The Good Bad and Ugly weekly review : 12 Dec 2023

Markets this week

Nifty had a remarkable gap up on 04 Dec 2023 (start of the week) and then continued on the momentum for the next couple of sessions before consolidating for the next few days. On the weekly chart, we witnessed a breakaway gap up candle indicating an extremely bullish trend.

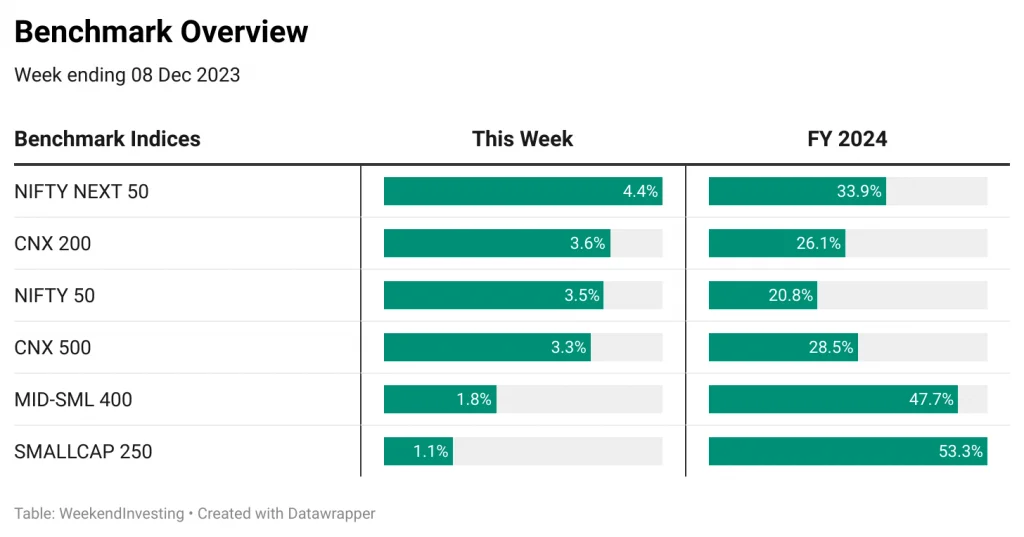

Benchmark Indices Overview

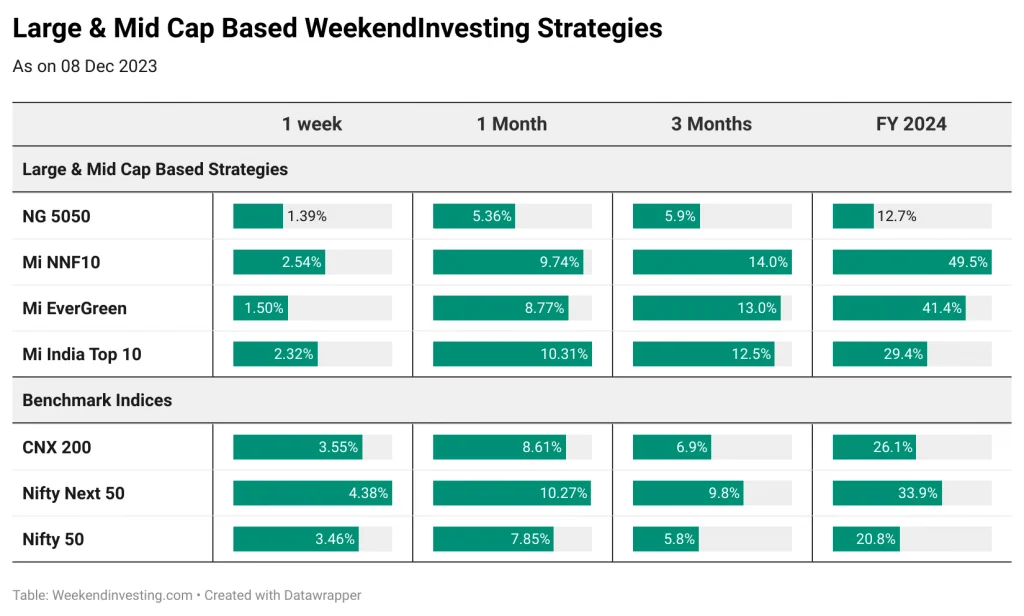

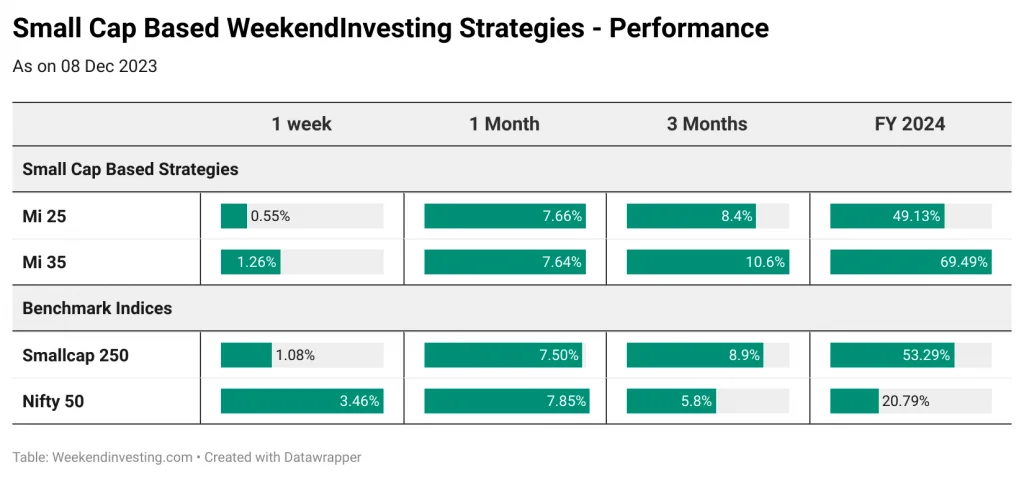

Nifty clocked 3.5% this week but the winner was Nifty Jnr at a massive 4.4% gains while Smallcaps and midcaps were relatively weaker though not bad at all. Smallcap 250 tops the FY 24 charts so far having clocked a massive 53% gains with Mid-small 400 following at 47% gains.

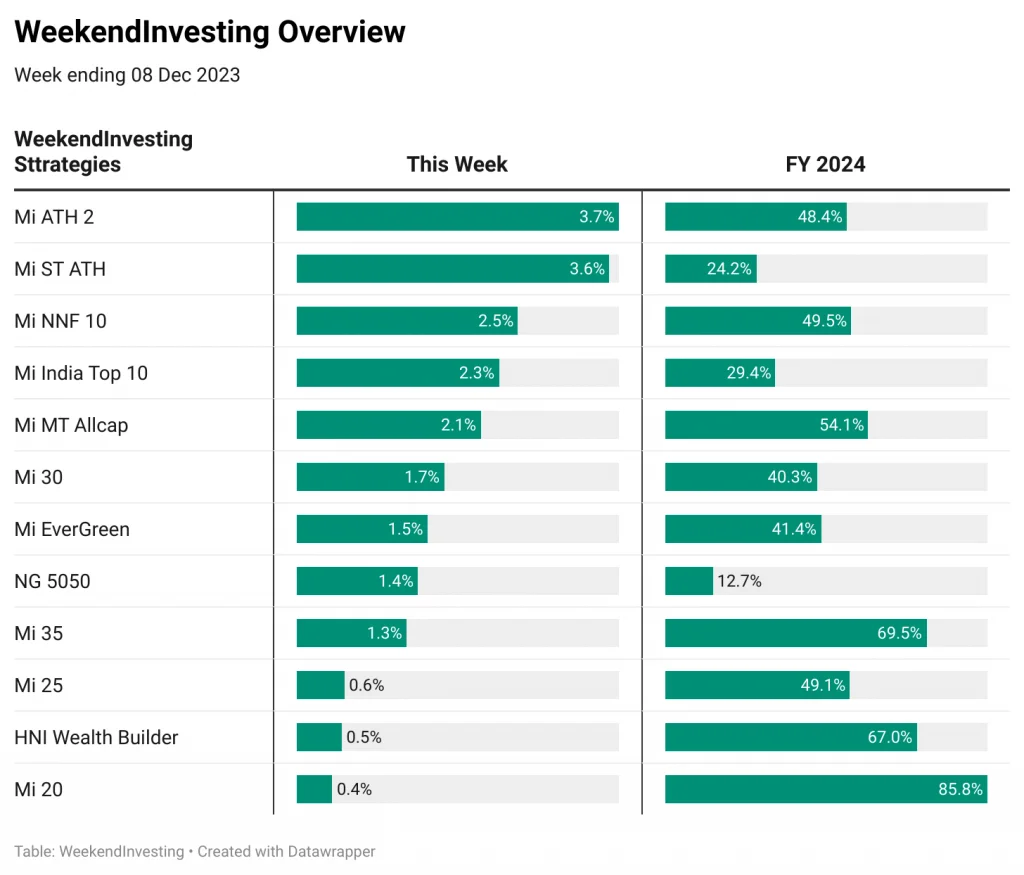

WeekendInvesting Overview

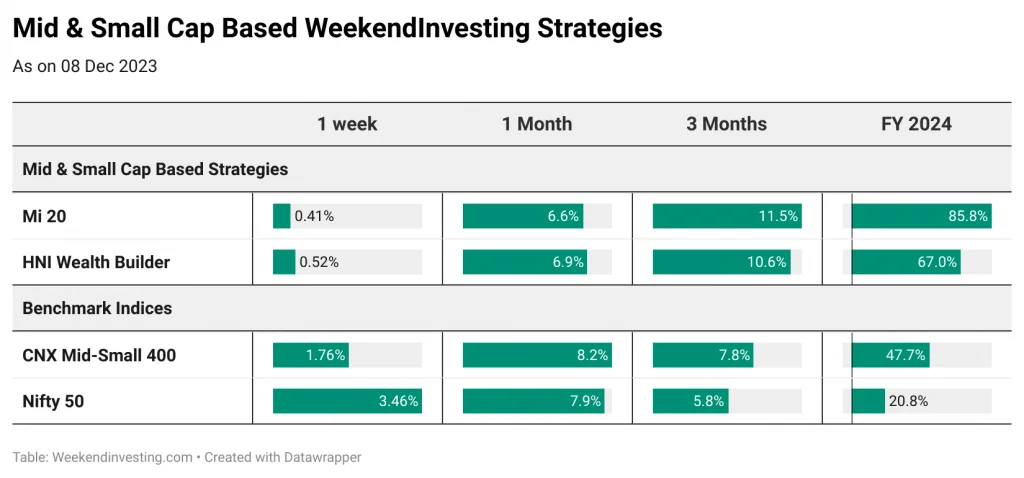

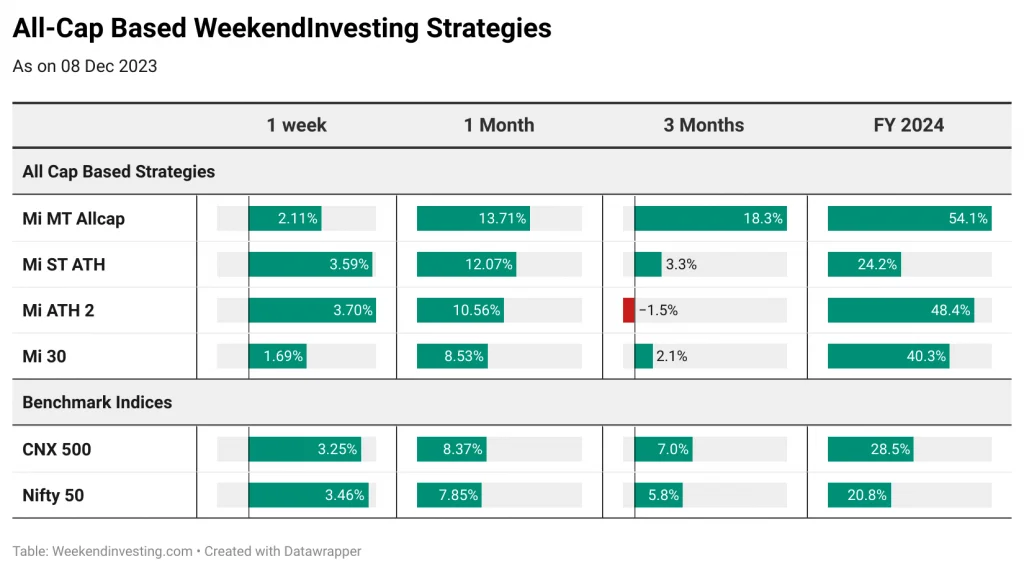

Mi 20 has been absolutely stunning clocking a spectacular 85.8% this FY 24. We would also like to break this news on this week’s report that the strategy will soon be closed for new subscriptions. So if you are still on the fence, please go ahead and add this phenomenal mid&small cap strategy to your portfolio. HNI Wealth Builder clocked 0.5% this week and a whopping 67% this FY 24. Mi 35 has been doing extremely well too clocking 1.3% this week and almost 70% this FY 24. Mi ATH 2 was the top gainer of the week at 3.7% followed by Mi ST ATH and Mi NNF 10 recording 3.6% and 2.5% respectively.

Overall, fantastic performance in the first 8 odd months of FY 24. Let us hope to close out this financial year on a high.

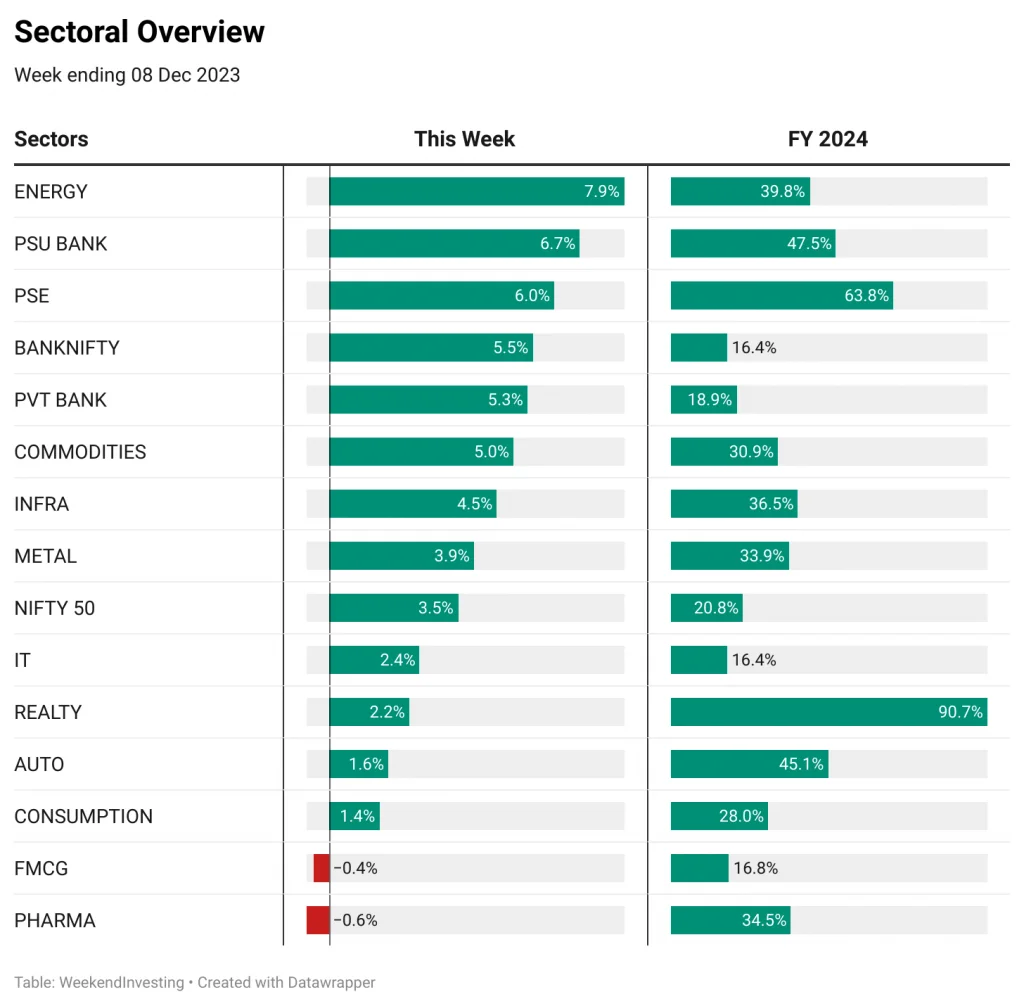

Sectoral Overview

Energy sector was splendid at almost 8% this week followed by PSU Banks and PSE’s at about 6% each. Except for defensive sectors like FMCG and PHARMA, all other sectors did quite well this week. On the FY 24 chart, Realty continued to top with a whopping 90% gains followed by PSE at 63% and PSU Banks at 47%.

PSE continues to take up the top spot on the short term momentum chart with consistently good performance followed by ENERGY, COMMODITIES and INFRA occupying the next few spots. REALTY has moved to the #13 on the 10 day ranking despite churning out decent numbers primarily due to the stronger relative performances put in by other top sectors. METALS have gained momentum while FMCG, IT and GOLD continue to languish at the bottom. BANKS have gained strong momentum after consistently underperforming for the last many weeks.

SPOTLIGHT – 26% CAGR on a large cap strategy ?

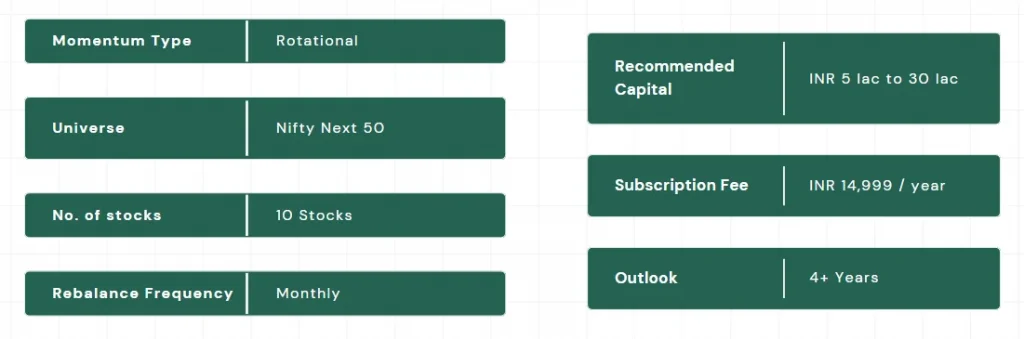

Large cap based strategies predominantly are known for their relative stability and not a high CAGR performance. Mi NNF 10 has been exceptional to have returned a handsome CAGR of 26% in the last 3 years despite operating in the large caps space.

