smallcase in focus – Why Growth Strategy Underperformed in 2022? ft. CANSLIM-esque

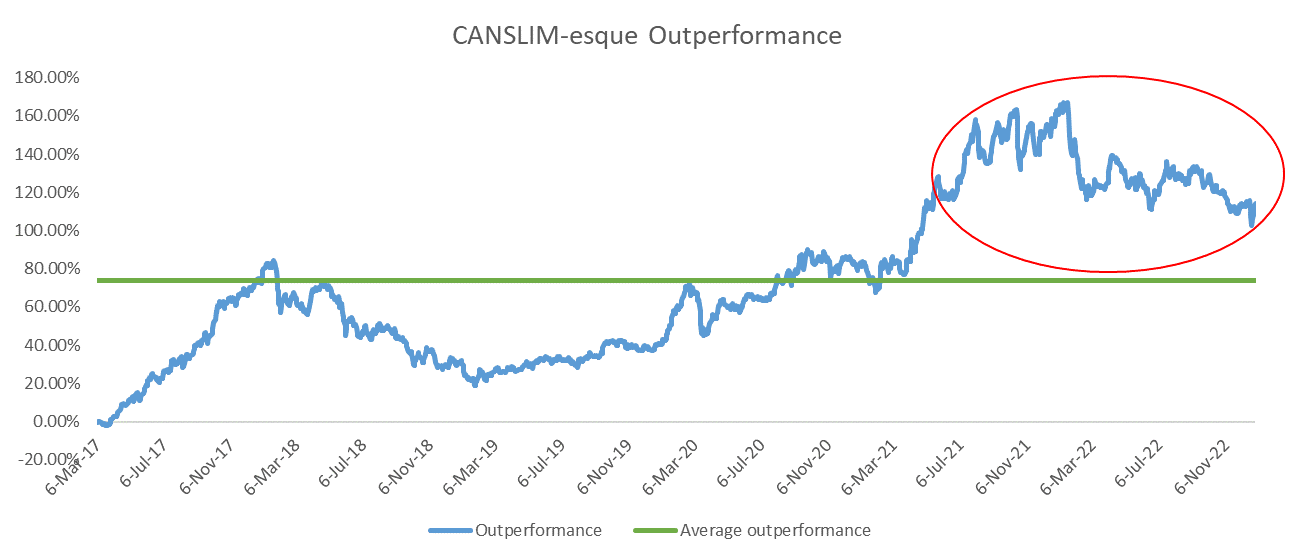

In this edition of smallcase in focus, we talk to you about why growth as a strategy has not been working well recently. The objective here is to make sense of the underperformance of CANSLIM-esque smallcase in 2022, as it is based on the criteria of growth and momentum for selection. Let’s get to the bottom of this.

First things first, what essentially do I mean by growth strategy? Growth strategy entails picking up the high fliers. The strategy is to include stocks in the portfolio that have already demonstrated better than average topline and / or bottomline growth and the expectation is that it will continue to do so. Therefore, these stocks usually command high valuations (high P/E ratio). Another nuance to bear in mind is that these stocks tend to be slightly more volatile than the broader markets, as any headwind could result in a sharp correction in prices – Tata Elxsi being a prime example, as one saw its share price decline drastically after posting weak quarterly numbers. In the same context, it’ll be relevant for you to get the understanding of value strategy. And here the deal is quite the opposite. The aim under this strategy is to identify those hidden gems, which have not been performing well, in spite of good fundamentals. As a result, these companies tend to have lower valuations or lower P/E ratio.

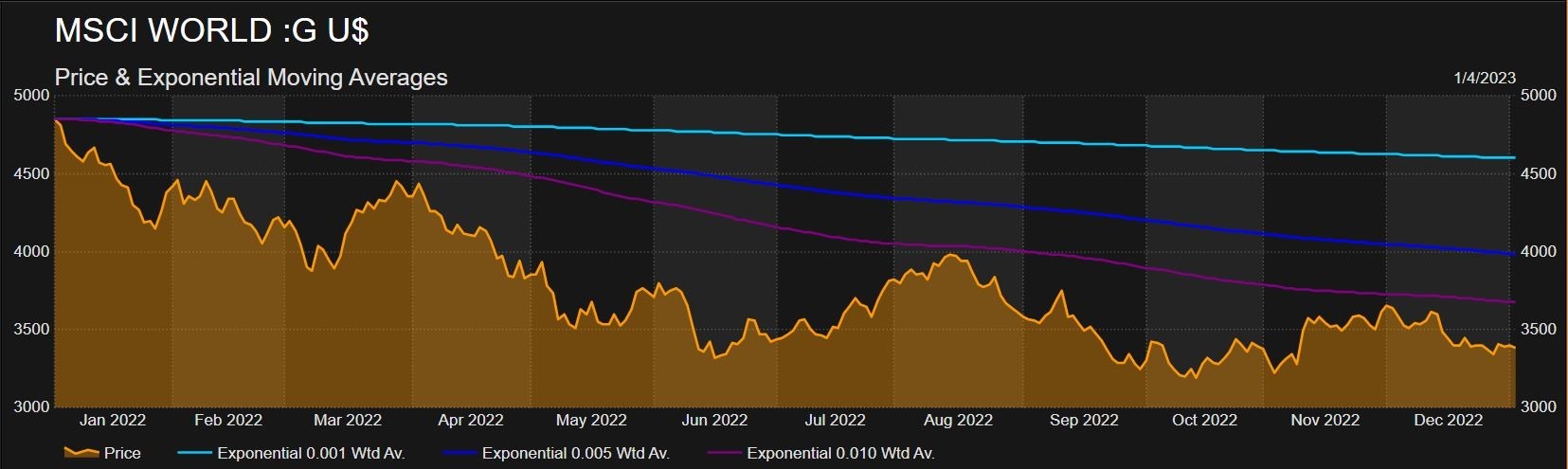

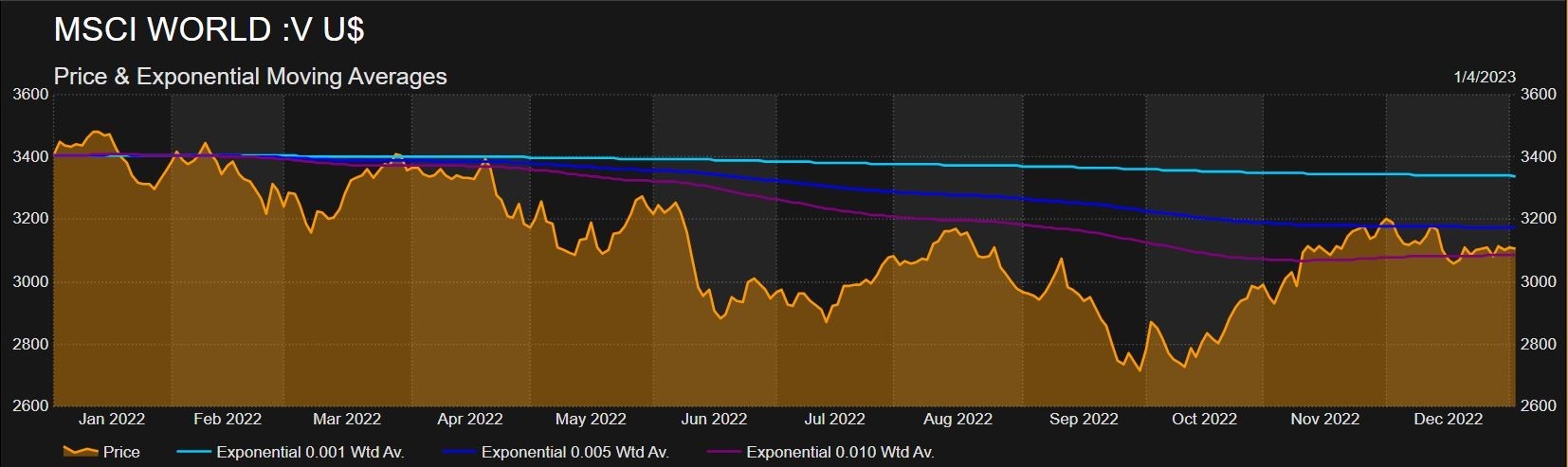

Before jumping onto the specifics of the CANSLIM smallcase, let us take a bird’s eye view and see what has been happening to growth stocks across the world.

The charts above indicate the performance of the MSCI World Growth Index and MSCI World Value Index in 2022 and it says it all. While the Value Index is flattish, the Growth Index has witnessed a sharp decline.

The pain in growth stocks was to be witnessed from the November 2021, when valuations peaked out for them and the correction began. Stalwarts such as the likes of Apple, Google, Tesla started tumbling. Having said that, the interesting bit is that even post the recent underperformance, the valuation gap between growth and value stocks remains wide.

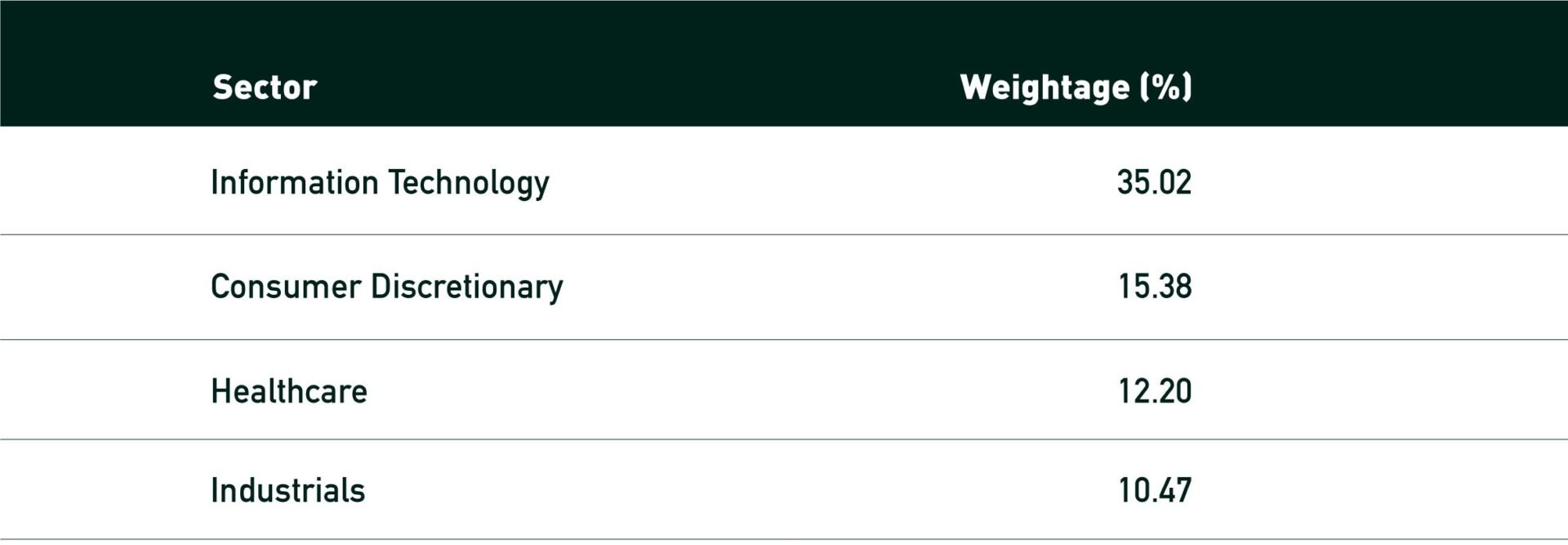

Now, allow me to shift gears and drill this down a step further. Given the characteristics of the growth strategy, there are a select few sectors that tend to dominate this strategy. As per the latest factsheet of MSCI World Growth Index, these 4 sectors are the heavyweights contributing ~72% –

Hence, it goes without saying that if the Growth Index has underperformed, these sectors ought to have underperformed.

CANSLIM-esque Performance

So we went back to our drawing board and checked out the median holding period returns of all the sectors that form a part of the smallcase. The merit behind displaying the sectoral spread in the MSCI World Growth Index was to drive home the point that we also naturally have these sectors in the smallcase, because they get auto selected owing to the underlying growth strategy.

As far as the table underneath is concerned, the way to interpret is straightforward. Since Dec’21, all the stocks’ median returns that belong to the Consumer Staples segment and are/were present in the smallcase is -19.8%. Similarly for others.

The picture will become entirely clear once you see the weightage allocation of the smallcase across the year –

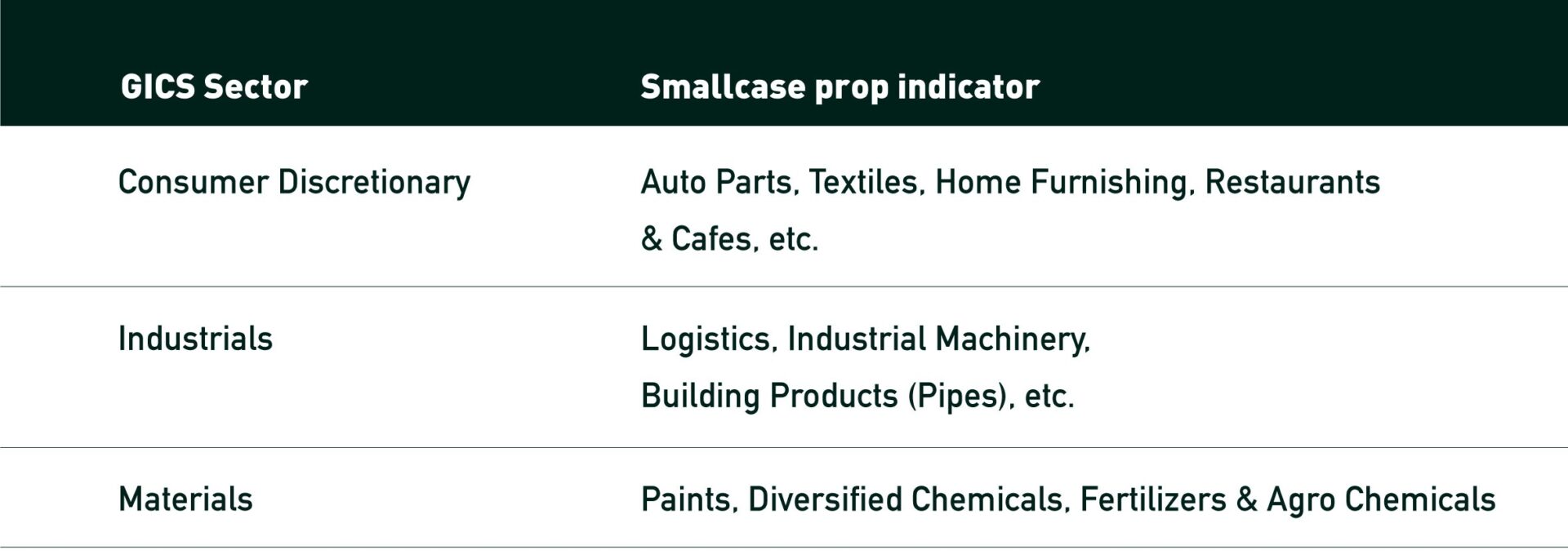

If you notice, the marked sectors – Consumer Discretionary, Industrials, Materials have more than 50% representation in the smallcase, every quarter. IT also forms a part of the smallcase, however its weightage is on the lower side, as momentum for the sector was weak last year, which is one of the main selection criteria for CANSLIM. To provide further context, let us take a look at the specific industries present in these broad sectors:

And as mentioned earlier, these sectors have underperformed due to unfavourable macroeconomic conditions, reasons being –

- Elevated Inflation – With inflation trending upwards, both locally and globally, sectors like Consumer Discretionary have had to bear the brunt of it, as households were not left with extra funds to expend on discretionary items. Companies – Devyani International and Sheela Foam faced headwinds because of the higher inflation seeping into the budgets of their consumers. Other companies like Affle India and Wipro witnessed slowdown, as businesses undertook cost-cutting on discretionary spends like marketing, IT spends, and so on.

- Broken supply chain leading to higher input costs- Russia’s invasion of Ukraine cracked down the global supply chain and companies in India who rely on certain key products from outside the borders, had a hard time making ends meet. Industrials were the most severely impacted with the constant rise in input costs, which made raw material procuring expensive, but also difficult. Pipe companies have witnessed margin contractions due to these higher input costs, like APL Apollo Tubes. JK Lakshmi Cement and Gujarat Gas also were pulled in the bandwagon of higher input costs, which translated into margin shrinkage.

As a conclusion note, we would like to reiterate the point that growth as a factor hasn’t been performing well since November ’21, due to unsustainability of high valuations coupled with lackluster momentum, leading to the underperformance in the CANSLIM smallcase. Due to slowdown in global growth and elevated inflation levels, both momentum and growth factors can remain under pressure in the near term. This doesn’t take away the fact that such kind of underperformances have been a part and parcel of equity markets from time and again and we believe that over the medium to long term, CANSLIM will outperform the broader markets.

Check out the CANSLIM-esque smallcase

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy / sell any security or financial products.

Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team

Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. For more information and disclosures, visit our disclosures page here –https://windmillcapital.smallcase.com/#disclosures