Mi EverGreen – Your Affordable Companion for Financial Independence

Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises of 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

We started WeekendInvesting back in 2016 with one single GOAL..

“To Help you Achieve Financial Independence”

Financial independence can mean different things to different people. Everyone is wired in a unique manner and could be traveling with different sets of goals or carrying varied sets of responsibilities. So, the wealth one has to create to achieve this shall certainly differ based on ones goals and expectations.

In short – Financial Independence is defined as having enough passive income to pay all of your living expenses.

The HURDLE . .

You decide that you want to reach this goal at a certain stage in your life and start putting in some hours of research to identify the kind of instruments that can take you towards your goal. You basically need a good return but you’d want a reasonable amount of stability too. You cannot allow for drastic shocks during this journey.

Debt instruments are stable but will taken you FOREVER to achieve this goal as they hardly beat inflation.

You may turn to equities as they’ve been quite rewarding with 12% – 14% odd CAGR over long periods. You may wonder what can you achieve with this return. The answer is enormous wealth. Do watch these videos to understand better – Video 1 | Video 2

Use this calculator to play around.

You think – “You are convinced that 15% CAGR seems to be a very very realistic expectation if I am looking to stay invested for Long for my GOAL of FINANCIAL INDEPENDENCE”

Great – You start your research and decide that this CRUCIAL PORTFOLIO (your companion that will hold your hands in your journey towards financial independence) should consist of nothing but Top Quality stocks that can keep you calm in your long journey.

Mostly, people check the returns (CAGR) and seldom understand the PAIN one may have had to endure to generate those returns.

You may wonder – PAIN ? Now, what is this PAIN you are referring to ?

If I am considering , say top 50 or top 200 stocks in the entire universe of Nifty, isn’t it self explanatory that the journey will most certainly be non turbulent or PAINFREE ?

Nope ! You may be in for a surprise here. Let us explain this a bit.

The PAIN that is being referred to is the Drawdown or the downside risk your portfolio carries.

This chart indicates the CAGR and the Drawdown on the CNX 200 Index at any given point in time had you begun your investment on 01 Apr 2016.

At point (a) Mar 2018 (end of 2 years , since Apr 2016) : Things look certainly fine with a CAGR 16% and a current Drawdown of 10%

Come to point (b) Feb 2019 (end of almost 3 years) : Both CAGR & Drawdown are at 11% each, which is still okay. Part and parcel of markets.

At point (c) though (COVID Crash) : the CAGR has plummeted to a negative (-0.7%). And the current Drawdown is at a steep 38% which means that if you had invested Rs 1 Lac on 01st of Apr 2016, after 4 long years in Mar 2020, your capital would be at Rs 97,230.

You get through this torrid phase and come to point (d) Dec 2021. A sumptuous Bull market has more than made up for the fall and the CAGR is at a highly respectable 15% today.

Someone who might come in today may be carried away by only 2 factors

(a) This portfolio consists of Top 200 stocks – All high quality , no rubbish, stable.

(b) CAGR of 15% which is great for a long term investing point of view.

But may not pay attention to the kind of intense drawdowns one may have had to endure along the way. It may be quite easy to say

” I can take in a 40% Drawdown “. But can you afford to stay effortlessly calm watching your portfolio drop by 40% in real time ?

Presenting Mi EverGreen

Presenting, Your AFFORDABLE COMPANION for ALL MARKETS with the ULTIMATE GOAL to take YOU to FINANCIAL INDEPENDENCE.

Mi EverGreen is solid core portfolio with a built in ASSET ALLOCATION factor which COMBINES BEST of EQUITY with the PROTECTION of GOLD to make your JOURNEY AS SMOOTH AS POSSIBLE

Mi Evergreen is a 20 stock rotational momentum based strategy that rotates between the strongest of stocks from the CNX 200 universe (Nifty Top 200 stocks) along with a fixed allocation to GOLD.

While the philosophy of Rotational Momentum will ensure that your portfolio always stocks to the strongest performing stocks at all points in time, the exposure to GOLD will further bolster the portfolio during events of market corrections / falls / crashes.

Why GOLD Though ?

