The Good Bad and Ugly weekly review : 10 June 2022

Performance Update

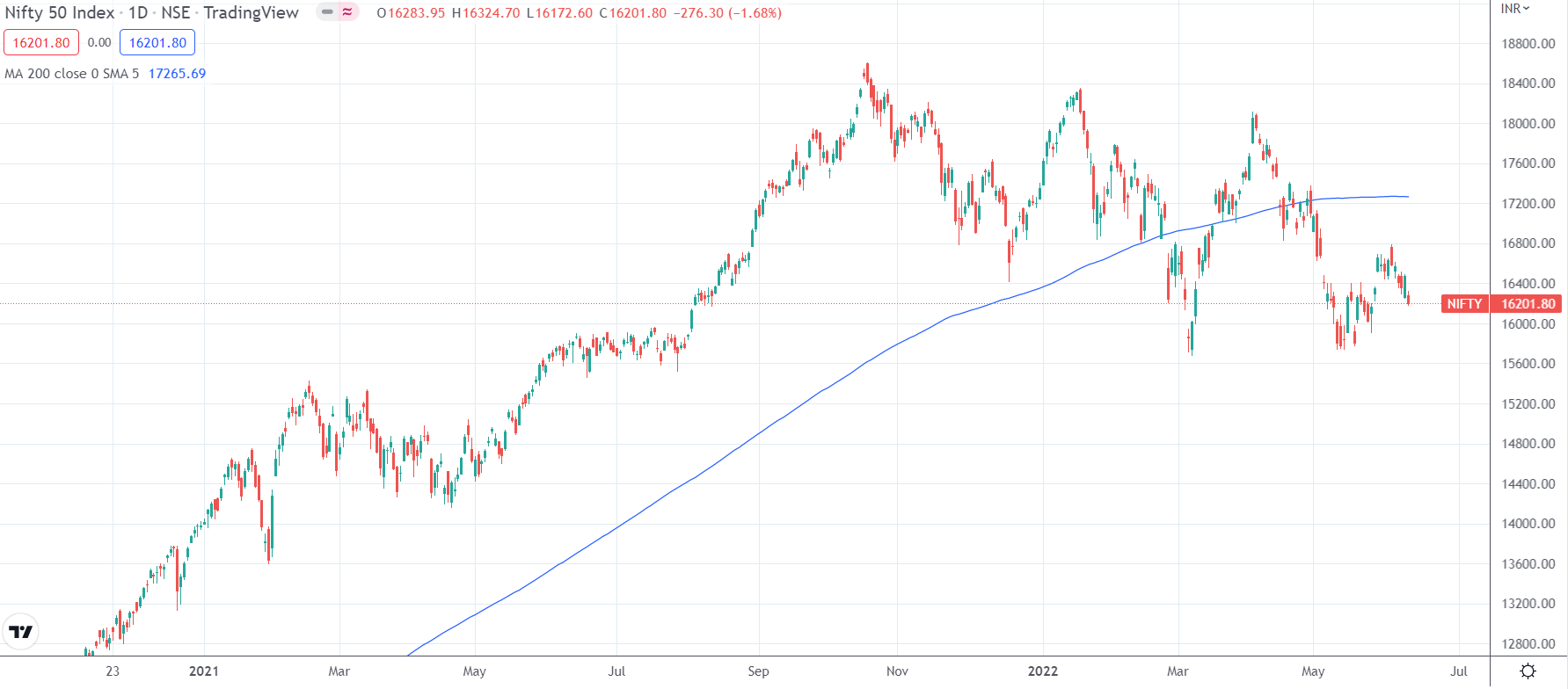

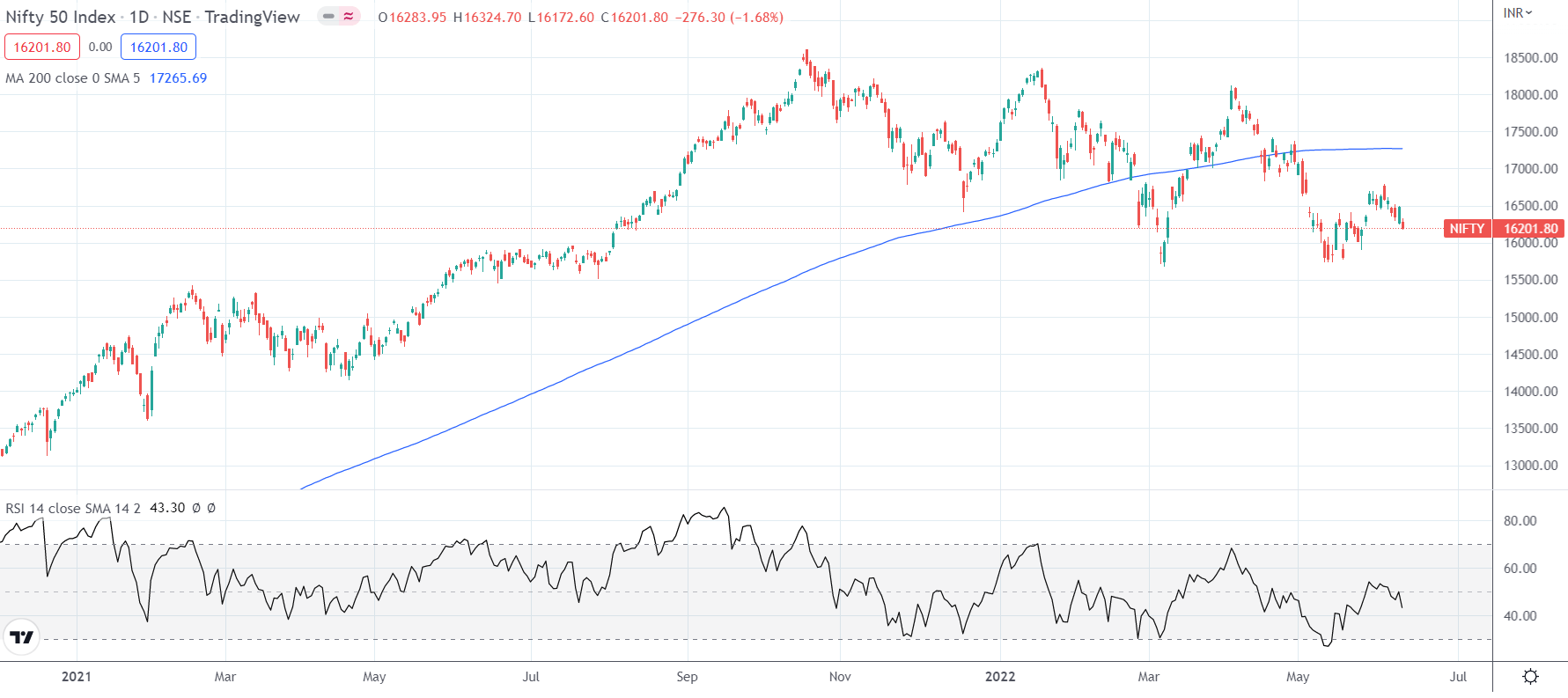

After a short spike of about 1000 points from 15740 levels (Mid May 2022), we have seen another round of downward move in the last one week. We had discussed that we will have to witness a move above the 200 MA or the latest lower high to confirm an up trend. But unfortunately, we have been hit by bad news one after the other which has left the markets to consolidate for a very long time. As you can see from the image above, the relative strength index seems to be contained below 50 mark indicating weakness. We will need to battle out all negative factors that prove to be an impediment to an up trend. When this will happen ? That’s anybody’s guess. We will have dull periods like this once in a while where weaker hands shall be taken out. One has to patiently sit through these times to be able to witness light at the end of the tunnel.

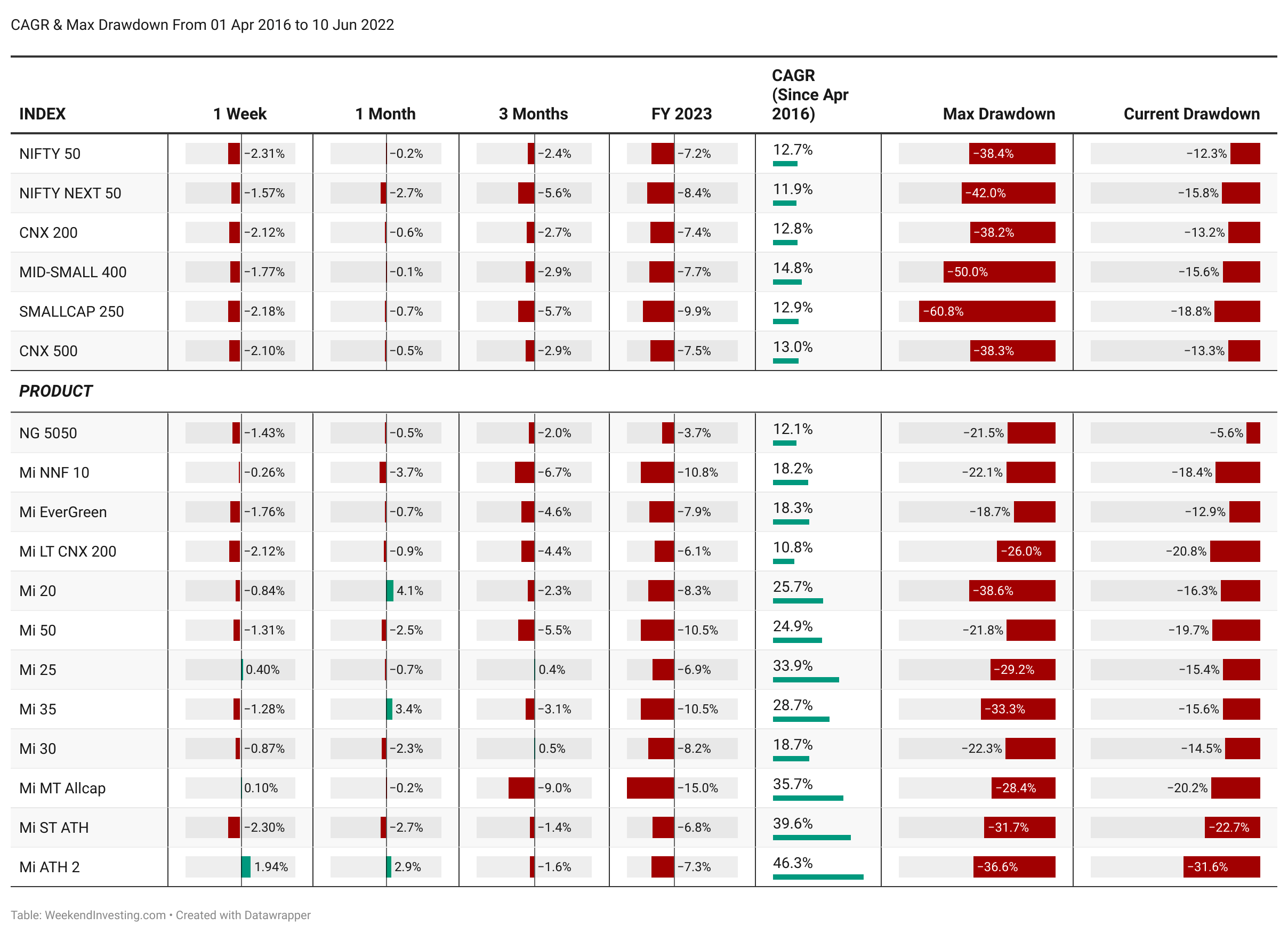

Most Benchmark Indices cracked down between (-1.5%) to (-2.5%) this week and the drawdowns continue to be in double digits too. Amongst the sectors, most remained in red except for PSE (+1.02%) & AUTO (+0.99%). In fact, AUTO has been a pleasant surprise in the last 3 months returning (+13.72%) while rest of the sectors seem quite far away. WeekendInvesting strategies continue to bear the brunt of weak market scenario. The last one year has more or less been a muted journey while those who may have stated their journey around Aug – Oct 2021 must have been a witness to a constant downtrend. But – as we have said many number of times, it is during such times that conviction of an investor is put to test. If you are following a strategy and you are here for the long term , you need not worry and rather continue your SIPs. Performance is updated below.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important questions we often get asked is whether markets will crash from here ? Should we exit ? and few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except NNF10 which is monthly rebalanced)

These are all long term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeating this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years it has been shown that much superior CAGR returns are possible than the benchmarks.

FY22 was also superb and I will let the numbers speak for themselves. You may read the Consolidated FY22 report.

