What happens if you skip a smallcase rebalance?

Last month we rebalanced a lot of our fee-based as well as free smallcases. If you have not already rebalanced, please do it now.

Rebalance is recommended to update your smallcase. It helps you stay true to the original intended idea of the smallcase. If you skip a rebalance update, the composition & returns for your smallcase may vary from the original.

With the help of a fictitious character Rekha, let us understand more about what happens to investments when a rebalance update is applied.

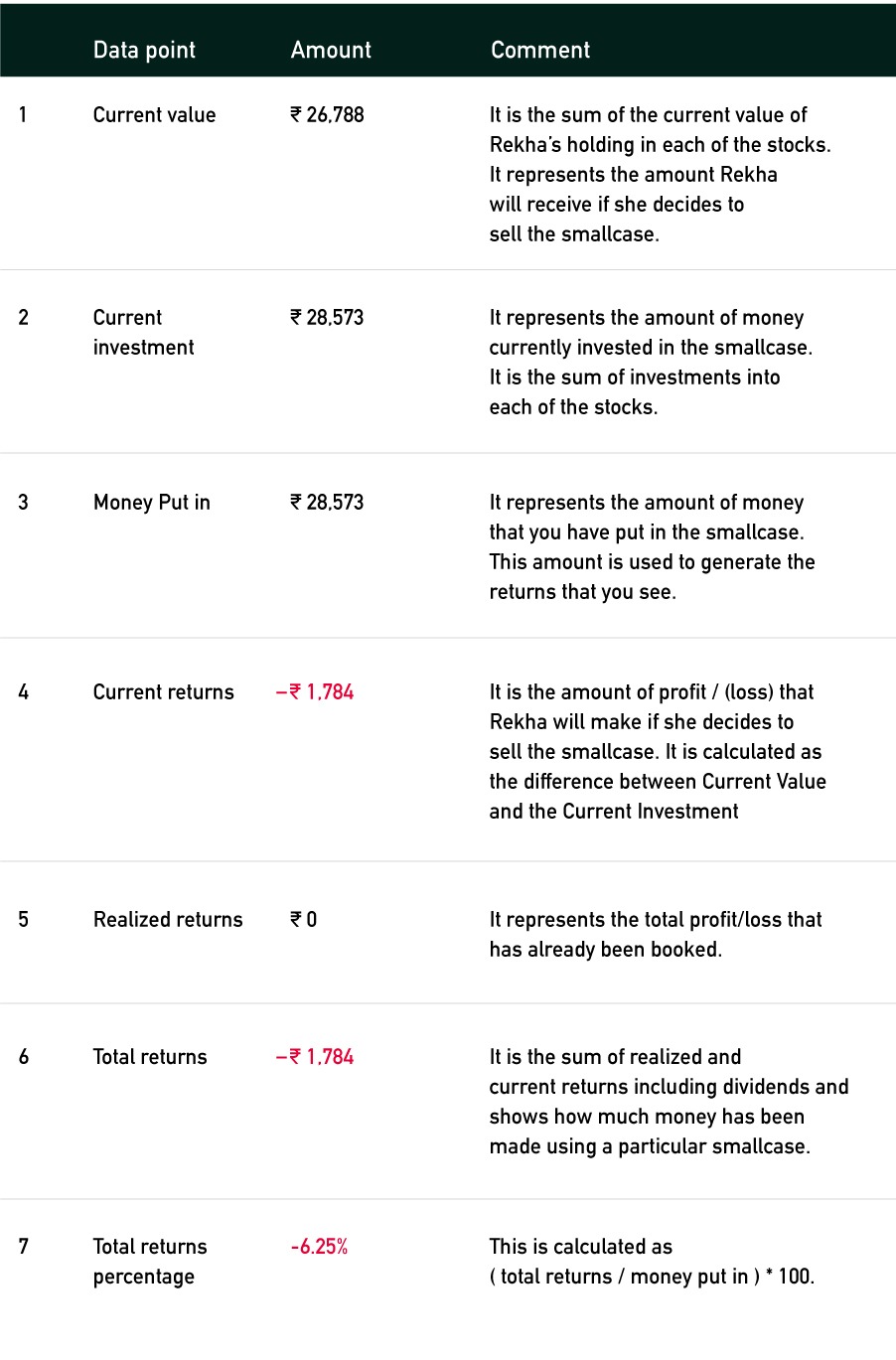

Rekha invested Rs.28,573 on 3rd Jan 2022 and bought equal weighted smallcase A that had 8 stocks. The smallcase was rebalanced on 16th March 2022. As of March 16th, before applying the rebalance update, Rekha’s investment details were as follows:

When rebalancing a smallcase either one or both of the below can happen:

- Stocks which got removed from the smallcase are sold and stocks which got added are bought

- The weights of stocks might be changed to ensure it is close to the prescribed weighting scheme

The below changes were recommended during the rebalance:

- Orient Cement and KEI Industries were dropped

- FDC Ltd, KPR Mill and Jamna Auto Industries were added

The table illustrates the amount of money expended and earned after applying the rebalance update. Let us attempt to understand the constituents of the table using data in rows 2 and 5.

Realized investment refers to the amount of money invested in the stock when Rekha bought the smallcase in Jan 2022 and has now been sold. It is calculated as the no. of shares sold * average buying price. The average buying price of Orient Cement was Rs.163.40, so 22 * 163.4 = 3595.

Amount invested refers to new funds pumped into the smallcase to buy the newly added stocks. It is also calculated as no. of shares * avg buying price, i.e 3 * 1004 = 3013 for KPR MIll. This is the amount of outflow from Rekha’s trading account.

The amount sold is calculated as the no. of shares sold * average selling price. The average selling price of Orient Cement is Rs.143.70, so 22 * 143.70 = 3161.

Realized P&L is calculated as the difference between the Amount sold and Realized investment. A positive number indicates profit and loss is represented by negative numbers. Since the average buying price of Orient Cement is higher than the average selling price, Rekha incurred a loss of Rs.433.

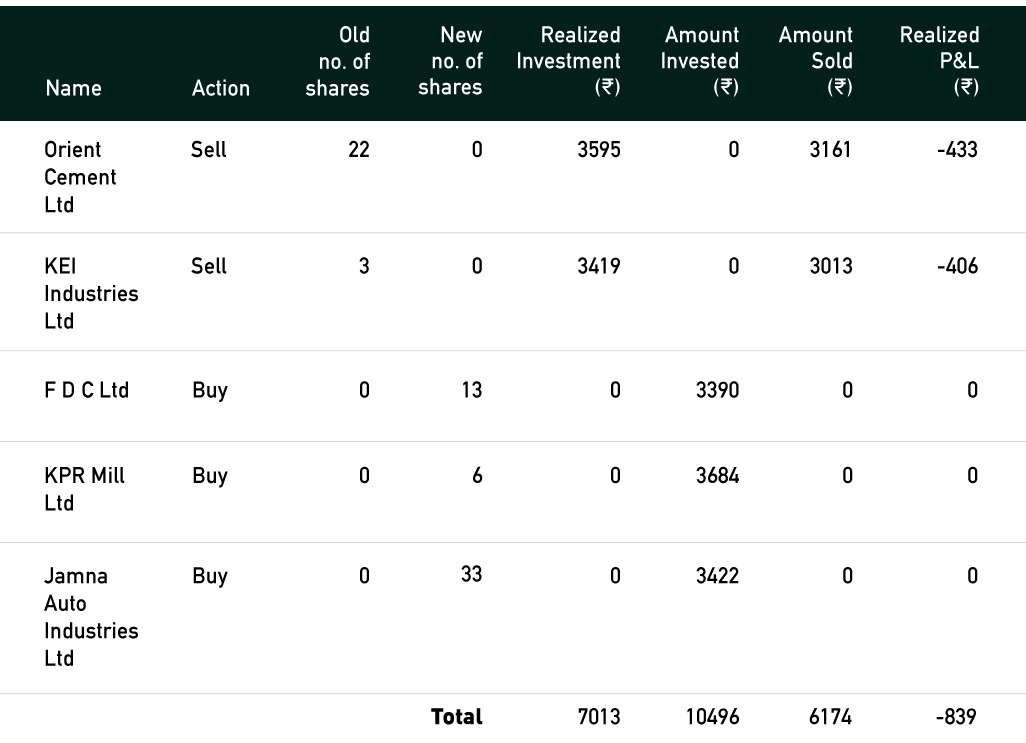

Let us now study the new investment details:

Let us also consider an alternate scenario where the returns were positive. So prior to rebalancing, the total return percentage would have been 6.2% (1784 / 28,573) * 100. While after rebalance, the total return percentage drops to 5.4% (1784 / 32850) * 100. This is because more money was invested in the smallcase leading to a jump in money put in. Actions like buying more of a smallcase or partially exiting the smallcase also impact profitability. Read more about it here.

In conclusion, skipping a rebalance update can lead to your smallcase drifting away from its intended strategy, potentially affecting both the composition and returns. By staying on top of rebalances, you ensure that your investments remain aligned with the original vision, helping you achieve your financial goals more effectively. Always remember, a timely rebalance keeps your portfolio on track.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital TeamWindmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.