The Gensol Crisis: A Cautionary Tale for Investors

A ₹43-crore luxury apartment in Gurugram’s swanky real estate property. A ₹26 lakh golf set. Over ₹11 crore wired to family members. And miles away, a nearly deserted EV plant that was supposed to be buzzing with production.

This isn’t a plot twist from a thriller cinema—it’s the unfolding reality behind Gensol Engineering Ltd and BluSmart Mobility, one of the biggest corporate frauds in India’s startup scene in recent times.

Let’s break down what happened—and what retail investors must learn from it.

Gensol Engineering: The Inception

Founded in 2007 by brothers Anmol Singh and Puneet Singh Jaggi, Gensol started as a solar EPC (Engineering, Procurement, and Construction) company. It went public in 2019 on the BSE SME platform and eventually moved to the main stock exchanges by mid-2023, attracting a broad investor base.

Additionally, in 2019, the firm had pivoted toward electric mobility, setting up BluSmart, India’s first all-electric cab service, positioned as an Uber/Ola disruptor with zero-emission rides and no surge pricing (initially).

And what followed was a dream run for Gensol — revenues jumped from ₹61 crore in FY17 to ₹1,152 crore in FY24, while profits and borrowings also soared. Shareholders multiplied from 155 in FY20 to over 1 lakh by the end of FY25, while promoter holding halved. With investors drawn by the EV growth story and strong reported financials, the stock reached a high of ₹1,126, boasting a market capitalisation of ₹4,300 crore, before tumbling to ₹133 by April 2025, with a valuation of ₹506 crore, as cracks began to appear.

The ₹262-crore Discrepancy

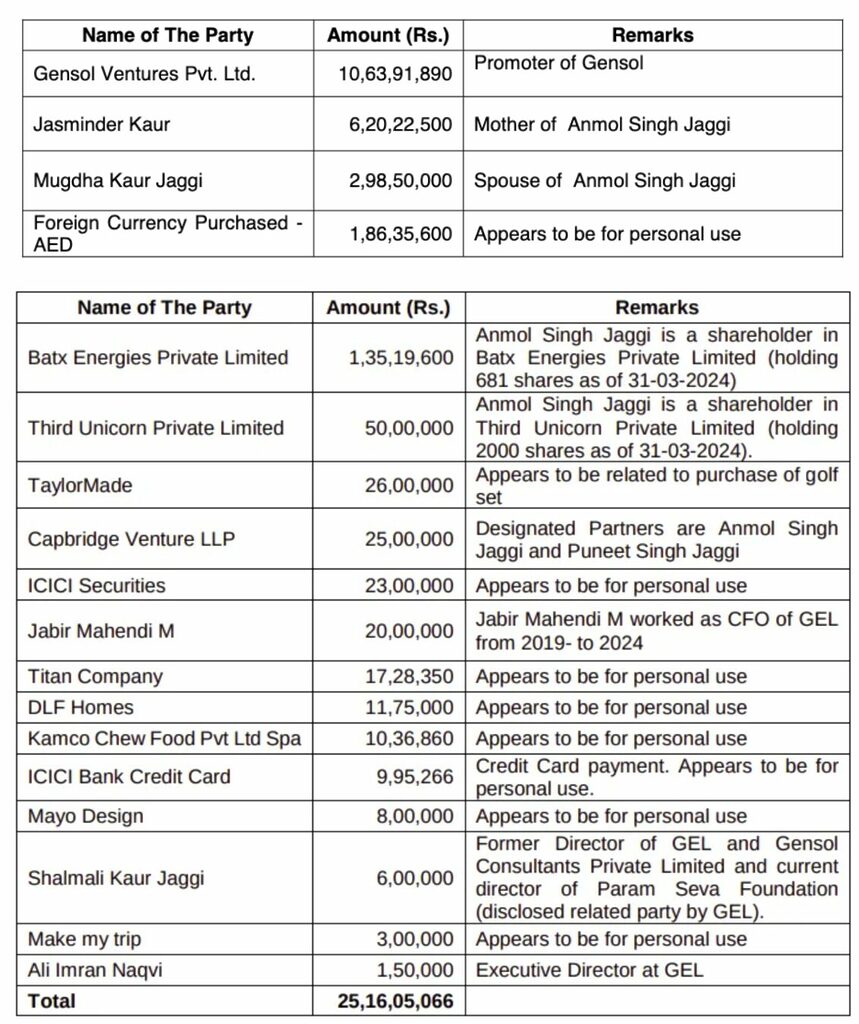

Here’s where it gets murky. Gensol secured ₹978 crore in loans from public-sector lenders IREDA and PFC to procure 6,400 electric vehicles. However, the market regulator Securities and Exchange Board of India (SEBI)’s probe revealed that only 4,704 cars were actually purchased. Around ₹262 crore went missing, and SEBI traced the trail. Take a look:

This wasn’t an accounting error. SEBI alleges systematic fund diversion using a web of related-party transactions, where money meant for clean mobility was allegedly used to fund personal indulgences and other ventures.

BluSmart’s Unravelling

Though BluSmart isn’t listed, the blowback has been severe. The company’s business model was capital-intensive. Unlike Uber or Ola (where drivers typically bring their vehicles), it leased or owned its EVs, meaning it needed hefty financing to grow its fleet. That’s where Gensol came in – the company took on debt to buy electric cars and lease them to BluSmart, intertwining the fates of the two companies.

BluSmart bore the brunt of the Gensol scam. Services were suspended without notice. Wallet refunds continue to be stuck in limbo. Its failure highlights how listed companies like Gensol can mask risks associated with their unlisted siblings.

Market Fallout: Impact on Investors

Gensol’s stock has crashed by 91% from its peak, with an 84% decline in 2025 alone. Over 90 lakh retail investors are now staring at red in their portfolios. SEBI blocked a stock split planned earlier during the investigation.

This wasn’t just Gensol’s collapse—it sent ripples across India’s small-cap space. Beyond share price, the scandal has broader implications for investor confidence. It’s a textbook example of how corporate governance lapses can translate into financial risk.

The message? Governance is not a footnote—it’s the plot twist.

Not an Isolated Event

Well, Gensol’s case is not unique. It is only the latest in a string of Indian startup implosions driven by governance issues:

GoMechanic (2023): This Sequoia Capital-backed automobile service startup’s co-founder admitted to financial misreporting early in 2023. GoMechanic had been on the verge of a major funding round when due diligence found accounting irregularities.

The fallout? The startup laid off 70% of its employees and nearly collapsed. Investors pulled back, and GoMechanic became a cautionary tale of “growth at all costs”, leading to ethical lapses.

What connects it to Gensol: Both relied heavily on storytelling to raise capital. Both misled stakeholders through fudged numbers. And in both cases, the truth only emerged when external scrutiny was applied—by investors in GoMechanic’s case, by SEBI in Gensol’s.

BharatPe (2022): Co-founder Ashneer Grover allegedly misused company funds through fake vendors and personal spending. An independent audit sealed his ouster.

The Gensol parallel: Personal enrichment at the company’s cost. In both cases, founders allegedly used corporate funds to support their personal lifestyles, thereby undermining investor trust and violating their fiduciary duties.

Zilingo (2022): A fashion-tech startup founded by Ankiti Bose, Zilingo was once valued at nearly $1 billion. But when the board questioned irregularities in its financial reporting, it led to Bose’s suspension and eventual firing. The company’s funding dried up, and it slid toward insolvency.

Why it matters: Zilingo showed that even startups backed by marquee VCs can falter when governance fails. It also proved that “unicorn” status doesn’t immunise a company from collapse if numbers don’t match the narrative.

All different industries, but the same core issue: when transparency is sacrificed for hypergrowth, the market eventually hits the brakes.

What Investors Should Watch Out For

The Gensol–BluSmart saga is a crash course in what not to ignore as a retail investor, especially in fast-growing smallcaps and “new-age” businesses. Fraud may be hard to spot from the outside, but red flags usually leave a trail. Here’s what stood out:

- Promoter Dealings with ‘Friendly’ Entities

Gensol regularly transacted with BluSmart, a company co-founded by its promoters. It wasn’t even a subsidiary. Over ₹50 crore was routed to promoter-linked firms. If revenue or loans disproportionately involve such parties, it’s worth digging deeper.

- Exit of Key Watchdogs

Earlier, even before SEBI’s action, there were hints of board churn, as one director left during the probe. That followed earlier board churn and potential friction. Similar alarms include sudden auditor exits or refusal to certify results. If those entrusted with oversight are walking away, investors should wonder why.

- Promoters Selling Out or Pledging Big

Gensol’s promoter stake halved—from ~70% to ~35%—in just over a year. Worse, 88% of the remaining stake was pledged. Heavy pledging = potential risk. It implies promoters are raising cash via loans against shares. If stock prices fall, lenders can dump pledged shares, triggering steep declines.

- Mismatch Between Story and Numbers

Despite telling a bullish growth story, Gensol defaulted on ₹470+ crore of loans from IREDA and couldn’t account for thousands of EVs it was supposed to buy. High debt, weak asset growth, or missing cash flows in a company are warning signs. Credit rating downgrades or missed payments are other red flags.

- Opaque or Delayed Disclosures

Did Gensol promptly reveal its loan defaults or the extent of its related-party transactions? It appears information only dribbled out once ratings agencies and SEBI got involved.

- Overstretched Ambitions

From solar EPC to EV fleet ops—Gensol diversified into an entirely new, capital-intensive space. Businesses that leap too far from their core should raise caution. As the saying goes, “Don’t lose sight of the forest for the trees” – keep an eye on the balance sheet strength and corporate governance even when the growth numbers look good.

In short, do your due diligence beyond the glamour. Read through annual reports for related-party links, scan exchange filings for red flags like sudden pledges or exits, trace where the money’s actually going, and pay attention to financial reporting.

Final Thoughts

The Gensol-BluSmart saga is a classic case of misplaced trust, not in the green sector, but in the people driving the vehicle. The EV and renewable energy sectors remain critical to India’s sustainable future, but growth potential can’t be a blind spot.

As an investor, the lesson is simple: don’t get carried away by the promise of a sunrise sector. The stock market will always have exciting stories to offer. But the only ones worth backing are those built on credibility, not just charisma.