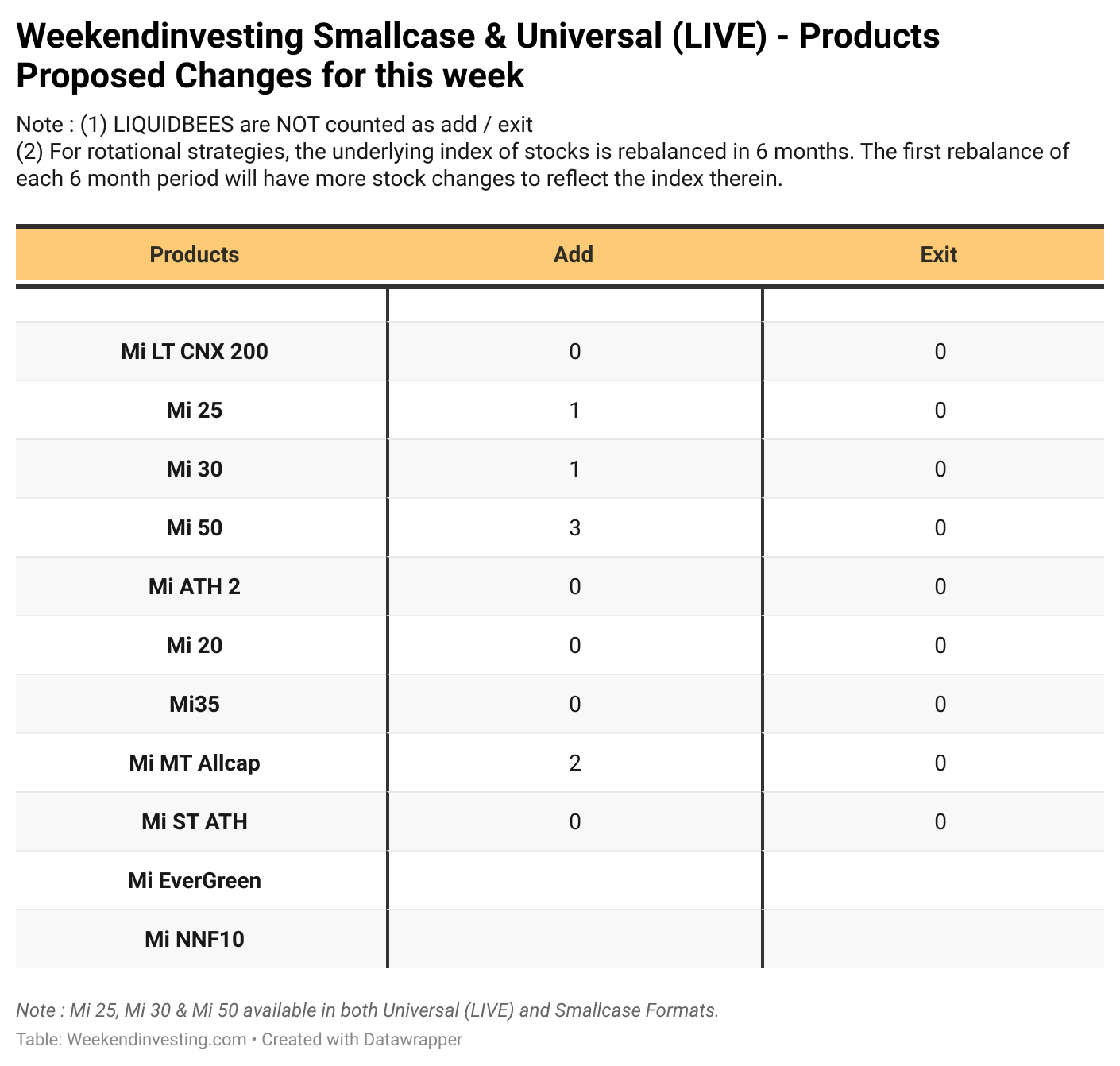

Rebalance Update

We give an advance notice here on the upcoming changes in your smallcase for Monday . This advance notice can be used to ignore Monday update if there is no change. If there is a change indicated you can use the smallcase app or login to weekendinvesting.smallcase.com to see the rebalance. A back up email is sent by mid day Monday if you have not rebalanced by then and yet another one a day later.

Note : We are not including LIQUIDBEES as an ADD or an EXIT count.

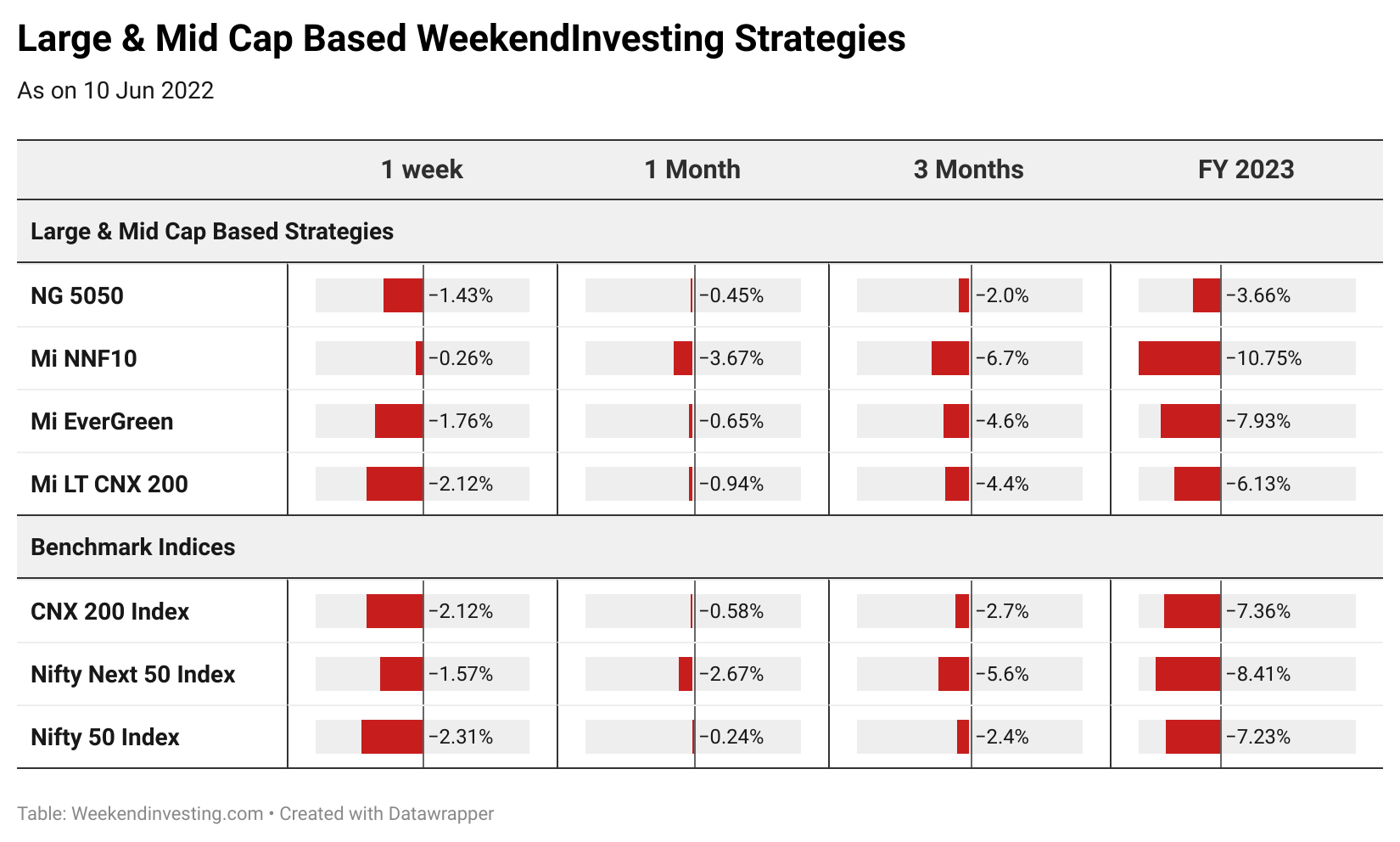

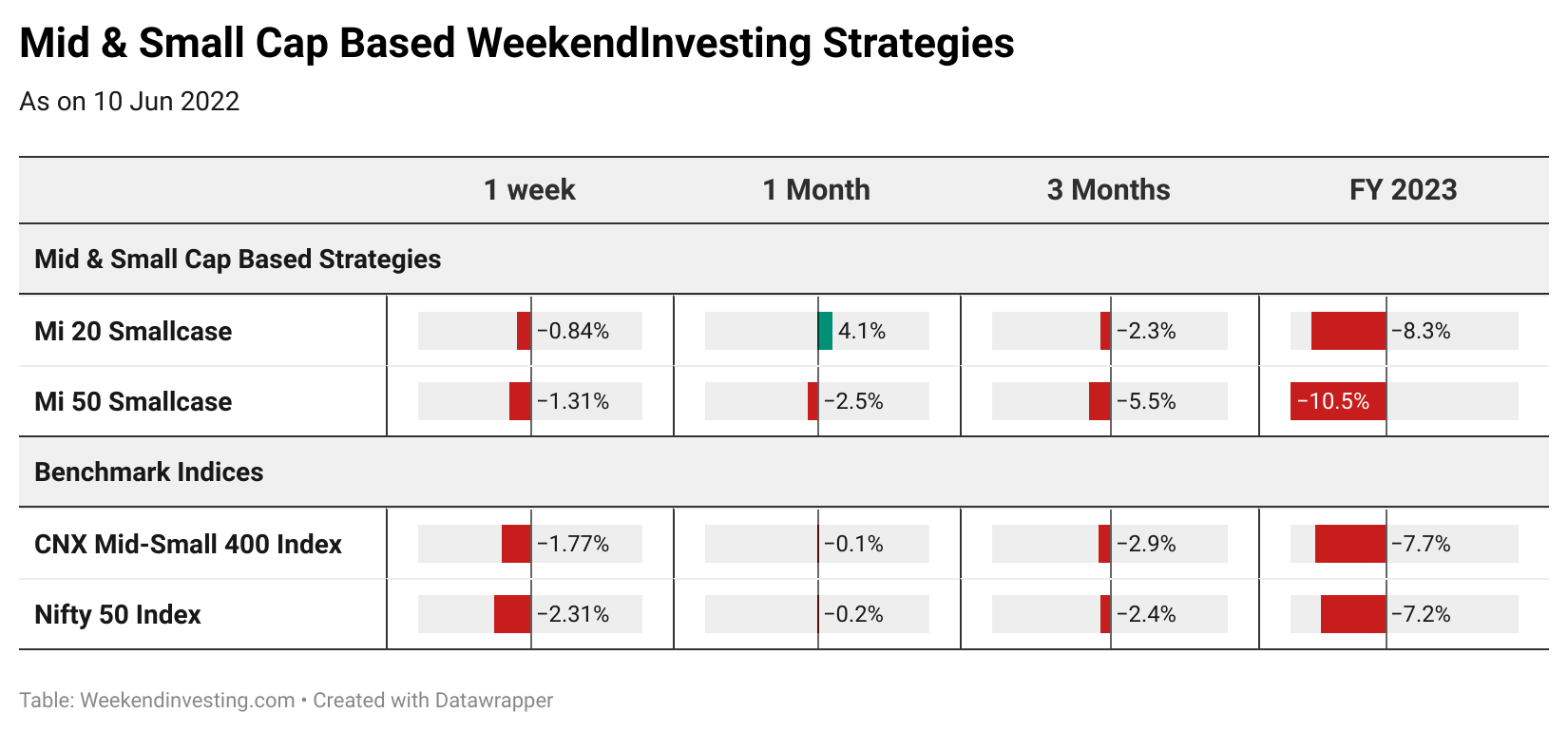

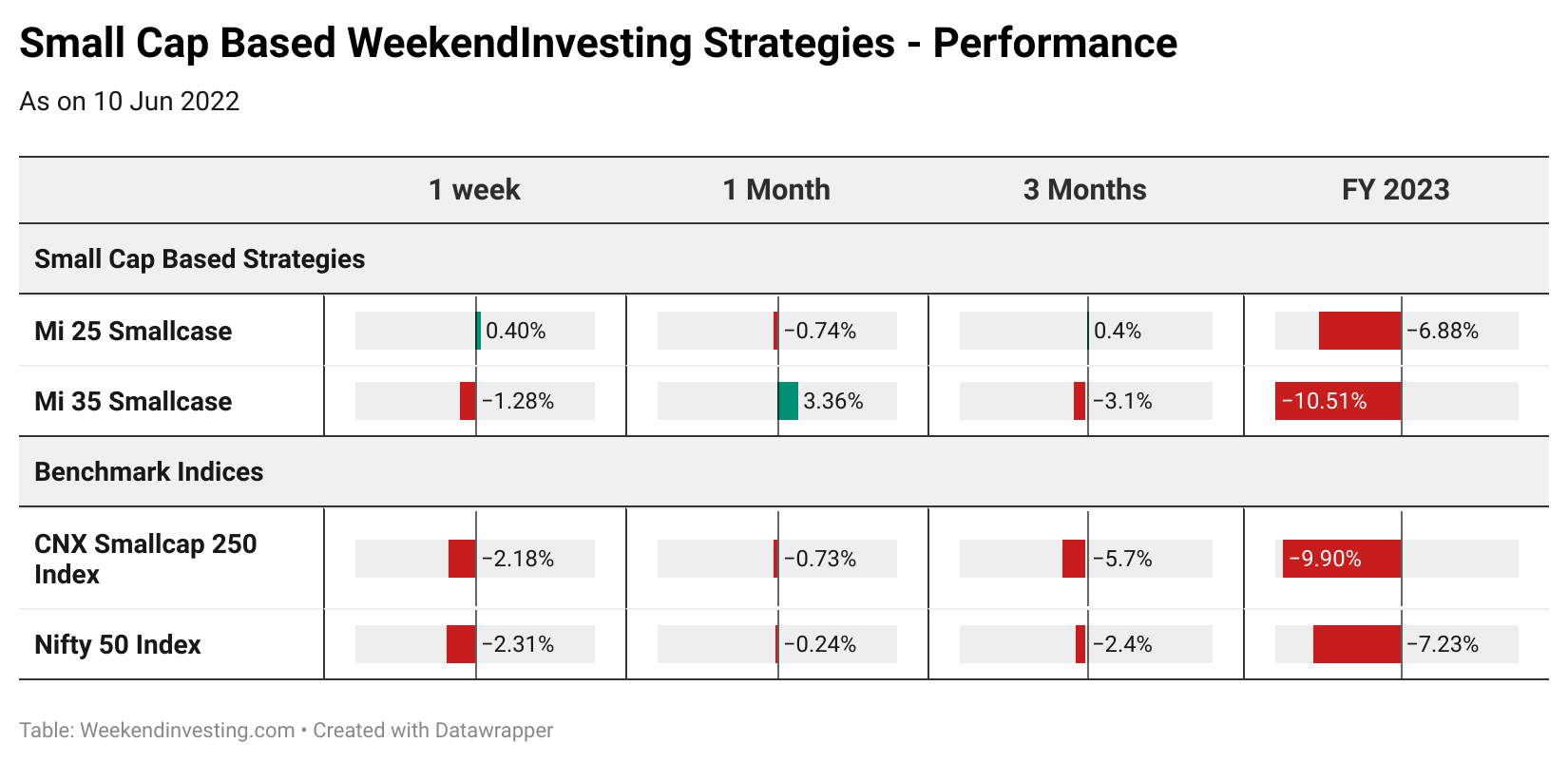

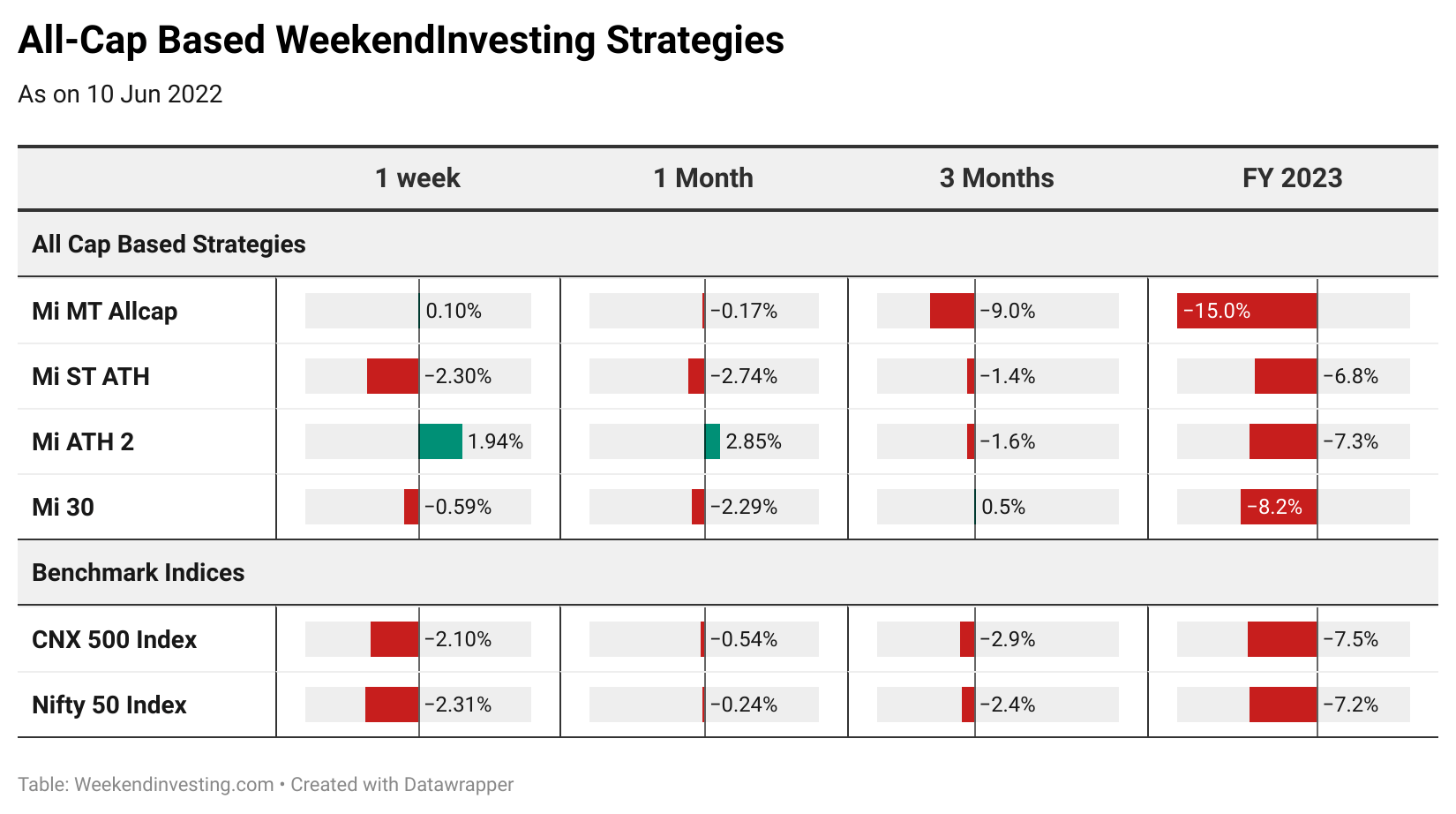

The performance for the week and the month for all the smallcases is presented below.

Large & Mid Cap Strategies – Performance

Mid & Smallcap Strategies – Performance

Smallcap Based Strategies

All Cap Based Strategies – Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there.! The several videos in this blog are from this series.

STAIRS Revamped Models

We have launched revamped versions of our STAIRS models and we had made a video giving you a basic introduction to the models.

STAIRS is a LONG / SHORT derivative strategy that is designed to offer an uncorrelated diversification option to your equity portfolio. STAIRS will do well when there are up trends & also when there are down trends while giving up some of the gains when markets remain rangebound / volatile.

STAIRS models went through yet another rough week owing to choppiness. You may go through the Weekly Review

All 4 STAIRS models go in line with our fundamental philosophy of making the most and compounding aggressively when markets give us trends and go very defensive as trends fizzle out and enter a rangebound territory thus providing a robust capital & profit protection.

Effectively – STAIRS is a complete trading system (Futures & Options) that covers each of the following decisions required for a successful trading outcome:

• Markets – What to buy or sell ?

• Position Sizing – How much to buy or sell ?

• Entries – When to buy or sell ?

• Stops – When to get out of a losing position ?

• Exits – When to get out of a winning position ?

We also run a dedicated telegram channel for STAIRS which you may join using this link

Testimonials

This is all for this week. Please stay safe and we shall meet again next week. Bye !