smallcase Raises $50M in Series D Funding

Today, we are announcing a $50M Series D funding led by Elev8 Venture Partners with participation from new investors, State Street Global Advisors & Niveshaay AIF and existing investors Faering Capital & Arkam Ventures.

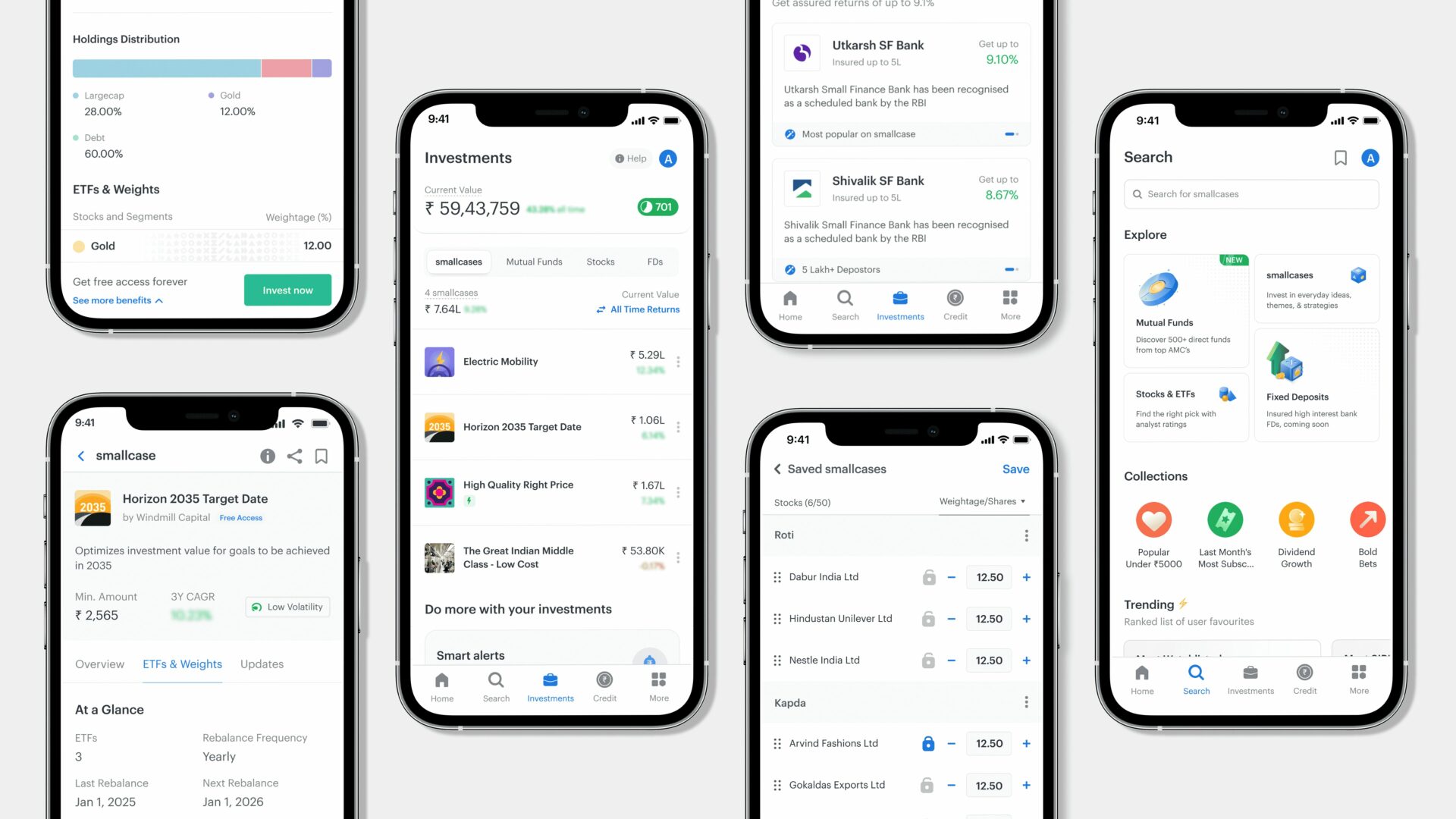

In the last 9 years, smallcase has created a new class of investment products – model portfolios of stocks & ETFs, also called smallcases – for individuals to take a diversified approach towards building their long-term portfolios with full transparency and control. This has enabled millions of retail investors to responsibly allocate to stocks and ETFs to design better financial outcomes. 18 months back, we extended our products layer to our own index funds & ETFs by launching a new asset management company (in a joint venture with Zerodha).

As more people choose our products to build their portfolios, we remain focused on continuously improving the experience we provide. With this funding, we look forward to continue innovating with new asset classes in the smallcases form factor, tools for our customers to manage & optimize their wealth better and expanding our offerings to new markets, channels and partners.

“The smallcase team has built a world-class investment platform that has become a mainstream player in India’s asset and wealth management landscape. smallcase has not only established itself as a trusted brand but also continues to innovate on new formats to further scale its platform. At Elev8, we strongly believe in smallcase’s vision and growth potential and are excited to support them in their journey”, said Navin Honagudi, Managing Director and Founding General Partner, Elev8 Venture Partners.

“smallcase has built a robust and scalable platform serving retail investors with differentiated products with a focus on cost efficiency. We are excited to invest from both our funds, having witnessed the journey firsthand and can vouch for the team’s steadfast execution”, said Arvind Kothari, Founder, Niveshaay.

“Since our initial investment, smallcase has continued to innovate and grown AUM and revenues over 10X. We are delighted to strengthen our partnership with the smallcase team as they continue to build one of the most trusted investment platforms for retail investors in the country” said Sameer Shroff, co-founder and Managing Director at Faering Capital.

“Arkam invested in smallcase in 2020, seeing their potential to bring sophisticated investment products to the masses: affordable, transparent, and built on deep market insight. smallcase has demonstrated incredible scale with clear focus on user experience and product innovation. We’re excited to continue backing them as they shape the future of wealth tech in India.” said Rahul Chandra, Managing Director, Arkam Ventures.

Thank you to all our customers and partners for being on this journey with us. We’ll keep working hard to make our products & platforms even better.