The Good Bad and Ugly weekly review : 16 Jan 2024

Markets this week

Nifty 50 experienced a slight dip at the beginning of the week but quickly rebounded in the last two days, reaching an all-time high. The index has been consistently strong for the past ten to eleven weeks since hitting its bottom in October, indicating a positive trend.

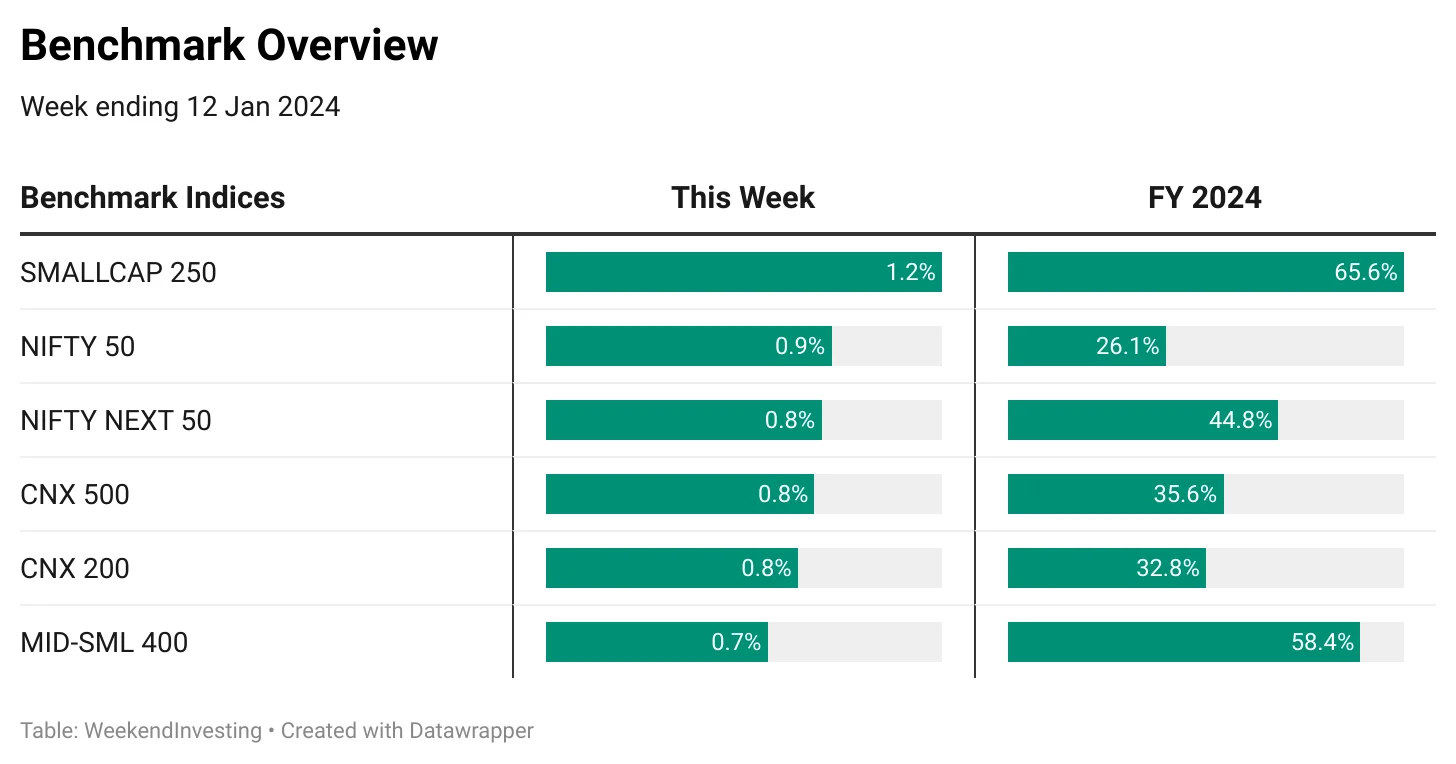

Benchmark Indices Overview

In terms of benchmark indices, the Nifty gained 0.9%, while small caps, Nifty Next 50, CNX 500, CNX 200, and mid and small cap 400 also made gains ranging from 0.7% to 1.2%. Notably, the small-cap stocks have been performing exceptionally well, outperforming the benchmark indices by wide margins. The Nifty Next 50, a large-cap oriented index, has also surprised with its impressive performance, exceeding the CNX 500 and CNX 200.

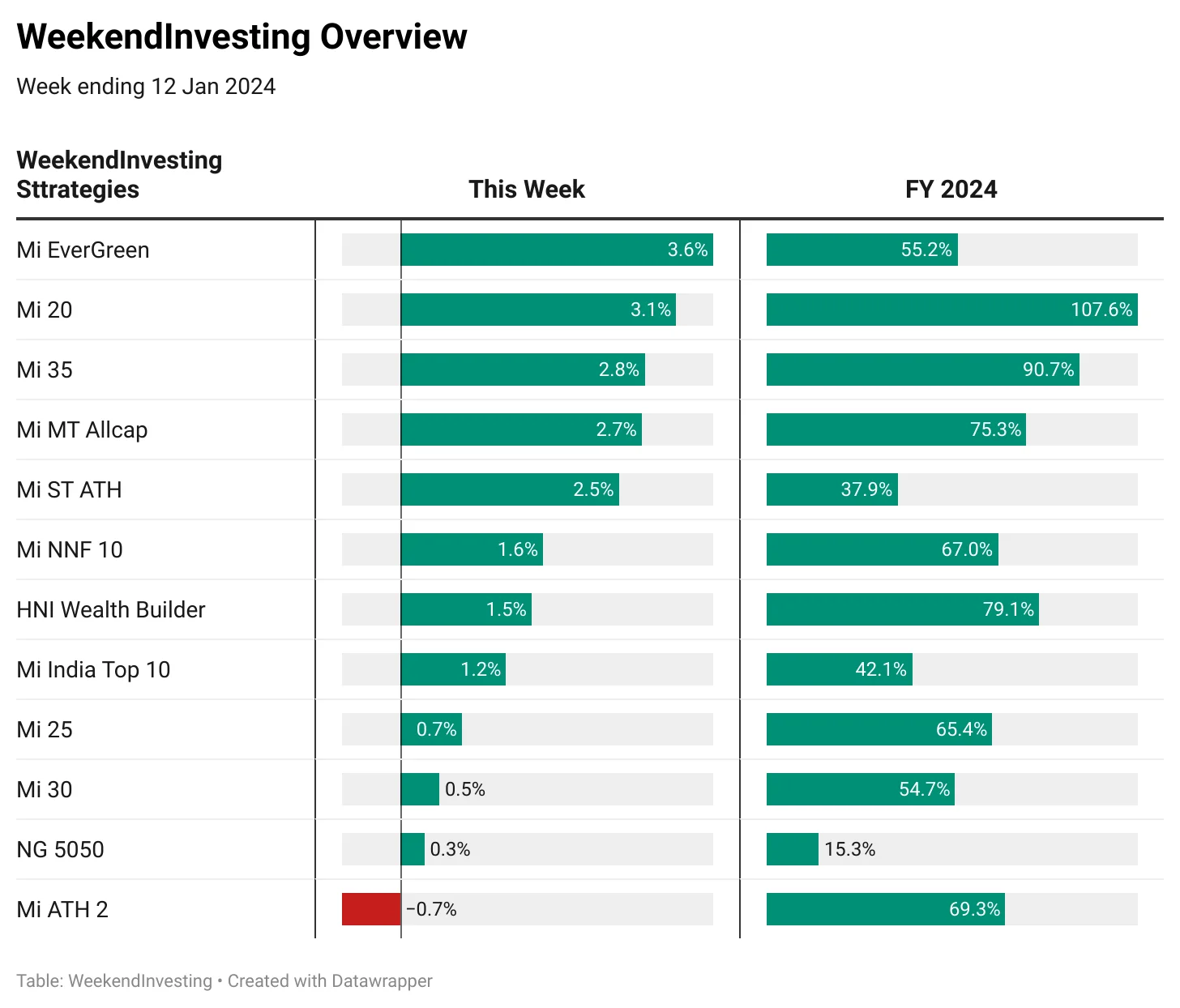

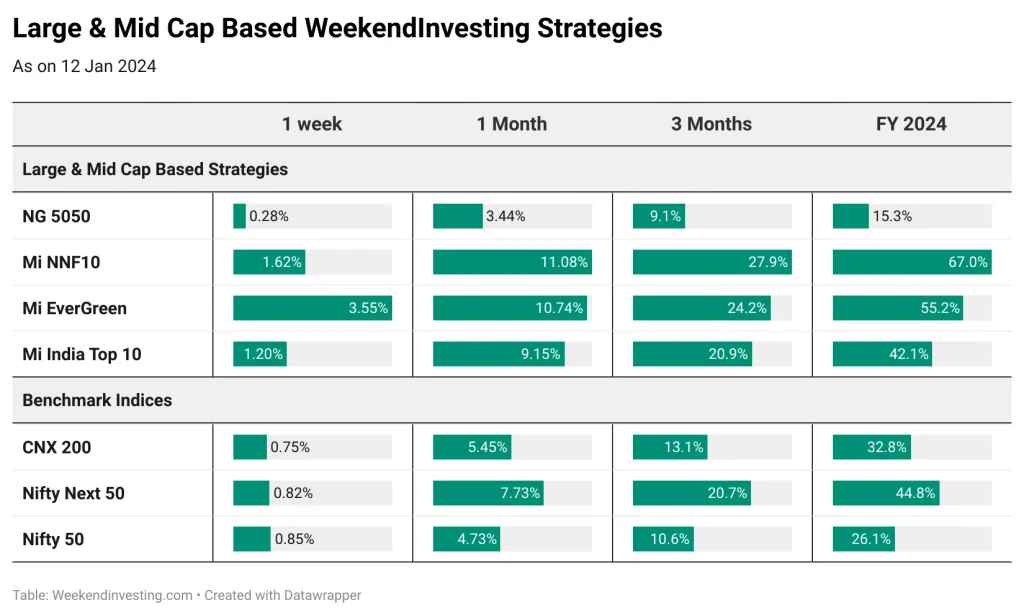

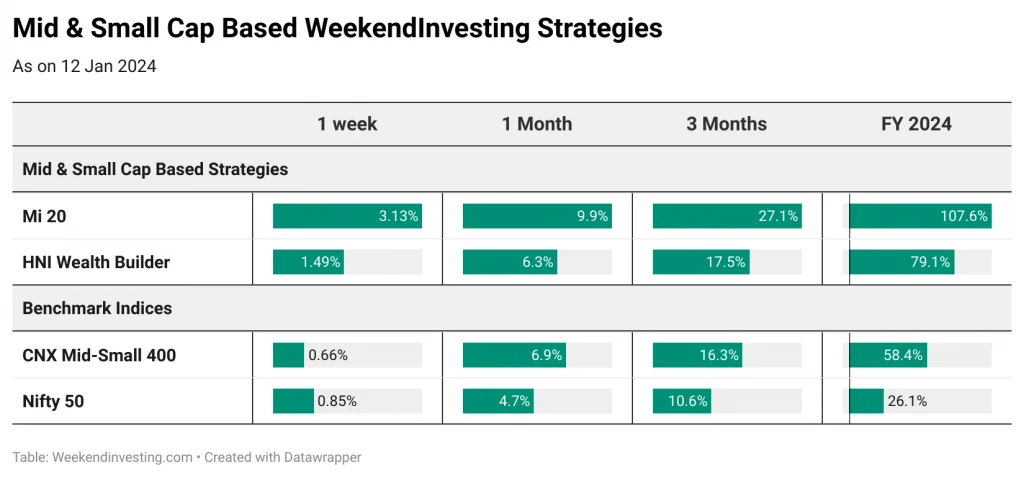

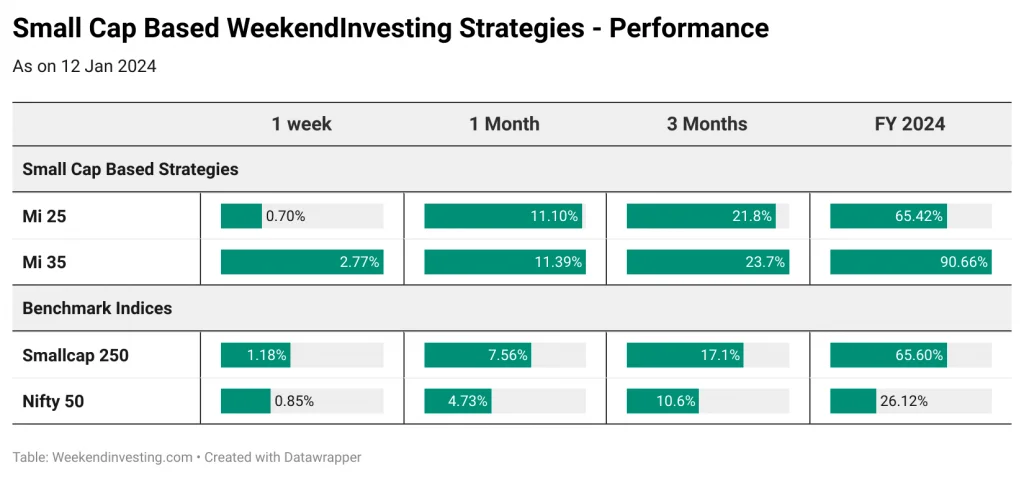

WeekendInvesting Overview

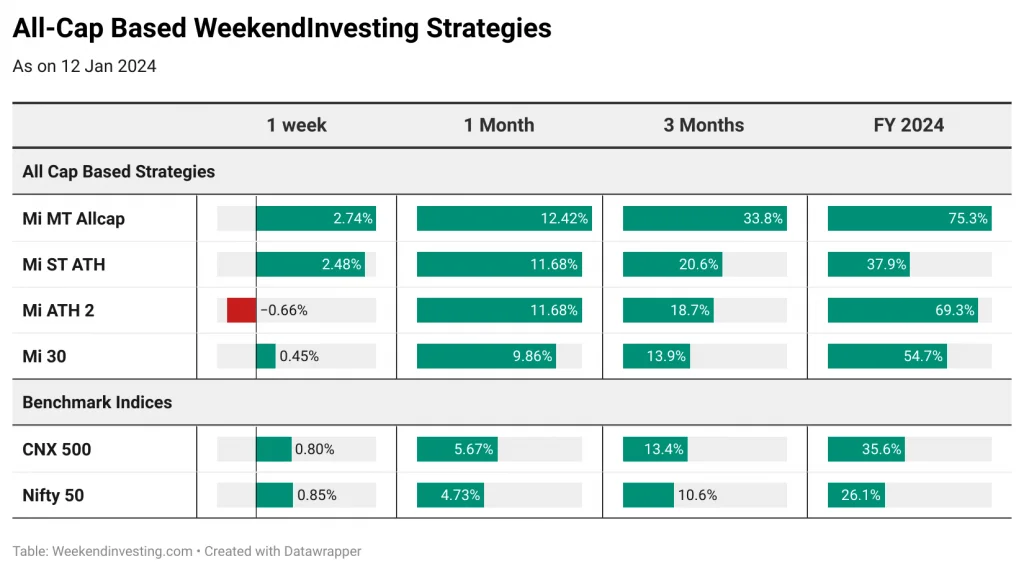

Several strategies and sectors also displayed noteworthy performances. Mi Evergreen and Mi 20 experienced significant boosts, gaining 3.6% and 3% respectively. The Mi 35, Mi MT Allcap, and Mi ST ATH were not far behind, registering gains ranging from 2.7% to 2.8%. It’s interesting to observe how the returns of certain strategies, like the Mi MT Allcap, can vary significantly from year to year, highlighting the lumpy nature of returns in the market.

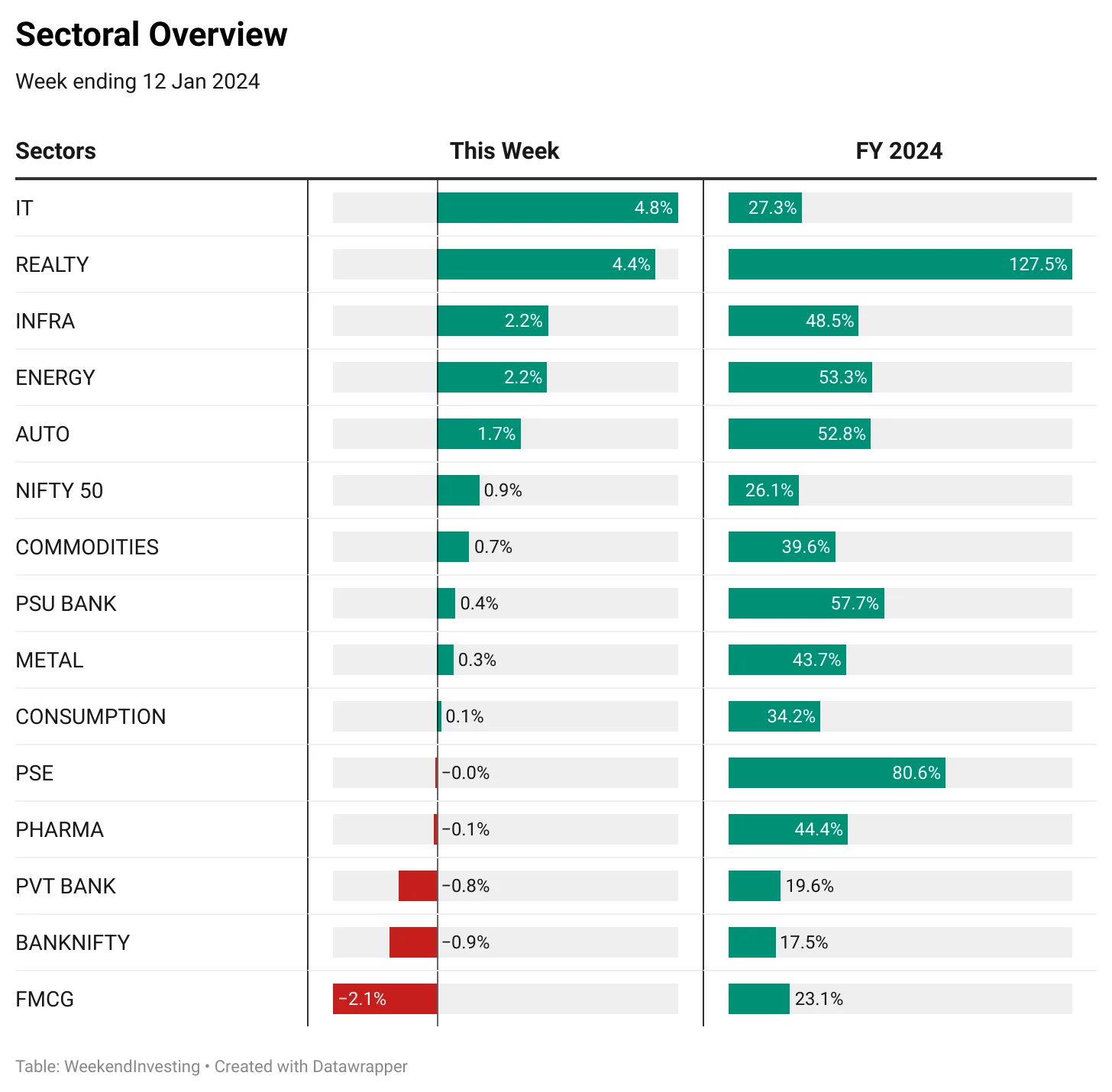

Sectoral Overview

Analyzing sector performance, it was the IT sector that led the way, with a 4.8% increase, following positive results from companies like TCS and Infosys. Real estate also continued its strong run, with a 4.4% gain, resulting in an impressive 127.5% increase for the financial year. Other sectors that experienced gains included infra, energy, and autos, while FMCG and Bank Nifty saw slight declines.

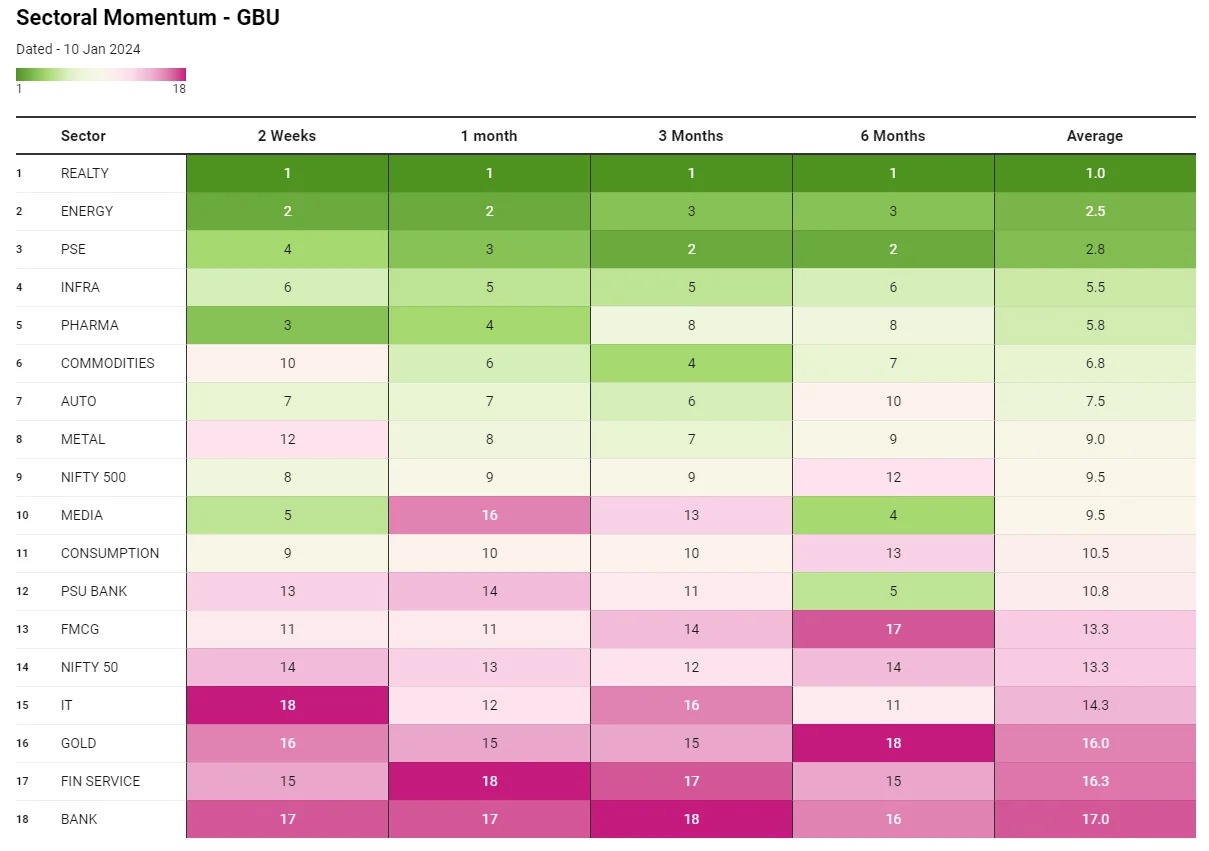

When examining the broader market picture, it is evident that real estate, energy, pharma, public sector enterprises, media, and infrastructures have been on the rise, while metals and commodities have experienced recent declines.

Spotlight – Mi MT Allcap’s Resurgence

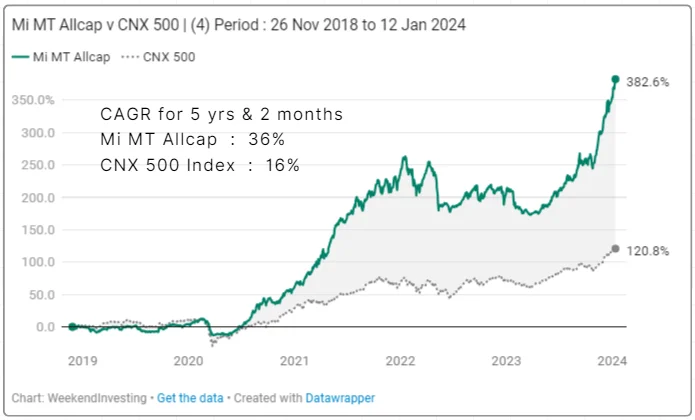

Mi MT Allcap has done exceptionally well right since its launch in Nov 2018 completing a strong CAGR of 36% compared to that of 16% on the CNX 500 index.

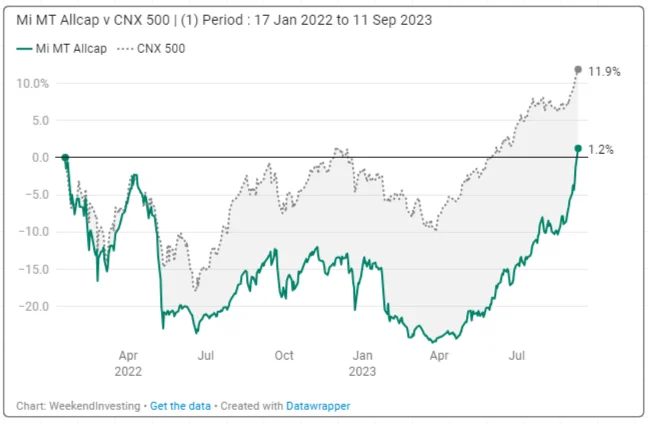

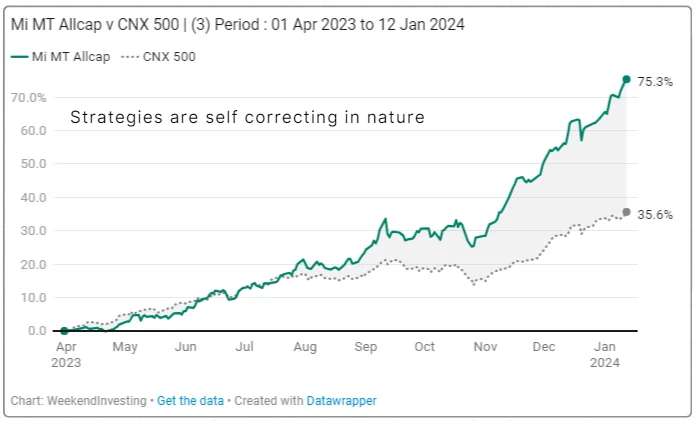

There was a period of stagnation on the strategy last year where many had questioned the effectiveness but we saw a massive bounce back in FY 24 where the strategy has clocked a whopping 75% so far.

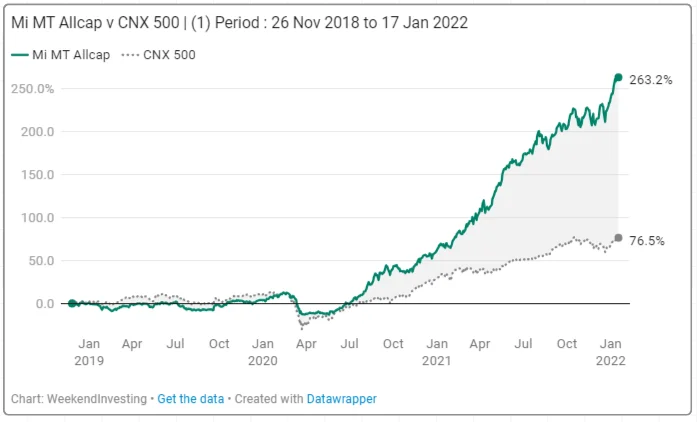

Phase 1 – Outperformance

Phase 2 – Underperformance

Phase 3 – FY 24 Outperformance

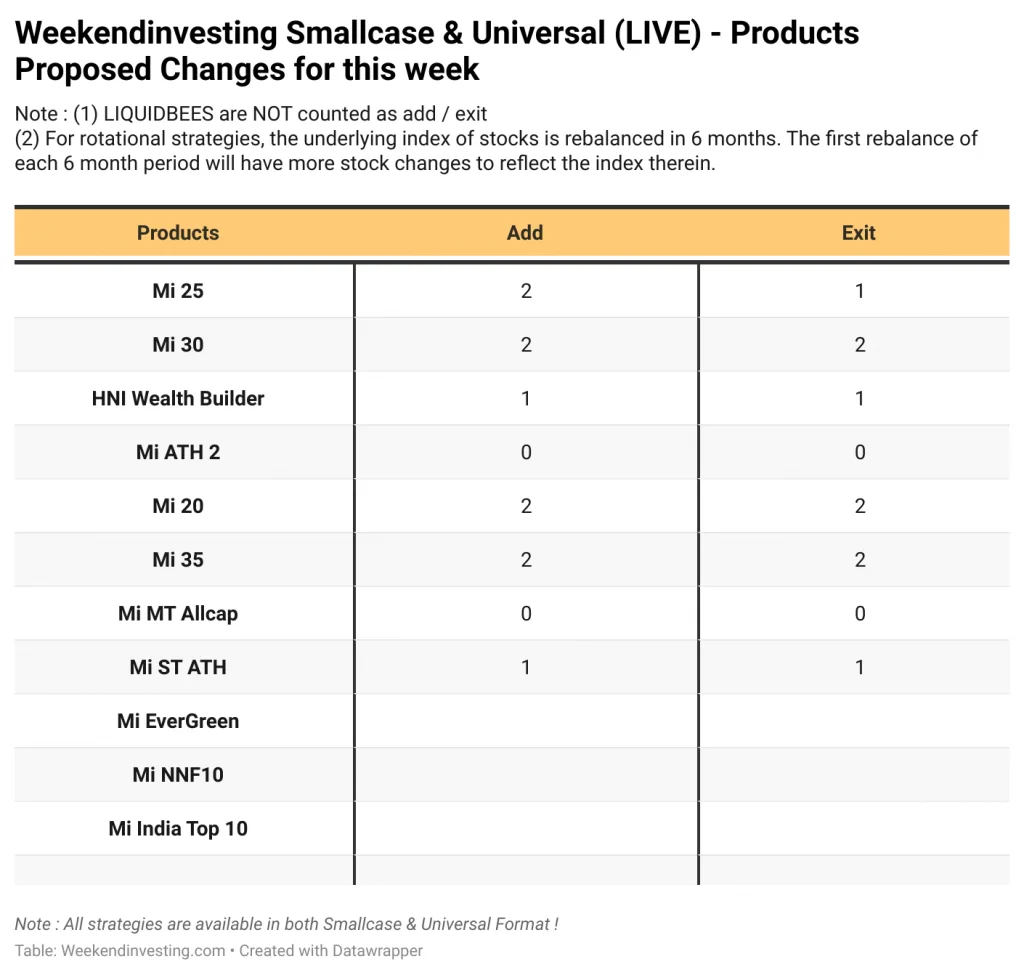

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMI