Sprouting Profits: Why India’s Agrochemical Industry is Ready to Bloom

Agriculture: The Heartbeat of India’s Economy

Agriculture is not just a sector; it’s the lifeblood of India providing livelihoods for over half the population and contributes about 18% to the nation’s GDP. From the staples like rice and wheat to high-value crops like spices, fruits, and vegetables, India has not only become self-sufficient in food grains but also carved a niche for itself in the global export market.

India’s agricultural exports make a substantial impact on global food security.

- India supplies 30% of the global rice trade, feeding millions worldwide.

- India leads in spice exports, contributing 30% to the global market, essential for food flavoring and preservation.

- India exports 15% of the world’s pulses, a critical source of protein.

All these highlight India’s critical role in the global food supply chain, impacting a significant portion of the world’s population.

Shrinking Farmland and the Crucial Role of Agrochemicals

With the global population at around 8 billion, set to grow by 1.2 billion by 2030 and an additional 2 billion by 2050, which means more demand for food and protein. Despite this, food insecurity is a growing concern. Currently, about 10% of the global population, face food insecurity. If trends continue, this number could rise to between 800 million and 1 billion by 2030.

Tackling these issues will require boosting agricultural productivity, improving food distribution, and enhancing resilience to environmental challenges. However, arable land is shrinking significantly—from around half an acre per person today to less than a third by 2050. This sharp decline in available farmland underscores the urgent need to increase food production on less land. Agrochemicals become vital in this context, playing a crucial role in enhancing crop yields and ensuring global food security.

India’s Agrochemical Revolution: A Harvest of Opportunities

The Indian agrochemical industry is valued at around $7.5 billion and is projected to grow at a compound annual growth rate (CAGR) of 8-10% over the next few years. This makes it one of the largest agrochemical markets globally.

India is on the cusp of an agrochemical revolution, and there’s plenty to be excited about! As the 2nd largest exporter of agrochemicals in the world and a top player in crop protection production, India’s agrochemical sector is set for remarkable growth. With domestic innovation picking up pace and a strong focus on manufacturing competitive post-patent products, the market is expected to expand at a healthy rate, yielding a bountiful harvest of opportunities in the agrochemical sector.

Agrochemicals might sound like a complicated term, but it’s really all about two main things: fertilizers and pesticides.

Fertilizers vs. Pesticides: What’s the Difference?

Think of fertilizers as the vitamins for plants—they give crops the nutrients they need to grow big and strong. Pesticides, on the other hand, are like the medicine—they protect crops from the bad guys like pests and diseases.

Fertilizers often rely heavily on government subsidies and face challenges with pricing power and differentiation, leading to lower margins. On the flip side, pesticide companies operate with more flexibility, often enjoying higher margins due to the unique formulations they offer.

Pesticides: The Unsung Heroes of Indian Agriculture

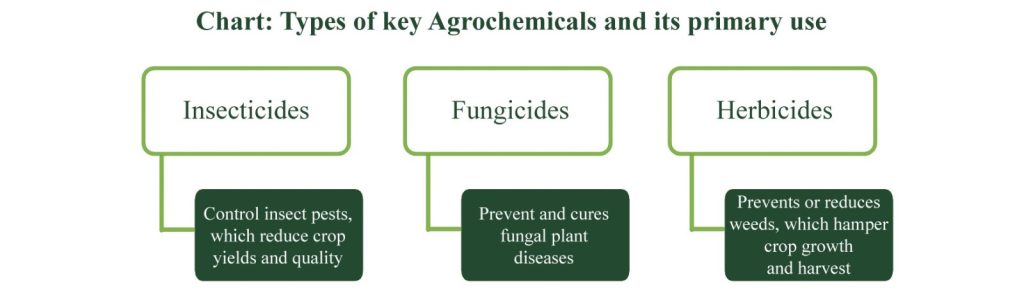

In India, pesticides play a vital role and come in various types based on what they target:

- Insecticides: These are used to battle crop-damaging insects. India’s tropical climate and high production of crops like paddy, cotton, and sugarcane make insecticides a staple. Popular choices include organophosphates, carbamates, and synthetic pyrethroids.

- Herbicides: Weeds are a big problem, and herbicides are here to save the day. They manage and eliminate weeds that compete with crops for nutrients, water, and sunlight. As labor costs rise and worker shortages increase, herbicides are becoming more popular. Common ones include glyphosate, atrazine, and 2,4-D.

- Fungicides: These are crucial for preventing fungal diseases in crops. The shift towards cultivating fruits and vegetables, coupled with government support for exports, has boosted fungicide demand. Some commonly used fungicides are mancozeb, carbendazim, and copper oxychloride.

Paddy is the biggest consumer of agrochemicals in India, accounting for 26-28% of use, followed by cotton. Eight states—Andhra Pradesh, Maharashtra, Punjab, Madhya Pradesh, Chhattisgarh, Gujarat, Tamil Nadu, and Haryana—dominate the market, using over 70% of India’s agrochemicals, with Andhra Pradesh leading the pack.

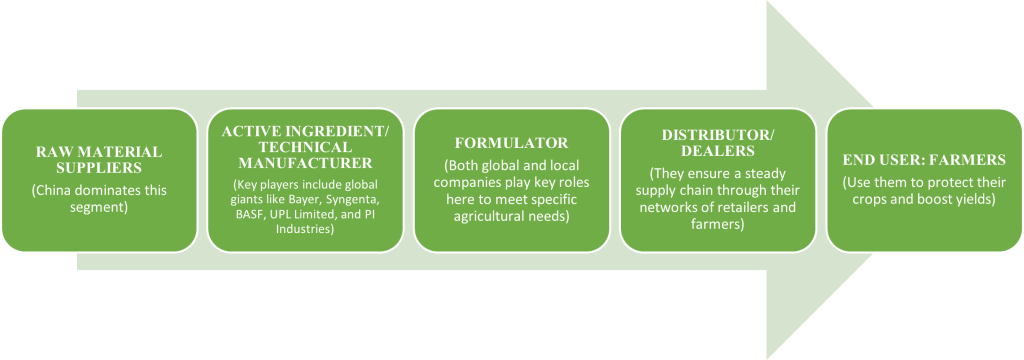

The Pesticides Market Value Chain: From Factory to Field

The journey of a pesticide from raw material to the farmer’s field involves a complex value chain:

Why Invest in India’s Agrochemical Industry?

So, why should investors keep an eye on India’s agrochemical industry? Here’s the scoop:

- Surging Demand, Shrinking Farmland:

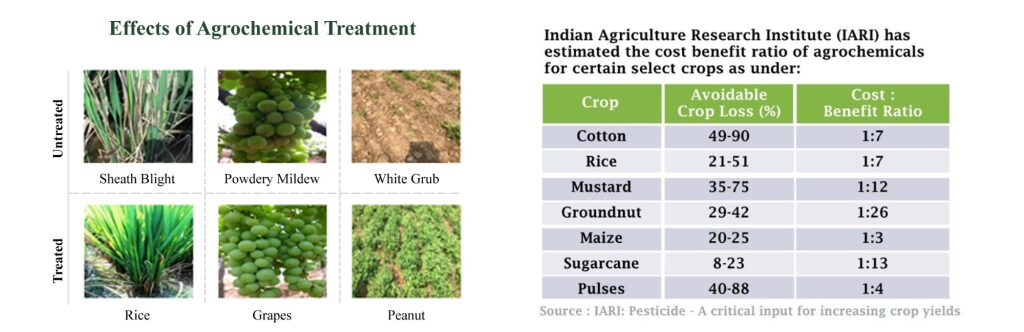

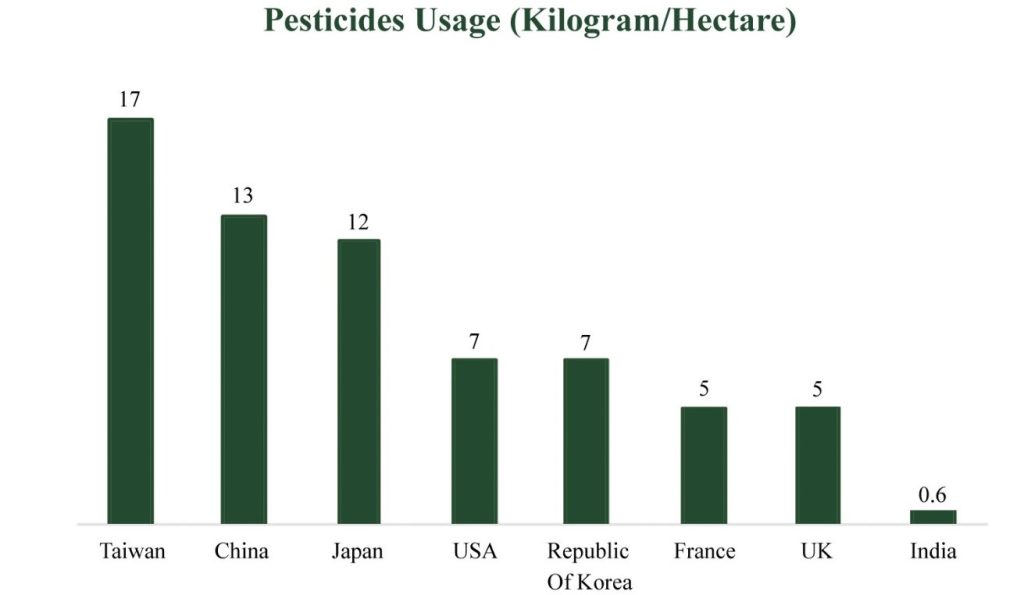

With a rising population and increasing focus on nutrition, expanding agrochemical use is crucial. The reduction in arable land further amplifies the importance of agrochemicals in optimizing crop yields. In India, where agriculture is the backbone of the economy, this dynamic ensures a sustained and escalating demand for agrochemical solutions. India’s per hectare agrochemical consumption stands at just 0.65 kg, compared to 7 to 10 kg in countries like USA and China. This disparity stems from India’s fragmented agriculture, with many small farmers having limited access to agrochemicals, which hampers productivity. Additionally, about 20-25% of India’s food production is lost to pests and diseases.

Innovation and Export Potential:

India’s competitive edge in low-cost manufacturing and a growing focus on innovation position it well on the global stage. The agrochemical exports have shown remarkable growth recently and could exceed Rs 80,000 crore in the next four years – Agro Chem Federation of India

- Government Focus: With significant budget allocations for agriculture and allied sectors, the government is committed to boosting productivity and promoting sustainable farming. The government is now supporting this shift with favourable schemes and awareness programs to boost agrochemical adoption.

- Favorable Environmental Conditions: Positive weather forecasts from the Indian Meteorological Department for 2024 suggest strong agricultural output, further driving demand for agrochemicals.

Challenges on the Horizon

However, the road ahead isn’t without bumps. The industry faces challenges such as:

- Slow registration processes delay product approvals, hindering market entry and innovation.

- Rising raw material costs, especially due to import dependency from China, impact margins.

- The lack of reliable contract manufacturing partners adds operational inefficiencies.

- Inconsistent safety practices during production pose risks to farmers and crops.

- Revenue remains unpredictable due to the industry’s dependency on monsoon conditions.

Looking Ahead

Despite these hurdles, there’s optimism on the horizon as raw material costs stabilize and global inventory levels adjust. In the years to come, companies that succeed will be those that strategically invest in their capabilities, especially in backward integration. Speed to market, efficient payment cycles, and strong branding will be key differentiators in this rapidly evolving landscape.

The future of India’s agrochemical industry is bright, with opportunities sprouting at every turn. As the sector continues to bloom, it’s not just about feeding India—it’s about feeding the world.

Check out Niveshaay Consumer Trends Portfolio

“With innovation in agrochemicals, we are not just improving crop yields but also securing the future of Indian agriculture. These advancements are crucial for feeding our growing population.” – N. R. Narayana Murthy, Co-founder, Infosys

Disclaimers and Disclosures

SEBI Registration No. :INH000017338, IN/AIF3/24-25/1571, IN/AIF2/24-25/1607 | BASL Membership ID: 6276

Investment in Securities Market are subject to market risks. Read all related documents carefully before investing. The securities quoted are for illustration only and are not recommendatory. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.