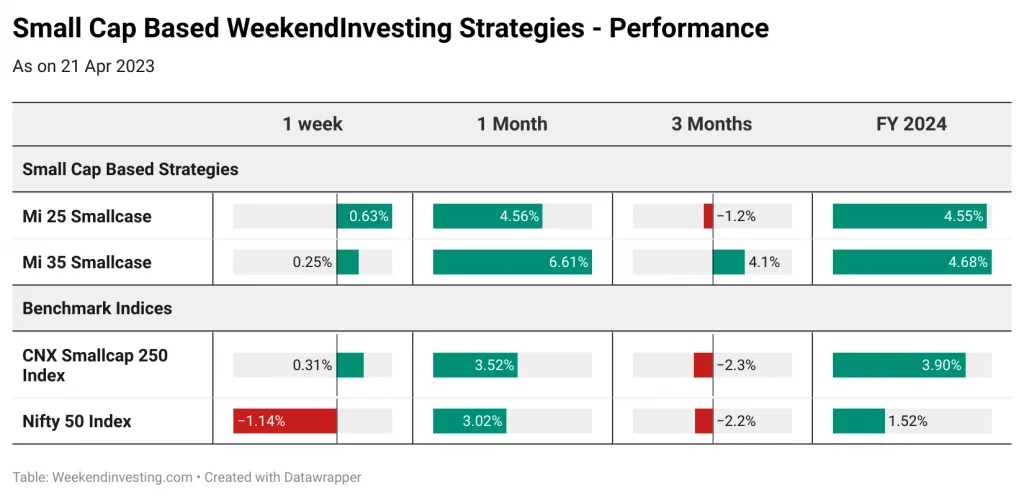

Performance across benchmarks was a bit contrasting with the likes of Nifty 50 , CNX 200 & CNX 500 down (-1.14%), (-0.8%) & (-0.72%) respectively while mid-small 400 & Smallcaps did relatively well to clock (0.31%) each. Mid & Smallcaps have, in fact led this uptrend clocking 3.9% this FY 24. We hope this FY turns out well !

PSU BANKS seem to have gotten back on their uptrend topping the weekly charts with 2% gains followed by FMCG at 1%. When you look at the FY 24 (last 3 weeks) REALTY has taken a strong lead at 9.3% followed by AUTO (5.35%) & PSU BANKS (4.5%).

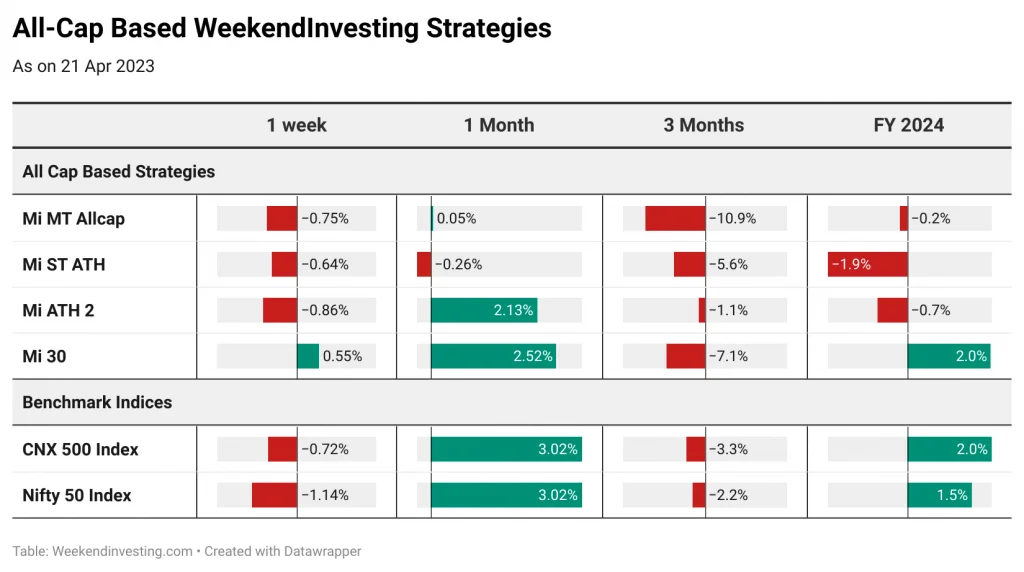

Mi 20 rode on the mid-caps rise clocking 1.28% this week while Mi 25, Mi 30 & Mi 50 also did well to clock about half a percent. Most other strategies mirrored their benchmarks. Mi 20 has topped the FY 24 chart clocking 7.7% followed by Mi 35 at 4.68% and Mi 25 at 4.55%. Happy start to the new FY.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

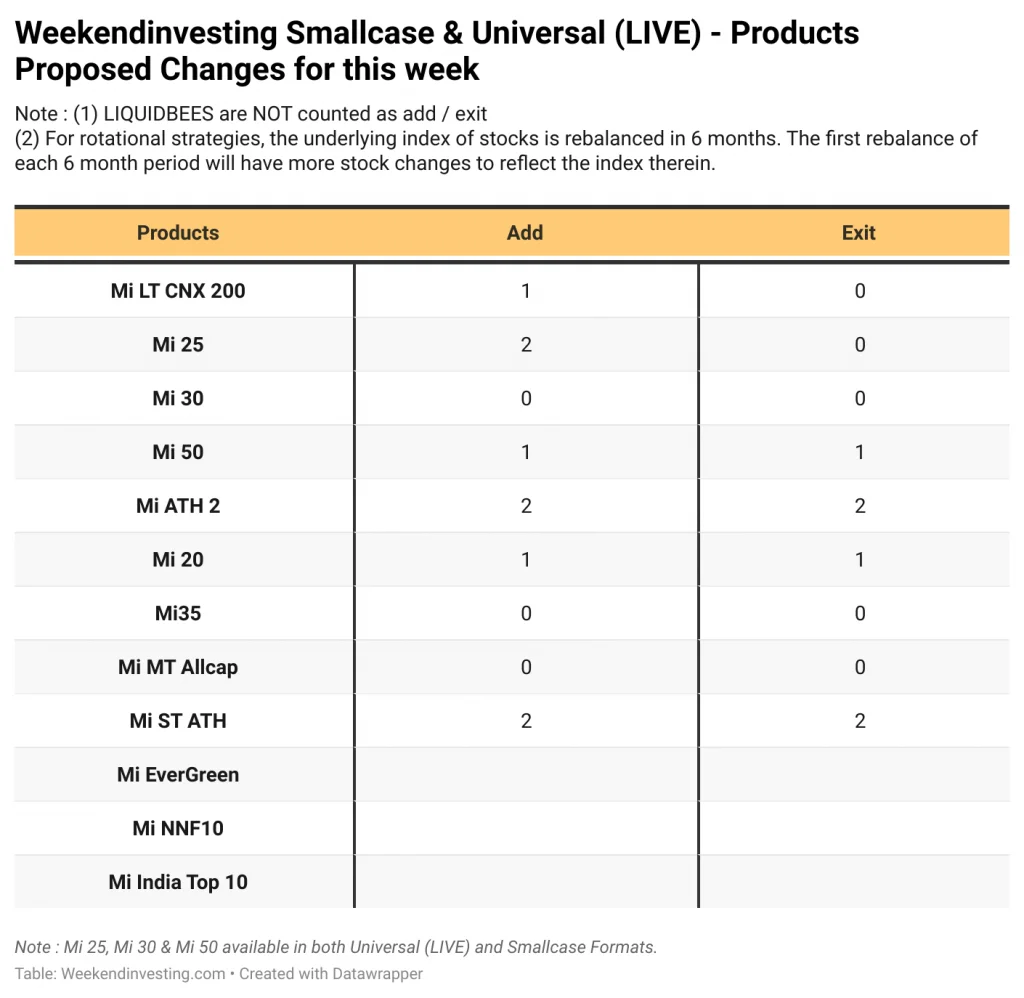

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count. The upcoming rebalance on 03 Apr 2023 will be a biannual rebalance where stocks are updated as per changing underlying indices and weights shall be recalibrated back to original weights as per the composition of the respective strategies (Mi20, Mi35, Evergreen specifically)

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Testimonials