The Good Bad and Ugly weekly review : 09 May 2023

Despite the sharp sell off on HDFC twins which led to a 1% fall on Nifty on 05th May 2023, we are still comfortably holding up in an uptrend which started from 29 Mar 2023. Nifty broke out of the receding channel in the first of March also crossing it’s 200 DMA. This rally has already seen Nifty clocking about 7% with RSI also heading into overbought territory.

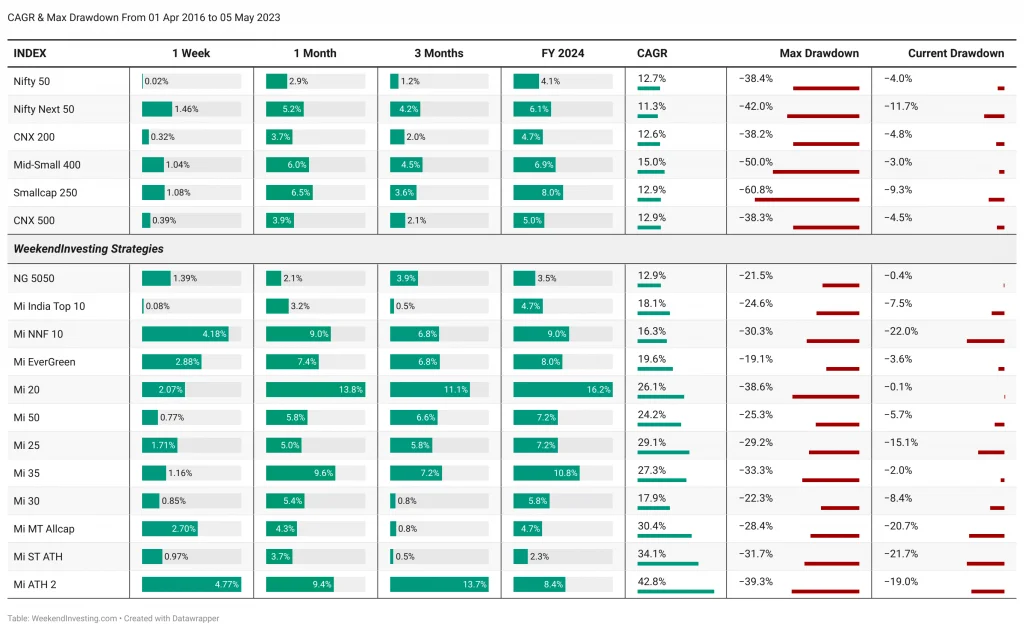

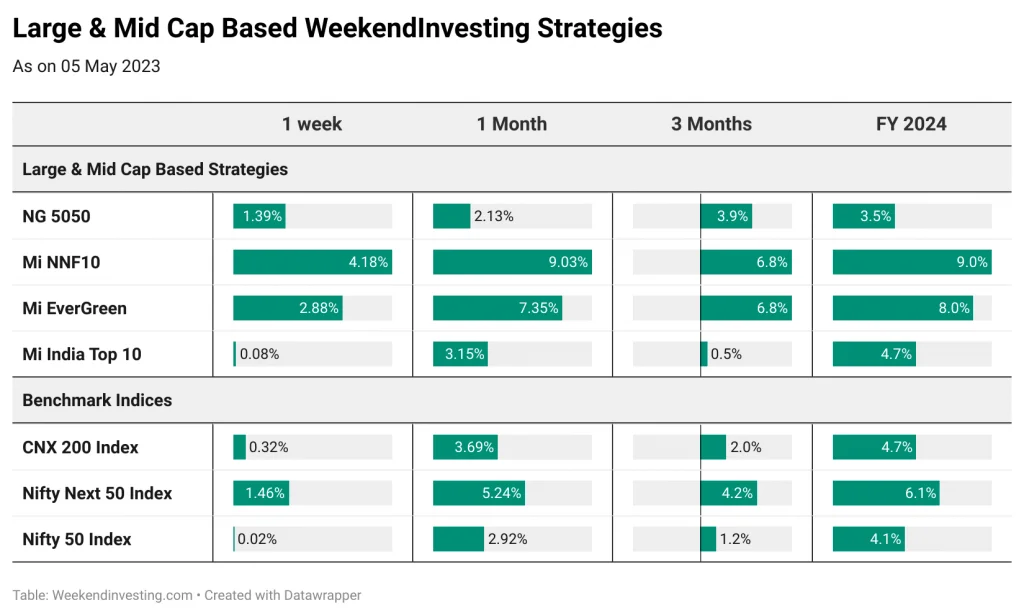

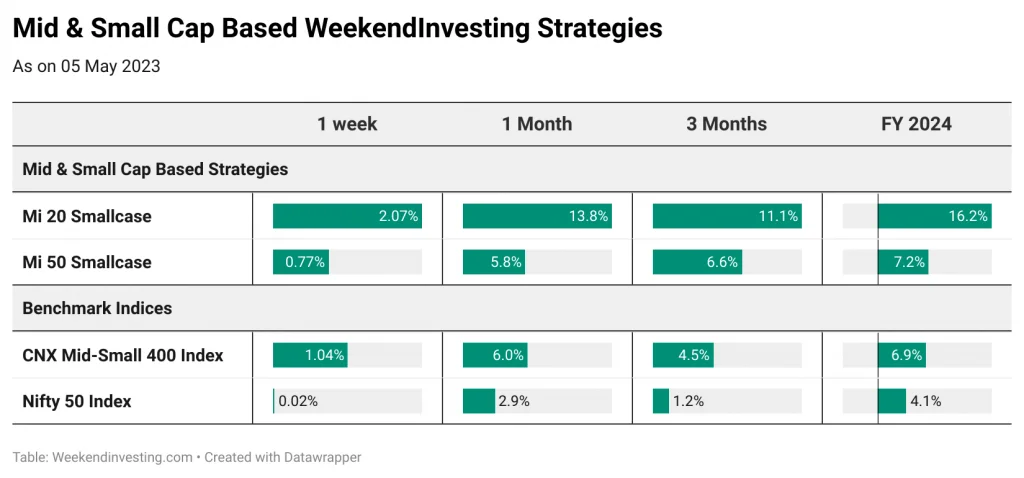

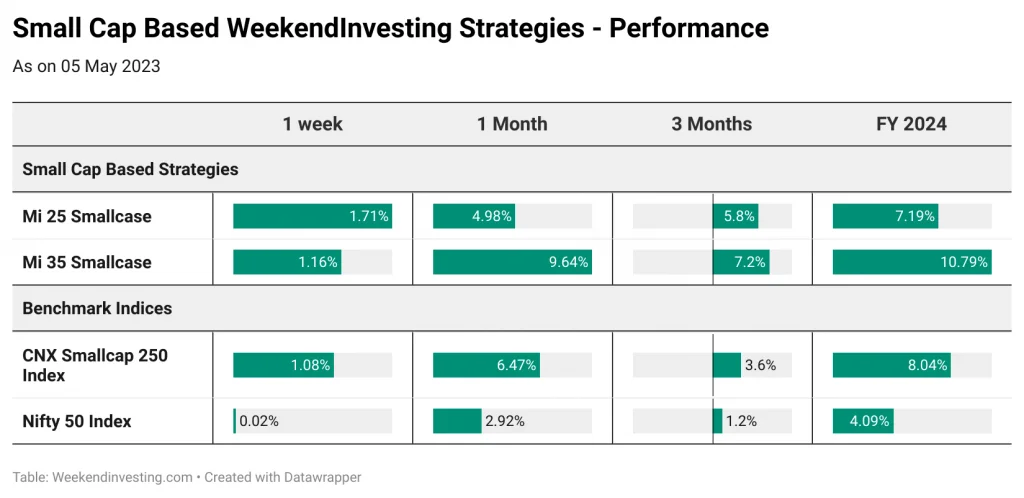

Midcaps and Smallcaps continued on their good run returning around a percent each along with Nifty Jnr topping the weekly charts clocking 1.4%. Nifty was on it’s course to clock similar gains but the sharp fall on Friday erased all the gains from pervious sessions of the week resulting in a flat performance. Smallcap 250 leads the FY 24 chart with 8% gains followed by Mid-Small 400 @ 6.87% & Nifty Jnr @ 6%.

PSE index has raced to become the best performer in the last 3 months clocking 10.75% and also in the current week with gains of 1.35%. In FY 24, REALTY tops the table with 15% gains followed by PSU BANKS @ 11.7% and AUTOs @ 9%. Unfortunately, IT is the only sector to return negative figures (-3.4%) this FY 24.

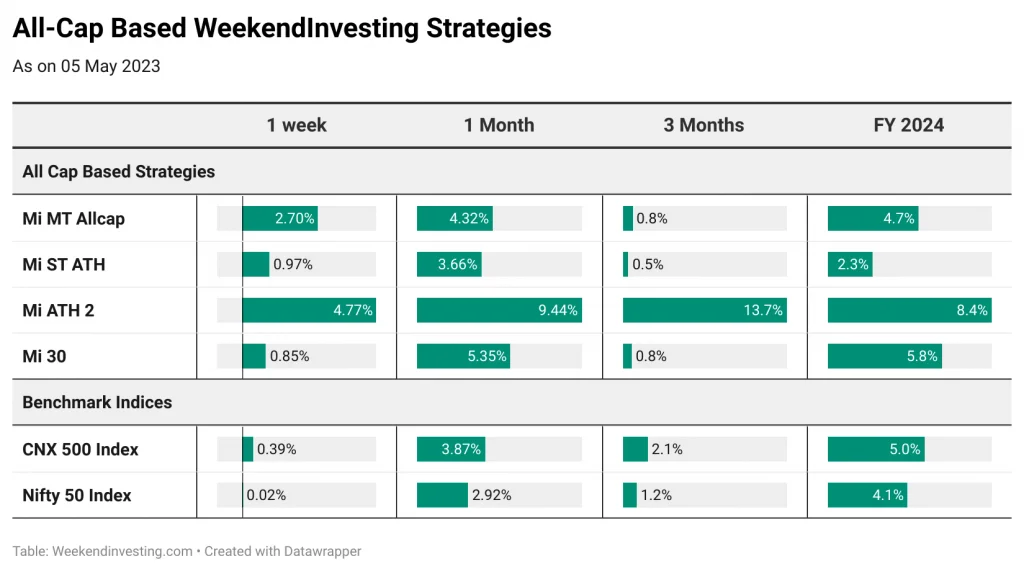

A god indication of strong momentum is when all our absolute momentum strategies have 0% cash allocation and that is the case at present. Mi ATH 2 did extremely well to clock 4.7% thus leading the weekly charts followed by Mi NNF 10 at 4.18%. All strategies did very well this week. Mi 20 has taken a ferocious start in FY 254 clocking 16.2% along with Mi 35 @ 10.8%. Overall, we are extremely happy with this positive start and hope this continues heading forward.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

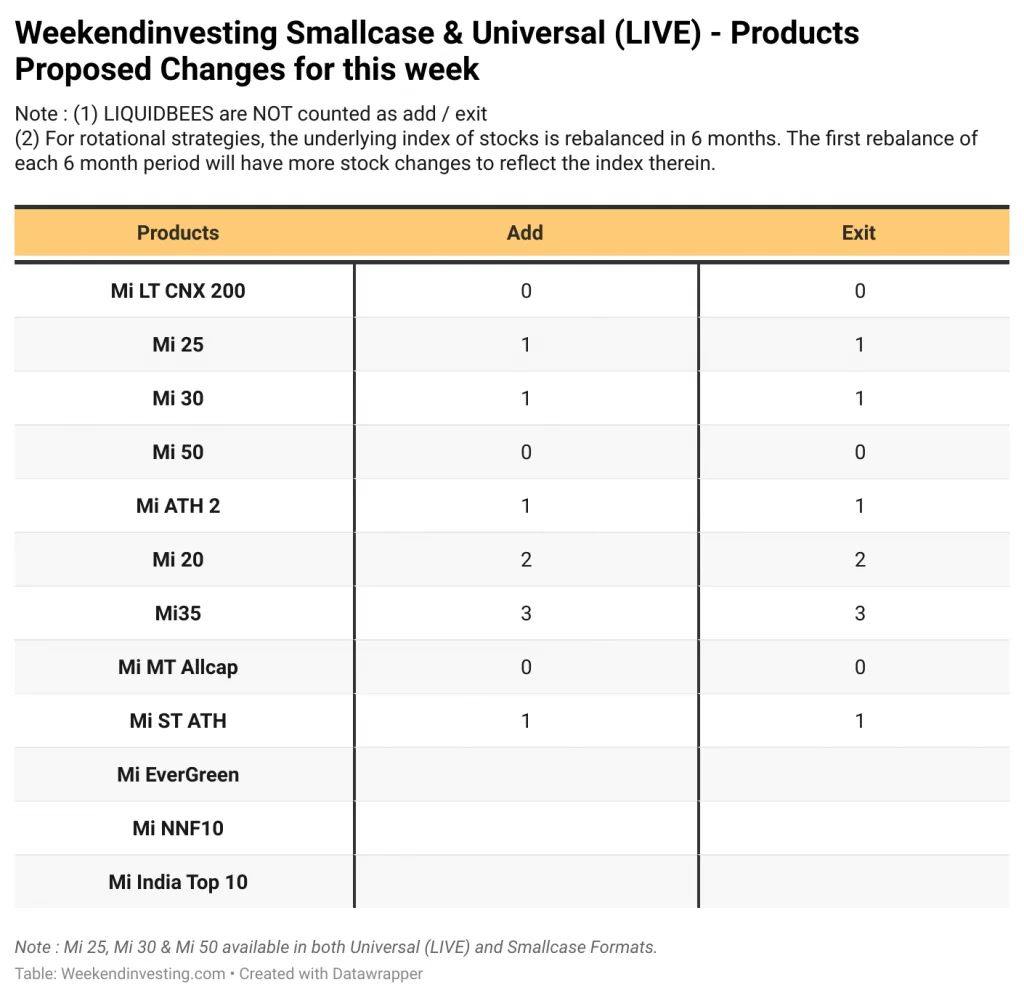

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count. The upcoming rebalance on 03 Apr 2023 will be a biannual rebalance where stocks are updated as per changing underlying indices and weights shall be recalibrated back to original weights as per the composition of the respective strategies (Mi20, Mi35, Evergreen specifically)

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Testimonials

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst based at 103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN. For more information and disclosures, visit our disclosures page here