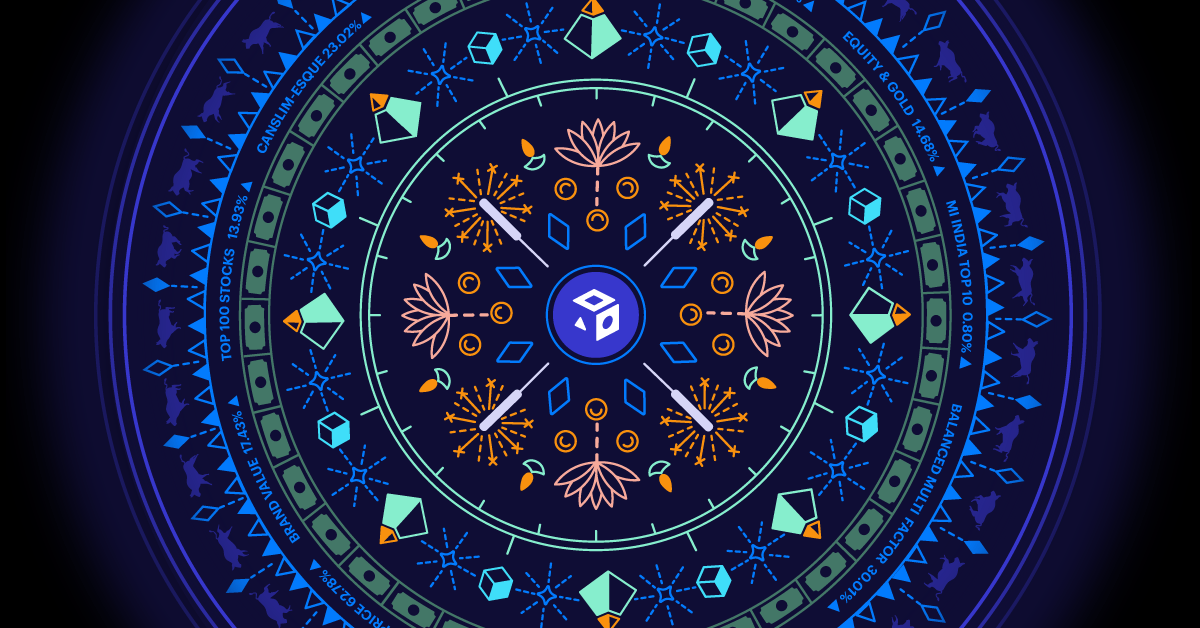

Most Invested smallcases of FY 2022-23

The financial year 2022-23 was challenging for stock investors on Dalal Street, as novice investors learned the hard way that making money is not a straightforward process. Many new investors fell prey to the fear of missing out (FOMO) as they attempted to time the market during the ups and downs caused by concerns about Fed rate hikes, the Russia-Ukraine war, inflation, and recession projections.

Despite this, the Indian stock market outperformed most global markets, leading to a rise in investor wealth in terms of market capitalization.

As the financial year approached its end, the Nifty fell below the psychological support level of 17,000 in March 2023 before rebounding. Despite geopolitical tensions, the SVB crisis, and rising inflation, experts suggest that the current correction is an excellent opportunity to accumulate stocks for the long term at reasonable valuations.

Here are the 5 smallcases from FY 2022-23 which garnered the most investments

Equity & Gold

- 36% of all smallcase investments made in FY 2023 were in this smallcase

- This smallcase invests in Equity & Gold, fixing their weights to 70% and 30%

- Large-cap composition

- Large cap companies included in this smallcase are well established and the chances of such companies going bust are low. Adding such stocks to the portfolio increases stability of the portfolio as their stock prices are not very volatile. They are also best suited for long term wealth creation

- Managed by: Windmill Capital

Timeless Asset Allocation (formerly All Weather Investing)

- 21% of all smallcase investments made in FY 2023 were in this smallcase

- This smallcase invests in 3 asset classes, equity, debt and gold

- Large-cap composition

- When the markets go up, equity allocation builds wealth & when they crash, gold provides a cushion. Your eggs are always in different baskets, making for smooth sailing even in volatile times

- Managed by: Windmill Capital

Top 100 Stocks

- 17% of all smallcase investments made in FY 2023 were in this smallcase

- India’s most powerful companies in one portfolio offering solid stability

- Large-cap composition

- Large cap companies are usually well established and the chances of such companies going bust are low. Adding such stocks to the portfolio increases stability of the portfolio.

- Managed by: Windmill Capital

Green Energy

- 16% of all smallcase investments made in FY 2023 were in this smallcase

- A portfolio of stocks, which will get benefit from the renewable energy sector development and energy transition. As the global energy sector’s shift from fossil-based systems of energy production and consumption, including oil, natural gas, and coal, to renewable energy sources like wind and solar, as well as other sources like biofuels.

- Small-cap composition

- Energy transition along with building renewable energy infrastructure remains to be the focus area of the government, as seen in this year’s Union Budget as well.

- Managed by: Niveshaay

Value & Momentum

- 16% of all smallcase investments made in FY 2023 were in this smallcase

- This smallcase includes stocks that are undervalued compared to their peers, but have been attracting attention off late as evidenced by their recent stock price movements

- Small-cap composition

- This smallcase shortlists fairly valued, growing companies whose prices have been witnessing positive momentum. During times of market crisis, stocks of fairly valued growing companies do not drop too much and help steady the portfolio. During bullish phases, momentum kicks in and helps the smallcase beat the broader market

- Managed by: Windmill Capital