The Good Bad and Ugly weekly review : 17 Oct 2023

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

From the Research Desk of WeekendInvesting

This week, we had several insightful stories from the research desk that covered a range of topics in the financial and investing world. In this blog post, I will provide an overview of some of the key stories and give you a glimpse into the trends and developments in the market.

One of the stories that caught my attention was about the ability to predict returns in ten years. The article questioned the thesis itself, raising doubts about the accuracy and reliability of long-term predictions. It emphasised the importance of being cautious when making decisions and highlighted the need for a comprehensive analysis of various factors.

Another interesting case study focused on Tata Elxsi and discussed the concept of opportunity costs and regrets. The study showed how small concentrated periods have contributed significantly to the returns over a 20-plus year period. It underscored the importance of identifying and seizing opportunities when they arise, rather than harbouring regrets later.

A thought-provoking article explored the possibility of a major interest rate downtrend in the near long term future. It analyzed various factors and speculated on the likelihood of interest rates dropping significantly in the future. Such a downtrend would have far-reaching implications for various sectors of the economy, making it an interesting topic for investors to dig into.

In light of the ongoing disruptions in industries due to technology advancements, AI, and consolidation, another story focused on the survival of the fittest in the corporate world. It discussed how companies are experiencing much faster turnovers, with the average number of companies lasting for shorter durations. This highlights the need for companies to adapt and innovate to stay competitive and relevant in today’s fast-paced business environment.

For those interested in gold as a long-term investment, a technical study provided insights into the best time to buy gold. It highlighted specific indicators that suggested a high probability of a price jump in gold. Interestingly, the study’s predictions aligned with recent market movements, demonstrating the value of technical analysis in determining investment opportunities.

On the occasion of the Disney Company completing 100 years in existence, a case study examined its performance in the markets. It delved into the company’s journey, its growth, and its impact on investors over the years. Disney’s sustained success serves as an inspiring example for long-term investors.

Hindsight is always 2020, as the saying goes. We wrote an article echoing this sentiment and discussed how we tend to look back and speculate about what we could have done differently in the past. It emphasized the need to focus on the present and make well-informed decisions based on available information rather than dwelling on past regrets.

In terms of market trends, there were indications that interest rates may be topping at least in the short and medium term. This development could have implications for various sectors and investment strategies, making it a topic worth monitoring for investors.

The market’s unpredictable nature was also highlighted in a couple of stories. The US markets were near oversold territory before experiencing a bounce, showcasing the volatility and surprise elements inherent in the market.

Markets this week

If we analyze Nifty’s performance comparing it with the previous week’s close, we initially had a down move and then witnessed a support emerging around 19480 levels which was a crucial one to look out for. Further Nifty continued on the bounce before finally consolidating in the last two sessions of the week.

Analyzing the weekly chart, we noticed a long legged candle lastf week which probably indicating the end of the short term bearishness. The current week candle was a good follow up breaking above the high of last week’s candle.

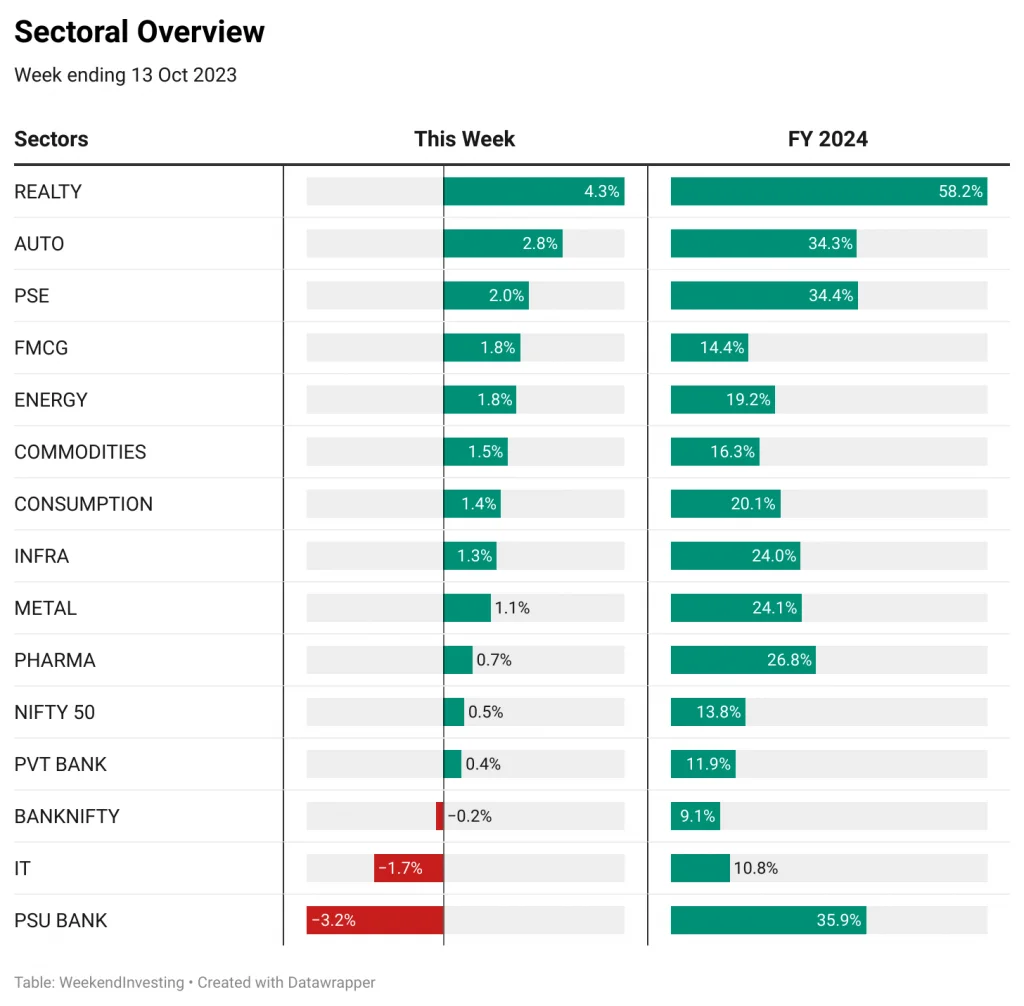

Sectoral Overview

In terms of sector performance, real estate emerged as the standout industry, gaining 4.3% during the week. Autos, public sector enterprise stocks, FMCG, energy, commodities, and consumption stocks also showed positive gains. On the flip side, PSU banking space and pharma stocks experienced declines during the week.

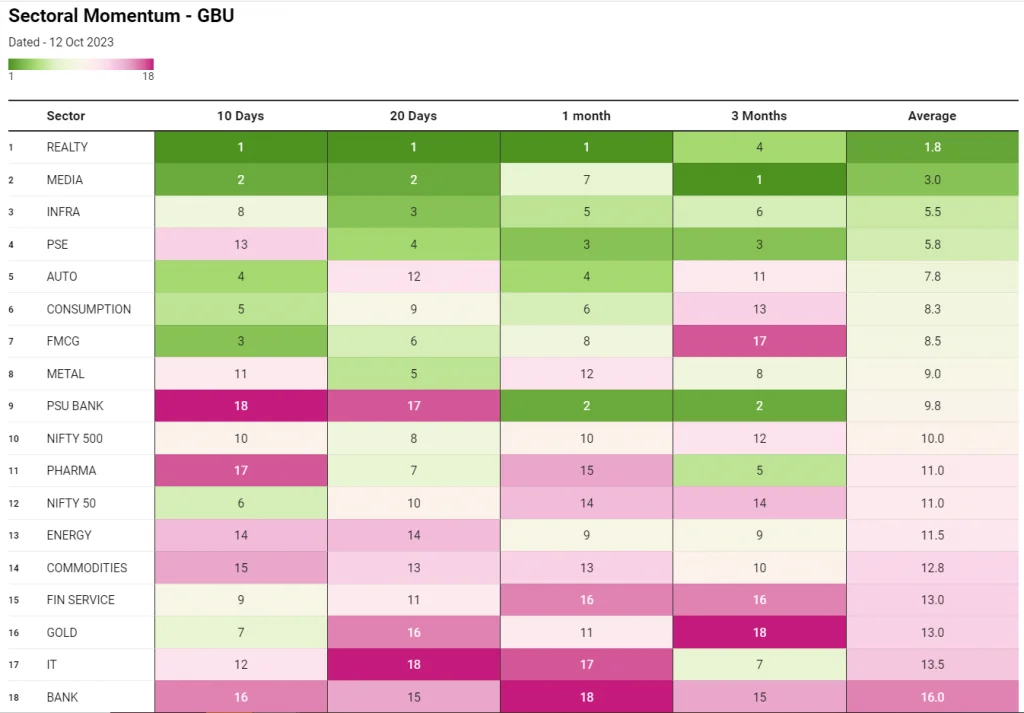

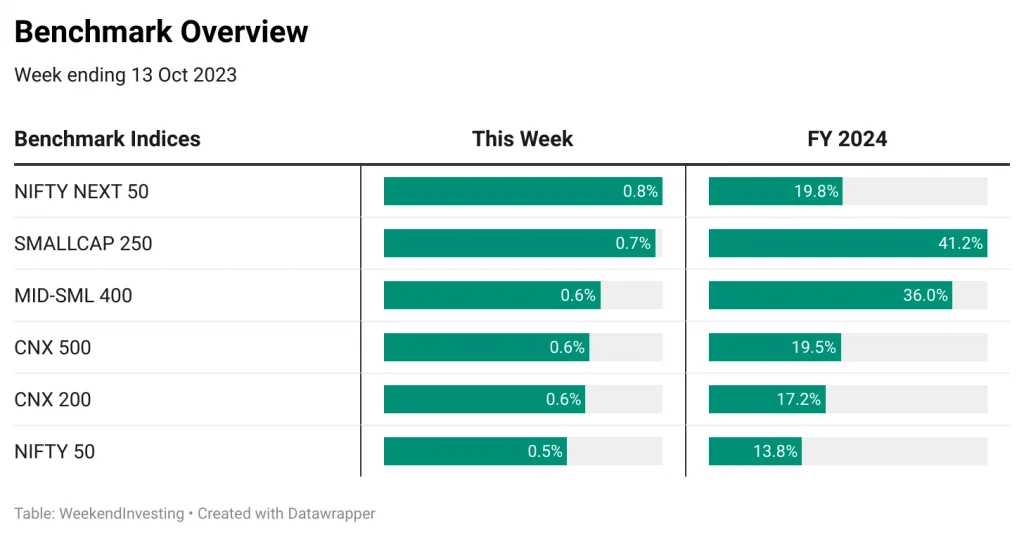

Real estate has been on a blockbuster run leading the momentum ranking charts. This sector has clocked about 58% this FY 24 which is astounding. Media and Infra occupied the second and third positions having dislayed good momentum in the last 90 odd days.

Benchmark Indices Overview

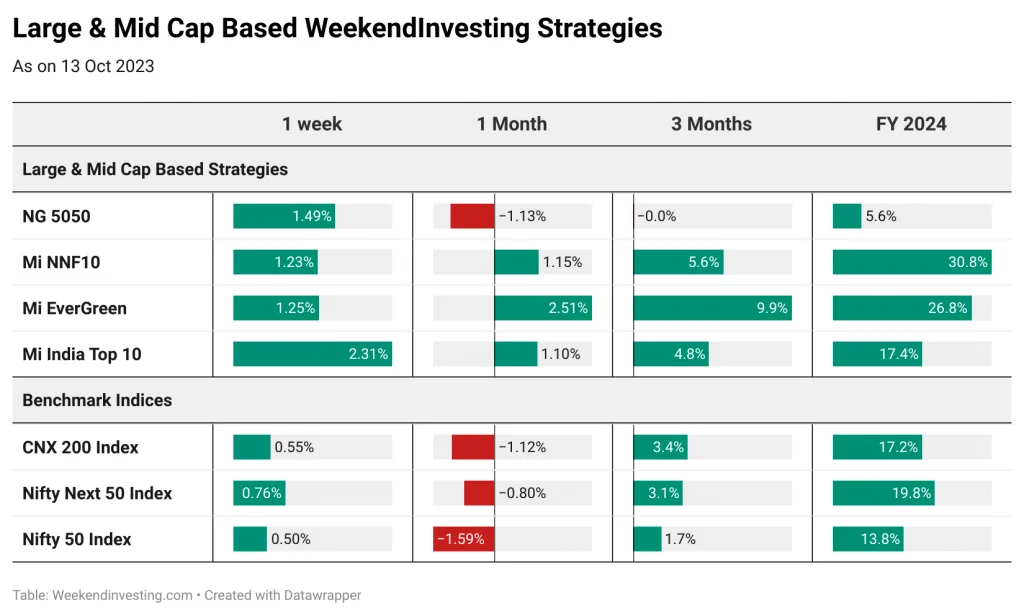

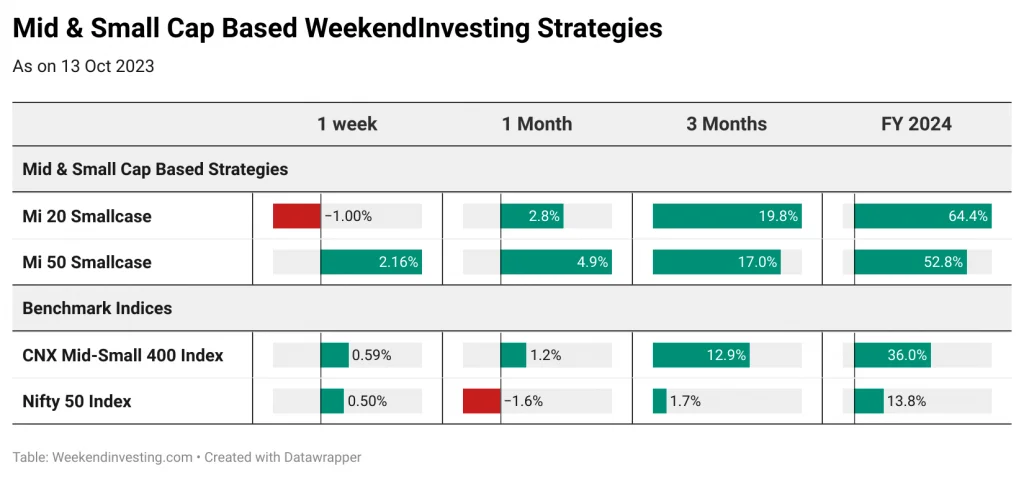

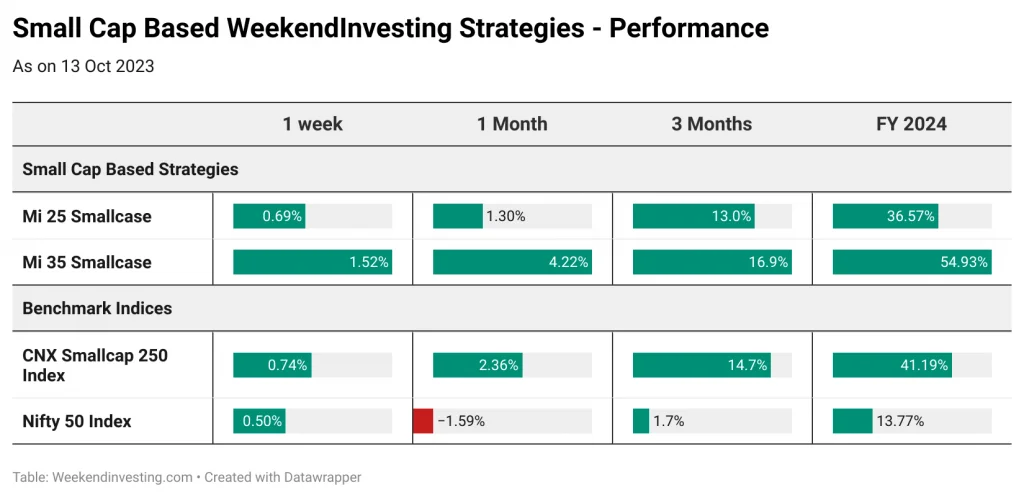

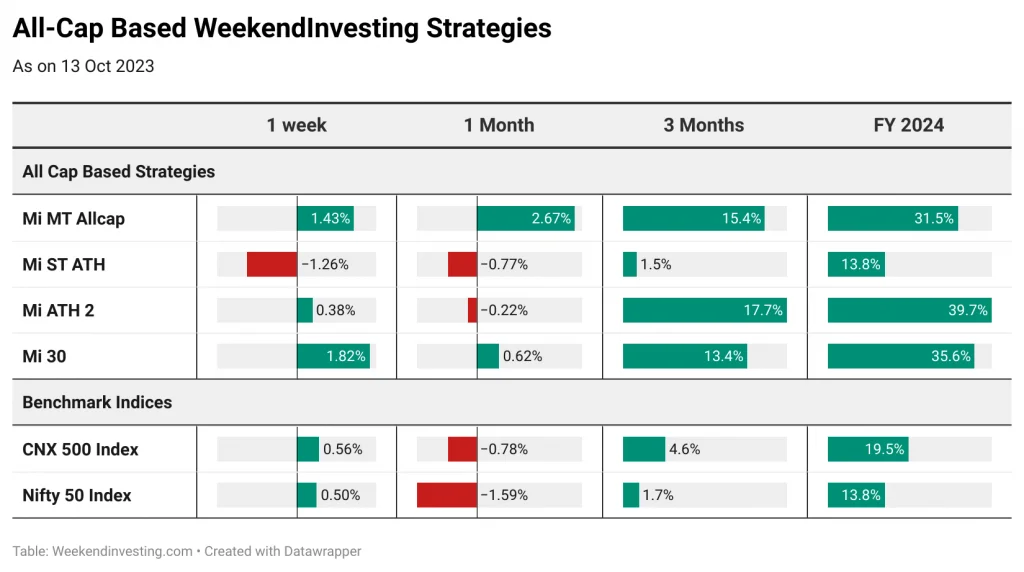

Looking at the broader market overview, Nifty 50 index was up by half a percent, while the CNX 200, CNX 500 Mid-small 400 and small-cap 250 indexes all experienced similar gains of 0.6%. The mid and small-cap segments didn’t outperform the large-cap segment significantly during the past week.

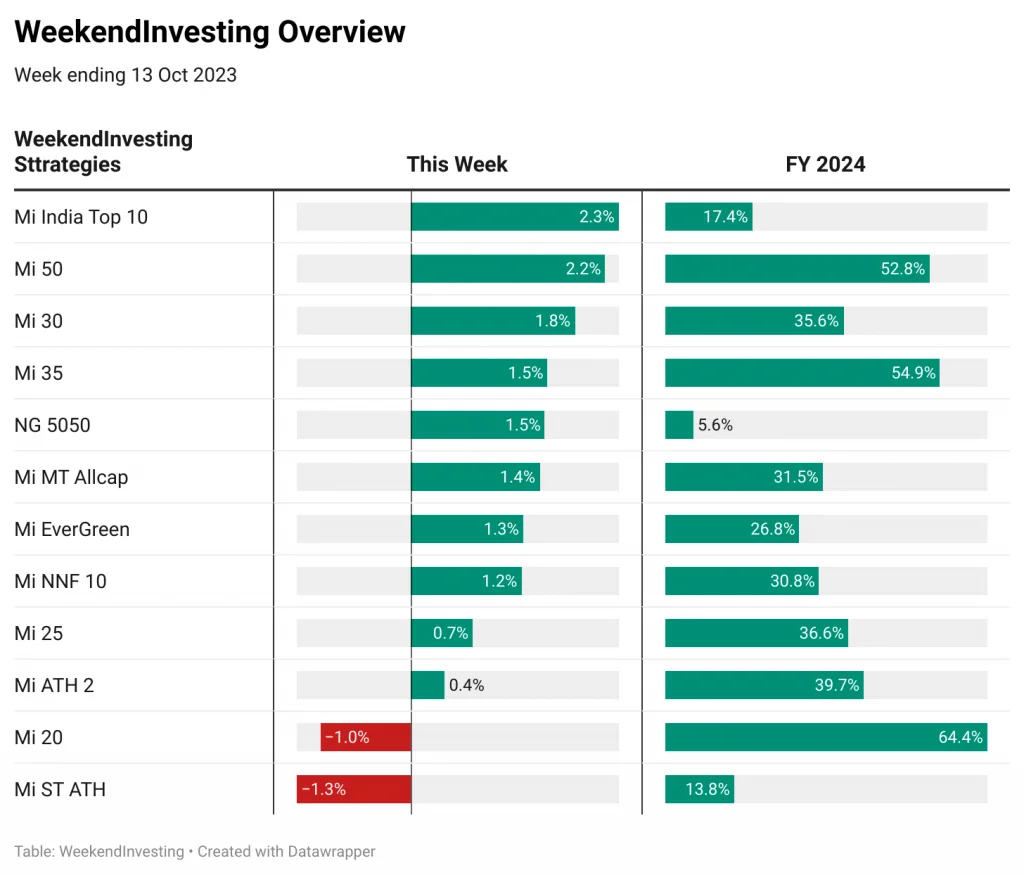

WeekendInvesting Overview

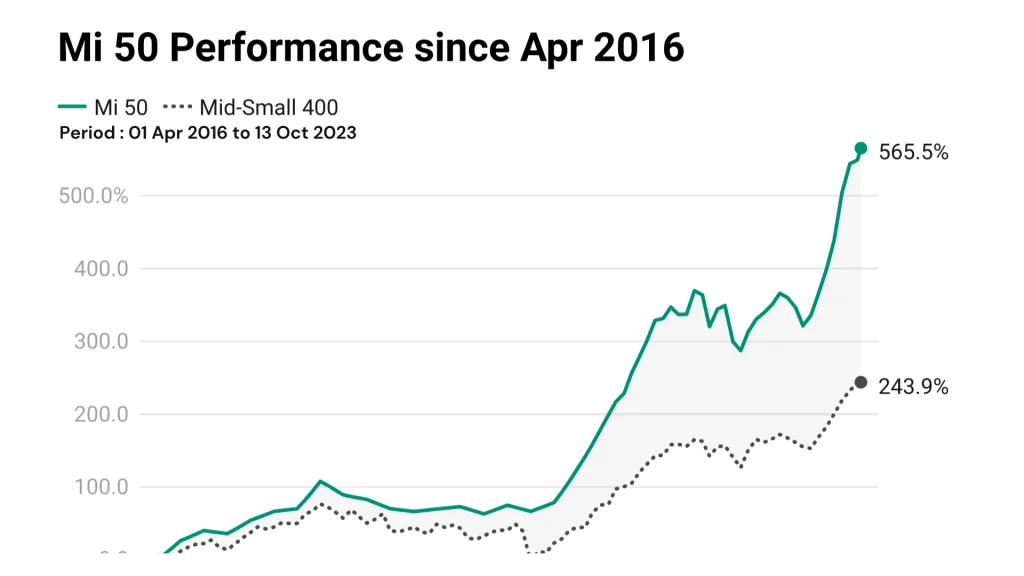

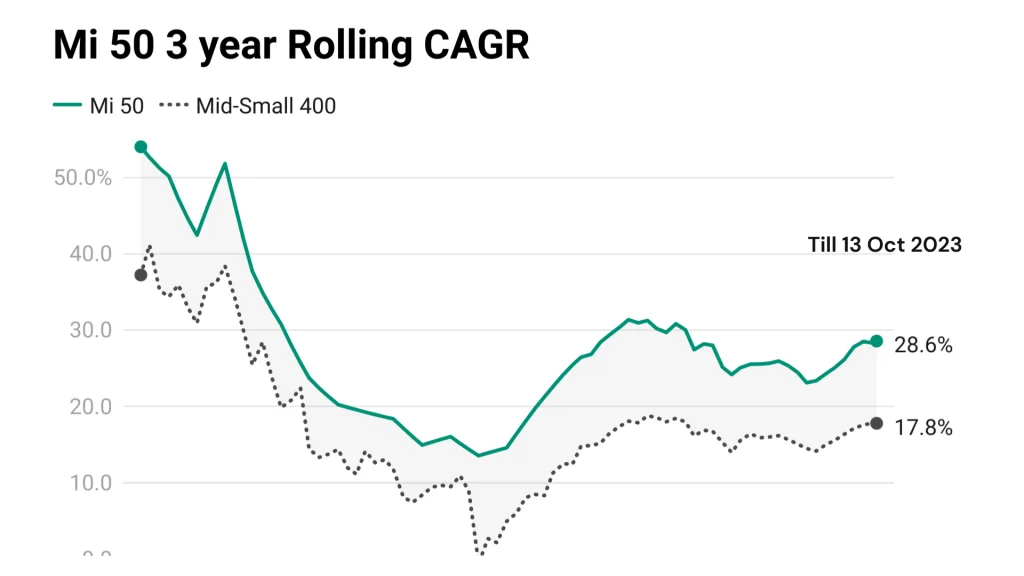

Examining the performance of various strategies, Mi India Top 10 and Mi 50 stood out with gains of 2.3% and 2.2% this week respectively. These strategies have consistently delivered strong results and showcased their potential for generating substantial returns over time.

Spotlight – 2x bagger on Prakash Industries in Mi 50

Prakash Industries has seen a remarkable rise clocking almost 100% gains within 2 months time. We had entered the stock on 04 Aug 2023 at Rs 93 and the stock is currently trading at Rs 183 becoming adding another multibagger to Mi 50. It is important to note that not every stock will experience such significant gains. The key is to build a structured portfolio with a mix of stocks and carefully manage risk to maximize overall returns.

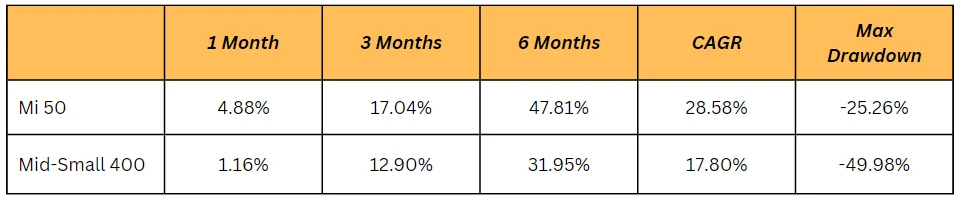

Mi 50 – Performance

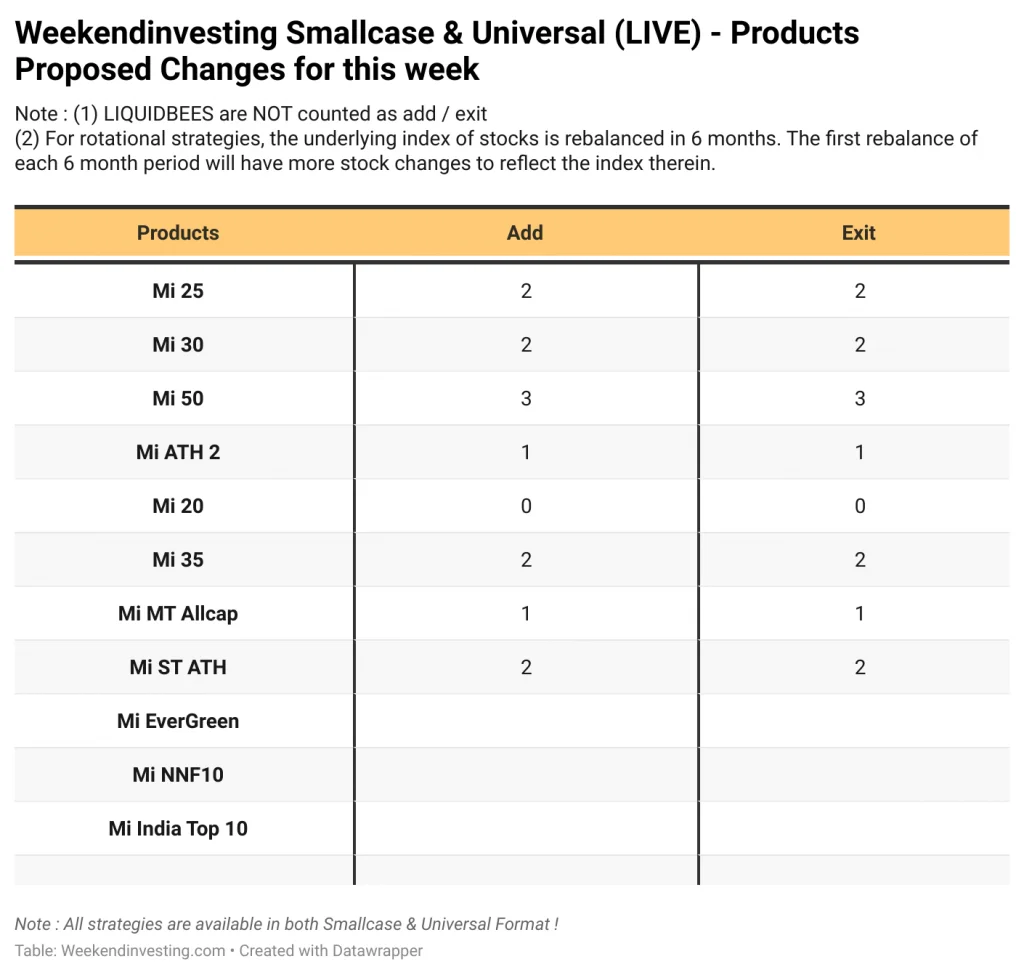

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst