The Engine Behind the Engine: A Look at India’s Auto Ancillary Sector 🚗

The Indian auto industry is a powerhouse, consistently ranking among the world’s largest. But it’s not just about the big car companies we see. A crucial, but often unseen, force is the Auto Ancillary Sector, the network of companies that design, manufacture, and supply the essential parts that make vehicles run.

From Nuts and Bolts to High-Tech Systems:

Let’s understand what auto ancillary companies do in detail. Imagine a car – every single component, from the nuts and bolts that hold it together to the complex engine, braking systems, music system, sunroof, etc is made by a company in the auto ancillary sector. This sector encompasses a vast array of specialists, producing everything from body panels and seats to electrical components and emission control systems.

Diving Deeper: A Breakdown of the Industry

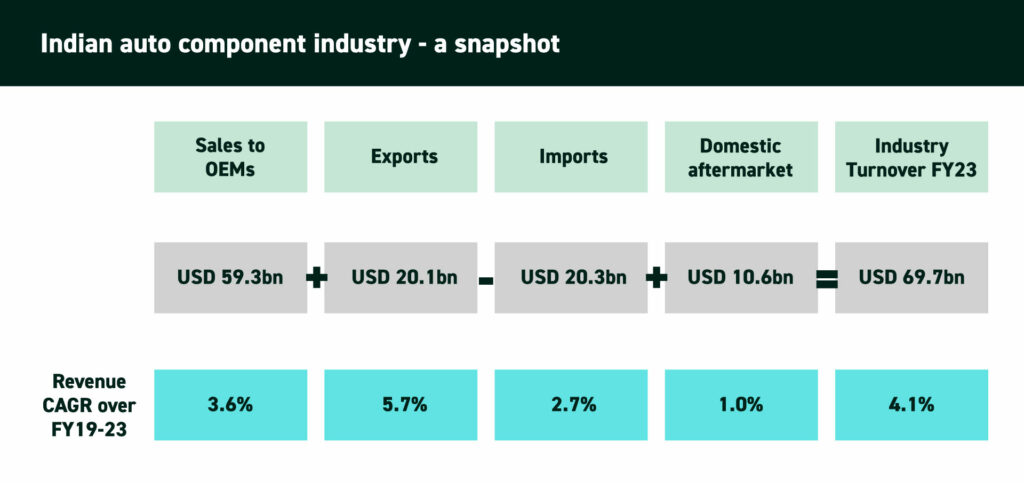

Now, let’s delve into the data. The Indian auto component industry is a significant contributor to the Indian economy, generating billions in revenue. Sales to OEMs (Original Equipment Manufacturers) referring to car companies that purchase the auto components were the largest category at USD 59.3 billion.

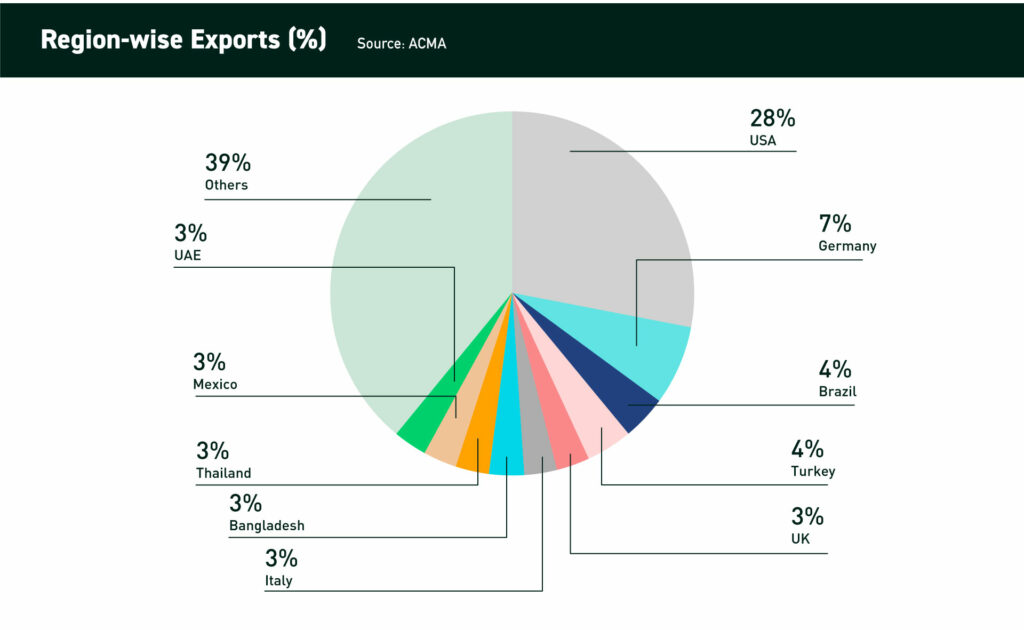

North America (32%), Europe (31%), and Asia (26%) were key markets that India exported to. Imports were largely at par with exports at USD 20.3bn. After export-import and domestic aftermarket (companies selling parts and services to repair existing vehicles) the turnover came up to USD 69.7 billion. The numbers also indicate that the Turnover revenue CAGR over FY 19-23 has been at 4.1%.

Revenue breakdown by Category

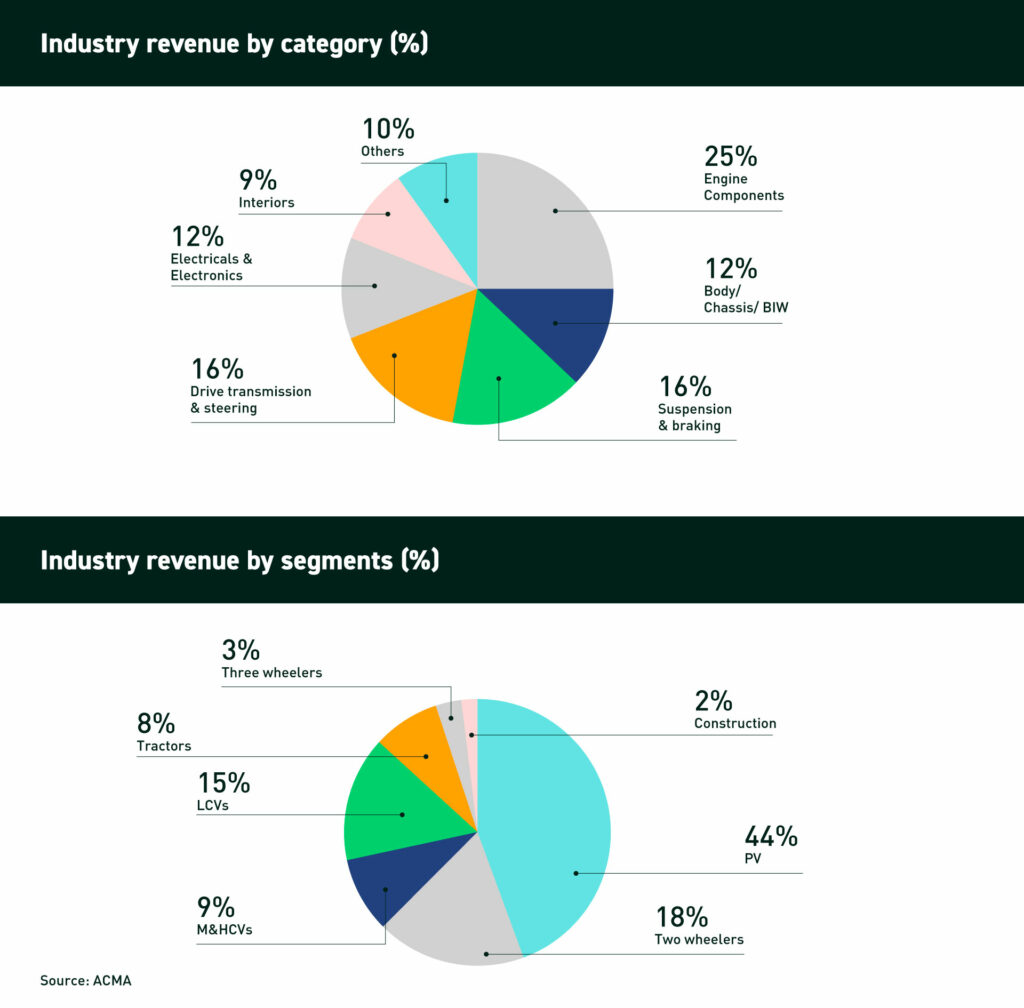

- Engine components account for the largest share at 25%.

- Drive Transmission and Steering are at 16%, and Suspension and Braking, are also at 16%. These categories ensure smooth operation and control of the vehicle.

- Body, Chassis, and Body-in-White (BIW) contribute to 12%. This includes the framework and foundation of the vehicle.

Revenue Breakdown by Segment

Passenger vehicles like private cars, SUVs, etc (PVs) dominate at 44%, followed by two-wheelers at 18% and Light Commercial Vehicles (LCVs) at 15%. This reflects the demand for cars and SUVs in India.

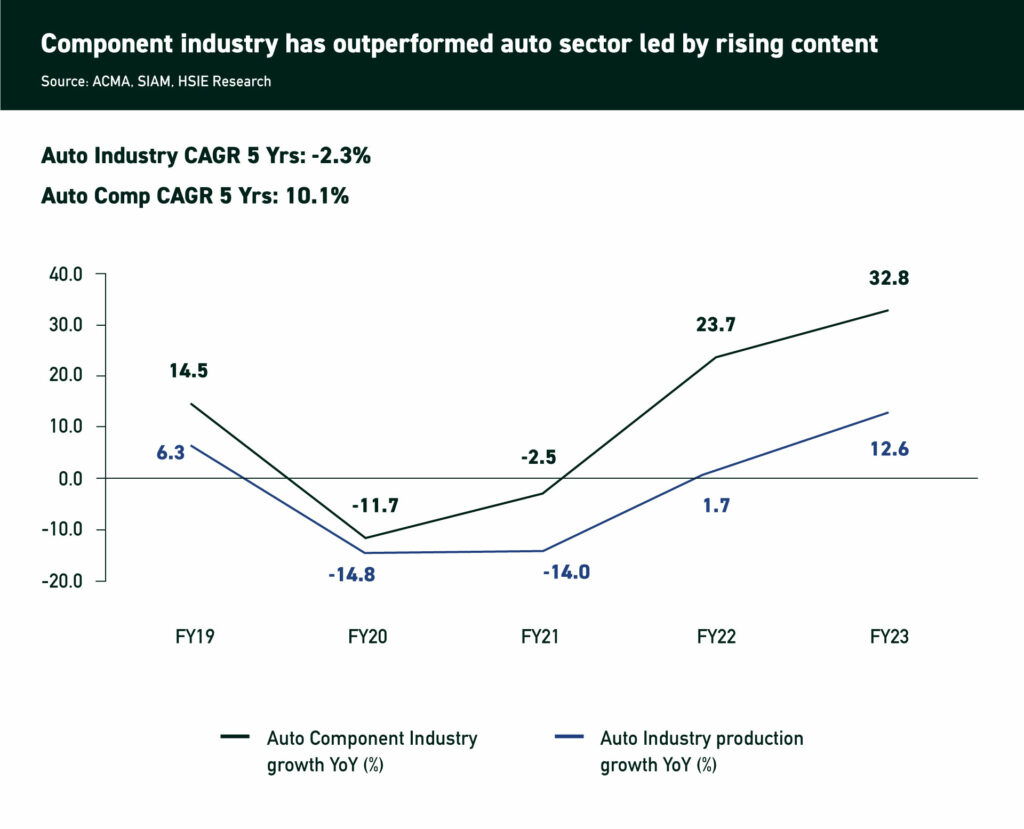

Traditionally, the Auto Ancillary sector has mirrored the performance of car manufacturers, but several significant trends have positioned this sector as a standout performer. Let’s understand this in detail.

Supply Chain Disruptions in the Auto Sector

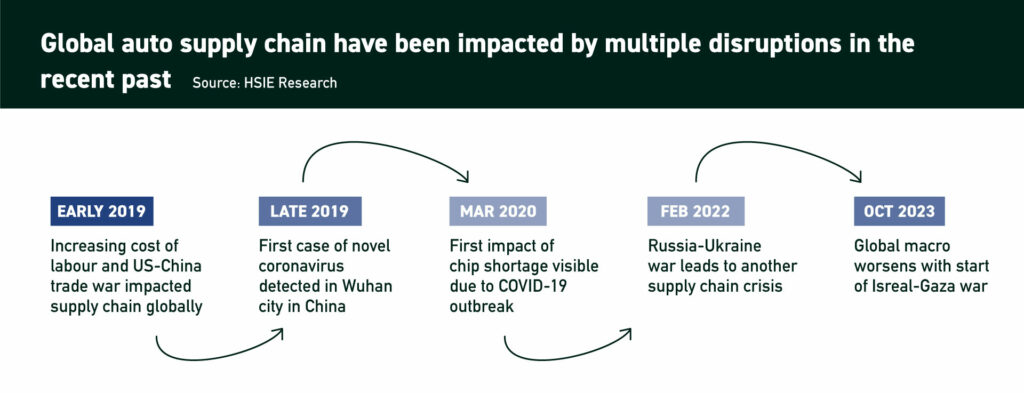

The past few years have been a rollercoaster for the global automotive industry. Since 2018, a series of events have caused major disruptions to the supply chain, leading to production slowdowns and parts shortages.

Here are some of the key culprits:

- COVID-19 Pandemic: The pandemic’s impact went far beyond lockdowns. Factory shutdowns and worker shortages caused significant delays in production.

- Chip Shortage: A ripple effect from the pandemic, a global shortage of semiconductors, crucial for modern vehicles, crippled car production worldwide.

- Trade Tensions: The ongoing trade war between the US and China created uncertainty and made it harder for automakers to source components freely.

- Geopolitical Conflicts: More recent events, like the war in Ukraine and the conflict in Israel-Gaza, have further disrupted supply chains and added pressure to an already fragile system.

The combined effect of these disruptions is staggering. Estimates suggest that between 2020 and 2022, roughly 12% of global car production was lost. What did the Auto Ancillary companies do to get out of this soup?

Derisking Strategy of Global OEMs

First of all, what exactly does derisking mean in the context of the Auto Industry? A derisking strategy refers to the efforts taken by global automakers (OEMs) to reduce their dependence on any single source for car parts.

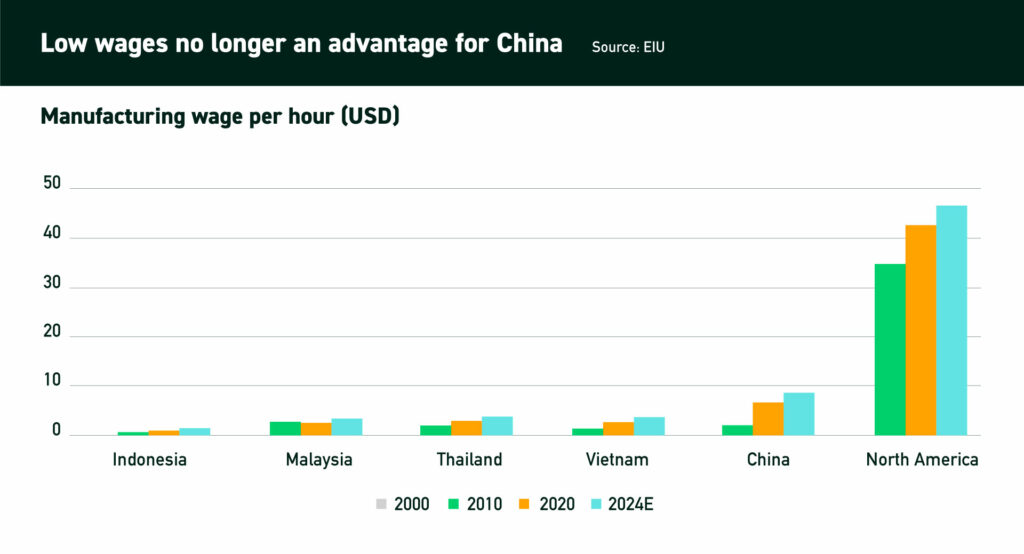

Major manufacturers are looking to diversify their sources. India is emerging as a strong candidate to benefit from this trend. The shift is likely driven by rising manufacturing costs in traditional locations like China, making India’s competitive wages more attractive.

Beyond China

While a complete move away from China is unrealistic, car manufacturers are looking to reduce their dependence on a single source. This “de-risking” strategy involves spreading production across different regions.

Southeast Asian countries like Vietnam, Indonesia, Malaysia, Thailand, and Cambodia are emerging as attractive alternatives to China. These regions boast adaptable and high-quality industrial bases, making them well-positioned to absorb some of the production shift.

India, in South Asia, is also seen as a potential beneficiary. According to the EIU Business Environment Rankings, key economies in ASEAN and India are well-placed to capture this supply chain diversification.

Moreover, the US is reducing its reliance on China for imports. In fact, US imports from China have declined by 10% (inflation-adjusted) between 2018 and 2022. India is emerging as a strong alternative to the US. Exports from India to the US have surged by 44% during the same period, reaching $23 billion in 2022. The combined value of new US and European investments in India has grown a staggering 400% to reach $65 billion in 2021 and 2022. Meanwhile, new investments in China have plummeted from a peak of $120 billion in 2018 to less than $20 billion in 2022.

Driving Towards Contentment

The Indian auto component industry is experiencing a boom in “content,” which refers to the increasing complexity and value of components supplied to original equipment manufacturers (OEMs).

This growth is fueled by several key trends:

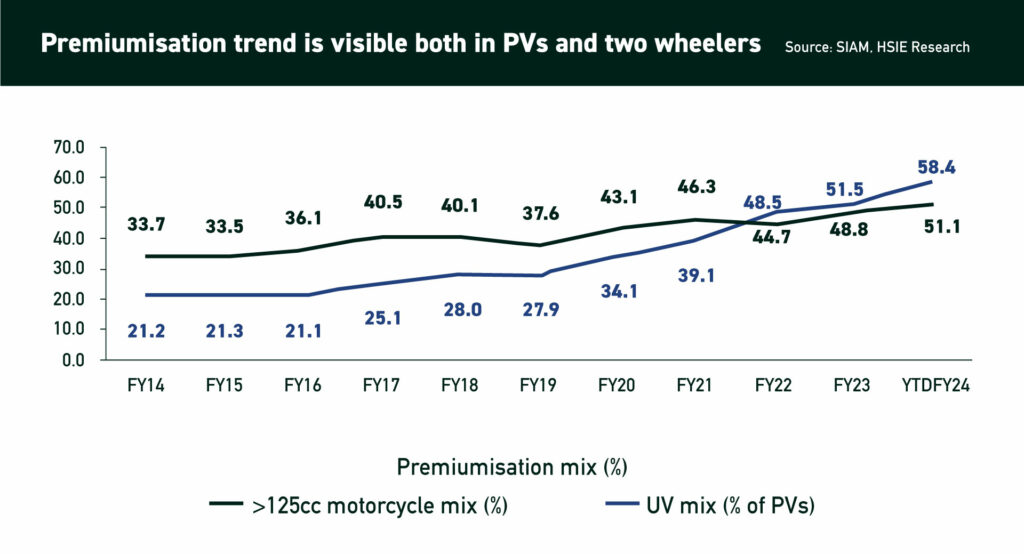

Enduring Premiumization: Consumers across all vehicle segments are increasingly demanding premium features and functionalities. This trend is expected to continue, driving the demand for more sophisticated components. For instance, when I ask you to imagine a car – you are more likely to imagine a sedan or an SUV vs a hatchback. You are also more likely to want a sunroof, automatic transmission, and proximity sensors (sensors that detect when a vehicle is too close to your own) among others.

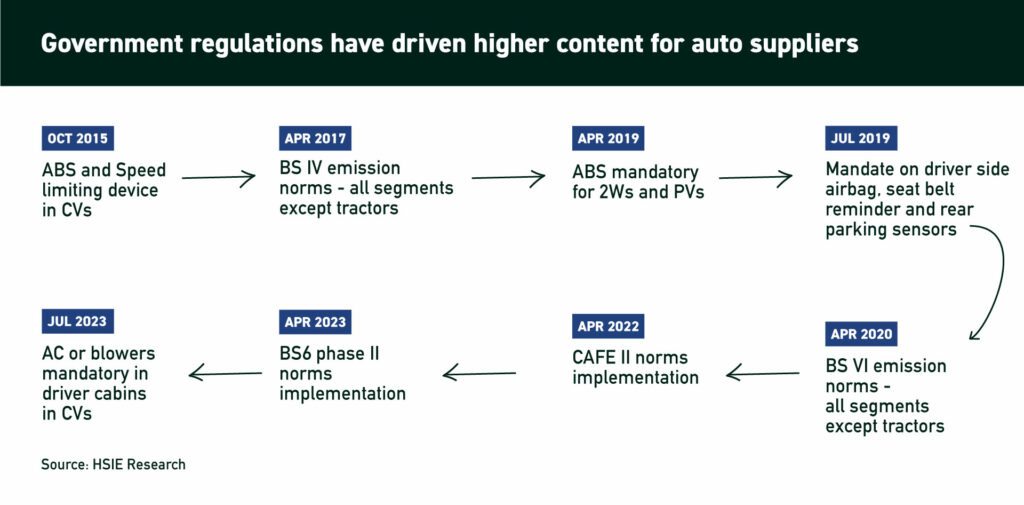

Regulatory Tailwinds: The Government is bringing up new safety regulations like mandatory crash tests, airbags, BS6, etc, pushing up the average selling price (ASP) of vehicles. To comply with these regulations, automakers need to incorporate advanced components, further benefitting the component industry.

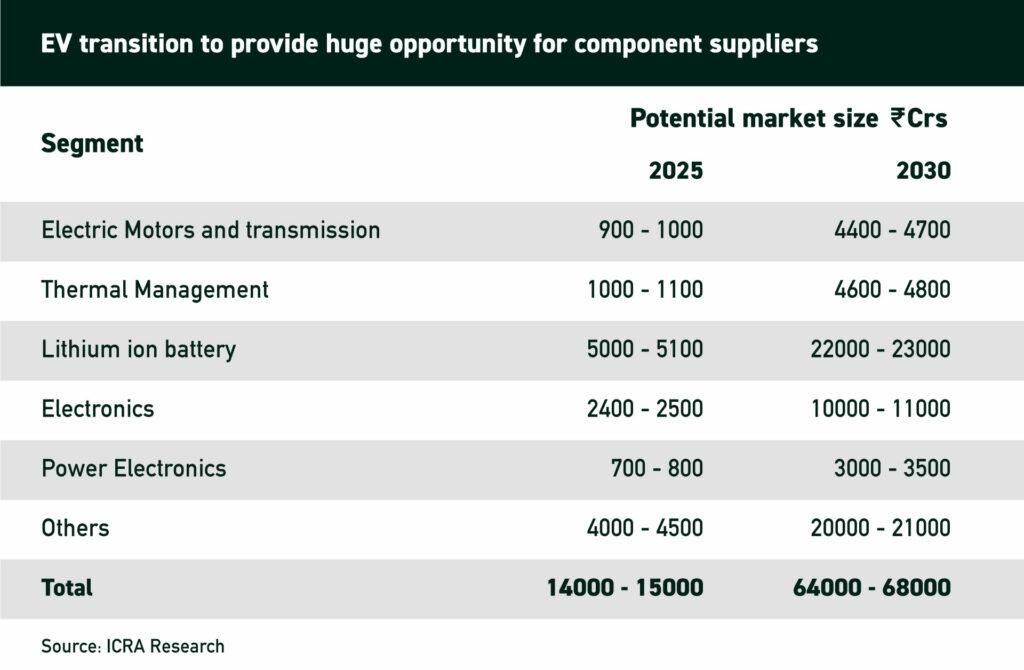

Electric Vehicle Revolution: The transition to electric vehicles (EVs) requires a whole new set of specialized components. This shift presents a significant growth opportunity for auto component manufacturers.

In fact, the sale of cars has surpassed two-wheeler sales since FY22.

Auto Industry Accelerates with ‘Make in India’ Initiative

The Indian government is pushing for a “Make in India” initiative in the auto sector, offering financial incentives to boost domestic manufacturing. The PLI (Production Linked Incentive) scheme, with a budget of ₹25,940 crore ($3.4 billion USD) provides support to both automakers and auto component manufacturers.

Here’s a breakdown of the PLI scheme for the auto sector:

Financial Incentives: The scheme offers financial rewards for localizing advanced car parts, including components for electric vehicles (EVs) and hydrogen fuel cell vehicles.

Focus on Advanced Technologies: The program aims to encourage domestic production of high-tech car components, like electronic steering systems, automatic transmissions, and advanced safety features.

Expected Growth: The government believes these policies will create significant growth opportunities for Indian auto component companies.

Industry Investment Boost: Anticipating this growth, the auto component industry is expected to invest heavily in expanding capacity and upgrading technology. This investment is projected to be nearly double what was invested in the past five years.

India emerging as an auto hub:

India is becoming a significant player in the global auto industry. With a rise in demand for vehicles and the country’s emissions now aligning with many other markets, India is attracting global auto manufacturers, which is expected to benefit the Ancillary sector. The auto component industry is projected to invest around USD 6.5-7bn in the next five years, twice the amount invested in the previous five years, due to India’s core strengths of providing global quality at a low cost and improving R&D skills.

Auto Component Industry – In a sweet spot?

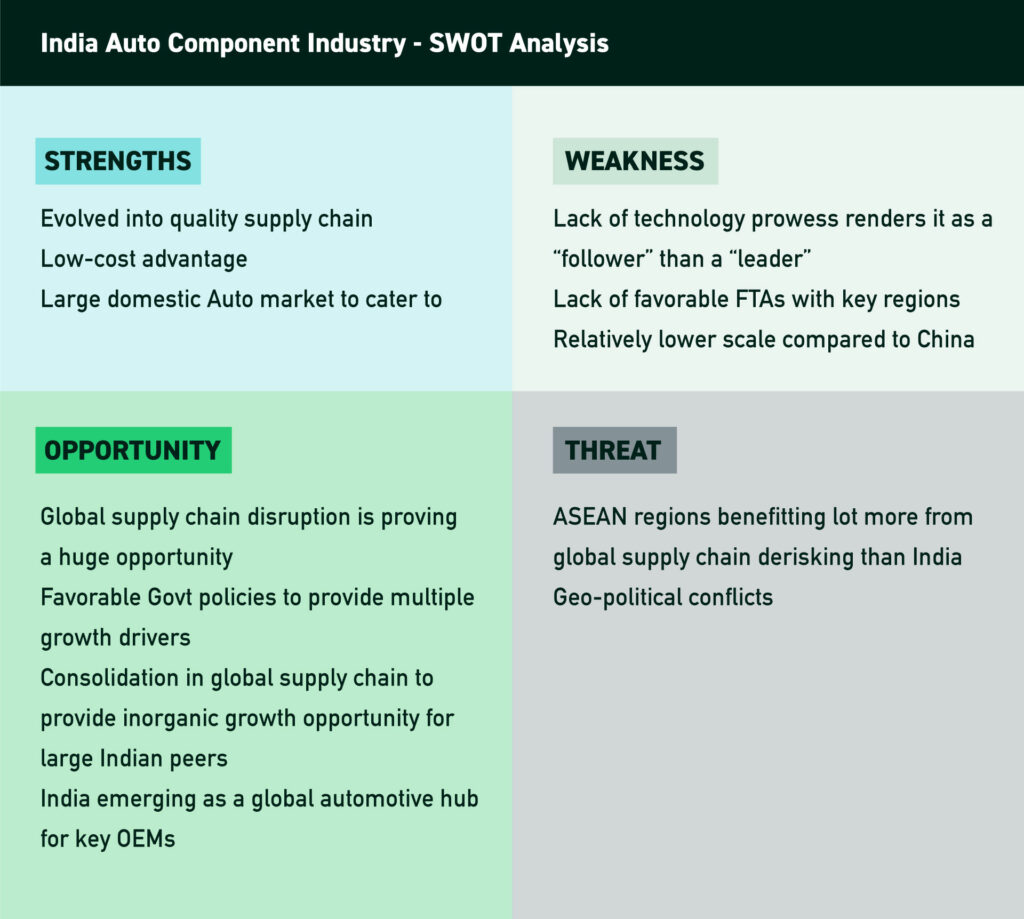

The Indian auto component industry has transformed from a regional player to a crucial participant in the global automotive supply chain over the past decade. This growth is attributed to a combination of the industry’s inherent strengths and favorable external factors.

The domestic market size and cost competitiveness are strengths that position India well. Additionally, disruptions in global supply chains and supportive government policies present significant opportunities for growth. The industry is poised for sustained momentum in the coming years, potentially becoming a major supplier in the global automotive landscape.

A lack of cutting-edge technology compared to global leaders restricts the industry’s ability to compete for high-tech components. Additionally, the absence of favorable Free Trade Agreements (FTAs) with key regions hinders exports. India’s component industry also faces challenges in terms of scale when compared to giants like China.

While disruptions create opportunities, Southeast Asian nations might be better positioned to capitalize on them. Geopolitical conflicts can disrupt supply chains and create uncertainties for the industry.

Driving Forward: The Future of Auto Ancillary in India:

The Indian auto ancillary sector is well-positioned for future growth. By capitalizing on its strengths, addressing its challenges, and adapting to the evolving global market, the Indian auto ancillary sector can solidify its position as a major player on the world stage.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.