Musings with Analyst | February, 2024

How does Windmill Capital incorporate ASM/GSM framework in stock selection?

For investors curious about the implications of investing in stocks categorized under Additional Surveillance Measure (ASM) or Graded Surveillance Measure (GSM) in their smallcase portfolios, Windmill Capital (WCPL) offers insights. Understanding the significance of these regulatory frameworks and their impact on portfolios is crucial. This article aims to discuss the inclusion of companies within the ASM & GSM lists, WCPL’s meticulous approach to smallcase curation, and address concerns about stocks added to these lists post-investment. By delving into the nuances of ASM/GSM stocks, investors can navigate this market segment with clarity and confidence. First up, what is ASM/GSM?

ASM/GSM Framework

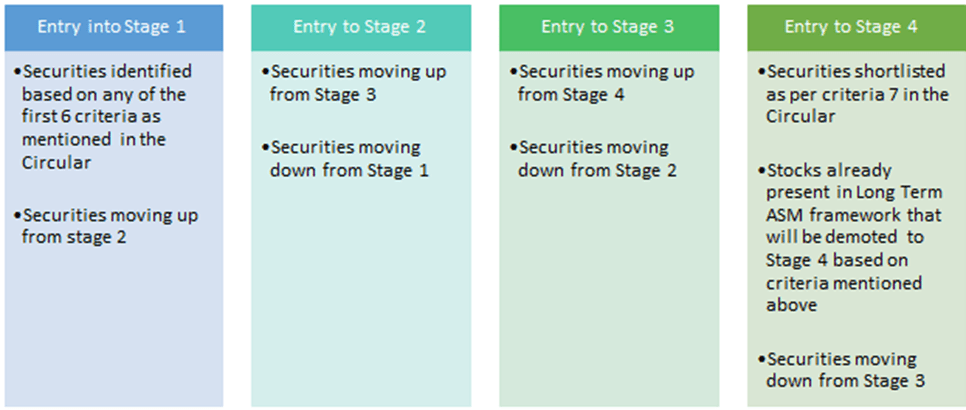

SEBI and exchanges introduced the ASM & GSM framework to address concerns over price volatility and market integrity. ASM securities are categorized into Long Term (LT) and Short Term (ST) based on objective criteria like price variation and market cap. In the LT ASM framework, securities progress through four stages, while the ST ASM framework identifies stocks facing short-term concerns, subjecting them to additional margin requirements and surveillance.

The GSM list comprises stocks identified for enhanced surveillance due to specific criteria such as abnormal price movements, volatility, or corporate actions. These stocks are subject to stringent trading restrictions to prevent excessive speculation and market manipulation, safeguarding investors’ interests and market integrity.

WCPL’s Vigilant Approach

WCPL prioritizes investor protection and portfolio resilience. While we previously refrained from including all stocks from the ASM list, we have had to review our approach in the recent past. Consequently, after a thorough study, WCPL’s ASM negative list now includes stocks in Stage 3 and Stage 4 of the LT ASM list, as well as those listed in the ST ASM framework. By excluding exceptionally volatile stocks, we prioritize stability and long-term growth potential in our stock selection, aiming to insulate portfolios from heightened volatility and market disruptions. Take a look at the image below.

At WCPL, we ensure not to incorporate companies listed in the GSM category. The risks outweigh the benefits. This decision aligns with our fundamental ethos of avoiding illiquid stocks in our smallcases.

Addressing Investor Concerns

Despite thorough pre-investment scrutiny, concerns may arise if a company enters the ASM list after smallcase investment. WCPL addresses these concerns proactively through rebalancing and communication. When a stock is added to the ASM/GSM list, we conduct a review and remove it from the smallcase if necessary, based on predefined criteria.

Communication is key in addressing investor concerns. WCPL communicates post-rebalancing updates through push notifications on the smallcase app, newsletters, or Manager Updates sections within the app. Our commitment to investor protection ensures timely updates and informed decisions to safeguard investors’ interests.

Conclusion: Navigating the Market with Confidence

As investors navigate Dalal Street’s labyrinth, WCPL remains a beacon of trust and stability. Our vigilant approach to smallcase curation, coupled with proactive risk management strategies, empowers investors to navigate the market confidently. By demystifying regulatory frameworks like ASM and GSM, we facilitate informed decision-making and sustainable portfolio growth. At WCPL, we guide investors through the dynamic landscape of the Indian stock market, prioritizing transparency, and investor well-being.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.