New Covid strain leaves markets nervous

The Indian stock markets ended the week marginally lower. At the start of the week, all benchmark indices took a massive hit amid fears of a new strain of the Covid-19 virus that is supposedly 70% more contagious, as claimed by health authorities in the UK. In the wake of such an event, UK imposed travel restrictions and stringent lockdown measures. Moreover, India banned flights coming in from the UK during the festive season. All these developments made markets nervous and contributed to the fall in the markets. Another important highlight of the week was that the Brexit (Britian’s pledge to exit the European Union) deal is finally done – that lifted investor confidence, but only marginally.

That apart, it was a fairly uneventful week in the markets on account of the holiday season. Well, the holiday season reminds us of something though..

Matter of Fact

As we enter the last trading week of the year, we thought it would be fitting to talk about a peculiar phenomenon that occurs in the stock markets around the globe. It’s called the Santa Claus rally.

The Santa Claus rally is the tendency of stock prices to increase during the last 5 days of the year end and first 2 trading days of the new year. There are various explanations to this behaviour of stocks. Some believe that traders and investors general feel happy and optimistic during the holiday season, which leads to more buy orders than not. Another explanation is that employees of large institutions go on leave, which leaves the market to retail investors – who tend to be more bullish.

Historically, stocks have performed exceedingly well during a seasonal period that includes the year’s last 5 trading days and the first 2 sessions of the new year – this is called the Santa Claus Rally! Click To TweetMarkets Update

|

|

|

|

The Big Picture

- Foreign Exchange Reserves in India increased to $581.13 billion on December 18 from $578.57 billion in the previous week

Investing Insights

What is Value Investing?

Pretty much every person, even those outside the investments world, know about Warren Buffett. He is the world’s most famous investor, and arguably one of the best too. In over six decades of investing, Mr. Buffett has amassed enough wealth for him to be among the richest people in the world.

His mentor, Benjahim Graham, is called the Father of Value Investing. Graham believed that the value of a stock can be determined fairly accurately with proper research and analysis. He built a framework for the same which he outlined in his book called “The Intelligent Investor“. Read more about value investing, here.

Inside smallcase

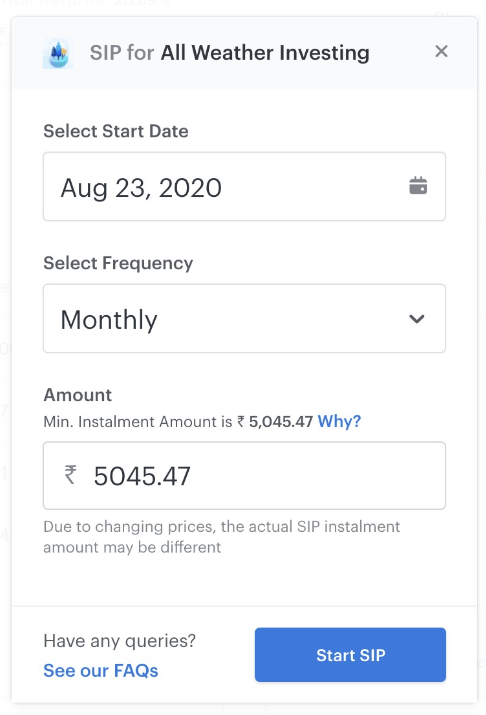

SIPs with smallcase

SIP stands for Systematic Investment Plan. As the name suggests, it helps the investor allocate funds in a smart and disciplined manner. Timing the markets is a difficult task, but SIP eliminates that worry. With SIP, you can invest fixed amounts at regular intervals. You, then, stand to have an advantage over market volatility and do not need to monitor the markets constantly.

Buy more when the price is low, less when the price is high. If on the SIP date, the stock price is high, you will be able to buy a lesser number of shares. And vice versa. This ensures that you invest more at lower prices and less at higher prices, and hence your overall cost of acquisition gets averaged out. Try out investing with SIPs in smallcases for passive, long-term wealth creation. Read more about SIPs, here.

Signing off for the week – Here’s wishing you a Merry Christmas and a Happy New Year from the smallcase family! 🙂

Subscribe to our weekly market analysis

3,00,000+ investors read our weekly newsletter for in-depth investment insights, latest market updates, and finance news.

[subscribe_form title=”” color=”blue” size=”compact”][/subscribe_form]