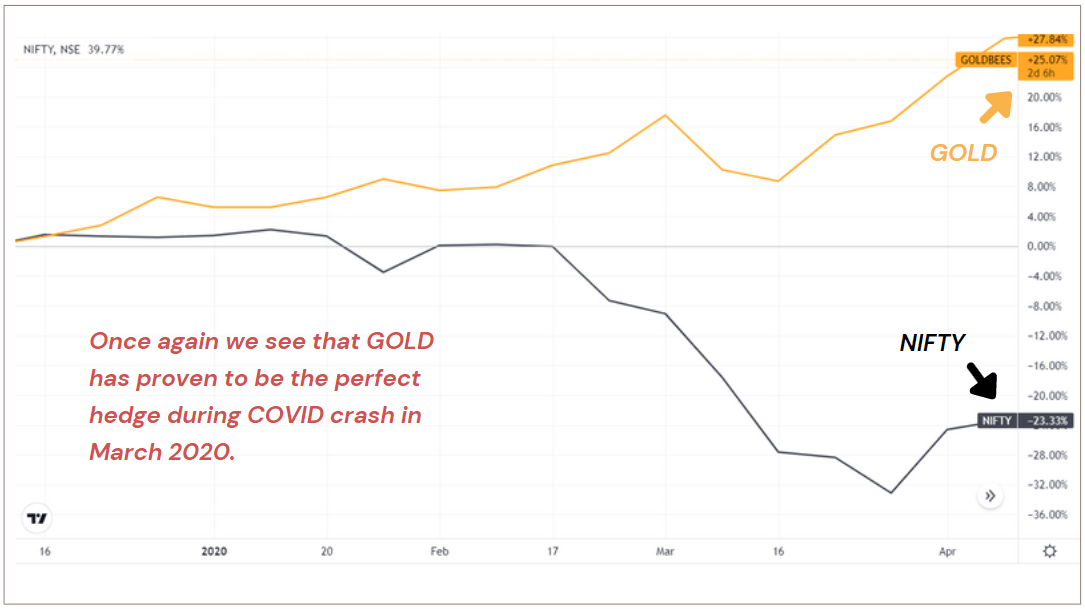

GOLD has proven to be the ultimate hedge to Equities for a very long time. GOLD as an independent asset class may not been the ideal choice for wealth creation but when combined with equities in the correct proportions, can provide you with the MUCH NEEDED CUSHION when markets take a downward plunge thus SIGNIFICANTLY REDUCING THE PAIN (or) DRAWDOWN in your portfolio

We have taken four examples from the recent past to demonstrate this phenomenon.

