Mi ATH 2 – The High Risk High Reward ATH Strategy

Mi ATH 2 is an absolute momentum strategy which chases stocks near their All time highs. It is a well-researched phenomenon that stocks that are near to their all-time highs have a high probability to keep performing well.

What is All Time High (ATH) ?

Now let us quickly understand this from an example.

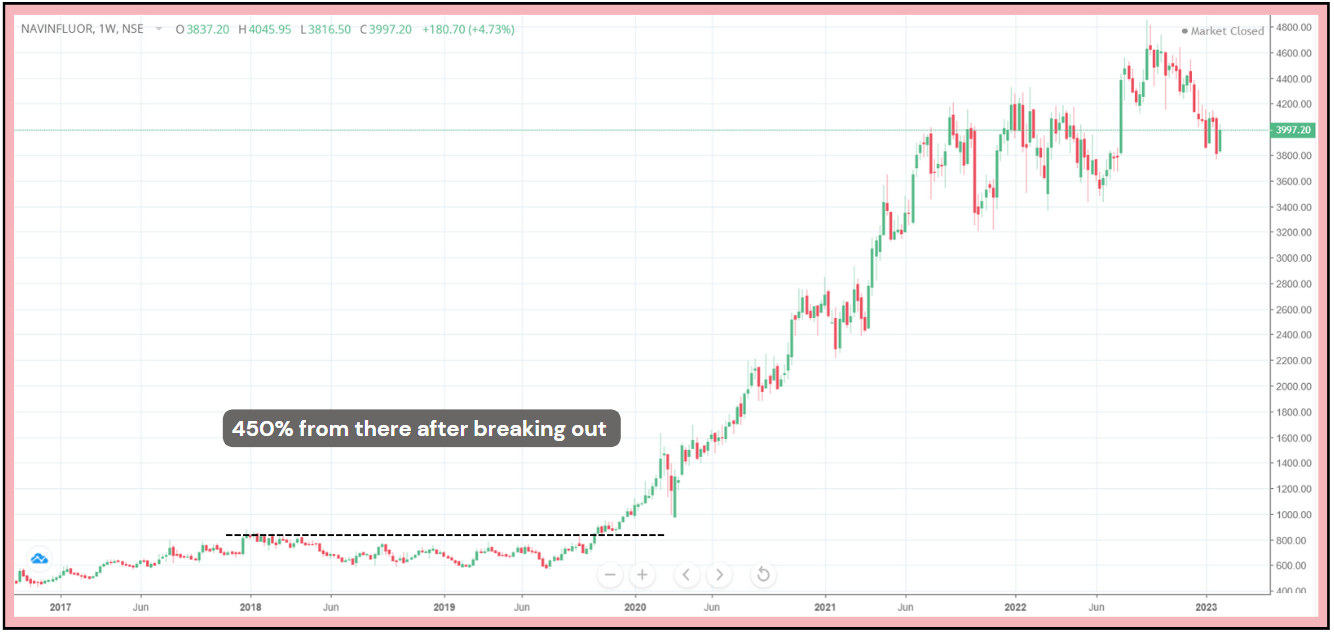

NAVINFLOURINE began its upward journey sometime in 2014 where it was trading around Rs 50 and steadily reached a high of Rs 880 in Dec 2017 making everyone take notice of the meteoric rise. Then commenced a phase of consolidation which saw the stock correct by 35% to hit a low of 575 around July 2019 post which the stock once again started to trend upward before hitting a fresh all time high of Rs 894 in Oct 2019.

At this point, investors generally shy away from taking fresh positions in this stock. The reasons we usually hear are

(a) The stock has already run up so high that valuations may not be justified

(b) We have already seen an 18x move from 2014. Is there any steam left in the stock ?

(c) We might see another round of profit booking and the stock could consolidate or correct from this level for sometime.

All those who may have entered around the previous all time high may have been stuck in the 2 year consolidation that happened and would ideally have waited for the stock to come back to previous all time high levels so that they can get a reasonable exit. All these points can make investors apprehensive of considering an entry into this stock.

Why is All Time High Important ?

The very fundamental reason why ATH as a concept works is because there is literally no resistance left once a stock hits a fresh all time high. There’s no one waiting to exit the stock at any particular level once it has crossed it’s all time high. Apart from some folks who may want to book profits occasionally , the pressure on the stock to be pushed down is certainly much lower & there’s a higher probability of the stock to continue the strong upward momentum

To say precisely in common terms – Sky is the Limit ! We do not know how much of momentum may be left in the stock on the upside but this certainly provides us with a meaty proposition to try and capitalize on this opportunity.

Let us now see what happened to NAVIN FLOURINE after making a fresh all time high in Oct 2019.

A truly remarkable run clocking almost 5x from Oct 2019. What happens is that our own mental frameworks do not allow us to participate in stocks because there is not anchoring in terms of how we should enter such stocks and in case we need to exit at some point how will that unfold. You may now be wondering if all stocks that make fresh ATH’s will go on to become multibaggers – The answer NO. Not all stocks may continue on the strong momentum. Some stocks may make fresh ATHs and drop from there, some may remain stagnated at the same level, some may go slightly higher and fall again but the point we wish to make here is that

THERE IS AN OPPORTUNITY & WE ARE TRYING TO MAKE BEST USE OF THAT OPPORTUNITY

Introducing Mi ATH 2 !

Mi ATH 2 onboards stocks that are ready to go up and shall help you exit those stocks that have lost momentum

Mi ATH 2 is Is a very high risk – Niche strategy that you may consider as an add on to your equities portfolio

This strategy may work well in high momentum markets & go through whiplashes during phases when there is no momentum

It is very nimble to get out of losing stocks and rebalances every week

Quickly moves to CASH resulting in lower drawdowns during sharp market falls

Can go through whiplashes during phases when there is no momentum

Kindly try to spend at least 4+ years to be able to extract the best out of this strategy.

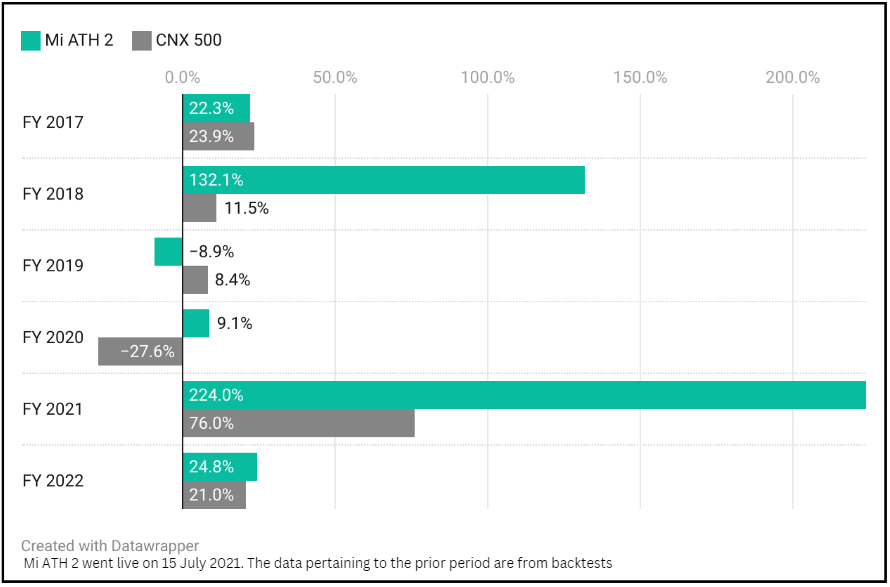

Mi ATH 2 Yearly Performance

As you can see from the above chart, markets are non linear. If you have come into the markets with an expectation that your journey shall be linear and smooth, you’ll certainly be disappointed. There shall be periods of great performance like in FY 17 – FY 18, some weak years like FY 19 , FY 20 & some extraordinary years like FY 21 too. So having a long term perspective is very crucial especially for a strategy like Mi ATH 2 that is highly dependent on strong upward momentum.

Absolute Return Metrics

Rs 100 invested in Mi ATH 2 back in Apr 2016 would be worth 1168 in Jan 2023 – a massive 10x in close to 7 years as compared to only 2x in the CNX 500 index.

Rolling Returns Comparison

The lowest performance across any given 3 years period in Mi ATH 2 has been (+83.5%) around Oct 2020 while the same on CNX 500 was (-12%) around Mar 2020. This shows how strong the strategy has been around during strong momentum markets.

The picture gets even better when you take a look at the 4 year absolute returns. So the idea is to clearly take a minimum 4 year perspective to be able to benefit out of this strategy.

CAGR Metrics

The lowest CAGR seen on the strategy was 29% during the Covid fall in Mar 2020 while the same on CNX 500 was just about 2%. The chart showcases the sheer strength on the strategy to do superbly well in uptrends and be very nimble to get out of losers and move to cash when markets do not present enough opportunities.

The CAGR across any given 3 year period has never dipped below 22% which was recorded around Oct 2020 while the benchmark saw this metric dip below zero during Covid fall.

Other Performance Metrics

To Summarize . .

Mi ATH 2 can be a superb alpha booster to your equities portfolio.

- 10 trending stocks from the universe of all stocks above 500 crore market cap

- Tries to outperform when the markets trend on the upside thus extracting alpha while keeping the drawdowns minimal when the markets trend on the downside.

- Superior performance & significantly lower drawdowns compared to CNX 500 index

Come in with a mindset to stay for as long as possible (preferably 4+ years) and have a phenomenal journey !Hope to see you in WeekendInvesting Family soon.