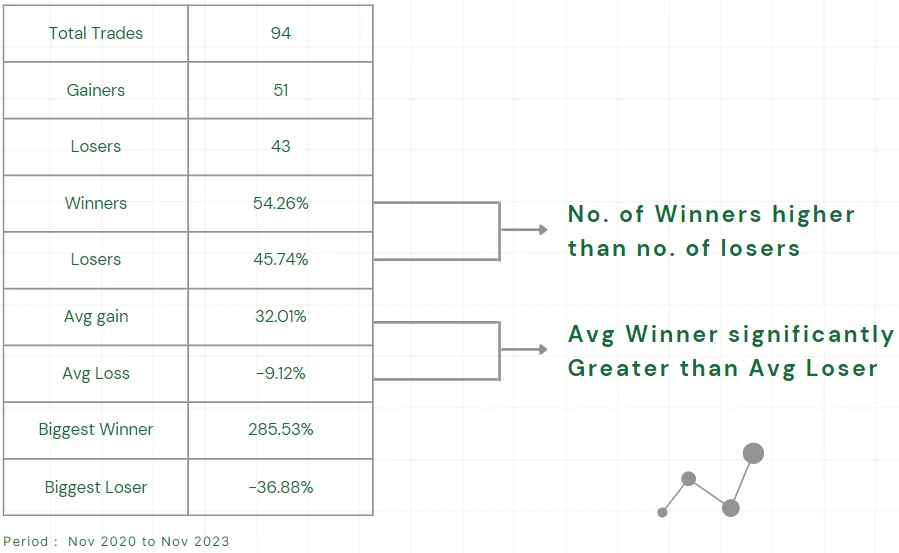

The most important metric we have repeatedly highlighted across our communication is the importance of allowing the winners are allowed to run far while losers are chucked out of the portfolio very early.

The average winners earns 32% while the average loser gives away only 9%. The biggest winner has yielded a massive 285% while the biggest loser has given away 27% only thus paving way for alpha creation in the portfolio.

Here’s a brief summary of the strategy.

Check out the detailed video below

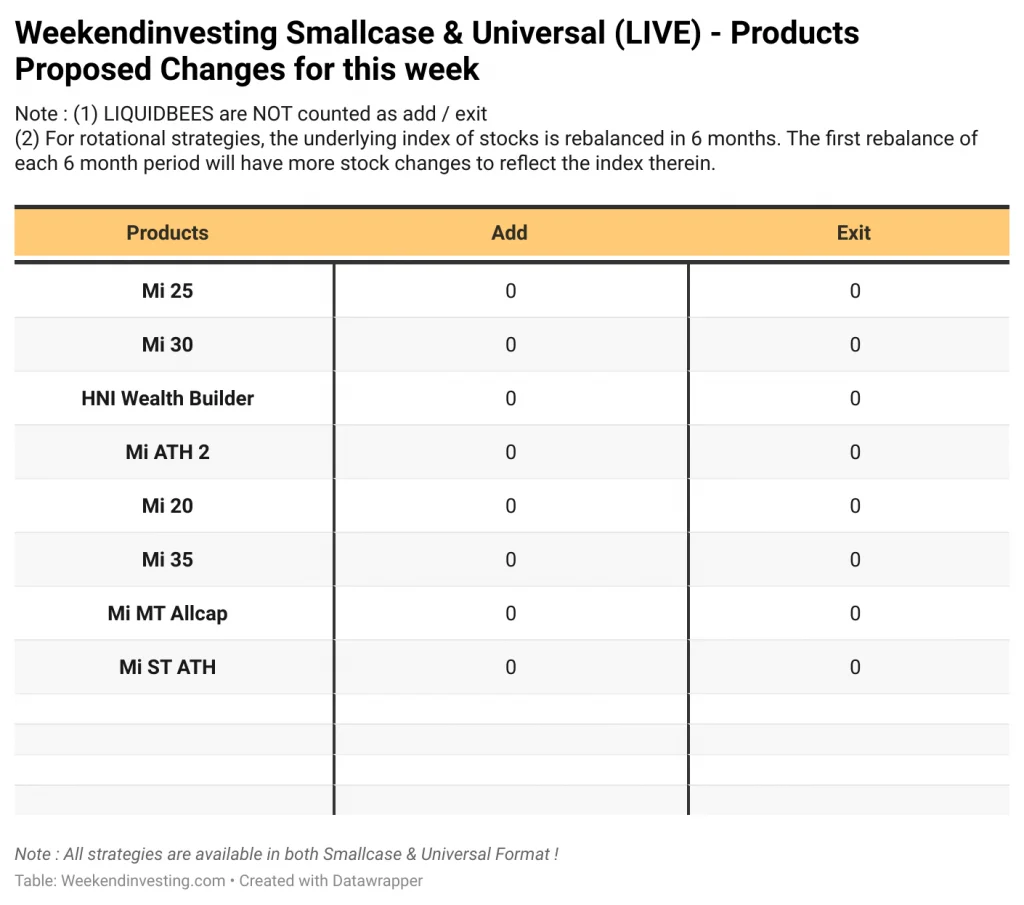

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst