The Good Bad and Ugly weekly review : 13 Nov 2023

Markets this week

This week was certainly better than the last one. Not very bullish, rather on the sideways to optimistic note but we did see upward traction as global markets moved up.

On the weekly candle front, you can very notice the latest candle candle making an effort to inch past the strong red candle we saw two weeks earlier which also becomes the most crucial resistance to watch out for at 19557 levels.

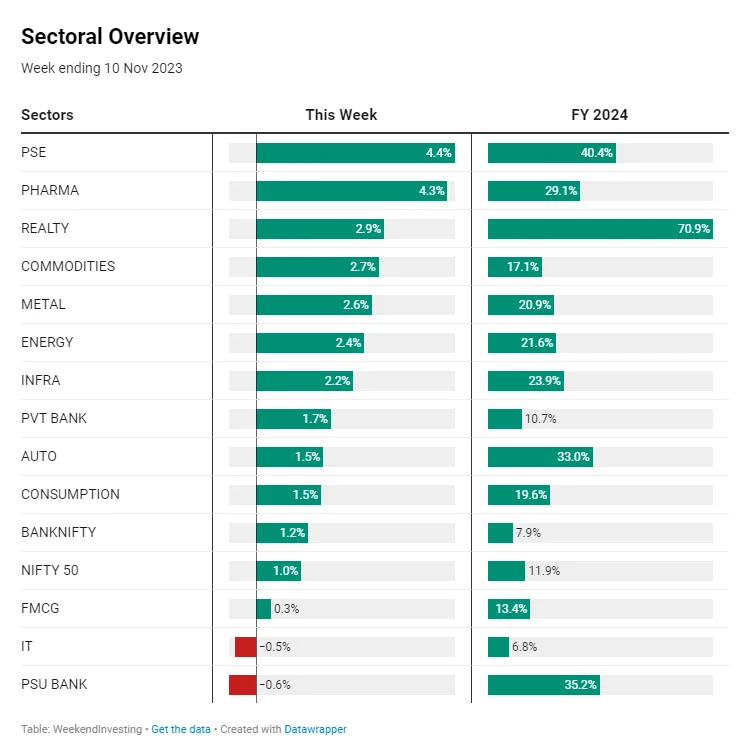

Sectoral Overview

PSE stocks and PHARMA had a blockbuster week clocking more than 4% gains while REAL ESTATE has continued on its phenomenal run with 2.9% this week and 71% this FY 24. INFRA, ENERGY, METALS & COMMODITIES all did quite well this week to record gains of 2% plus while IT and PSU BANKS taking a pause.

REAL ESTATE has been absolutely phenomenal across all recent timeframes securing the first rank while PSE has held on to its second position with a consistent performance. The sector to note this week would PHARMA which has done outstandingly well in the last 10 days to sit and #3 and #4 in the last 10 and 20 days as against its weak rank of #16 across 3 months. A solid recovery for the index. GOLD seems to have collapsed in the last 10 days after remaining at the top spot for a couple of weeks sometime ago. METALS, BANKS, FINANCIAL SERVICES and IT remained weak occupying the last spots on our charts.

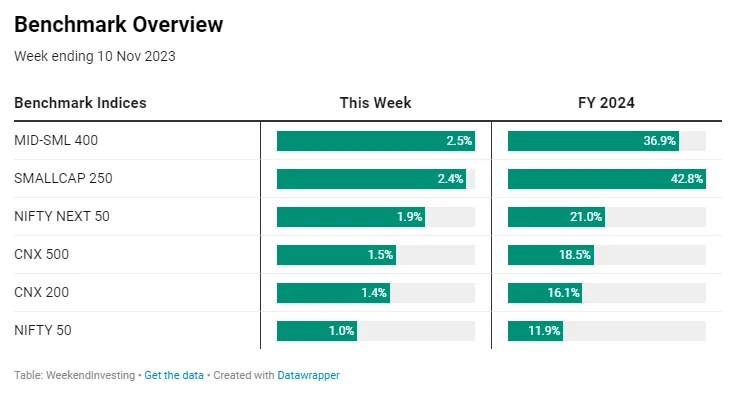

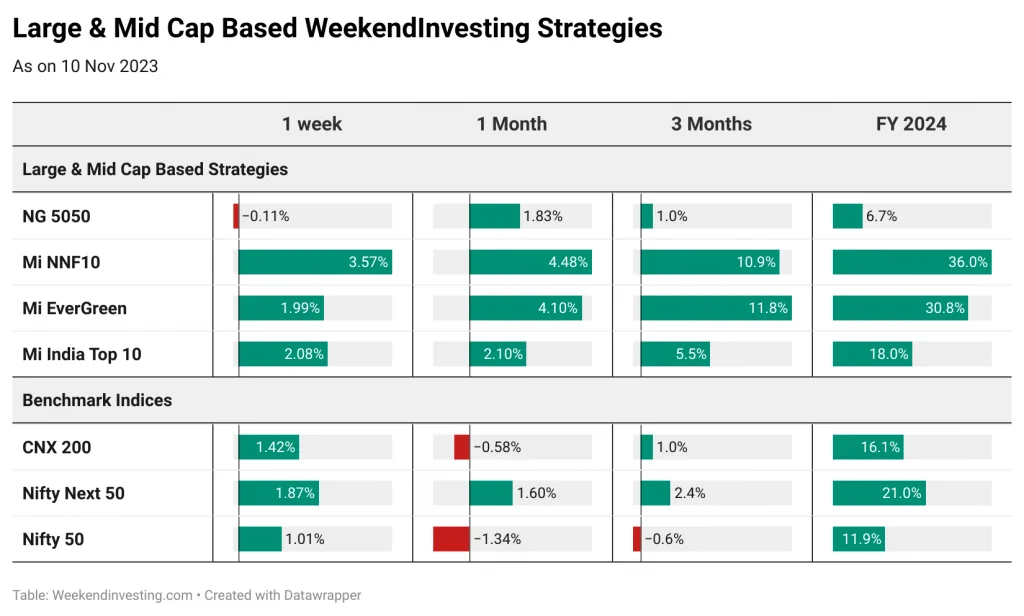

Benchmark Indices Overview

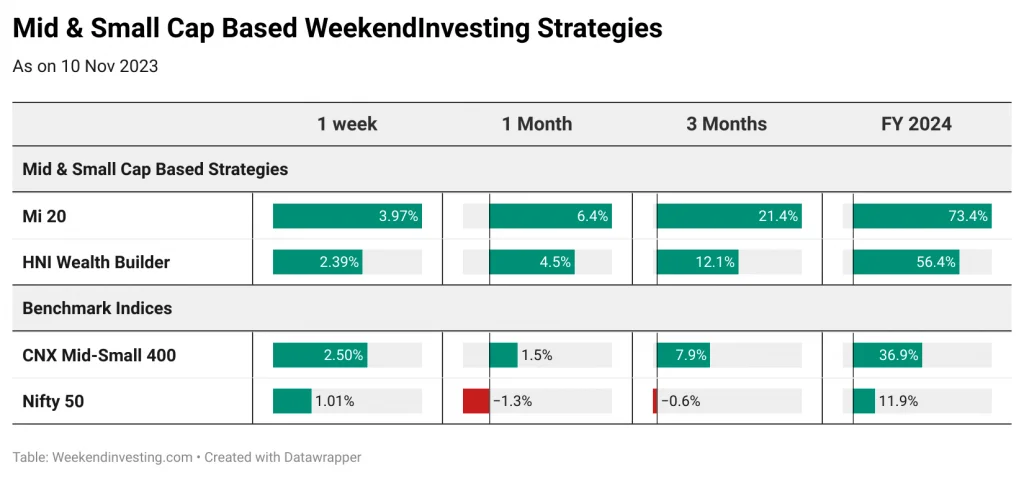

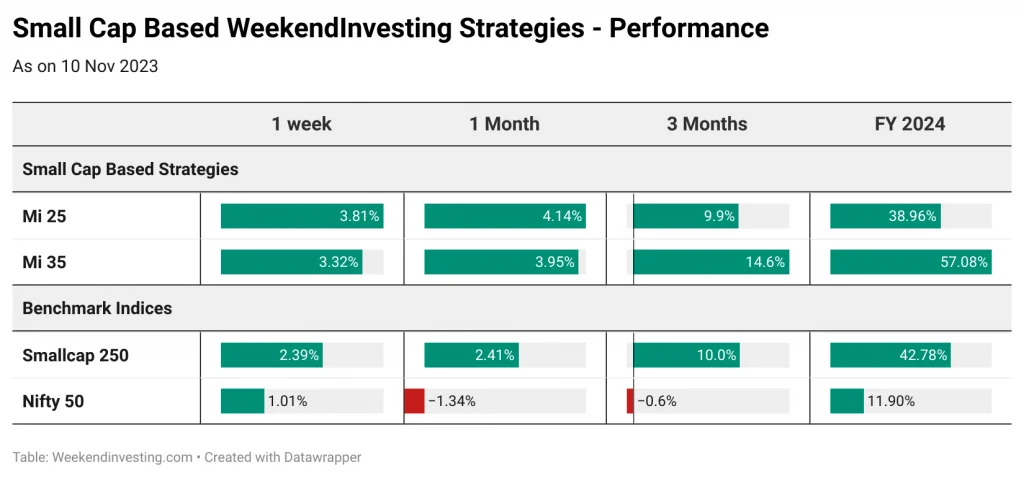

Nifty 50 was relatively weak at 1% gains compared to Mid & Small caps which have displayed a very strong outperformance in the last 7 months to be more precise. Mid-small 400 index & Smallcap 250 index clocked around 2.4% while rest of the indices stayed between 1.5% and 2%. Smallcap 250 index leads the FY 24 charts with superb gains of 42%.

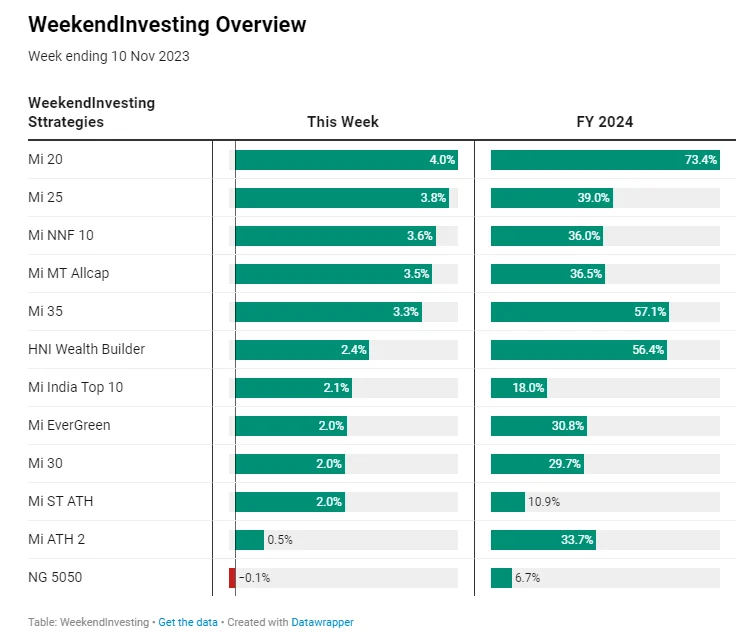

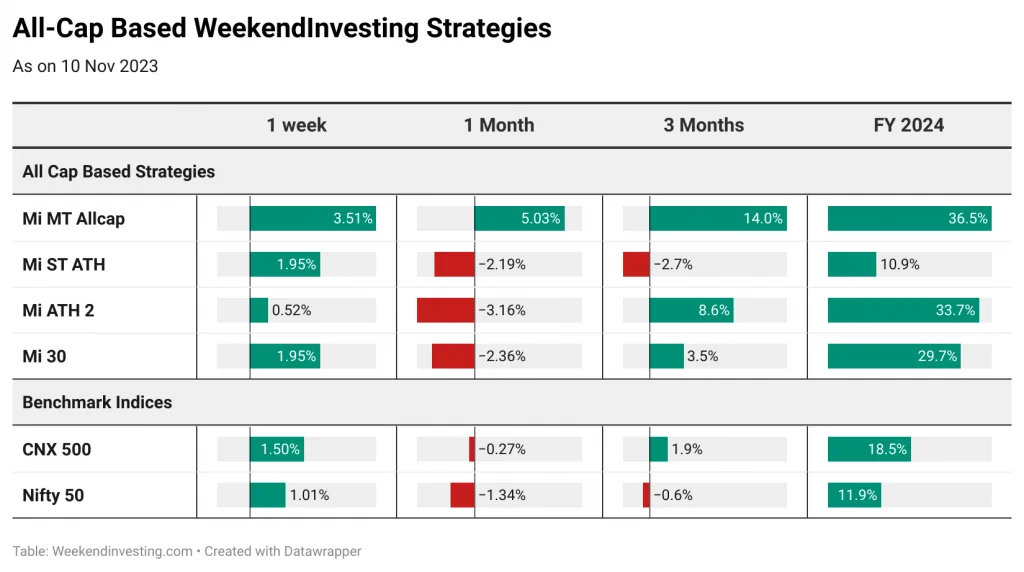

WeekendInvesting Overview

Mi 20 continues to put on a fabulous show recording a whopping 4% this week along with Mi 25, Mi NNF 10, Mi 35 & Mi MT Allcap all clocking 3% plus. Barring NG 5050 all strategies have done exceptionally well this week. Mi 20 tops the FY 24 table with an outstanding return of 73.4% followed by Mi 35 & HNI Wealth Builder at 55% each.

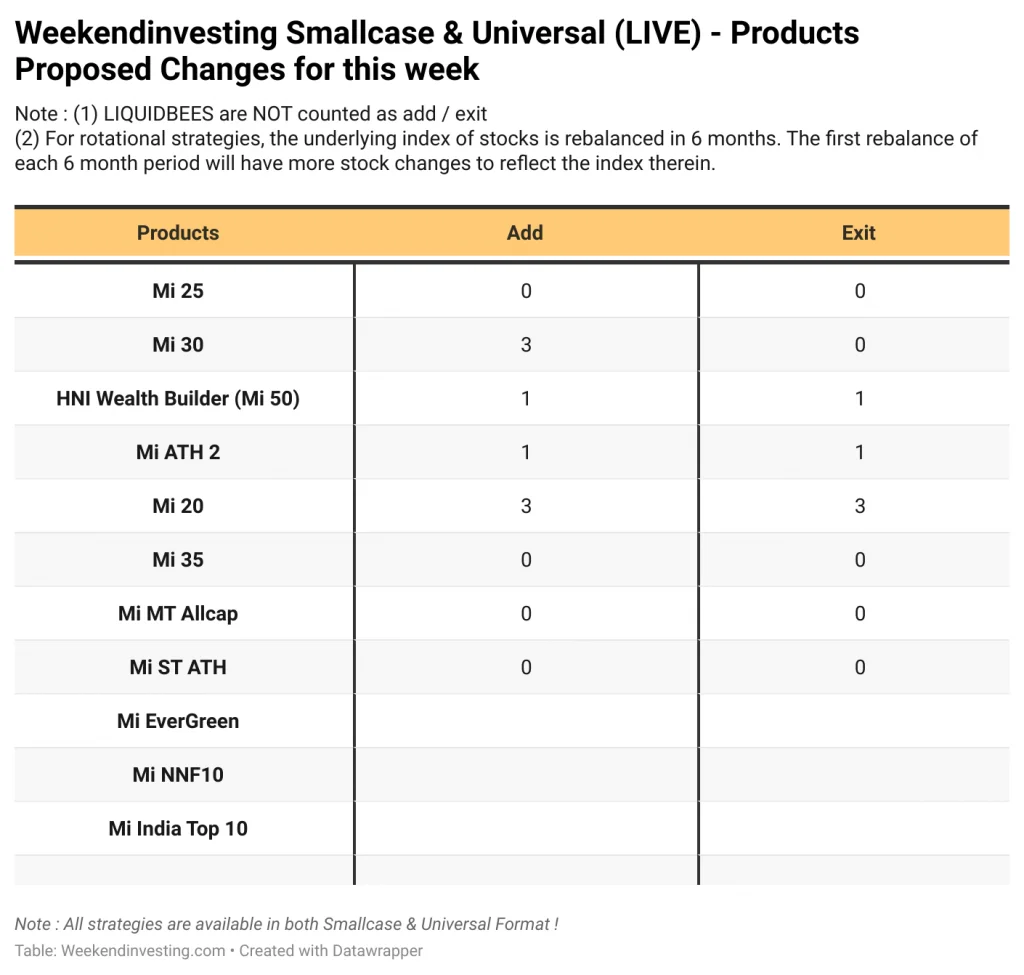

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Explore Mi35 smallcase by Weekend Investing here, use code MUHURAT2023 for FLAT 15% Off

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst