Musings with Analyst: May 2023

Why do smallcases have a Minimum Investment Amount and Mutual Funds don’t?

On a frequent basis we keep getting this question asked,

‘Why do smallcases have a Minimum Investment Amount?’

‘Why can’t I start investing in smallcases with ₹500 like in mutual funds?’

If you have also wondered about this, we have got you covered. In this blog post, we will explain the concept of Minimum Investment amount (MIA) and why it applies to smallcases. In this process, you will also get to understand the core difference between a smallcase and a mutual fund.

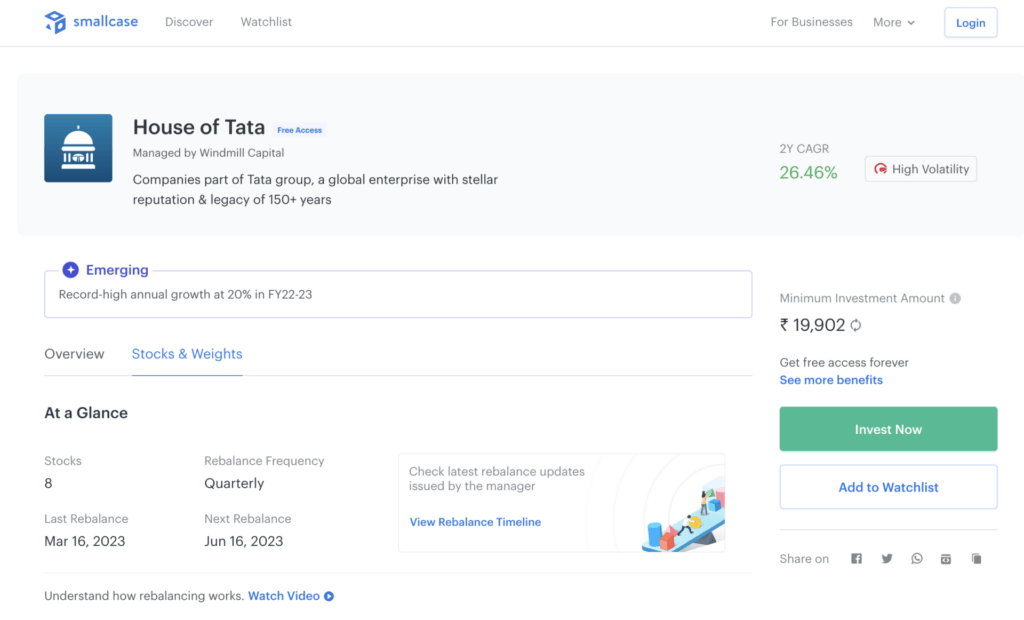

To begin with, let’s compare the structures of a smallcase with that of a mutual fund. For instance, you choose to invest in the House of Tata smallcase.

You land on the page and see that the smallcase has 8 stocks with the MIA close to ₹20,000. Once you invest in this smallcase, all the 8 stocks will be credited to your demat account. Now, you will notice that these 8 stocks won’t have the same number of shares. Titan Company might have 1 share, whereas Tata Steel might have 16. The number of shares, in the smallcase, is determined using the Price to Weight (P/W) ratio of a stock. We start by calculating the P/W ratio of each stock and then check the highest P/W ratio. For example, TCS is trading at ~₹3,200 and the weight ascribed to it is 18.5%. The P/W ratio of TCS would come out to be ~₹17,000. Suppose instead of the above figures, the price of the stock is ₹2,000 and the prescribed weight is 10%, the P/W ratio will be ₹20,000 for this stock. Similarly, P/W is calculated for each stock, and the highest value becomes MIA of the smallcase. The highest P/W ratio indicates the amount of money needed to buy the basket using the prescribed weights and is the minimum investment amount of the smallcase. This minimum investment amount ensures that at least 1 share of each stock is bought. This combination of the price and weight of the smallcase is the most essential component in determining the MIA of the smallcase.

Now, let’s talk about mutual funds. When you invest in a mutual fund, your money along with that of others is pooled into a common fund. And then units get allotted to you, on the basis of your contribution to the fund. For example, 5 investors collectively contribute ₹100 to a mutual fund. Investor A has contributed ₹20 to the fund. So, in this case, this investor will get 20 units of the fund, with the assumption that each rupee is considered to be a unit.

The way you track the performance of any mutual fund is by Net Asset Value (NAV). NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on a given date. For example, if the market value of securities of a mutual fund scheme is ₹200 lakhs and the mutual fund has issued 10 lakh units of ₹10 each to the investors, then the NAV per unit of the fund is ₹20 (i.e., ₹200 lakh/10 lakhs).

After explaining the structure of both products, I hope you would get closer to understanding the concept of MIA in the case of smallcases. In a mutual fund, you don’t get shares allotted. You have access to a common fund, hence you can start investing in these funds with any amount. On the other hand, smallcases allot shares to your demat account which needs to be bought a piece each, at the bare minimum. Therefore, any arbitrary amount does not work in the latter case.

Since there is a difference between the underlying – stocks for smallcases and units for mutual funds, the MIA concept gets applied to smallcases.