India’s Economic Rollercoaster: GDP, Inflation, & Market Madness

A positive growth, a cooling inflation and a market mayhem. While it’s two against one, this concoction is not the most suitable one for you to consume. Confusing? Let us explain.

India’s economy is having quite a ride! After a bit of a stumble, it is getting back on its feet, with GDP growth bouncing back to 6.2% in the third quarter of FY25 from a concerning 5.4% in the previous quarter. Meanwhile, January brought some relief as the headline inflation eased to a five-month low of 4.31% due to a fall in food prices.

But don’t pop the champagne just yet. These economic indicators emerge against a backdrop of unusual market volatility that has left many investors questioning their investment strategies.

Here’s a lowdown.

GDP Growth: The Comeback Kid

India’s GDP clocked in at 6.2% growth for October- December 2024, according to the National Statistics Office (NSO), aided by rural consumption and higher government spending.

While this is a welcome improvement from the seven-quarter low of 5.4% recorded in Q2FY25, it’s still far from the country’s sweet spot of 7-7.5%.

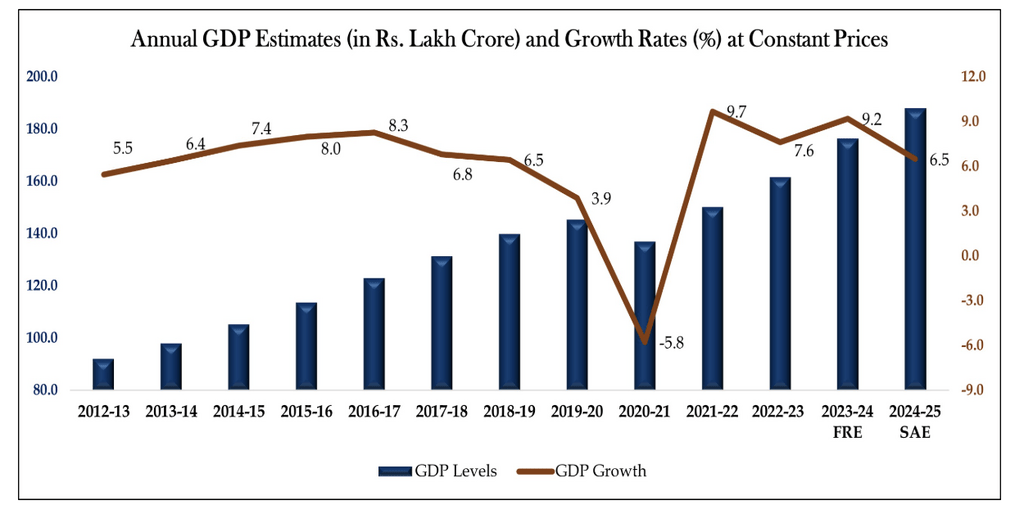

The growth trajectory over recent quarters reveals a pattern of sequential slowdown that began after a robust post-pandemic recovery. After reaching 8.4% in Q3FY24, growth declined to 7.6% in Q4FY24, further moderated to 6.7% in Q1FY25, and then dropped sharply to 5.4% in Q2FY25 before the current uptick. This recovery, while modest, suggests that things are stabilising.

Seeing the trend, the Ministry of Statistics has revised its full-year GDP forecast (April 2024 to March 2025) to 6.5% from 6.4%, while the RBI is slightly more optimistic at 6.6%. Looking ahead, they are expecting 6.7% growth in FY26, suggesting a slow but steady upward trend. Also, the government revised its previous year’s GDP estimate to 9.2% from 8.2%, hinting that India’s post-pandemic comeback was stronger than initially calculated.

Inflation: Some Breathing Room

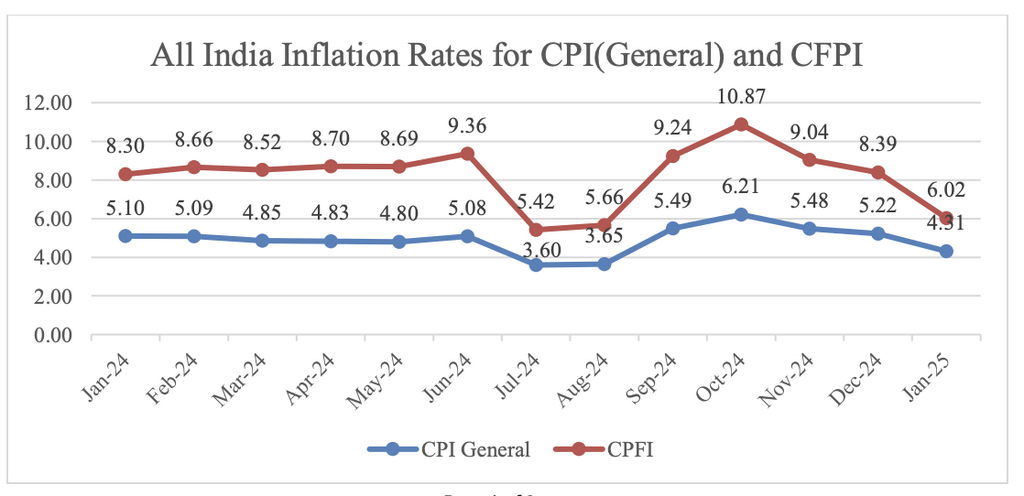

Now, let’s move towards retail inflation. January’s Consumer Price Index (CPI) cooled to 4.31% from 5.22% in December 2024. That’s the lowest we’ve seen since August 2024 and way down from the scary 6.21% peak in October 2024.

How does it affect you? CPI tells you how much the prices of everyday things like food, rent, and fuel have increased over time, showing how inflation affects your cost of living.

The biggest reason for this ease is food inflation, which has been giving people heartburn for months. The Consumer Food Price Index (CFPI), which measures how food prices change over time, fell to 6.02% in January, a solid drop from 8.39% in December. This was due to vegetable prices crashing from a dizzying 26.56% inflation in December to a much saner 11.35% in January.

However, there are some red flags. Edible oil inflation surged to 15.6%—maybe it’s time to rethink those deep-fried treats. Housing inflation (2.76%) remained steady, while clothing and footwear inflation eased slightly.

Overall, while we’re not entirely out of the woods, inflation seems to be heading in the right direction.

Stock Market: Testing the Turbulent Waters

If GDP growth and inflation look better, why is the stock market acting like a rollercoaster at an amusement park? Let’s understand this.

Early 2025 has been brutal for Indian equities. The markets have hit multi-month lows, and investors have seen red—literally.

This downturn represents a stark contrast to the market’s performance in previous years, with the benchmark indices posting losses for several consecutive months, the most severe decline since the March 2020 Covid market downturn. The correction has been particularly severe in the mid- and small-cap segments, with the BSE Smallcap index declining 13% — its first double-digit monthly reduction since the pandemic—and the Nifty Midcap 100 dropping 10.8%, since last one month till March 3, 2025.

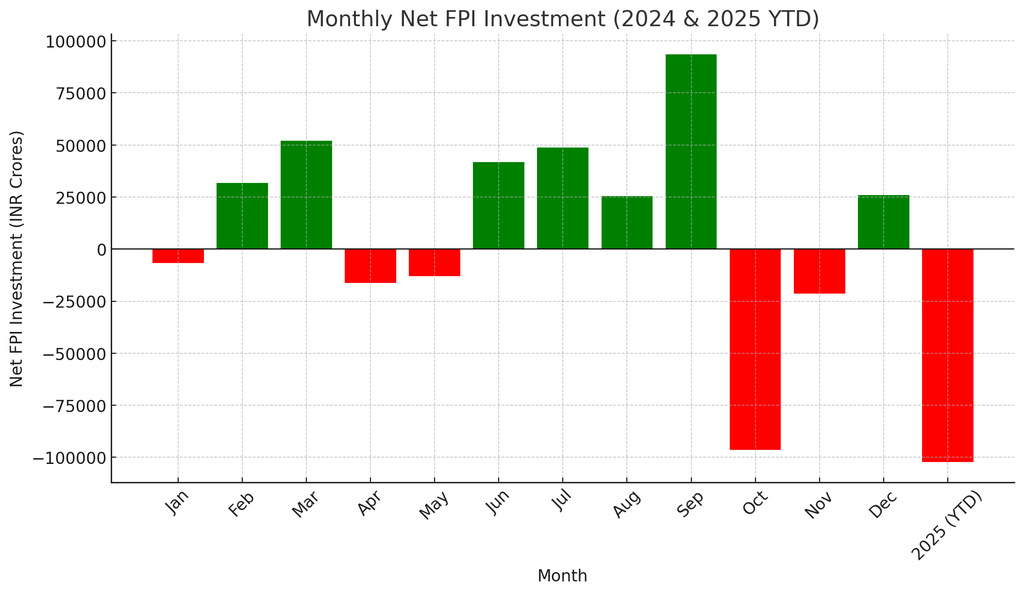

In mid-February, the market cap of Indian equities fell below $4 trillion for the first time in over 14 months, thanks to aggressive selling by foreign portfolio investors (FPIs). This led to the ‘Great Exodus of FPIs.’

From investing ₹1.7 lakh crore in 2023, the FPIs invested only ₹427 crore in Indian equity markets throughout 2024 and have pulled over ₹1 lakh crore this year alone (in the last two months). Imagine a long-time guest suddenly deciding to leave your party, taking all the snacks with them—that’s what FPIs did to Indian markets.

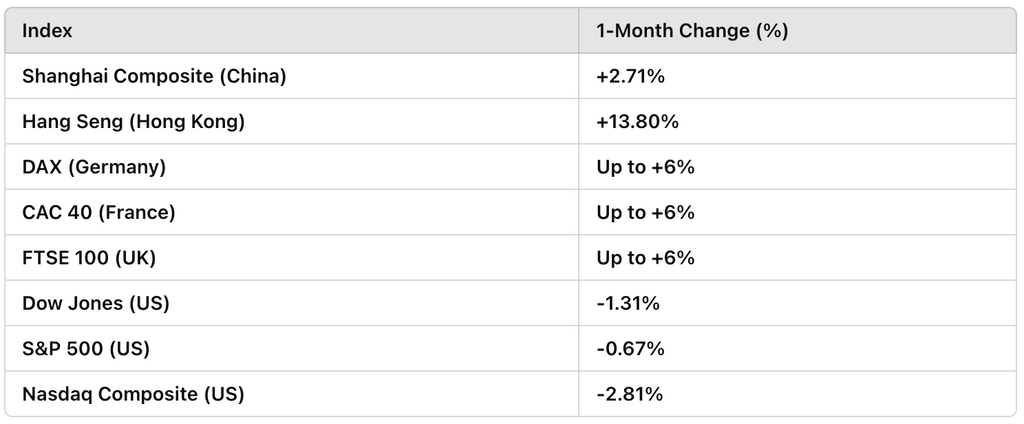

What’s making this worse is that while India’s markets are struggling, global markets are still stable. Major indices in the US, Europe, and Asia are showing more resilience with mixed market moves, unlike a plunge, leaving Indian investors wondering what’s going wrong here.

1-month basis data as of March 3, 2025:

Analysts say volatility might persist through the first half of 2025 due to factors such as Trump’s new tariff policies, China’s trade moves, India Inc.’s muted third-quarter earnings, and the rapid fall of the Indian Rupee against the US Dollar. But if history has taught us anything, it’s that markets have a way of bouncing back when least expected.

The key is to average out. Remember: In 2020, large, mid-and-small cap stocks fell up to 40%, but they also rose by 200%-400%.

Markets vs Macro: How it Connects

The relationship is more complex than the USA-Ukraine press conference!

Even with healthy economic growth, this moderate improvement has been insufficient to counter the opposing forces driving market volatility. This suggests that investors are more focused on what lies ahead than what has already happened.

You might infer that lower inflation means consumers have more spending power, which could drive growth in the coming months. However, the immediate market reaction to improving inflation data has been muted. This dichotomy suggests that while long-term prospects remain strong, short-term jitters are unavoidable.

To sum up, the economy has been moderating, potentially justifying some of the market’s recent caution. However, the revised GDP forecast of 6.5% for FY25 and the projection of 6.7% for FY26 suggest a stable growth outlook that should theoretically support market valuations in the medium term, though the timing remains uncertain.

What Should Investors Do?

If you’re a small investor, this market can feel like driving on Indian roads—unexpected speed bumps everywhere. The trick? Stay calm, stick to a strategy, and avoid knee-jerk reactions.

That said, the medium-term outlook for Indian equities seems optimistic, supported by factors like a stable macroeconomic environment, increased government spending, and improving corporate earnings. Additionally, with inflation cooling off, the RBI might ease interest rates further, which could boost market sentiment.

Experts recommend a hybrid investment approach—maybe split between large-cap stocks (which have become relatively cheaper) and equity funds. SIPs continue to be a good bet, as domestic investors have been a stabilising force in the markets, even as FPIs bail out.

To Wrap Up

India’s economic trajectory is stabilising after a few turbulent quarters. The positive headline indicators give room for policy adjustments, and market jitters, while painful, are not permanent.

Long story short: Stay patient, keep investing systematically, and use volatility to your advantage. The markets may be unpredictable now, but for those playing the long game, this phase might provide better opportunities.