Example 1 – 2008 Global Financial Crisis | Nifty Drawdown @ 65%

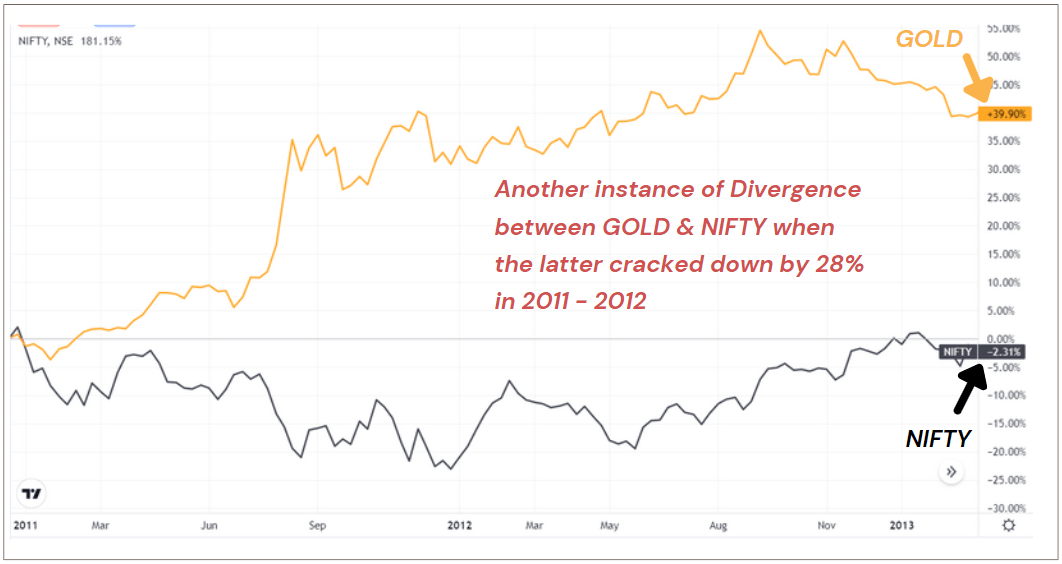

Example 2 – 2011 Market Correction | Nifty Drawdown @ 28%

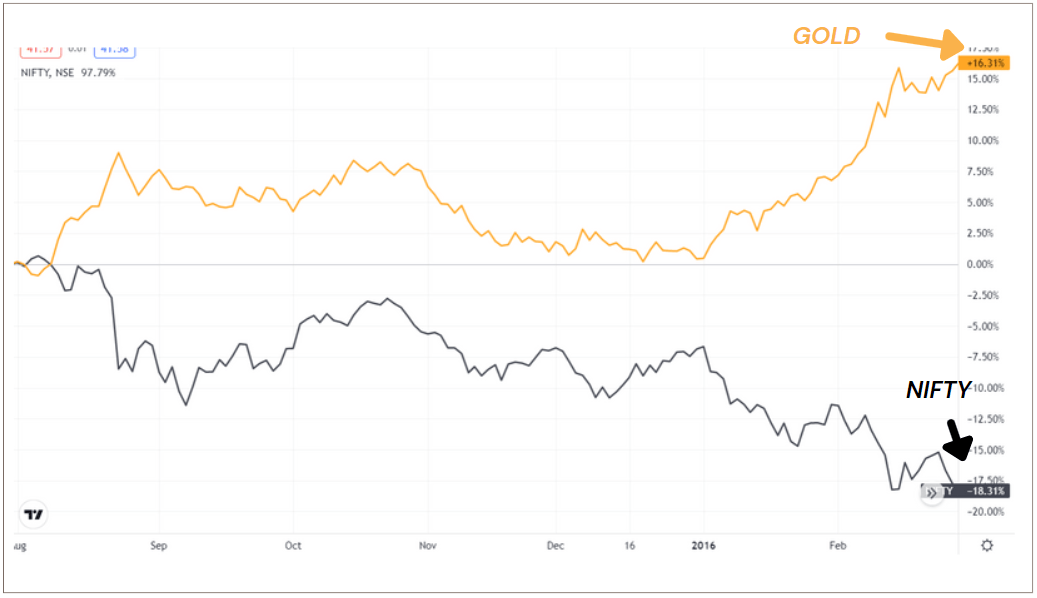

Example 3 – 2015 Correction | Nifty Drawdown @ 25%

Example 4 – COVID Crash (Mar 2020) | Nifty Drawdown @ 38%

Mi Evergreen is a very special product that is designed to deliver a HIGHER CAGR at a MUCH LOWER DRAWDOWN when compared to it’s benchmark, the CNX 200 Index thus targeting an outright outperformance both on the upside and on the downside.

Mi EverGreen Performance Metrics.

Over a period of 6 years and 3 quarters, Mi Evergreen returned a CAGR of 21.1% at a Max Drawdown of only 18.6% while it’s benchmark, the CNX 200 index returned a much lower CAGR at 14.3% at a high drawdown of 38.2%.

Basically, a CAGR higher than the max Drawdown is an indication that the portfolio has a better risk – reward metric.

Absolute Returns Comparison . .

As you can see from the previous chart – The portfolio was more or les tracking the CNX 200 Index until March 2020. The exposure to GOLD and ability to stick to strongest stocks ensured a much lower fall compared to the benchmark CNX 200 Index.

When the markets started to recover and zoom on the upside, Mi Evergreen was quick to latch on to the strongest of trends and thus could outperform the CNX 200 Index quite comfortably.

If you are new to rolling returns , you can check out a quick explainer below,

CAGR Comparison

The CAGR of Mi EverGreen has always been higher compared to that of it’s benchmark – the CNX 200 index. Thanks to the GOLD allocation which has maintained sanity in the portfolio during tough times like the COVID fall.

The above chart (3 year rolling CAGR) denotes the 3 year CAGR at any given point in time. Again – the performance during stands as a testimony to the robustness of the strategy.

SIP Comparison

A monthly SIP of Rs 10,000 on Mi EverGreen – starting from Apr 2016 till Nov 2022 would have yielded a fantastic XIRR of 23.4% compared to 15.8% on the CNX 200 index.

Let’s see some winners and losers of Mi EverGreen

Momentum’s fundamental philosophy of riding winners far and dumping losers early is quite evident from this table

To Summarize – –

Stock markets are definitely non linear and your portfolio will most certainly go through all kinds of ebbs and flows across various market cycles. Mi Evergreen has been crafted to be your affordable companion that will steadily help you reach your Financial Goals.

We will be super pumped to welcome you – your friends & family to Mi EVERGREEN.

- Always sticks to top 20 trending stocks from it’s universe – CNX 200

- Has a fixed 25% allocation to GOLD at all times to help reduce turbulence in your portfolio during weak times.

- Superior CAGR compared to CNX 200 index.

- Significantly Lower Drawdowns compared to CNX 200 index to keep you calm during weak market conditions

- A great companion for your financial independence journey.

Come in with a mindset to stay for as long as possible (preferably 4+ years) and have a phenomenal journey !

Hope to see you in WeekendInvesting Family soon.

If you have any questions, please send an email to support@weeekendinvesting.com and we’ll get back in a jiffy.