Mi NNF 10 -The passive money spinning strategy

The smallcase Mi NNF10 is a monthly rebalanced rotational momentum portfolio of 10 stocks carved out of the Nifty Next 50 Index (also called as Nifty Jnr) stocks . It is designed to extract alpha from within this highly liquid and coveted group of large cap stocks that make up the 51st -100th market cap positions.

Let us begin this with a quick tabular description depicting Mi NNF 10’s outperformance (vs) the Nifty Next 50 Index since 01 Apr 2016

Nifty Next 50 Index

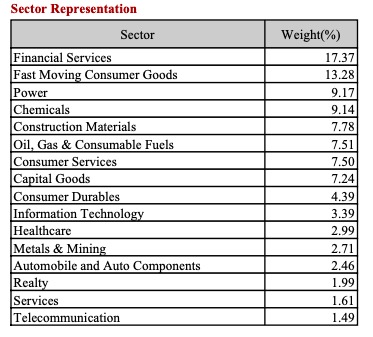

Nifty Next 50 universe is described by the National Stock Exchange website as “a well-diversified portfolio across sectors with top 5 sectors accounting for 76% exposure. The index in all has exposure to 16 sectors with 14 sectors having individual weight lesser than 10% each. This makes NIFTY Next 50 a well-diversified index strategy which may appeal to proponents of investment diversification”.

The Nifty Next 50 index is rebalanced by the exchange every 6 months. The current allocation of sectors and top stocks as of Oct 2022 is as follows

Nifty Next 50 (v) Nifty 50

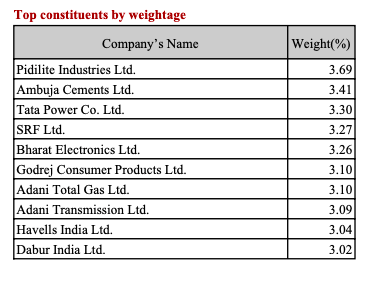

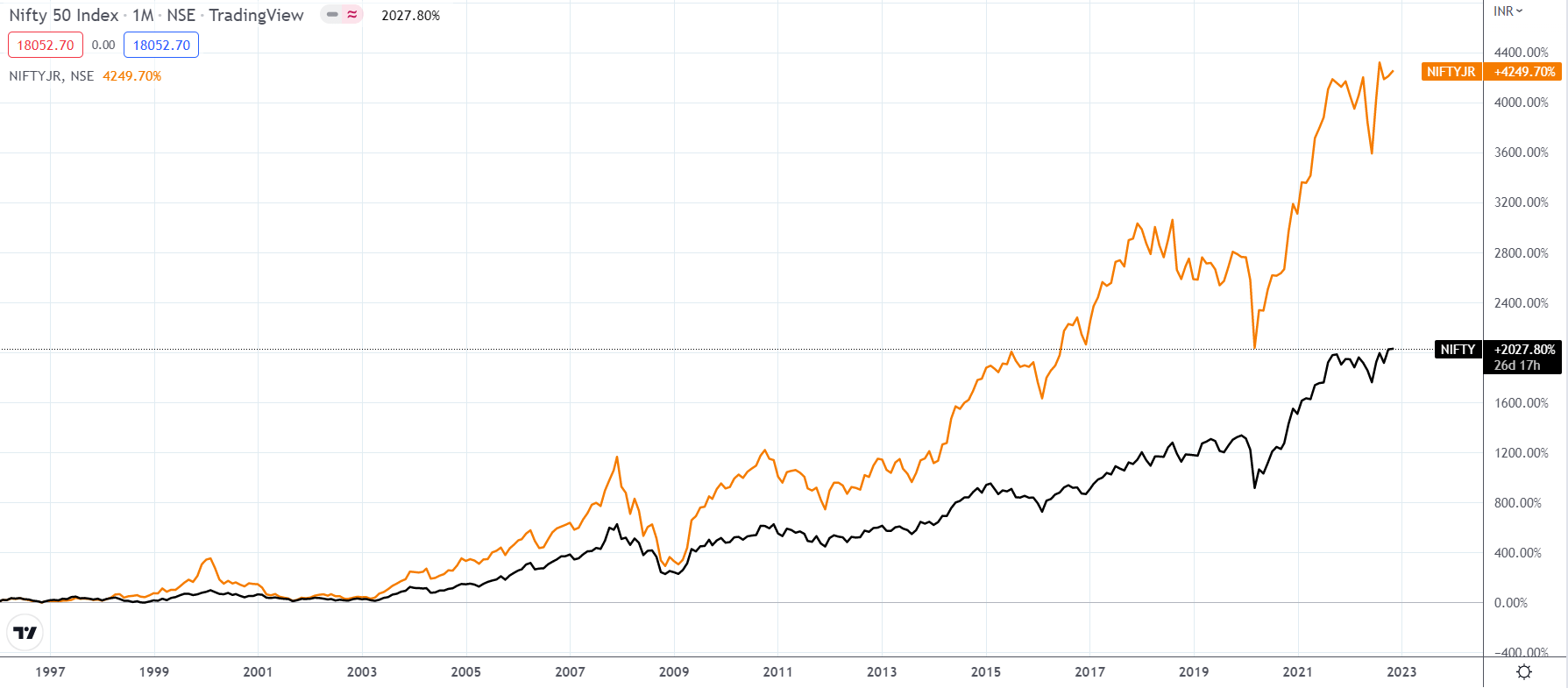

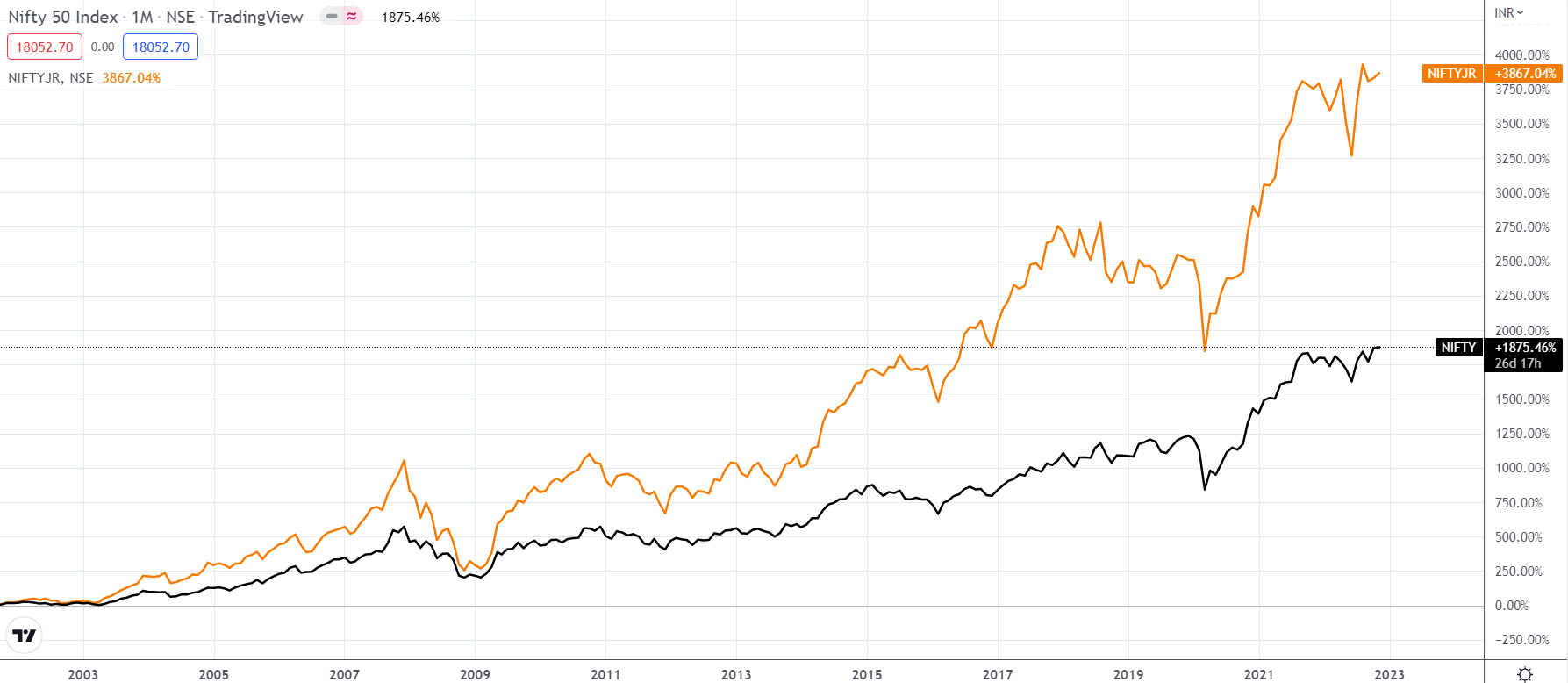

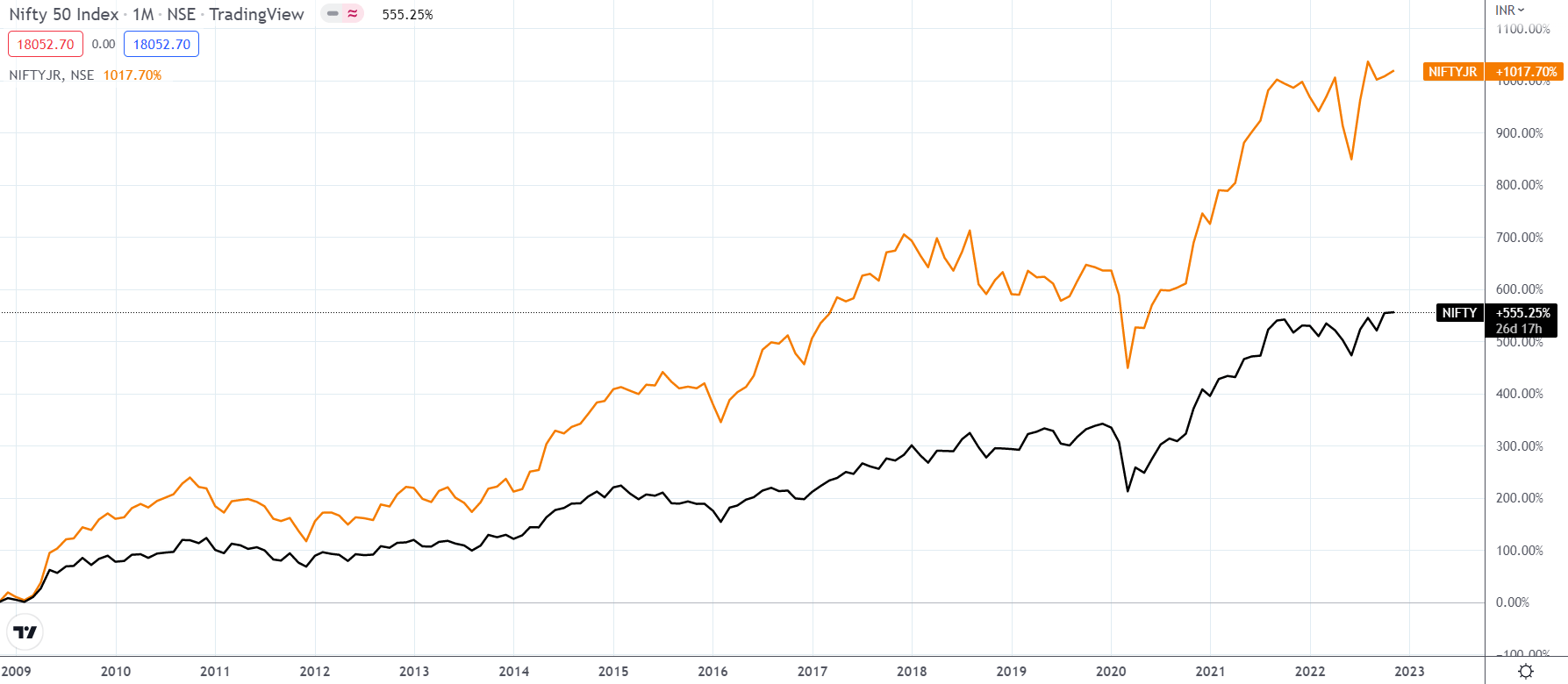

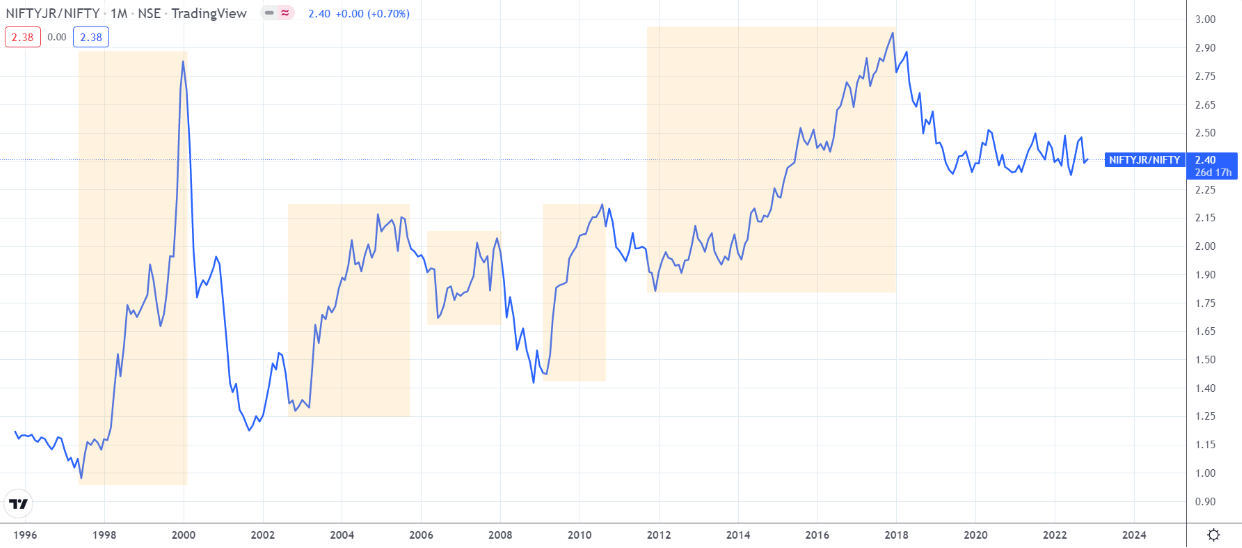

Nifty Next 50 has always had an alpha compared to the Nifty 50. Below are three chart compares the two indices in different periods.

Chart (1) – Since 1996

Chart (2) – Since Oct 2001

Since : Nov 2008

The performance of the Nifty Next 50 has either been on par or a slightly dragged compared to the Nifty 50 especially since mid 2015. It is very likely that reversion to mean of returns may happen in the next few years and this index could outperform the Nifty in doing so. In the past over the long term the Nifty Next 50 being more nimble than Nifty 50 stocks have outperformed in a big way. Yet there are shorter periods when the high concentration within Nifty ( example Reliance in 2020) have skewed the Nifty more as in the last few years. It may be time for outperformance again.

Mi NNF 10 – Cashing in on the Nifty Jnr Alpha

The Strategy NNF10 is a momentum portfolio of 10 stocks from the Nifty Next 50 universe. The portfolio always has allocation to 10 stocks and never goes to cash. It also always has a 10% allocation at the start of each month to each of its constituents. The portfolio is balanced based on the closing prices on the last trading day of each month and the rebalance sent out for execution on the first day of the next month. The logic of the strategy is the classic momentum way to weed out losers and include winning stocks . You can say this is akin to the Darwin’s Theory of Evolution -Survival of the Fittest.

As you can see from the chart below. Rs 100 invested in Mi NNF 10 on 01 Apr 2016 would now be equal to Rs 353 while the same money invested in the index – Nifty Jnr would have yielded Rs 227.

The strategy will require 5 min of your time on each first trading day of the month and you are all set to go. The smallcase smooth integration with top brokers ensures that this entire process is seamless and smooth. Your stocks remain in your brokerage accounts totally in your control and you retain full power to liquidate this portfolio at any point you like.

The strategy will require 5 min of your time on each first trading day of the month and you are all set to go. The smallcase smooth integration with top brokers ensures that this entire process is seamless and smooth. Your stocks remain in your brokerage accounts totally in your control and you retain full power to liquidate this portfolio at any point you like.

The performance of the strategy has been thoroughly tested on actual index constituents (survivorship bias free data) over the last 10 years but we have used the data from April 2016 as standard for all strategies as WeekendInvesting began it’s operations from the same period.

The best part about Mi NNF 10 has been the fact that the strategy has a much higher CAGR @ (+21.1%) as compared to (+13.3%) on the Nifty Jnr Index. But that is not the best part yet. This strategy has also massively outperformed the benchmark during weak market scenarios with an incredibly lower Max drawdown @ 23.6% compared to a much painful 42% on the benchmark.

If you are new to the concept of drawdowns, why a lower drawdown is crucial for success in long term, how to calculate drawdowns – given below is a detailed article we wrote sometime back. Do check it out

Other Performance Metrics !

Rolling Absolute & CAGR Returns

If you are relatively new to the concept of Rolling Returns, please do check out the below article so that you will be able to better interpret the metrics

From the absolute rolling returns chart, except for a very brief period, Mi NNF 10 has dominated it’s benchmark in every other period and all other charts too. This was possible due to it’s nimble footedness in latching on and more importantly always sticking to the strongest stocks within it’s universe.

The strategy – just like any other WeekendInvesting strategy discards losing stocks early and rides the winners for long long time till momentum fades away.

SIP Performance

Performance after going LIVE on 12 Nov 2020

We launched this strategy on 12 Nov 2020 and has been a SMASHING SUCCESS right since day 1 amassing spectacular performance and winning hearts of several thousands of its investors. Take a look at the below chart.

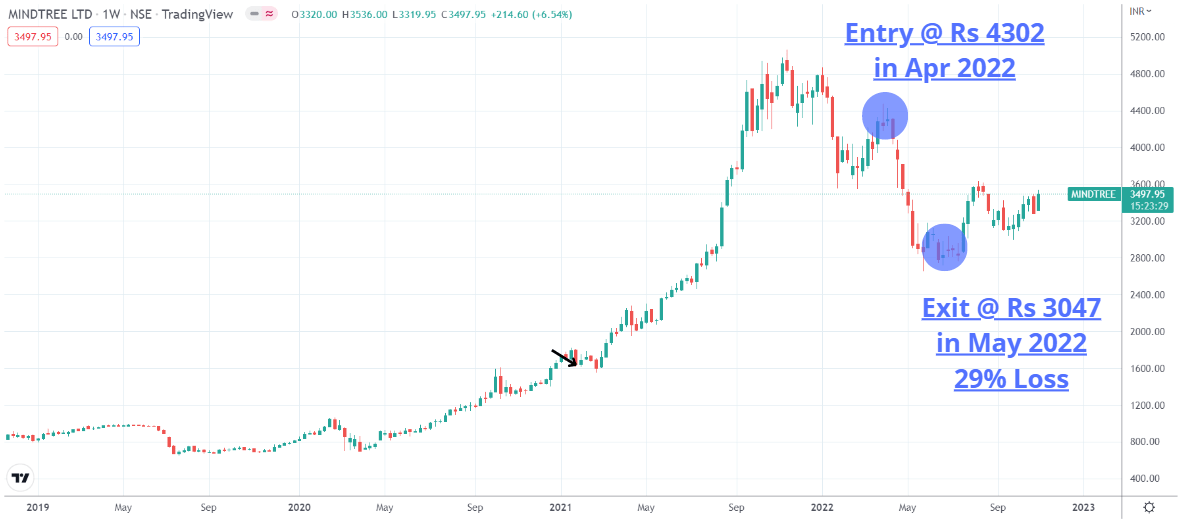

Let’s talk about some winners and losers of Mi NNF 10

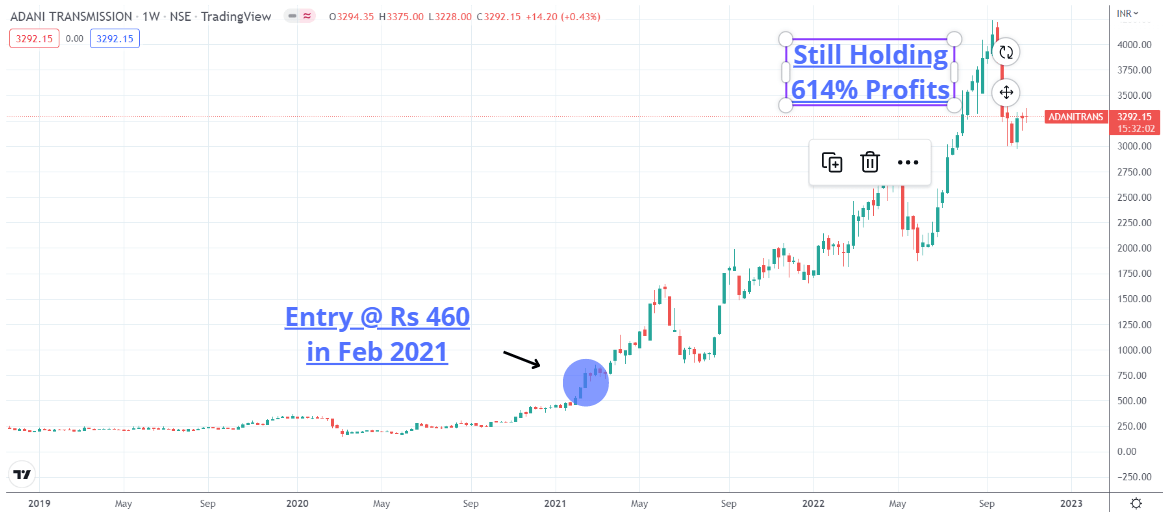

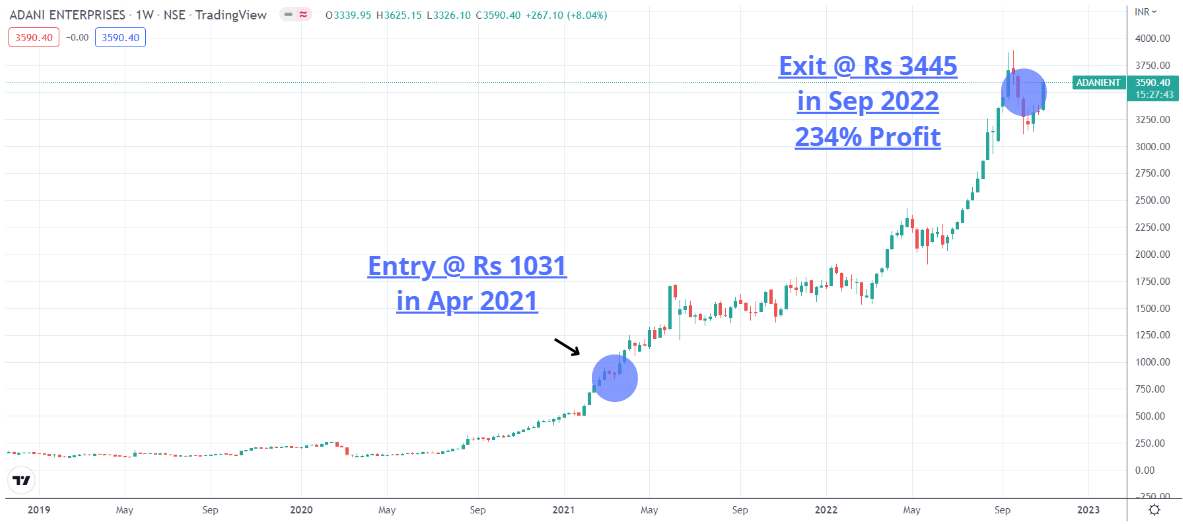

Stock Stories from Mi NNF 10

Let us take a look at our journey with top two winners

Below are examples of two of worst performers in the strategy

As you can see in all above cases, the strategy effectively allowed winners to run as far as possible before momentum faded out

Some Testimonials for Mi NNF 10

To Summarize – –

Mi NNF 10 can be an amazing companion – core strategy to help you towards your financial independence goals.

- Top quality stocks

- Outperformance against it’s benchmark – the Nifty Jnr Index

- Much Higher CAGR than Nifty Jnr

- Significantly Lower Drawdowns compared to Nifty Jnr to keep you calm during weak market conditions

- A great core companion for your long term goals

Come in with a mindset to stay for as long as possible (preferably 4+ years) and have a phenomenal journey !

Hope to see you in WeekendInvesting Family soon.

If you have any questions, please send an email to support@weeekendinvesting.com and we’ll get back in a jiffy.