smallcase in focus – Value & Momentum

In the last edition of smallcase in focus, we had spoken to you about the underperformance seen in growth stocks, owing to which CANSLIM-esque smallcase was a laggard in 2022. This time around we will be talking about the other side of the coin – value stocks’ dominance and hence the rise in Value & Momentum smallcase. Per the name suggests, this smallcase picks value stocks which are witnessing market momentum.

Value stocks are those stocks which trade below their intrinsic value, i.e. undervalued. These stocks typically have low P/E ratios, as a result. But the question is why is this shift from growth to value stocks happening all of a sudden?

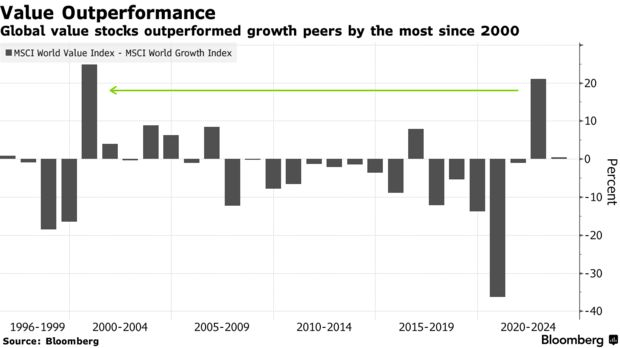

If I had to answer that question in one word, it would be – macros. Central banks, across the globe, are increasing interest rates and pursuing a hawkish monetary policy which has nudged investors to flee from highly priced stocks towards safety. A new world order is unfolding in front of our eyes, with high interest rates and high inflation, and value stocks seem to ride with the tide. The chart below corroborates our view.

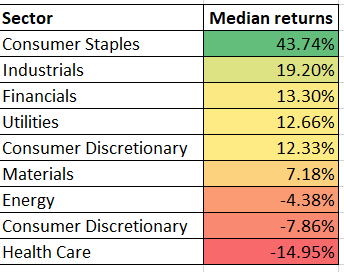

Well, we chose to peel the onion layer and assess the performance of the Value & Momentum smallcase with a closer lens. First things first, let’s take a look at the performance of various sectors present in the smallcase since June ‘22.

You see, most of the sectors have contributed positively to the smallcase since June ‘22, with consumer staples being the rank outperformer. This was due to ITC’s stellar run-up which was the only stock in the consumer staples segment.

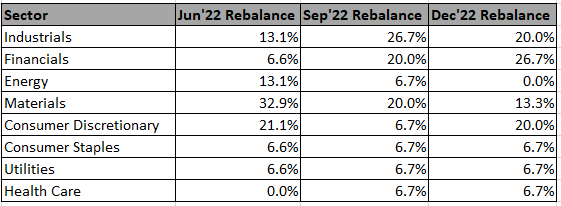

On the basis of the selection criteria, few value sectors have dominated the weightage in the smallcase, take a look –

At this juncture, it’s opportune to delve deeper into the understanding of value sectors. Before that, it is important to mention that since this is a model smallcase, all of these sectors get self-selected into the smallcase.

In the table attached above, few patent value sectors include – Industrials, Financials, Energy, Healthcare, Consumer Staples. These sectors are generally characterized by low volatility coupled with valuations comfort. Now, healthcare and staples (with ITC being an exception) have had a lower representation primarily because of lack of momentum in these sectors, which is one of the primary selection criteria.

Before wrapping up, let’s quickly assess the reason for the momentum in industrials, financials, and energy sector:

- Industrials – A huge capex boom has been undertaken by both public and private players in the value chain which is acting as a natural tailwind for industrial players. This coupled with favorable government policies and better capacity utilization, post pandemic is helping industrial companies.

- Financials – Strong credit off-take in tandem with rapid asset quality improvement has been a deal maker for the sector. Deposit rates have also been healthy for major private players. It is expected that the banking sector will continue to ride on the tailwind of asset quality, less provisions, and strong credit offtake.

- Energy – Coal India has been the sole contributor to the energy sector’s performance in the smallcase. Rising power demand, surging global coal prices due to geopolitical tensions and low coal inventory levels have helped give thrust to the stock.

All in all, with the value flavor coming back in style, Value & Momentum smallcase could be a good pick for you, if you have the risk appetite. At the end of the day, no one theme or strategy can outperform the markets forever. With ever evolving macroeconomic conditions, we (as portfolio managers) and you (as investors) need to adapt to the changes.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy / sell any security or financial products.

Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team

Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. For more information and disclosures, visit our disclosures page here –https://windmillcapital.smallcase.com/#disclosures