New Large Cap smallcase from Wright Research – Introducing Wright Titan

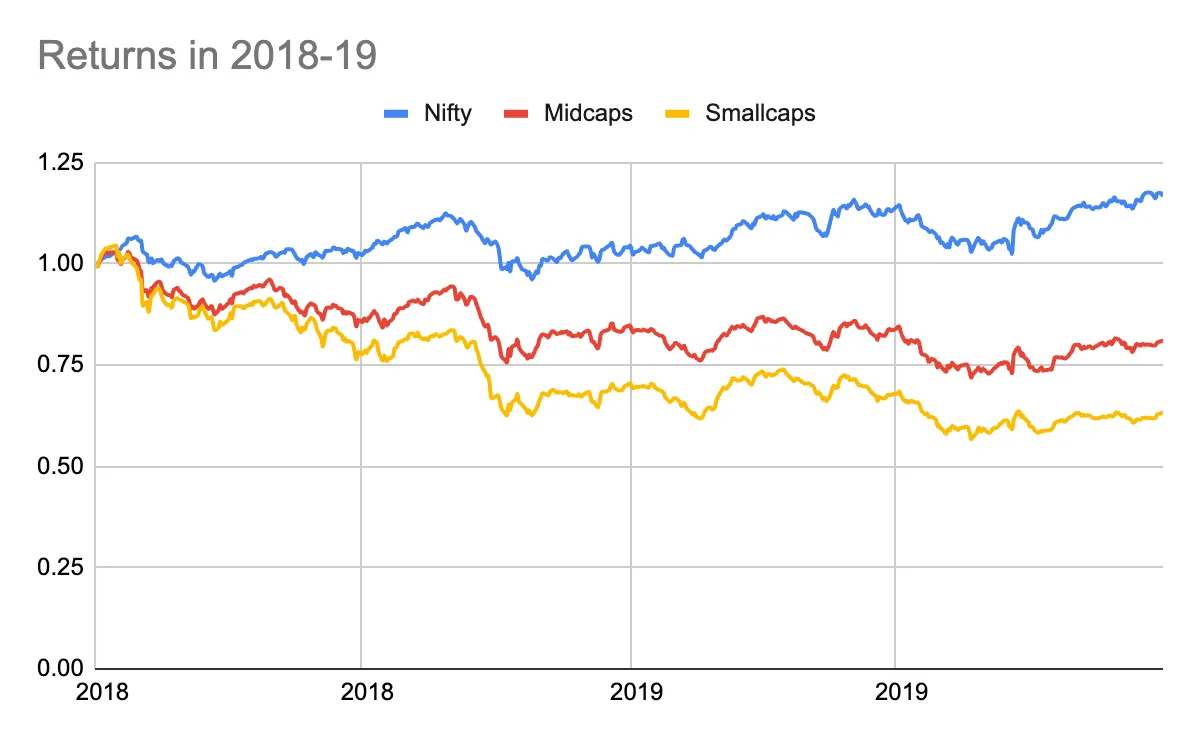

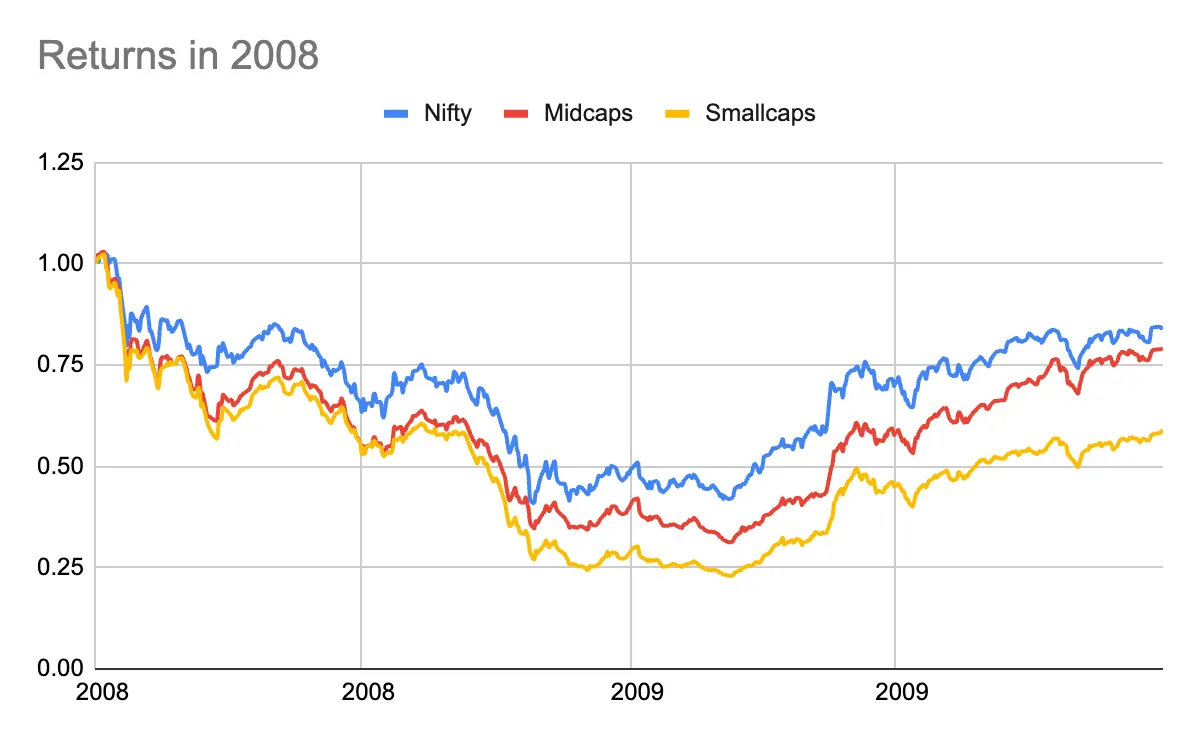

Reflecting on the past year, it’s clear that the Indian market indices have navigated from a position of relative undervaluation to a phase of significant growth, particularly for the small-cap and mid-cap sectors. With small-caps delivering returns in the vicinity of 60% and mid-caps not far behind. Recent trends in the Indian equity markets underscore the shifting dynamics, with a marked departure from the bullish momentum that characterized the past year. The broader market has experienced a significant downturn, with indices recording negative returns over the past month, and this trend persists on a year-to-date basis.

In the face of unprecedented market volatility, both in India and globally, investors find themselves at a crossroads, searching for a beacon of stability amidst the financial tempest unleashed by the pandemic. The question then arises: Where should one invest in such turbulent times?

Recent trends suggest a growing consensus that, in the current market scenario, large-cap stocks offer better value compared to their small-cap counterparts. With the March effect in full flow, we saw a period of correction and consolidation within the mid-cap sector and small-cap sector . In uncertain market conditions, investing in these dependable, large-cap sector companies offers a secure path, providing reliable returns at a reasonable cost. Large-cap stocks emerge as a beacon of stability, capable of weathering market storms and offering investors a safe haven for their capital.

How have large caps performed in Indian markets?

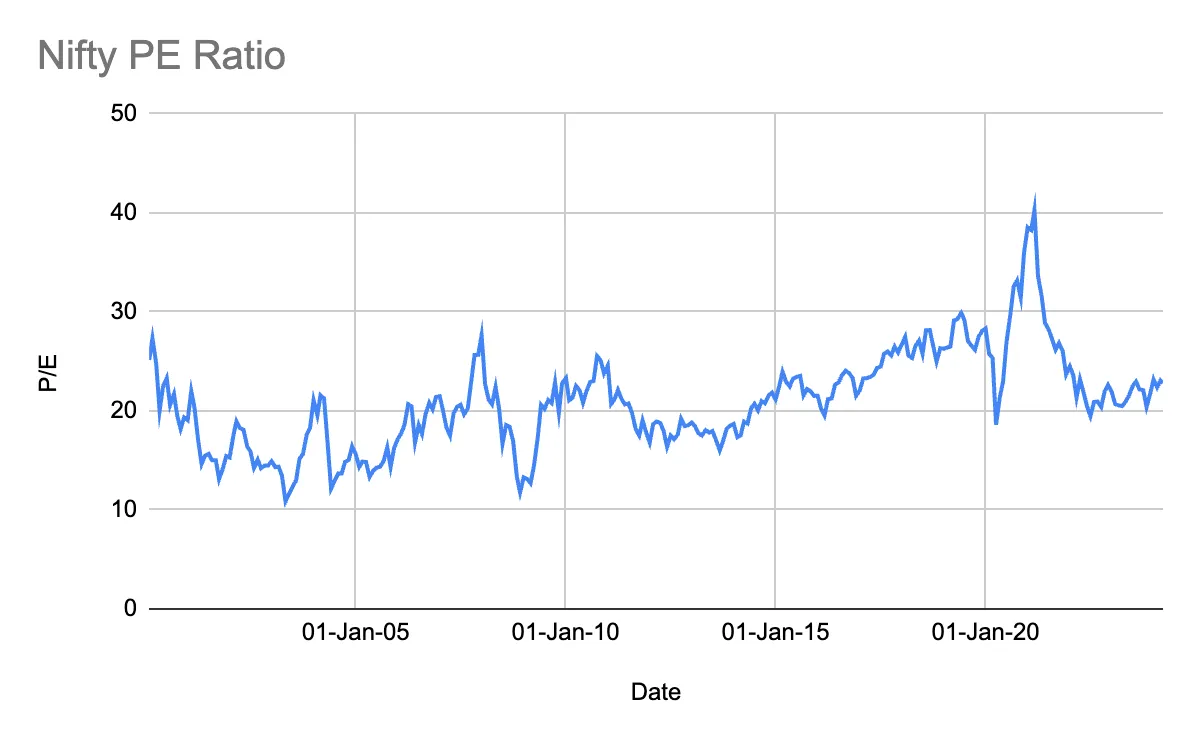

Historically, the Indian markets have been a fertile ground for such debates, with decades of experience underscoring the cyclical alignment of large-cap, mid-cap and small-cap valuations with their long-term return profiles. What becomes evident is that these market segments do not deviate significantly from their inherent return potentials over extended periods. However, short-term market dynamics can indeed skew perceptions, often driven by bursts of investor optimism or sector-specific earnings growth, leading to temporary distortions in valuation metrics.

The rationale for favoring large-cap investments during periods of market instability is well-founded. Large-cap stocks have demonstrated a superior ability to outperform their smaller counterparts during times of increased market volatility. This resilience is attributed to their strong corporate fundamentals, robust earnings growth potential, and the support of favorable macroeconomic factors. Large-cap stocks stand as reliable avenues for long-term wealth accumulation, offering a blend of stability and growth that is particularly appealing in unpredictable markets.

Large Cap Stock & Sector Valuations in 2024

In 2023, India’s equity market concluded the year at record highs, marking a remarkable journey for small and mid-cap stocks which significantly outperformed their large-cap counterparts. The Nifty Smallcap and Nifty Midcap indices saw astonishing rallies, outpacing the Nifty 50’s respectable 25-30% annual return. Despite this, the valuation metrics reveal that large caps have been trading at their 10-year average price-to-earnings (P/E) multiple, while small and mid-caps have been trading at a premium to their historical averages.

There are several compelling reasons why large-cap stocks appear particularly attractive at this juncture. For starters, the market capitalization share of large-cap stocks is at the lower end, indicating room for growth. Moreover, the historical correlation between market returns and earnings growth suggests a positive outlook for these stocks. With Nifty earnings expected to continue growing at a healthy rate, and the broad market performance over the past two years indicating a potential for convergence, the case for investing in large-cap stocks strengthens.

Introducing our largecaps focused portfolio for safety & stability, protecting you in volatile markets.

Strategic Appeal of Large Cap Stocks for Investors

Investors seeking an optimal balance between risk and return might find large-cap stocks an attractive option. A portfolio of large-cap stocks or large-cap funds are uniquely positioned to offer returns without significantly increasing risk. On a risk-adjusted basis, it can stand out as a viable choice for long-term investors, providing a strategic blend of stability and growth potential.

One of the key advantages of large-cap stock smallcases is the ability to automate asset allocation decisions across different market cap segments. Given the historical rotation of winners across these segments, predicting which one will outperform at any given time is challenging for individual investors. Large cap focused stock portfolios can help give investors that have allocated to mid & small-cap stocks an option to diversify their overall investments – enhancing their overall portfolio’s potential for returns while spreading risk.

The sector composition of large cap stock portfolios can also contribute to their appeal. While large-cap indices like the Nifty 100 are heavily weighted towards sectors such as BFSI, IT, Oil and Gas, and FMCG, large-cap stock portfolios can offer a more balanced exposure to a smaller set of 20-25 stocks. They not only invest in these established sectors but also provide access to new age and less represented sectors like textiles, media, and entertainment. This broader sectoral coverage ensures investors can benefit from diversification, reducing the impact of sector-specific downturns. Moreover, large cap stock portfolios also have the opportunity to create alpha by strategically overweighting or underweighting certain sectors or market cap segments based on the investment manager’s insights and analyses. Through rebalancing there is an element of active management even for advisory stock portfolios to ensure the portfolio is working in the interest of the investors.

The role of large-cap stocks in capitalizing on India’s growth story cannot be overstated. As the Indian economy expands, large-cap companies have significant room for growth, given their relatively smaller size in the global stage. India is well positioned to benefit from domestic consumption growth, rising per capita income, and shifts in the global supply chain, among other factors – all of which will help increase the opportunity even for large cap companies. Through Large cap stock portfolios investors can tap into these growth narratives, offering exposure to a wide array of investment opportunities aligned with India’s economic advancements.

Need for a Largecaps focused smallcase

Investors should consider a large-cap focused stock portfolio for its stability and growth potential, especially in turbulent market conditions. Large-cap stocks have historically demonstrated resilience during periods of volatility, underpinned by strong corporate fundamentals and robust earnings growth potential. This makes them a reliable choice for long-term wealth accumulation.

Valuation metrics suggest that large-cap stocks currently offer better value compared to their small and mid-cap counterparts, which are trading at a premium. Large-caps are positioned to benefit from India’s economic growth, supported by increased foreign inflows and a positive economic outlook. Their capacity to capitalize on domestic consumption growth, rising per capita income, and global supply chain shifts further enhances their appeal.

A large-cap focused portfolio provides diversified exposure to established sectors and the opportunity for strategic asset allocation. This minimizes sector-specific risks and offers potential for alpha creation through insightful sector and market cap segment adjustments. Given the potential for market volatility and the quest for stable returns, a large-cap focused portfolio stands out as a prudent investment choice for those seeking to navigate the challenges and opportunities of the current investment landscape.

Given the market’s positive reception to the underlying strengths of the Indian economy and the potential for volatility arising from unforeseen negative developments, having exposure to large-cap stocks could provide a safer harbor for investors. The experience of 2023, where risk was disproportionately rewarded, may not necessarily repeat in 2024. As the investment landscape evolves, the stability, proven track record, and growth potential of large-cap stocks make them an appealing choice for investors seeking to navigate the potential challenges and opportunities of the coming year. Check out our newly launched largecaps focused smallcase !. You have to make sure that the high risk nature of this portfolio suits you before you invest.

Use the code ‘TITAN30‘ to get a 30% discount on the subscription to this smallcase. Don’t miss this opportunity!

Check out Wright Titan smallcase

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Disclosure:

This is not an investment advise.

Disclosures: https://www.smallcase.com/manager/wright-research#disclosures

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.