smallcase in focus, June 2024

Highlight on Asset Allocation Version smallcases

It has been close to 3 years since we launched our asset allocation smallcases. We thought it’s due for us to bring you updates on the four asset allocation smallcases and to cover everything from performance, rebalance, and methodology changes we have made along the way. In case you need a refresher on these smallcases, refer to this blog post.

In the first place, it is important to understand the motive behind launching asset allocation versions. You see, the four smallcases we chose for the asset allocation versions are high volatility smallcases. They are high risk portfolios, constructed on the logic of investing factors, which strive to deliver the maximum returns.

When we went back to our drawing board, we felt the need to have a slightly conservative version of these smallcases, which would not only ride the high tide when things are bullish, but also will sit on the sidelines when things are bearish. Essentially, asset allocation smallcases help investors manage risk better. When markets are not volatile and bullish, these smallcases hold the constituents of the underlying smallcase. For instance, Canslim esque – Asset Allocation Version will have the same set of stocks as Canslim-esque smallcase when market view is positive, but will move towards alternate asset classes, viz. gold & liquid, when the market view sees a sell off coupled with heightened volatility.

Let’s begin by discussing the methodology we use to manage the asset allocation smallcases. We will use simple language to understand this as things might get technical.

Methodology

Asset Allocation smallcases have a weekly rebalance frequency. In spite of having weekly rebalancing, our churn has been extremely low. Over the course these 3 years, all the four smallcases have been churned around just about 13-16 times. The primary aim of the rebalance process is to gauge market signal – buy or sell, which in turn decides the allocation.

We begin the process by taking into consideration the data for the previous five weeks and based on our proprietary technical calculations, we generate the presence of an uptrend in each market segment. The uptrend might be building up in large caps while mid and small cap segments indicate weakness. Using the weighted combinations of the respective market segments based on the underlying stocks of the smallcase, we finally take the decision of switching between equity or gold & debt.

With this switching algorithm, we are trying to be in equity 100% when there is substantial proof of an uptrend in various market segments and try to be in alternate safe assets like gold & debt when no substantial proof of an uptrend exists. Now following this strategy not only saves the drawdown, but also generates handsome returns during bullish phases.

Performance Analysis

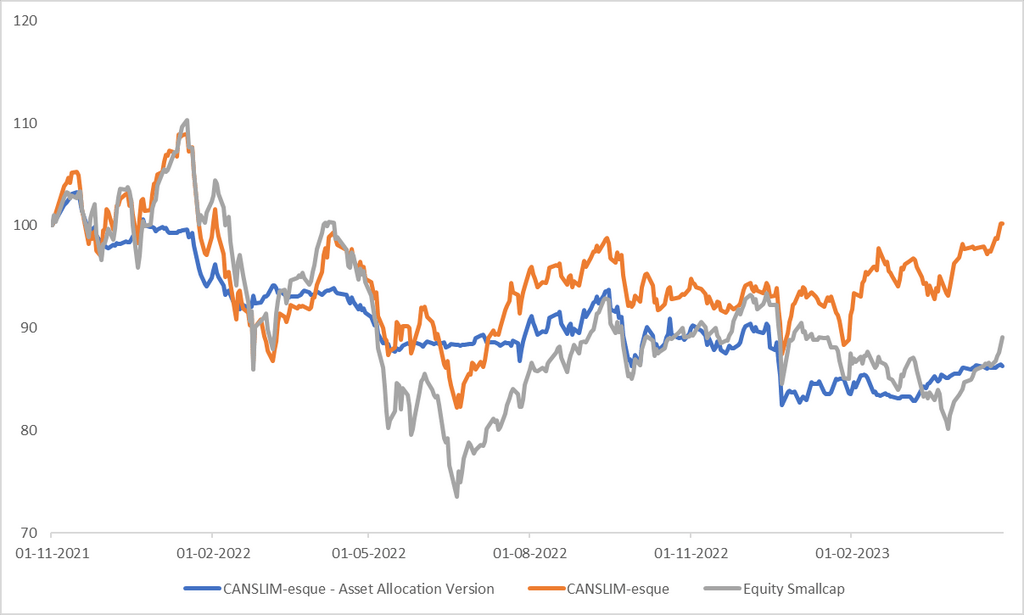

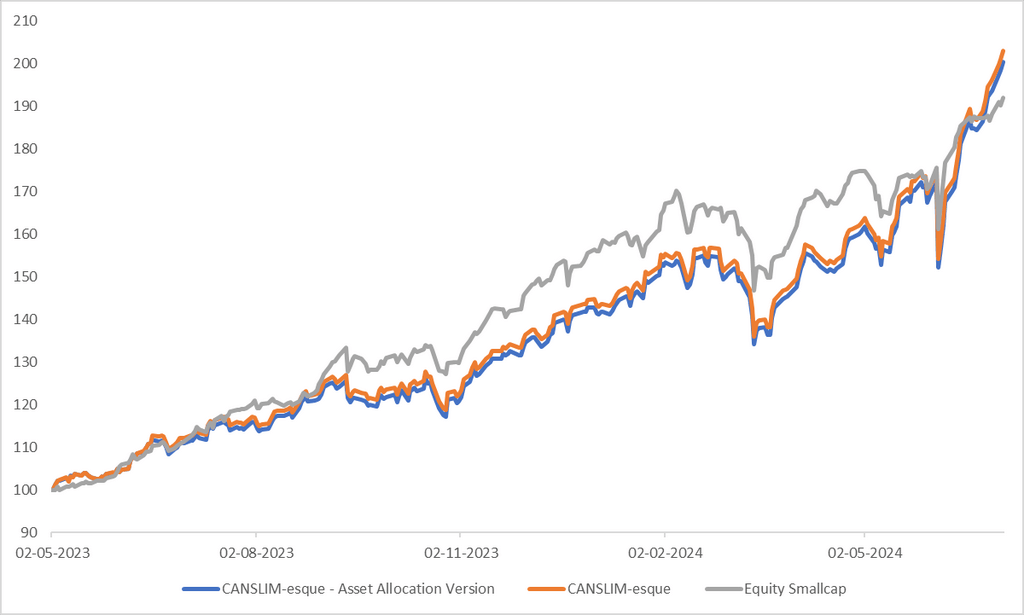

For the purpose of performance analysis, we shall break down the periods into two parts. First phase from Dec ‘21 to Apr ‘23 and second phase from May ‘23 to July ‘24. The reason to have two distinct periods is to highlight the use case of the asset allocation smallcases. You see, during the first phase, the markets were going through a turbulent time and as expected, all the asset allocation smallcases were invested in the alternate asset class (i.e. gold & liquid). Once the negative sentiment subsided, that’s when the second phase began, where the allocation moved towards equity.

Before we go any further, it is crucial to understand one aspect about the performance of asset allocation smallcases. These smallcases are designed in such a way that for instance if the markets are in a bearish zone over the next five years, the asset allocation smallcases will most likely outperform the underlying smallcases by virtue of moving into alternate asset classes.

You may ask, then what is the point of asset allocation smallcases? The answer to that is risk management. The asset allocation smallcases try to offer you the best of both worlds – risk & return. It may or may not deliver the same returns as the underlying smallcase, but will also have lower volatility & drawdowns (i.e. risk) as compared to them.

Now comes the interesting bit. While this has been the case with all the four asset allocation smallcases, take a look at the way Canslim esque- Asset Allocation smallcase has performed during the first phase. Extremely flattish, underperforming Equity Multi Cap for the majority of the time. You could say, this was the time for risk management and that is exactly what the smallcase was doing (we will check the risk metrics post this). And if you notice, the market was also flat as the Equity Multi Cap line also runs flat through the period. Therefore, the asset allocation version smallcases, did not materially miss out on any potential gains.

Then, once the bullish phase began, the asset allocation versions promptly signaled to move towards equity to ride on the bandwagon. And, here you will see that both the underlying smallcase and the asset allocation smallcase are hugging each other, indicating similar returns. You could say this was the time for the return generation.

Phase 1

Phase 2

Let’s look at the risk and returns data to drive home the narrative.

Phase 1

| Name | CAGR Returns | Annualized Volatility | Max Drawdown |

| Canslim esque – Asset Allocation Version | -9.4% | 10.7% | -20.1% |

| Canslim esque | 0.1% | 18.6% | -24.6% |

| Equity Small Cap | -7.5% | 21.1% | -33.4% |

Phase 2

| Name | CAGR Returns | Annualized Volatility | Max Drawdown |

| Canslim esque – Asset Allocation Version | 80.8% | 21.1% | -13.4% |

| Canslim esque | 82.8% | 21.2% | -13.4% |

| Equity Small Cap | 74.4% | 19.0% | -13.7% |

This should give you the complete picture as the numbers match with the narrative. Look at the Phase 1 numbers, you will notice, return metrics for asset allocation smallcases are poor however risk metrics are superior. Conversely, in the second phase, the asset allocation smallcases have delivered par returns as compared to the underlying smallcase. Another way to look at it, asset allocation smallcases give investors the opportunity to cash out on their profits and move towards safer asset classes once the market sentiment turns negative. However, investors should bear in mind that during sideways markets, a lot of churn can be expected from these smallcases due to the underlying methodology, which may add up to the costs for investors.

We hope this writeup helped you make sense of the idea behind the asset allocation smallcase and provided the right lens for you to view and judge the smallcase. The combination of risk and returns is what makes the asset allocation smallcases unique.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital TeamWindmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.